Daily Market Outlook - Wednesday, April 16

Image Source: Pixabay

Overnight, U.S. markets lost early gains and closed lower as President Trump's ongoing tariff disputes with trading partners kept investors wary despite strong equity reports from major financial firms. The S&P 500 ended the day down, while bonds gained value after the Treasury suggested potential rule changes to lower banks' trading costs. The dollar bounced back after a five-day slump. Trump called on China to start trade talks, signaling no immediate resolution to the tariff war. Meanwhile, China reportedly stopped Boeing jet deliveries, and little progress was made in U.S.-EU trade discussions. Global investors remain uneasy due to uncertainties in U.S. trade policies and market volatility. Economic sentiment has hit a 30-year low, with fund managers' scepticism not yet fully reflected in asset allocations, potentially leading to further declines in U.S. stocks, according to a Bank of America survey. Global markets stalled after a two-day rise due to unresolved U.S. trade tensions and new restrictions on Nvidia chip exports to China, with Nvidia trading as much as 6% lower. Asian equities and U.S. and European futures fell, influenced by Nvidia's performance. Treasuries held steady following recent gains, while gold prices surged as investors sought safe-haven assets. The dollar weakened slightly, with the Swiss Franc and Euro gaining ground. Japanese long-term bonds rallied. Stocks declined after a brief recovery from last week's volatility as traders navigated tariff-related news, including Trump's inquiry into tariffs on essential minerals. These market shifts have created uncertainty for investors amid inconsistent U.S. policy messages. In Japan, 30-year bonds rebounded as Treasury market volatility eased, and the Bank of Japan hinted at a policy change due to rising U.S. tariffs. A weak economy could affect Japan's interest rate plans. The EU and U.S. aimed to ease trade tensions, though most U.S. tariffs on the EU remain. Italian Prime Minister Meloni plans to visit Washington for talks. Oil prices remained stable after a slight decline.

UK March CPI inflation dropped to 2.6% year-on-year, 0.1 percentage points below expectations and the Bank of England's February projections. The services CPI rate also decreased to 4.7% from 5.0%, undershooting the BoE's forecast by 0.2 points. Core CPI stood at 3.4% y/y. While the March data seems positive, broad-based easing was seen except for clothing and footwear. However, inflation is expected to rise in April due to the OFGEM energy price cap reset and National Insurance changes impacting the recreation, culture, and hospitality sectors. These factors, along with tariff uncertainties, suggest the MPC may not heavily rely on March's figures. Coupled with slower pay growth, this data supports expectations for a 25 basis point rate cut in May under a gradual approach.

In other overnight developments, China's Q1 GDP growth was reported at 5.4% year-on-year, surpassing the 5.2% consensus. However, the positive economic data is overshadowed by worsening trade conditions. Elsewhere, Bank of Japan Governor Ueda acknowledged that a policy response might be necessary if US tariffs negatively impact the economy. Attention is now turning to Federal Reserve Chair Powell’s comments later today (6:30 PM BST), with US retail sales data and the Bank of Canada rate decision also on the agenda. Meanwhile, the return of a more pessimistic sentiment is likely to affect the European market opening.

Overnight Newswire Updates of Note

- Nvidia To Take $5.5B Hit; US Clamps On Exports Of AI Chip To China

- Trump’s Tariffs May Spur Policy Response From BoJ, Sankei Reports

- China Q1 GDP Grows By 5.4% As Trade War With Trump Escalates

- HK Post Stops Accepting US-bound Surface Parcels Amid Tariff War

- China Southern Halts Sale Of Boeing Jets On US New-Plane Freeze

- China's Xpeng Eyes VW Partnership On Joint Procurement, Car Models

- US Plans To Use Tariff Negotiations To Isolate China

- Donald Trump Pledges To Cut Drug Prices For Americans

- Trump Launches Critical Minerals Probe To Weigh New Tariffs

- Canadian Oil Producers See Opportunity In Donald Trump’s Trade War

- United Air Flags ‘Recessionary’ Risk While Keeping Profit Target

- TotalEnergies Flags Higher Production, Gas Sales Ahead Of Q1 Results

- Airbus Affirms 2025 Targets But Is Still Assessing Impact Of Trade Tensions

- UK CPI Inflation Expected To Dip, Opening Door To BoE Cut In May

- XAU Clinches Record Highs, Eyes $3,300 Ahead Of US Data, Powell

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1200 (EU1.37b), 1.0800 (EU1.35b), 1.0900 (EU1.33b)

- USD/CAD: 1.4335 ($1.14b), 1.4000 ($730m), 1.3700 ($624m)

- USD/JPY: 162.50 ($1.16b), 145.20 ($660.1m), 141.00 ($530m)

- AUD/USD: 0.6400 (AUD2.35b), 0.6350 (AUD1.29b), 0.6250 (AUD782m)

- USD/CNY: 7.2500 ($1.49b), 7.3000 ($1.4b), 7.5000 ($1.28b)

- NZD/USD: 0.5950 (NZD1.42b), 0.5600 (NZD739m), 0.5680 (NZD465.1m)

- GBP/USD: 1.2300 (GBP536m), 1.2535 (GBP526.9m), 1.3150 (GBP469.7m)

- EUR/GBP: 0.8650 (EU1.25b)

- USD/MXN: 23.10 ($355m), 18.80 ($350m)

- USD/KRW: 1455.00 ($309.8m)

CFTC Data As Of 11/4/25

- S&P 500 CME net long position was reduced by 75,583 contracts by equity fund managers to 803,250, while S&P 500 CME net short position was increased by 22,408 contracts to 287,605 by equity fund speculators.

- CBOT Speculators reduce their net short position in US Treasury bond futures by 14,494 contracts to 18,154. CBOT Speculators reduce their net short position in US Ultrabond Treasury futures by 53,719 contracts to 200,310. CBOT Speculators reduce their net short position in US 2-year Treasury futures by 28,282 contracts to 1,198,109 CBOT Speculators' net short position in US 5-year Treasury futures increased by 102 contracts to 2,021,575 Japanese yen net long position is 147,067 contracts, while CBOT US 10-year Treasury futures net short position is 215,207 contracts to 1,078,470.

- 17,310 contracts make up the British pound net long position.

- There are 59,980 contracts in the Euro net long position.

- The net short position of the Swiss franc is -30,277 contracts.

- 1,332 contracts make up the Bitcoin net long position.

Technical & Trade Views

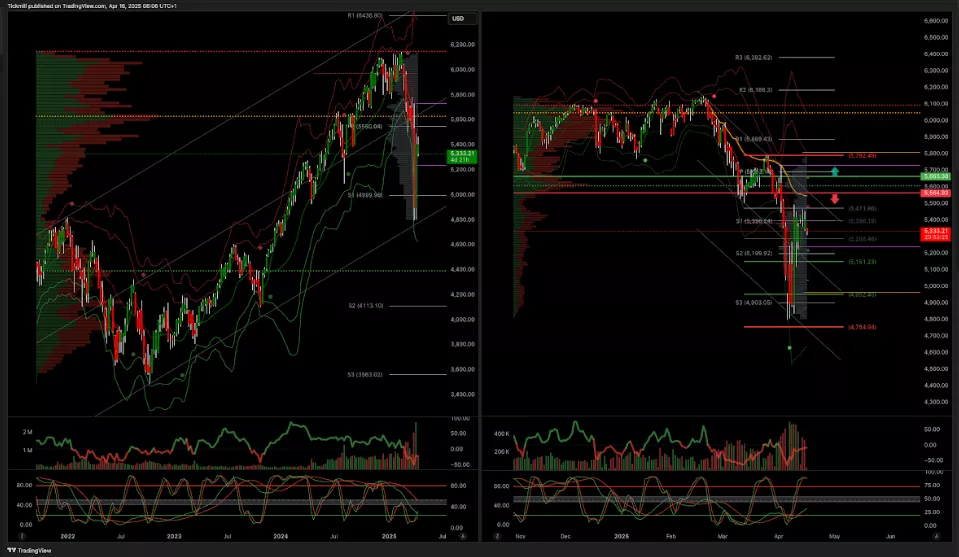

SP500 Pivot 5610

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 5665 target 5792

- Below 5000 target 4755

(Click on image to enlarge)

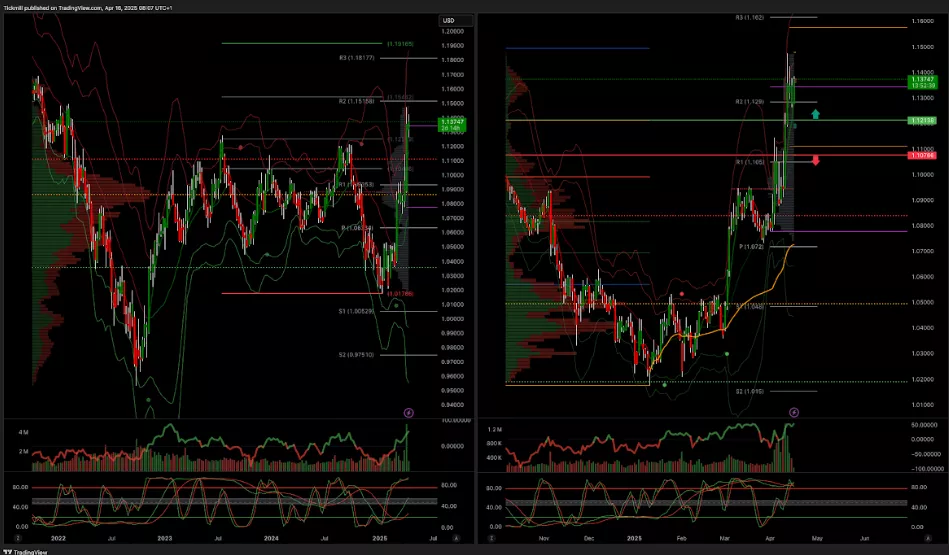

EURUSD Pivot 1.11

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into the end of April

- Above 1.12 target 1.15

- Below 1.1070 target 1.0945

(Click on image to enlarge)

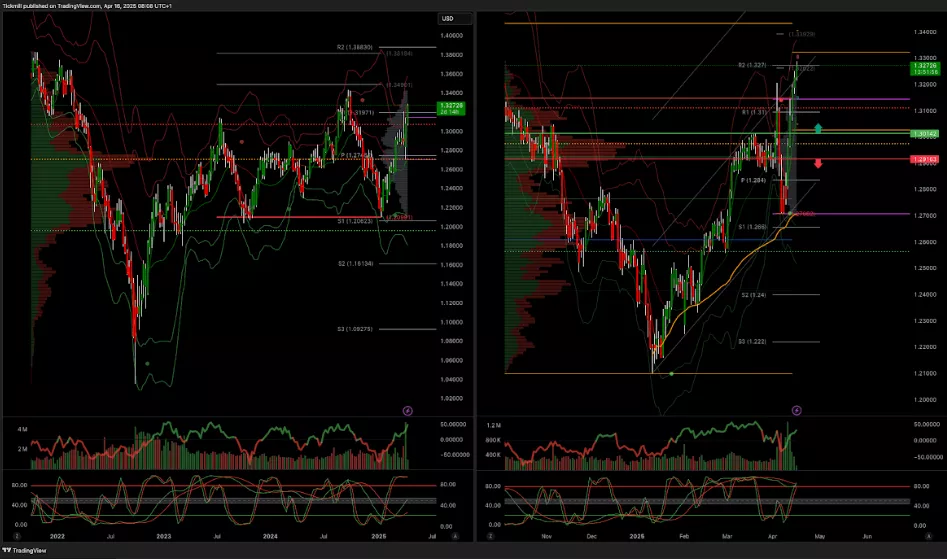

GBPUSD Pivot 1.28

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 1.2850 target 1.32

- Below 1.2790 target 1.2660

(Click on image to enlarge)

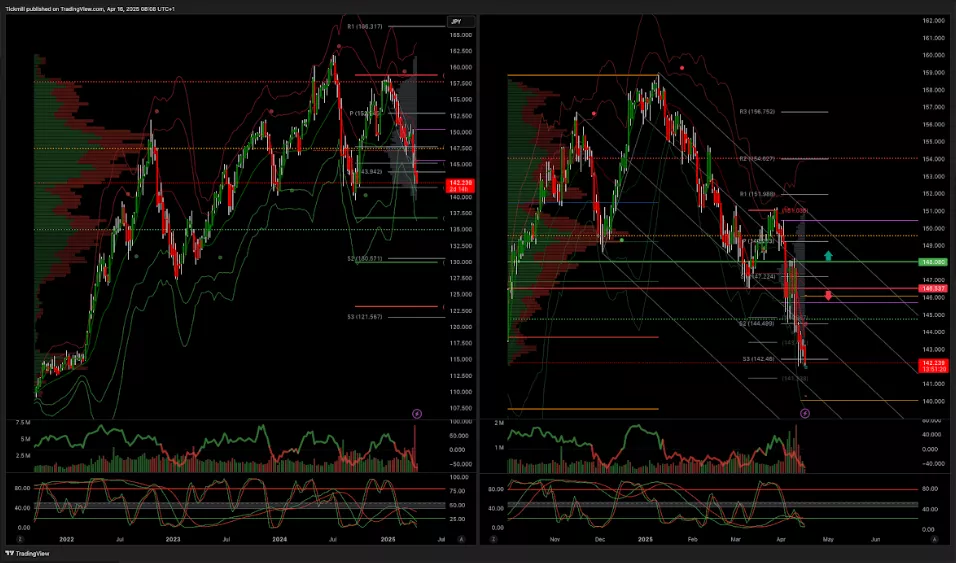

USDJPY Pivot 147.70

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bearishness into early May

- Above 1.52 target 153.80

- Below 146.53 target 140

(Click on image to enlarge)

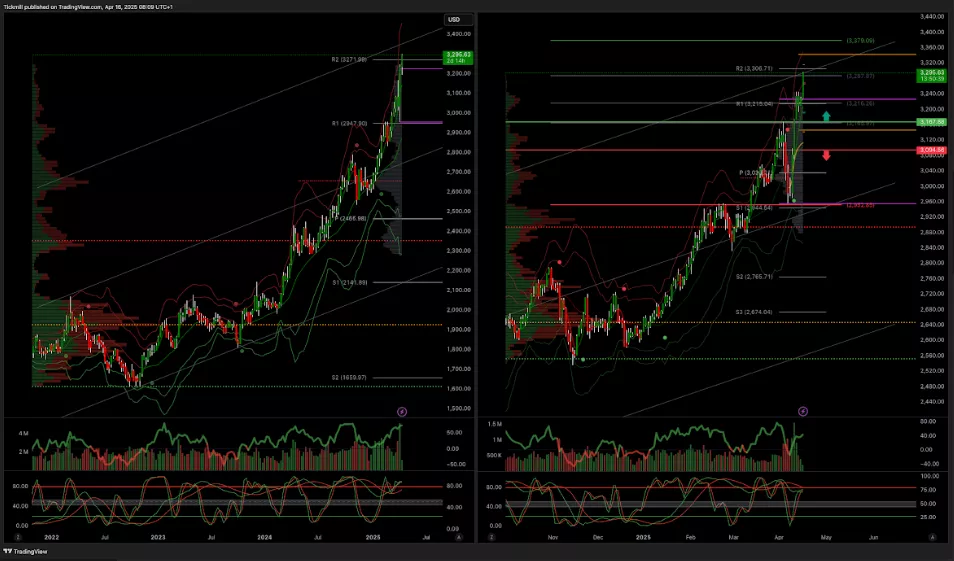

XAUUSD Pivot 3100

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into mid/late April

- Above 2900 target 3280

- Below 2880 target 2835

(Click on image to enlarge)

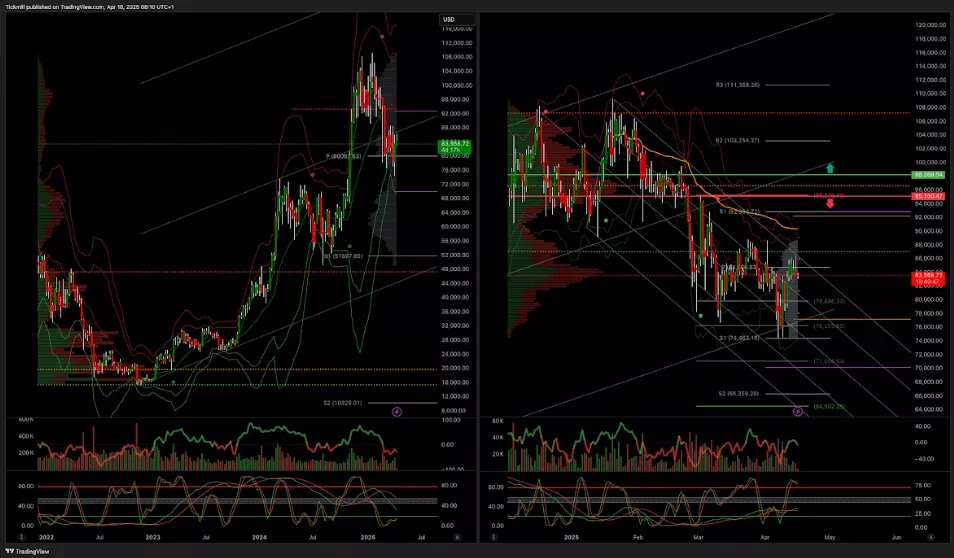

BTCUSD Pivot 90k

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into mid April

- Above 97k target 105k

- Below 95k target 65k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Tuesday, April 15

Daily Market Outlook - Tuesday, April 15

The FTSE Finish Line - Monday, April 14