Daily Market Outlook - Tuesday, Jan. 27

Image Source: Unsplash

Stocks extended their upward momentum for the fifth straight session, while currencies found some footing after Monday’s turbulence, as markets regained composure amidst whispers of potential Yen intervention. The MSCI All Country World Index, a key gauge of global equities, hovered near record levels, buoyed by a 0.7% surge in Asian shares, which reached an all-time high. Futures for US and European equity indexes signalled further gains ahead, following Monday’s strong performance on Wall Street. The Yen dipped modestly after two days of gains against the dollar, amid chatter about possible coordinated currency intervention between the US and Japan. Meanwhile, gold and silver held steady near their record highs. Disruptions in Japan's bond market and speculation about currency moves have driven heightened volatility across asset classes in recent market activity. The Federal Reserve is set to announce its policy decisions on Wednesday, and major tech companies are releasing earnings. The spotlight now shifts to whether the AI-fuelled stock rally can sustain its momentum. Despite the fluctuations in currencies and precious metals, stock traders seemed unfazed by the potential for further volatility. Wall Street rebounded on Monday, recovering from its first two-week losing streak since June.

Domestically, the British Retail Consortium reported a 1.5% y/y rise in shop prices in January, up from 0.7% in December. Food prices increased by 3.9% y/y (from 3.3%), while non-food items rose 0.3% y/y (from -0.6%). Although BRC shop price inflation is lower than overall CPI at 3.4% y/y, the food price component aligns with CPI food inflation, suggesting a potential upward revision in the next CPI release on 18 February. Additionally, rising wholesale gas prices may limit the expected easing of energy prices in CPI, as the Q2 OFGEM energy price cap window remains open until 17 February. While food and energy price inflation trends should decline year-on-year, recent developments may slow disinflation, with limited short-term impact on MPC hawks' positions.

The Yen, gold prices, US government shutdown risks, tariffs, rising gas prices, Starmer/Burnham developments, and speculation over the next Fed Chair are dominating market headlines. Against this backdrop, it may seem unusual to focus on the German IFO survey. However, with French politics aside, the eurozone has been a relative pillar of stability compared to the US and UK, with policies aligned as CPI hovers around the 2% target, the latest IFO data raises some concerns. January’s IFO indicators modestly underperformed expectations, casting uncertainty over the scale and timing of the anticipated benefits from German fiscal stimulus. Despite the optimism surrounding these measures, the IFO clock still places January’s results in the ‘crisis’ quadrant. Sectoral discrepancies are evident, with manufacturing outperforming services—contrary to Friday’s PMI results—but overall momentum appears tepid at best. Looking ahead, more clarity may emerge on Friday with the initial Q4 GDP growth figures. While the consensus anticipates a 0.2% quarter-on-quarter expansion, the 0.3% q/q median forecast for Q1 2026 seems ambitious given the current positioning in the bottom-left quadrant of the IFO clock.

Overnight Headlines

- Trump Raises Tariffs On S Korean To 25% Over Trade Deal Delays

- US Links Ukraine Security Guarantees To Peace Deal Ceding Territory

- UK Shop Price Inflation Rises To Highest Level In Nearly Two Years

- Gold Extends Gains Above $5,000 As Debasement Trade Gathers Pace

- Gold Boom Spurs Miners To Dig For Mother Lode In South Africa

- UK PM Starmer: Won’t Be Forced To Choose Between US And China

- US Natural Gas Prices Surge To 3-Year High After Winter Storm

- FTSE Aims To Ease Path For Overseas Listings In Blue-Chip Index

- EU Parliament Delays Decision To Unfreeze US Trade Deal

- Europe Can’t Defend Itself Without US, NATO’s Rutte Warns

- China’s Industrial Profits Reverse Slump As Deflation Eases

- Micron Commits $24B To Boost Chip Output In Singapore

- Pimco Stands By Japan Long Bonds View After $41B Rout

- UK Call For Competition Review Of Netflix Bid For Warner Bros

- Anta Sports To Acquire 29% Stake In Puma For $1.8B

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries and is more magnetic when trading within the daily ATR.)

- EUR/USD: 1.1700-05 (1.2BLN), 1.1720-25 (419M), 1.1735-50 (1.43BLN)

- 1.1780 (492M), 1.1800-10 (1.7BLN), 1.1815-25 (1.9BLN), 1.1885-00 (1.3BLN)

- USD/JPY: 156.15 (400M), 157.00 (909M), 157.50 (716M), 158.00 (334M)

- EUR/JPY: 180.50 (294M)

- USD/CHF: 0.7750 (265M), 0.7890 (350M)

- GBP/USD: 1.3460-75 (418M). EUR/GBP: 0.8600 (976M), 0.8700 (527M)

- AUD/USD: 0.6825-35 (760M), 0.6850 (239M)

- AUD/NZD: 1.1510 (300M), 1.1560 (200M), 1.1610 (230M), 1.1660 (302M)

- 1.1700 (445M)

CFTC Positions as of January 23rd:

- Equity fund speculators have reduced their S&P 500 CME net short position by 48,733 contracts, bringing it down to 400,381. Meanwhile, equity fund managers have decreased their S&P 500 CME net long position by 49,679 contracts, resulting in a total of 882,629 contracts.

- Speculators have cut their net short position in CBOT US 5-year Treasury futures by 132,601 contracts to 2,136,519 and have also trimmed the CBOT US 10-year Treasury futures net short position by 214,865 contracts to 655,640. The CBOT US 2-year Treasury futures net short position has been reduced by 79,758 contracts to 1,225,122. In contrast, speculators have raised their CBOT US UltraBond Treasury futures net short position by 23,725 contracts, now totaling 258,822. Additionally, speculators have shifted CBOT US Treasury bonds futures to a net short position of 23,070 contracts, compared to 13,835 net longs the previous week.

- The current Bitcoin net long position stands at 298 contracts, while the Swiss franc has a net short position of -43,207 contracts. The British pound is showing a net short position of -21,980 contracts, and the Euro has a net long position of 111,695 contracts. Finally, the Japanese yen reflects a net short position of -44,829 contracts.

Technical & Trade Views

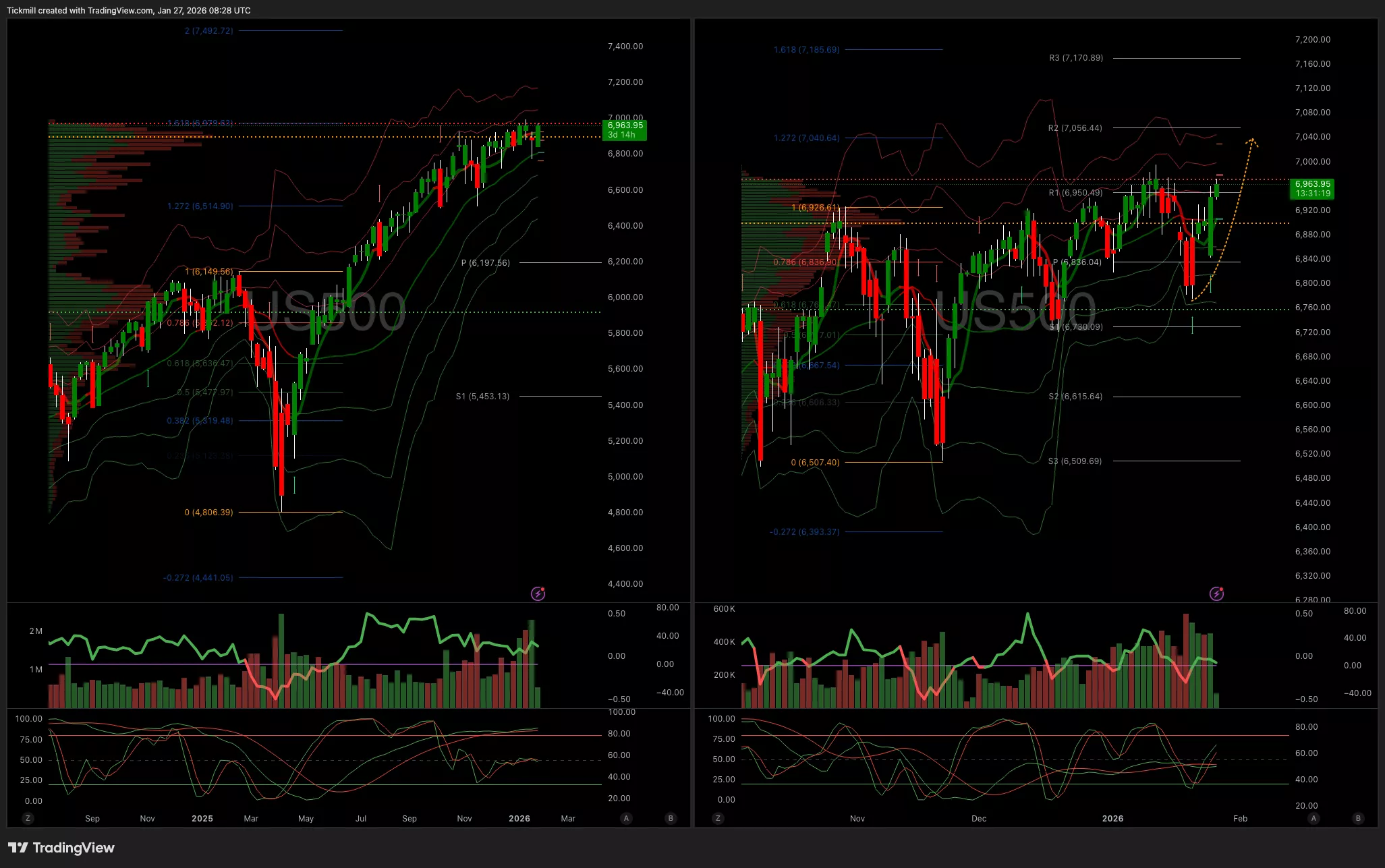

SP500

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 6905 Target 7000

- Below 6895 Target 6860

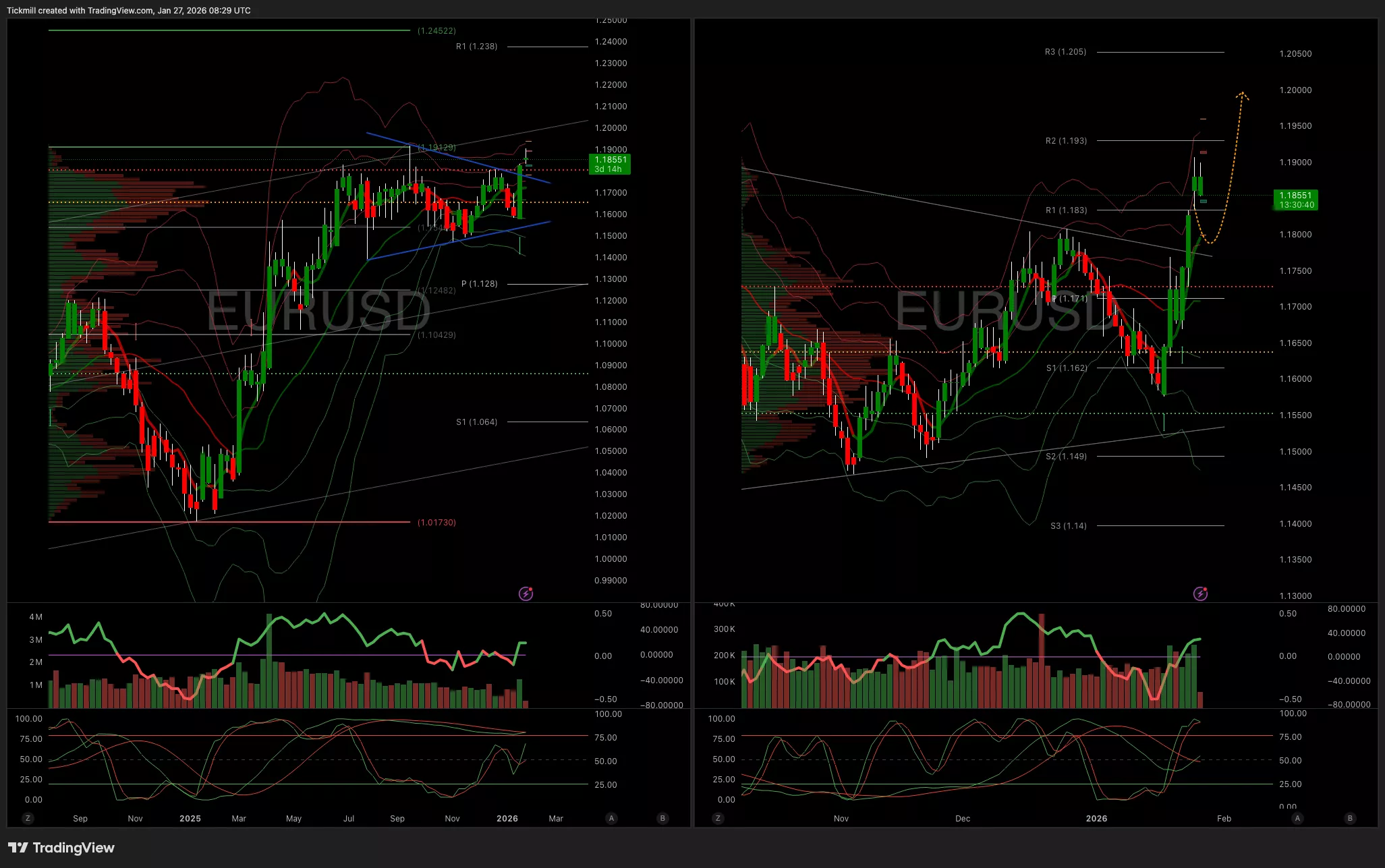

EURUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 1.18 Target 1.1930

- Below 1.1750 Target 1.1615

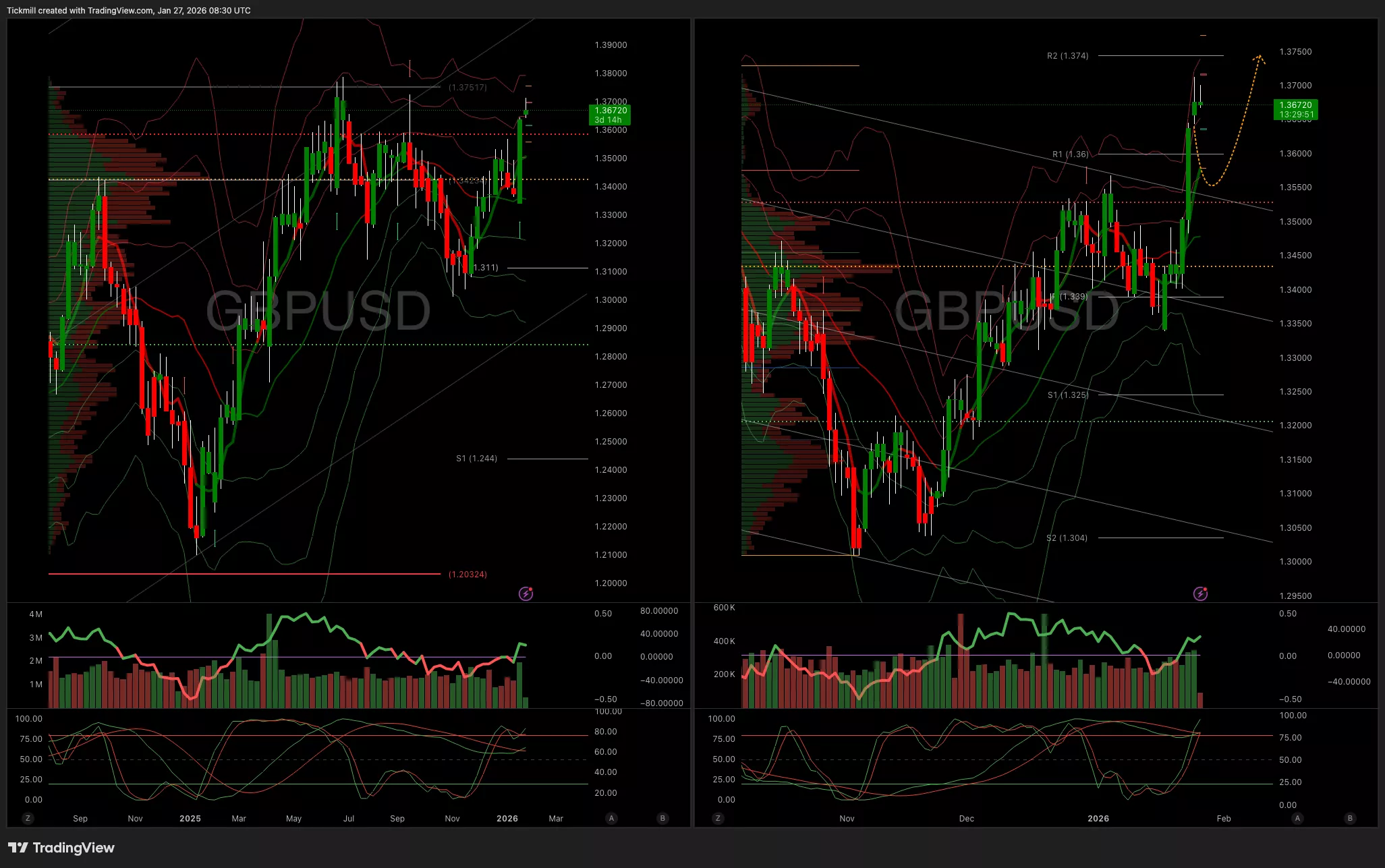

GBPUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 1.3550 Target 13740

- Below 1.3430 Target 1.3290

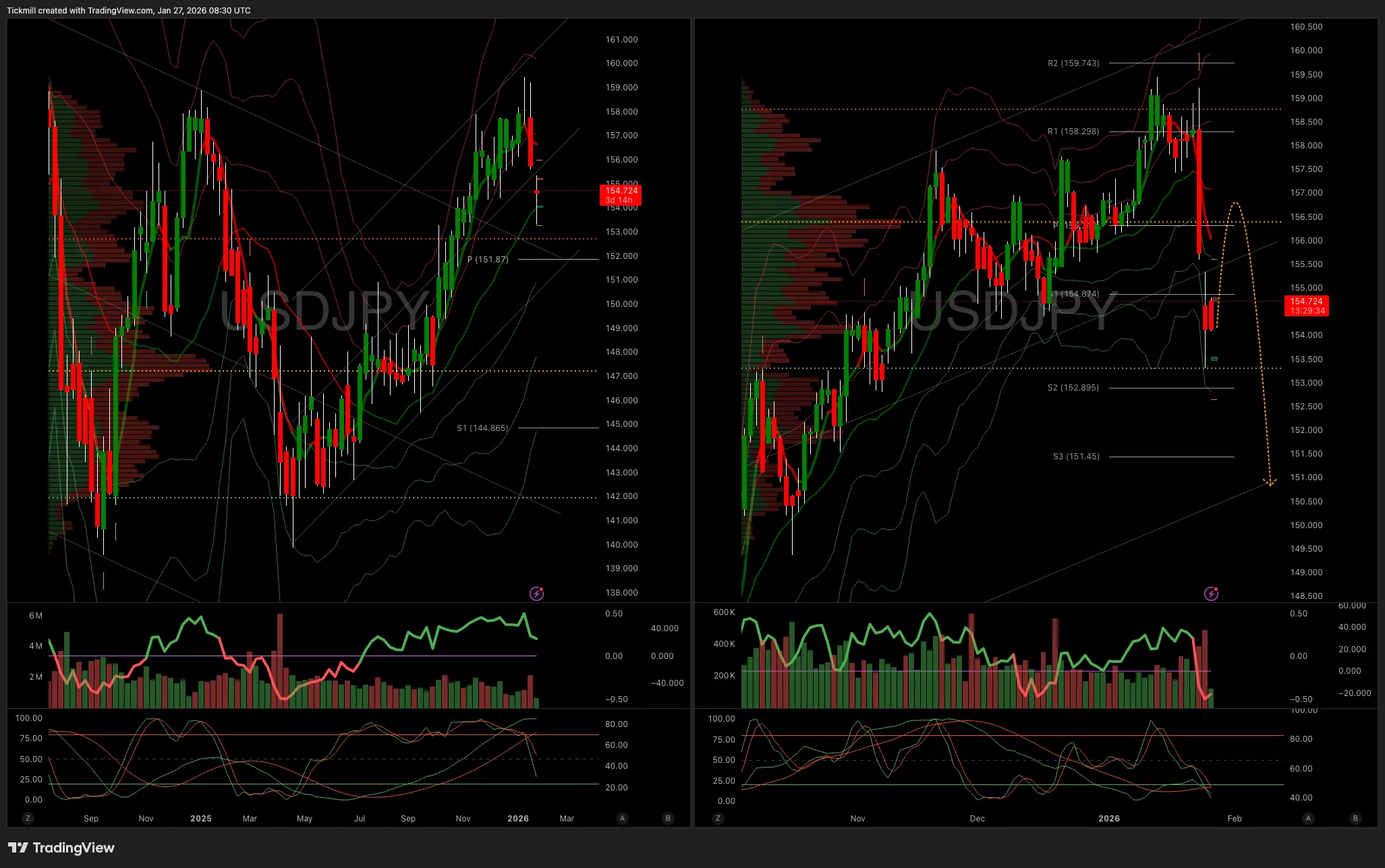

USDJPY

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 157.75 Target 160

- Below 156 Target 152

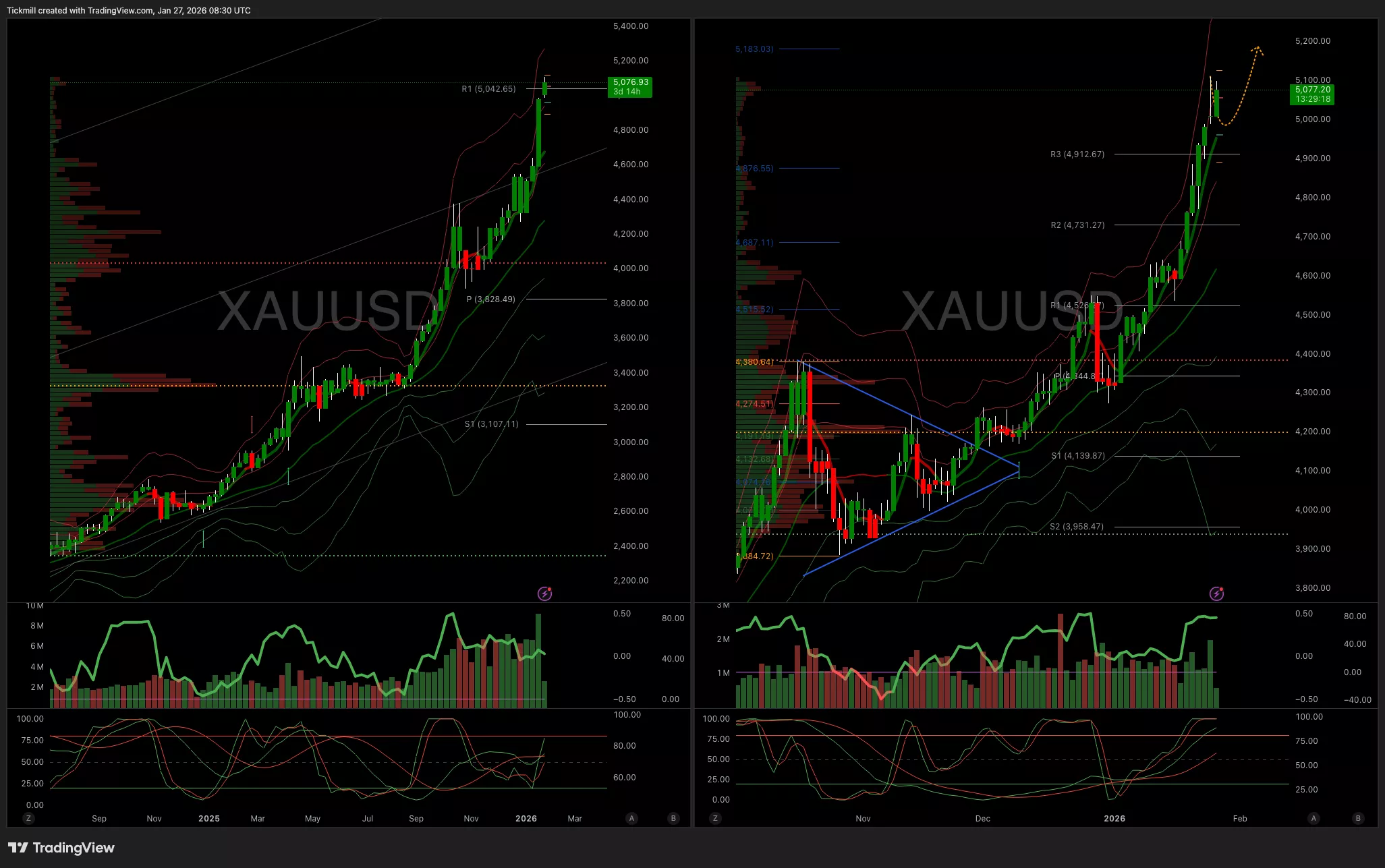

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 4900 Target 5200

- Below 4885 Target 4775

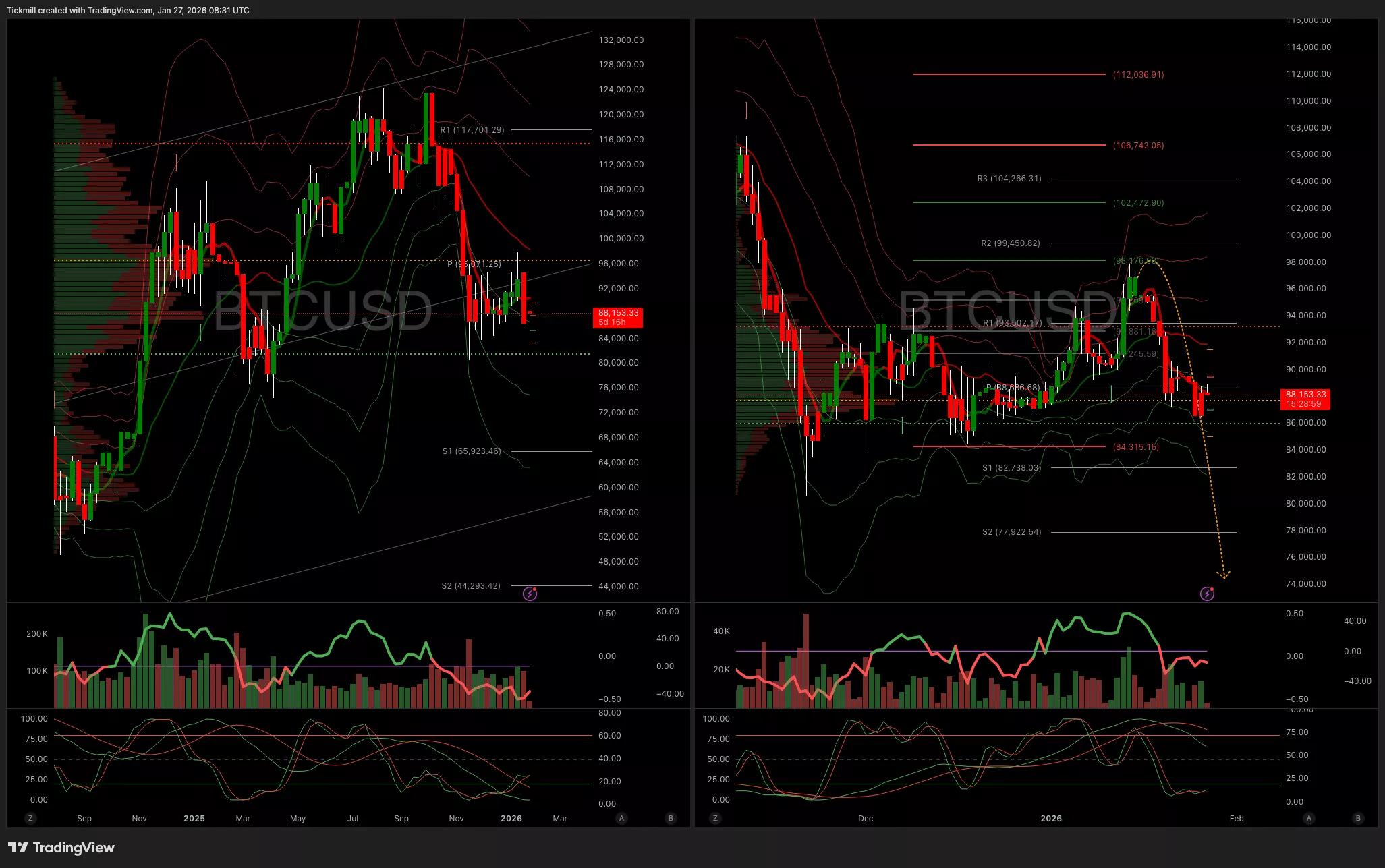

BTCUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 89.8k Target 92k

- Below 88.7k Target 84.3k

More By This Author:

The FTSE 100 Finish Line - Monday, Jan. 26

Daily Market Outlook - Monday, Jan. 26

The FTSE 100 Finish Line - Friday, Jan. 23