The FTSE 100 Finish Line - Friday, Jan. 23

Photo by Austin Hervias on Unsplash

The UK's FTSE 100 remained largely unchanged on Friday, as losses in major financial stocks counterbalanced gains in energy shares. Despite this, the index was poised to record its first weekly decline in four weeks, driven by renewed geopolitical tensions. By the close of trading, the blue-chip FTSE 100 inched up by 0.1%. Over the week, the market fell 0.7%, breaking a strong three-week rally during which it rose approximately 3.5%, marking its best performance streak since August. Investor sentiment faltered this week following U.S. President Donald Trump's controversial tariff remarks concerning Greenland. Although Trump later dismissed the notion of acquiring the territory by force and retracted his threats, the uncertainty unsettled markets.

The UK economic landscape wrapped up the week with retail sales volumes rising 0.4% in December, surpassing expectations. However, the data remains difficult to interpret. While annual growth for Q4 reached 2.1%, the quarter recorded a 0.3% contraction compared to the previous period. Factors such as favourable Q3 weather and shifting Black Friday trends likely influenced these figures. Consumer confidence saw a modest improvement in January, with personal financial outlooks showing greater positivity than broader sentiment. Looking ahead, disinflation may bolster real incomes by 2026, though rising energy costs—natural gas prices have surged 30% this month—pose significant risks, potentially affecting the Q2 energy price cap and CPI inflation.

In the markets, the FTSE 350 energy index climbed 1.2%, driven by gains in oil majors BP and Shell, which each advanced around 1%. This rise mirrored a recovery in oil prices, fuelled by Trump’s renewed warnings to Iran, sparking fears of supply disruptions. Conversely, travel and leisure stocks faced headwinds. Shares in British Airways' parent company, IAG, dropped 3.5%, while easyJet fell 2.7%. Carnival, the cruise operator, saw its London-listed shares decline by 2.1%, and Wizz Air slid 4.2%, giving back some of the 9% surge it experienced in the previous session amid optimism over a potential Ukraine peace deal. Financial stocks also struggled, with banks dipping 0.1%, emerging as the market's biggest drag. Among individual companies, defence contractor Babcock saw its shares drop around 1% after announcing that CEO David Lockwood plans to retire by the end of 2026. Irish drinks company C&C Group hit a 16-year low after slashing its fiscal 2026 profit forecast, blaming weakened consumer confidence following November's UK Budget, which altered purchasing behaviours and dampened demand.

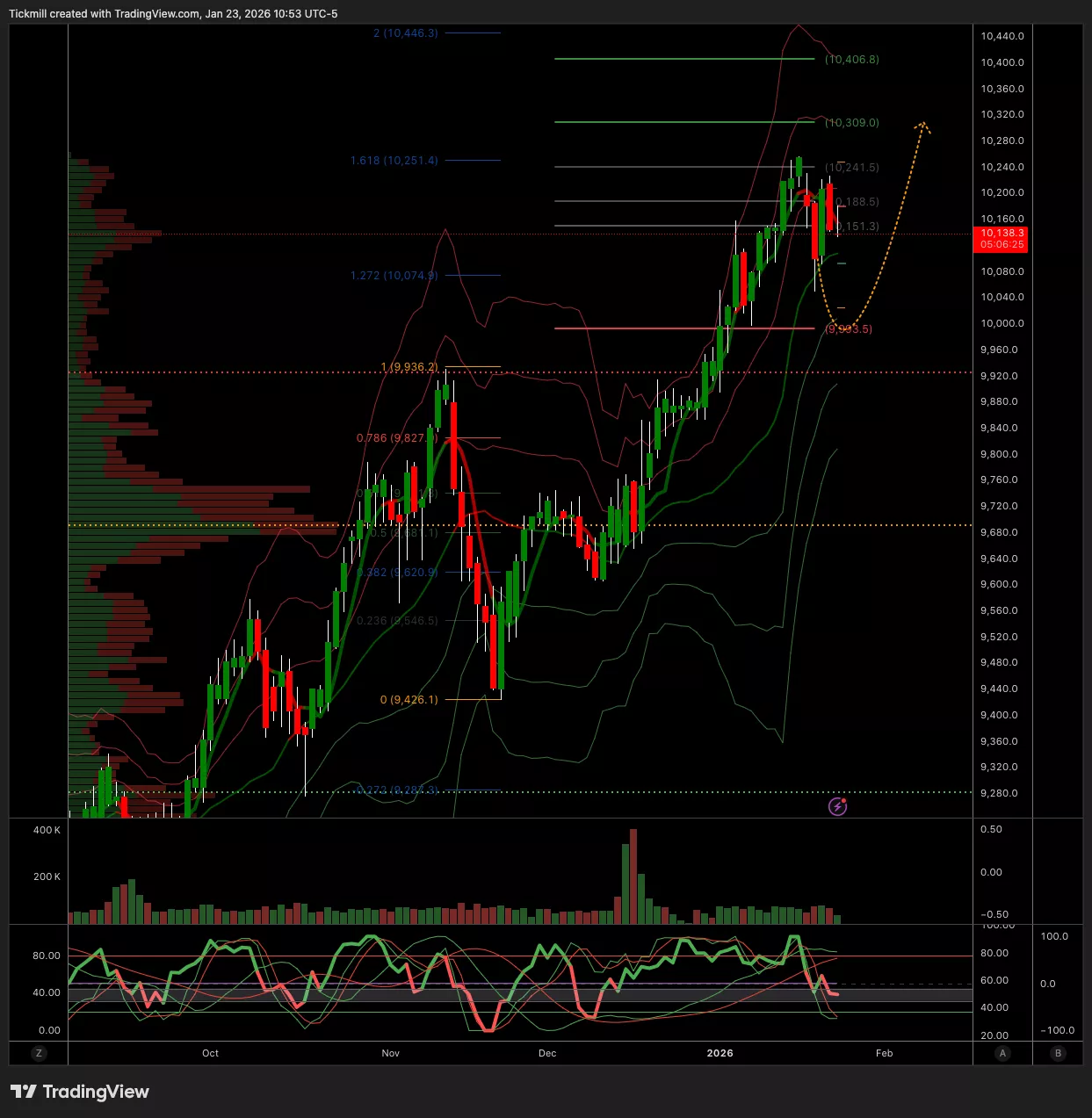

TECHNICAL & TRADE VIEW - FTSE100

Daily VWAP Bearish

Weekly VWAP Bullish

Above 10150 Target 10300

Below 10070 Target 9950

More By This Author:

Daily Market Outlook - Friday, Jan. 23The FTSE 100 Finish Line - Thursday, Jan. 22

Daily Market Outlook - Thursday, Jan. 22