Daily Market Outlook - Monday, Jan. 26

Image Source: Pixabay

U.S. stocks wrapped up a turbulent week with the S&P 500 marking its first back-to-back weekly decline since June, despite rebounding from earlier losses driven by strong consumer sentiment and gains in megacap stocks like Nvidia, which climbed 1.5%. Conversely, Intel tumbled 17% following a cautious outlook, while small-cap stocks underperformed after prior gains. Bond markets remained steady as expectations solidified that the Federal Reserve would hold interest rates steady at its upcoming meeting. President Trump's withdrawn tariff threats shook global markets, causing the dollar to post its worst weekly performance since May. The S&P 500 hovered near 6,915, the Russell 2000 dropped 1.8%, and commodity prices, including oil, gold, and silver, rose amid geopolitical tensions and the impact of a winter storm.

Overnight The US Dollar took a hit against most major currencies as concerns grew over potential American intervention in Japan's foreign exchange market, dampening sentiment toward the global reserve currency. Meanwhile, gold soared past the $5,000 mark for the first time, fuelled by its appeal as a safe-haven asset. Asian currencies capitalised on the Dollar's weakness, with Malaysia's ringgit climbing to its strongest value since 2018 and South Korea's won touching its highest point in roughly three weeks. Singapore’s dollar also made headlines, reaching levels not seen since 2014. The turbulence in the currency markets coincided with remarks from Japan's top currency official, Atsushi Mimura, who emphasised Tokyo's commitment to working closely with Washington. Adding to the tension, Japanese Prime Minister Sanae Takaichi issued a warning to markets, signalling that the government stands ready to take action if necessary. Market participants interpreted recent moves by the New York Federal Reserve as a sign that the US central bank might support Japanese authorities in direct currency market intervention to stabilise the yen. This comes after the Dollar tumbled to its lowest point since May, amid uncertainty surrounding US policies, ongoing tariff disputes with Europe, and heightened scrutiny of the Federal Reserve’s independence. Amid these developments, US Treasury yields rose despite growing worries over trade conflicts and mounting global tensions. Meanwhile, equity markets in Japan, South Korea, and Hong Kong all saw declines, reflecting broader jitters across the region.

The flash January S&P Global PMIs revealed mixed results. France's composite index fell, signaling contraction, while the UK saw a notable rebound to 53.9, aided by "post-Budget clarity" boosting activity and investment. However, challenges persist: the employment index dropped further (45.7 vs. 46.7), indicating job losses, and rising input costs suggest inflation remains stubborn. This divergence between employment and prices complicates the MPC's plans, likely slowing the pace of rate cuts. The path to a March MPC cut now looks less certain, shifting attention to April.

The upcoming week leans US-focused with an active data calendar, though it lacks top-tier releases. Key highlights include regional Fed surveys (Dallas Mon, Richmond Tue) to confirm trends in recent data, alongside capital goods (Mon), factory orders (Thu), trade data (Thu), and December PPI (Fri). The FOMC meeting (Wed) will dominate, with no rate changes expected. but focus will be on labour market and inflation insights, as well as Chair Powell’s press conference addressing the DoJ probe and Fed independence. In Europe, watch for Germany's IFO survey (Mon), Eurozone money and credit data (Thu), and Q4 GDP (Fri). The UK has a quieter week, with updates on the Lloyds Business Barometer and money/borrowing figures (Fri). The Riksbank policy meeting (Thu) is expected to leave rates unchanged, reflecting a stable but soft inflation environment. Speaker activity is light, with possible Fed member perspectives later in the week.

Overnight Headlines

- German IFO Conf Poised To Edge Higher After Greenland Scare

- Gold Tops $5,000 As Global Upheaval Fuels Precious Metals Rally

- Trump Threatens 100% Tariffs On Canada Over China Trade

- Canada PM Carney: No Plans For Free Trade Deal With China

- Takaichi’s Approval Ratings Dip As Japan Heads Into Election

- Japan In Close Contact With US On Yen As Needed, FX Chief Says

- Dollar Pressure Mounts As Reasons For Weakness Multiply

- China To Open Nickel, Lithium Futures To Foreign Investors

- Samsung Nears Nvidia Approval For Key HBM4 AI Memory Chips

- China Tells Tech Giants To Prepare Nvidia H200 Orders

- US Natural Gas Futures Soar Above $6 For First Time Since 2022

- Rheinmetall In Talks Over Starlink-Style Service For German Arm

- European IPO Market Starts 2026 At Record Pace

- Trump’s JPM Lawsuit Highlights Deepening Wall Street Clash

- Investors Hedge AI Bets As Big Tech Earnings Loom

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1780 (EU1.00 billion), 1.1750 (EU875.2 million), 1.1680 (EU761.8 million)

- USD/JPY: 160.00 ($1.66 billion), 159.00 ($1.26 billion), 157.50 ($860 million)

- AUD/USD: 0.6800 (AUD791.2 million)

- USD/CAD: 1.3800 ($1.15 billion), 1.3755 ($465 million)

- USD/MXN: 18.25 ($356.3 million)

- USD/CNY: 7.0000 ($499.6 million)

CFTC Positions as of January 23rd:

- Equity fund speculators have reduced their S&P 500 CME net short position by 48,733 contracts, bringing it down to 400,381. Meanwhile, equity fund managers have decreased their S&P 500 CME net long position by 49,679 contracts, resulting in a total of 882,629 contracts.

- Speculators have cut their net short position in CBOT US 5-year Treasury futures by 132,601 contracts to 2,136,519 and have also trimmed the CBOT US 10-year Treasury futures net short position by 214,865 contracts to 655,640. The CBOT US 2-year Treasury futures net short position has been reduced by 79,758 contracts to 1,225,122. In contrast, speculators have raised their CBOT US UltraBond Treasury futures net short position by 23,725 contracts, now totaling 258,822. Additionally, speculators have shifted CBOT US Treasury bonds futures to a net short position of 23,070 contracts, compared to 13,835 net longs the previous week.

- The current Bitcoin net long position stands at 298 contracts, while the Swiss franc has a net short position of -43,207 contracts. The British pound is showing a net short position of -21,980 contracts, and the Euro has a net long position of 111,695 contracts. Finally, the Japanese yen reflects a net short position of -44,829 contracts.

Technical & Trade Views

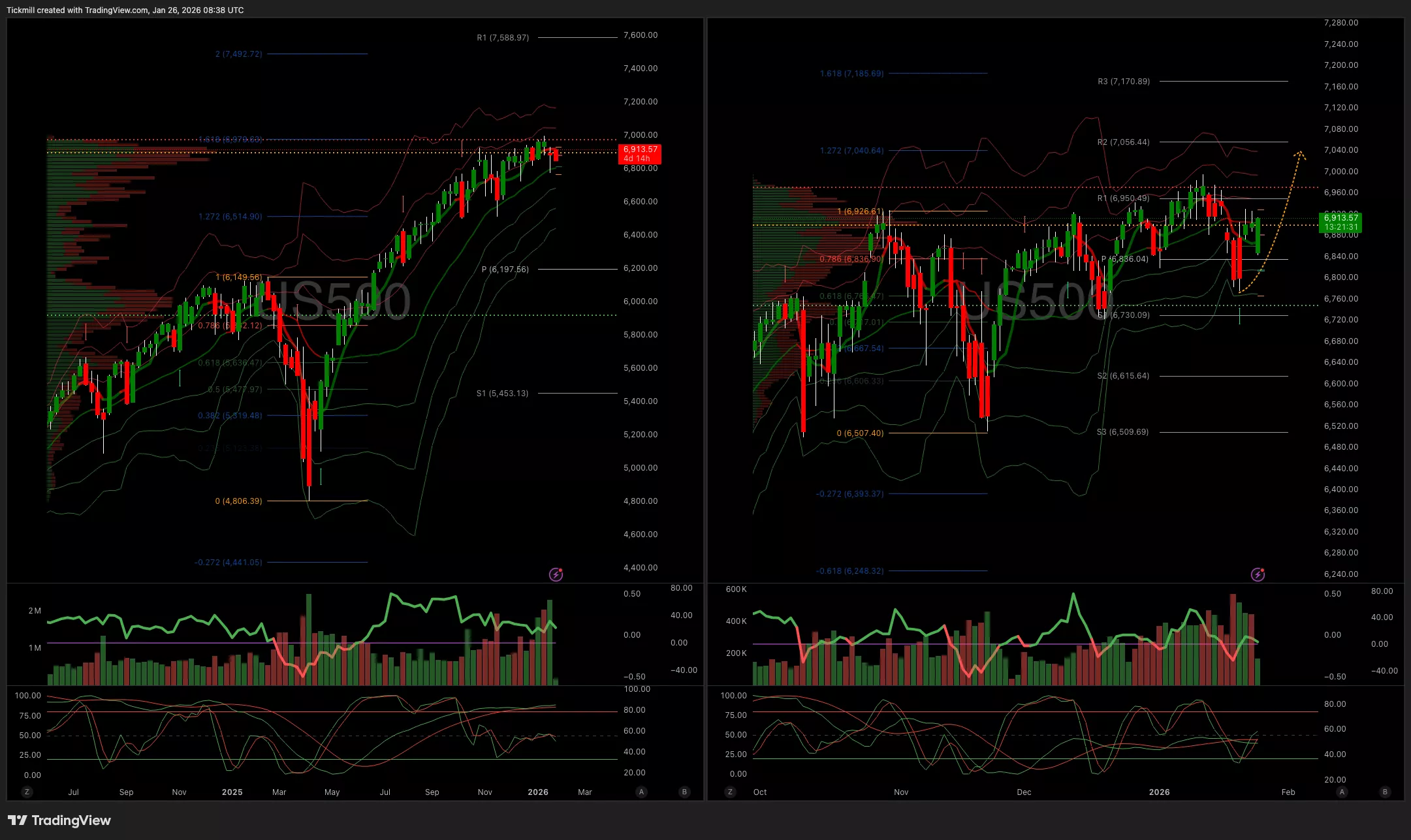

SP500

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 6860 Target 6950

- Below 6848 Target 6797

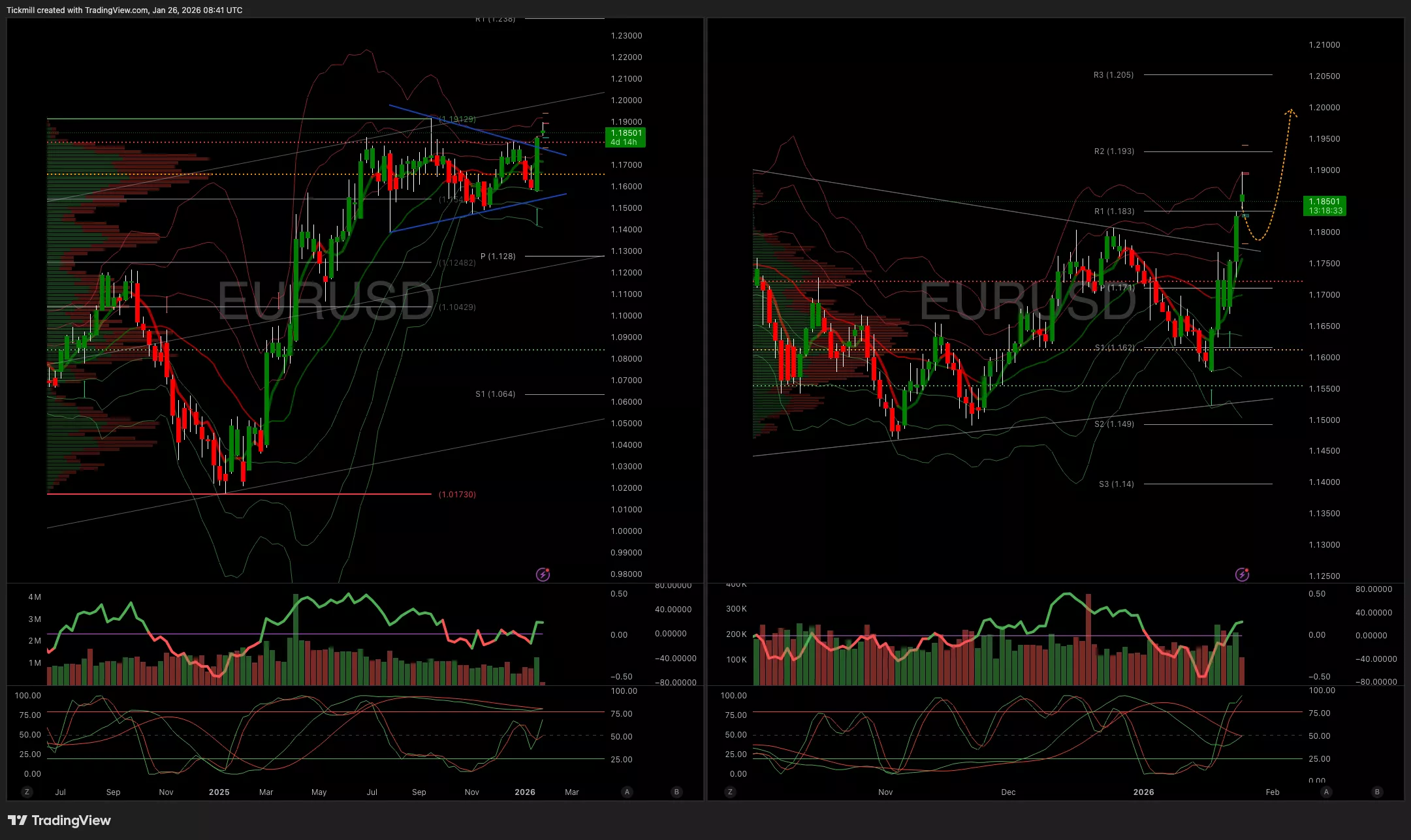

EURUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 1.18 Target 1.1930

- Below 1.1750 Target 1.1615

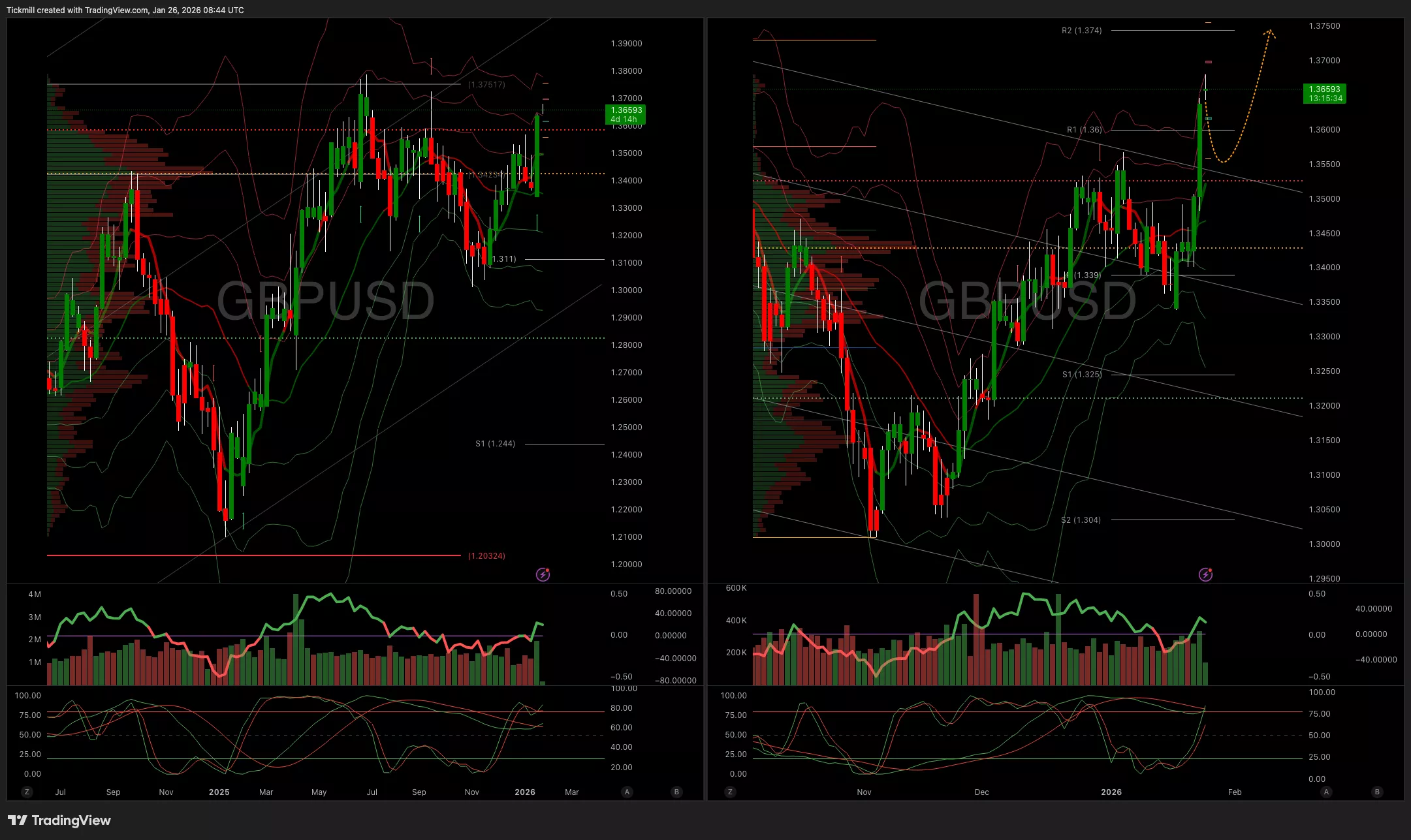

GBPUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 1.3550 Target 13740

- Below 1.3430 Target 1.3290

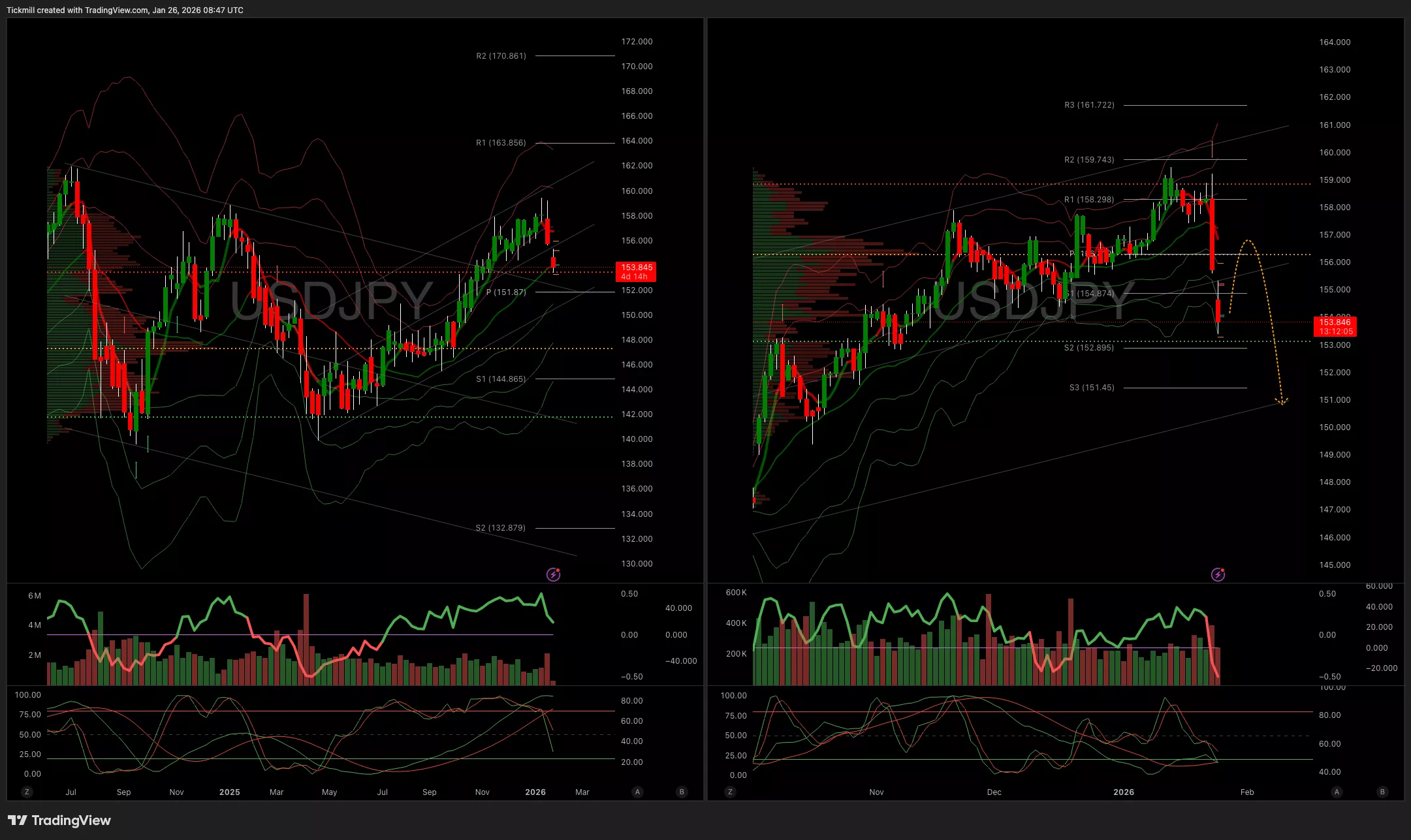

USDJPY

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 157.75 Target 160

- Below 156 Target 152

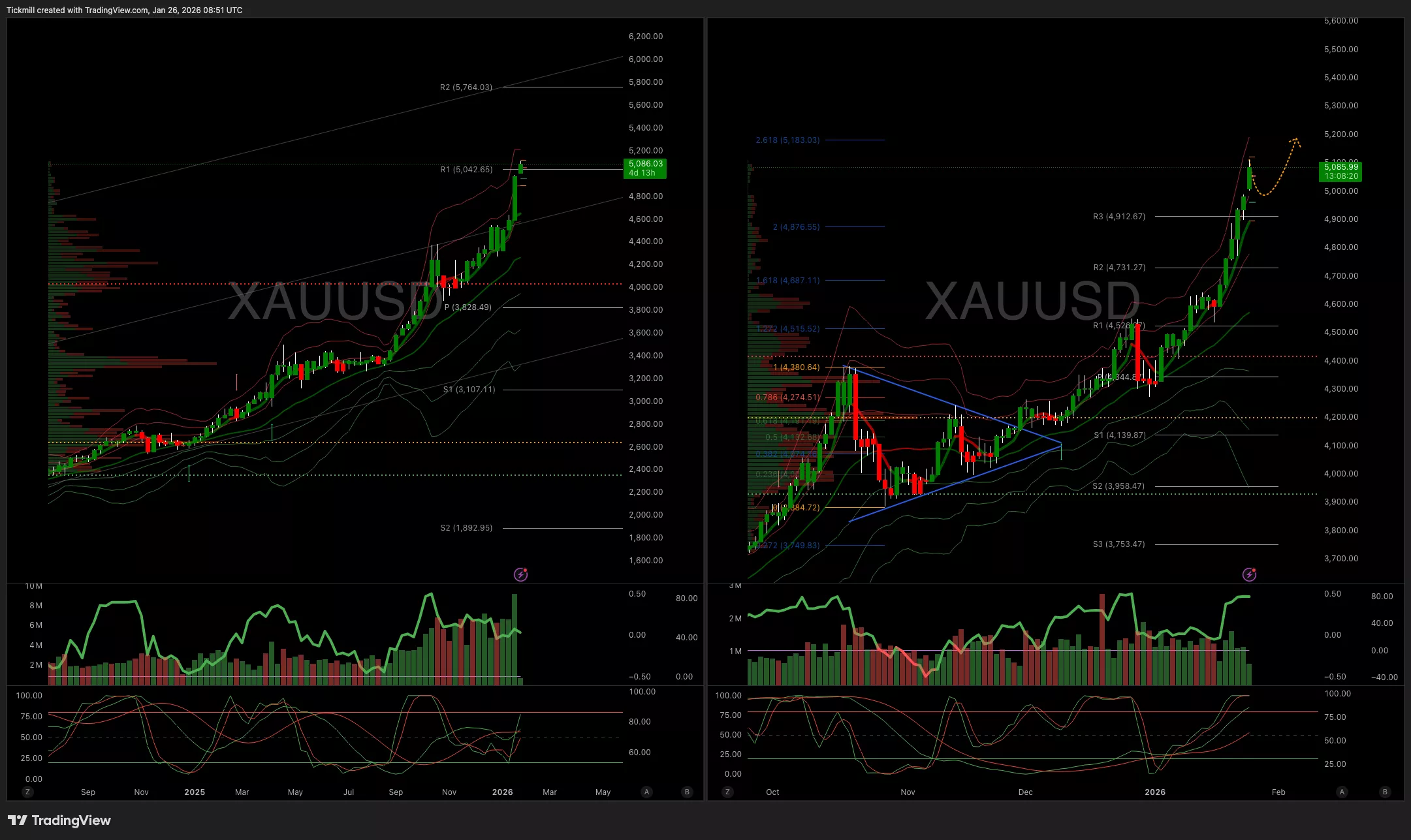

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 4900 Target 5200

- Below 4885 Target 4775

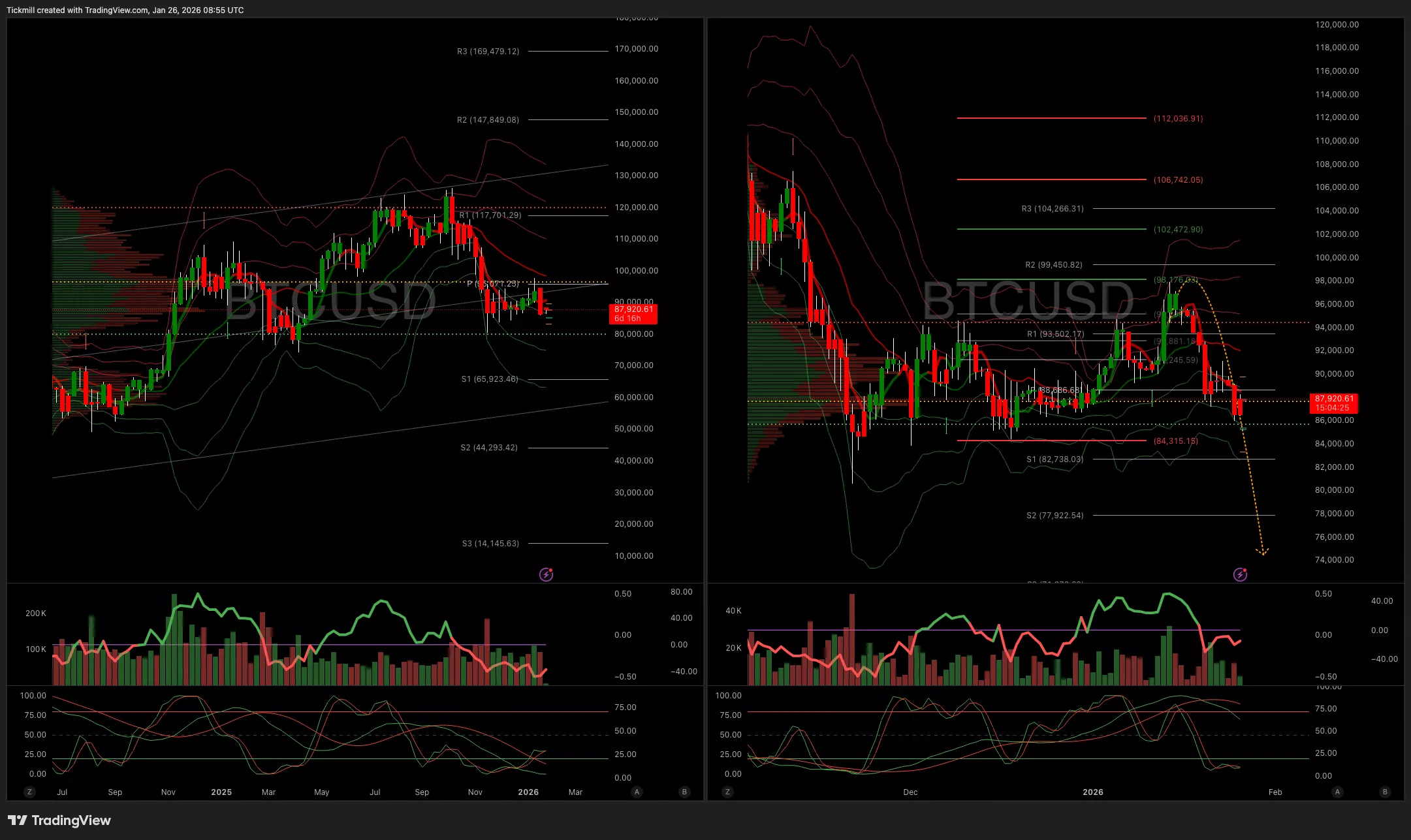

BTCUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 89.8k Target 92k

- Below 88.7k Target 84.3k

More By This Author:

The FTSE 100 Finish Line - Friday, Jan. 23

Daily Market Outlook - Friday, Jan. 23

The FTSE 100 Finish Line - Thursday, Jan. 22