Daily Market Outlook - Friday, Jan. 23

Image Source: Pixabay

Asian markets advanced, while the dollar continued to struggle as investors turned their attention to non-US assets amidst policy uncertainties and geopolitical tensions. Precious metals also soared to unprecedented levels. The MSCI Asia Pacific Index climbed 0.4%, and emerging market stocks hit record highs as well. Futures for US equity benchmarks signalled gains, though these were more modest compared to Asia’s rally. Japanese stocks surged, and the Yen weakened after the Bank of Japan (BoJ) kept its policy rate steady at 0.75%, in line with expectations. The Bank of Japan (BOJ) raised its growth outlook and maintained its inflation forecasts on Friday. BOJ Governor Kazuo Ueda highlighted that despite the recent December hike, demand for corporate funding is growing, and banks remain active in lending. Although the financial conditions are supportive, it will take time to assess the impact of past hikes, as we closely monitor developments. Future rate hikes will depend on economic, price, and financial conditions. The BOJ will evaluate data at each policy meeting, revising forecasts and assessing risks as needed. Currencies were in the spotlight as China’s central bank raised the Yuan’s daily reference rate beyond the closely watched 7-per-dollar threshold for the first time since 2023. The Dollar extended its losses after experiencing its steepest drop in a month. This weaker Dollar gave a boost to precious metals, with gold hitting an all-time high of over $4,965 per ounce, while silver hovered around $100 per ounce. In Japan, bond futures took a hit following the BoJ’s upward revision of its inflation forecast. On the political front, Japanese Prime Minister Takaichi dissolved the lower house of parliament and called for a snap election scheduled for February 8th. Signs are emerging that investors are increasingly pulling away from US assets. A growing wave of cash is flowing into emerging-market funds at record levels, signalling a shift away from US investments and further pressuring the Dollar. The November US PCE report showed steady inflation, with headline and core PCE rising 0.2% m/m and 2.8% y/y, matching expectations. Data reliability was impacted by missing CPI inputs for October. The rise in income was 0.3% m/m, while the rise in spending was 0.5% m/m. Income growth slowed nominally to 4.3% y/y, with wages weaker at 3.8% y/y. Meanwhile, spending grew at 5.4% y/y, driving the savings rate down to 3.0%, its lowest since post-lockdown highs. Real household income grew just 1%, lagging GDP, as wage income's share of GDP has fallen since early last year. Despite weaker employment, US productivity and corporate profits have risen, highlighting an uneven economic recovery.

The eventful week for UK economic data concluded with the ONS revealing that retail sales volumes rose by a stronger-than-anticipated 0.4% month-on-month in December. Interpreting signals from this often-volatile series is no straightforward task. For example, while retail sales volumes grew by 2.1% on a three-month annual basis in Q4, they declined by 0.3% quarter-on-quarter. So, what’s the takeaway? Does the annual growth suggest resilience despite the pressures of food and energy inflation, or does the quarterly dip highlight negative momentum? The reality likely lies somewhere in between. Part of Q3's relative strength can be credited to favourable weather and boosted food sales linked to sports events, while some of Q4's soft data might reflect shifting seasonal patterns, such as Black Friday sales. Meanwhile, the GfK survey on consumer confidence for January, released overnight, ticked up by 1 point to -16, marking its highest level since August 2024. While the survey has its intricacies, it’s worth noting that perceptions of personal financial situations improved more significantly than the headline figure suggests. Looking ahead, the disinflation process could potentially boost the UK in 2026 by providing real income gains to consumers. However, rising energy costs could dampen this optimism. Natural gas prices have already surged by over 30% this month, a trend worth monitoring closely. These price movements are still shaping the Q2 energy price cap, which will have a major effect on CPI inflation and, consequently, the outlook for real incomes.

The upcoming week leans heavily on US data, though none from the top tier. Key releases include regional Fed surveys (Dallas Mon, Richmond Tue), capital goods (Mon), factory orders (Thu), trade (Thu), and December PPI (Fri). The FOMC meeting (Wed) will dominate, with no rate changes expected, but the focus will be on labour market and inflation insights, plus Chair Powell’s press conference addressing the DoJ probe and Fed independence. In Europe, watch for Germany’s IFO survey (Mon), Eurozone money/credit (Thu), and advanced Q4 GDP (Fri). The UK has a quieter week, with the Lloyds Business Barometer and borrowing data on Friday. The Riksbank meeting (Thu) is expected to hold rates steady, as Sweden’s economy improves but inflation remains subdued. Speaker activity is light, with potential Fed member perspectives later in the week.

Overnight Headlines

- China To Set 2026 GDP Range For Greater Policy Flexibility

- China Fixes Yuan Below 7 For First Time Since 2023

- BoJ Keeps Rates Unchanged At 0.75%, Cites Recent Hike Impact

- Japan’s Inflation Slows On Subsidy Effect, CPI Misses Estimates

- New Zealand CPI Beats, Supports RBNZ Rate-Hike Expectations

- Intel Warns On Outlook After Supply Shortages Hit Sales

- Capital One To Acquire Brex In $5.15B Deal, Eyes Fintech Expansion

- Trump Sues JPMorgan, Dimon For $5B Over ‘Political Debanking’

- Amazon Plans More Corporate Layoffs Amid Cost Cuts

- TikTok To Form US Venture With Oracle, Silver Lake

- Norway Fund Shifts From Alibaba To Samsung On Chip Outlook

- Apple Accuses EC Of Political Delay Tactics On App Rule Changes

- Russia Agrees Next Steps With US Envoys, Says Territory Is Key Issue

- Ukraine Gets S&P Upgrade After Restructuring Growth-Linked Debt

- Gold Hits New Record Above $4,950 As Rally Extends

- Crypto Social App To Repay $180M To Venture Backers

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1650-60 (2.9BLN), 1.1665-70 (841M), 1.1700 (1.4BLN), 1.1800 (262M), 1.1825 (778M)

- EUR/GBP: 0.8600 (954M), 0.8780 (150M)

- GBP/USD: 1.3440-50 (295M). AUD/USD: 0.6800 (891M)

- USD/CAD: 1.3690-1.3700 (1BLN), 1.3850 (275M), 1.3895-1.3900 (1.1BLN)

- USD/JPY: 158.50-60 (526M), 158.80 (210M), 159.00 (1.1BLN), 159.50 (326M), 160.00 (1.4BLN)

CFTC Positions as of January 16th:

- Speculators have reduced their net short positions in CBOT US Treasury futures as follows: 5-year Treasury futures by 43,633 contracts to 2,269,120, 10-year Treasury futures by 45,047 contracts to 870,505, 2-year Treasury futures by 41,774 contracts to 1,304,880, and UltraBond Treasury futures by 10,650 contracts to 235,097. Additionally, speculators have shifted to a net long position of 13,835 contracts in CBOT US Treasury bonds futures, compared to 6,832 net shorts the previous week.

- Bitcoin net long position stands at 69 contracts. The Swiss franc shows a net short position of -43,392 contracts, the British pound at -25,270 contracts, the euro with a net long position of 132,656 contracts, and the Japanese yen at -45,164 contracts.

Technical & Trade Views

SP500

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 6860 Target 6950

- Below 6848 Target 6797

EURUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 1.1670 Target 1.1780

- Below 1.1650 Target 1.1590

GBPUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 1.3450 Target 13540

- Below 1.3430 Target 1.3290

USDJPY

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 158.19 Target 160

- Below 158 Target 157.46

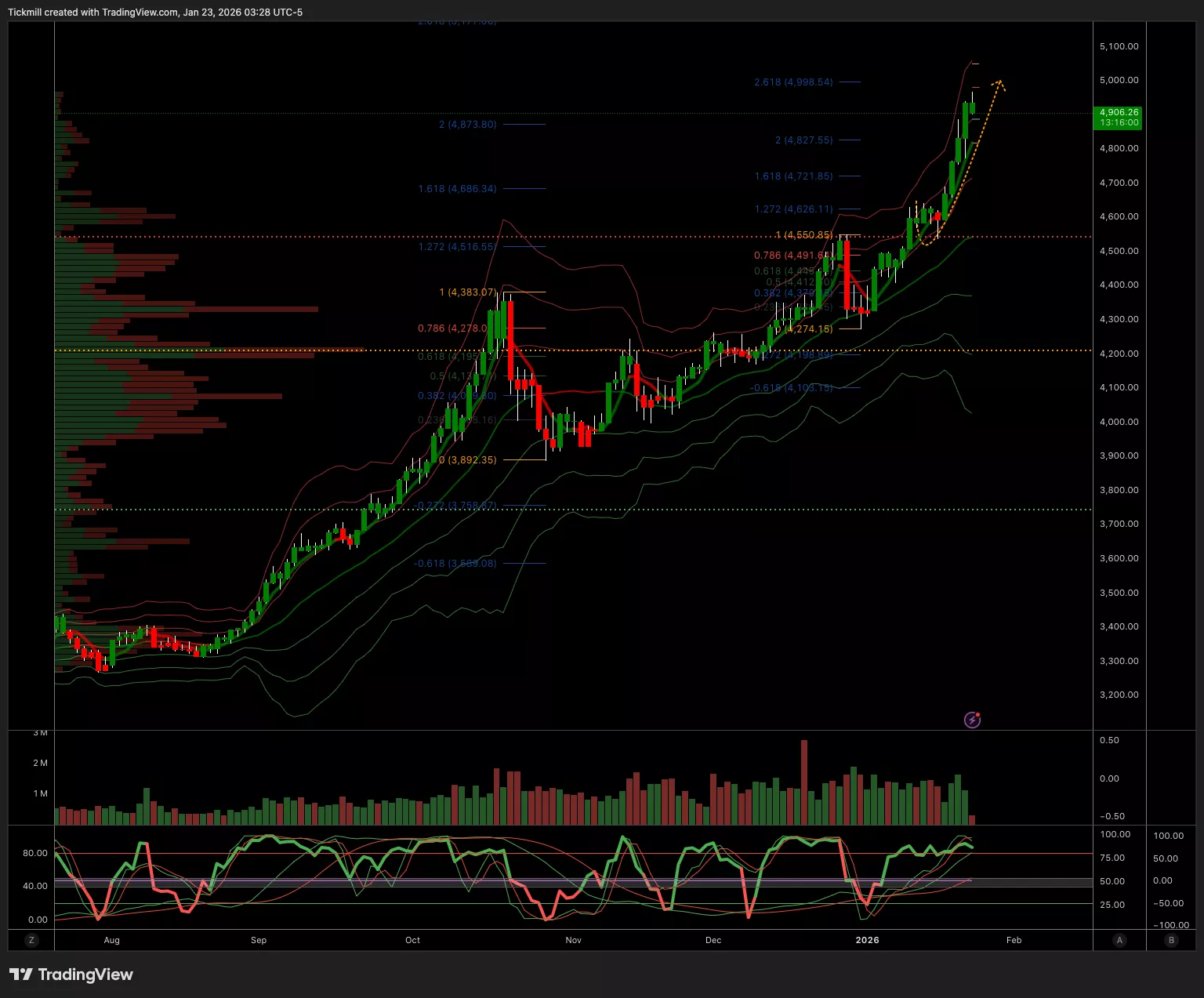

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 4740 Target 5000

- Below 4720 Target 4638

BTCUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 91k Target 94k

- Below 90.5k Target 85k

More By This Author:

The FTSE 100 Finish Line - Thursday, Jan. 22

Daily Market Outlook - Thursday, Jan. 22

The FTSE 100 Finish Line - Wednesday, Jan. 21