Daily Market Outlook - Thursday, Jan. 22

Image Source: Unsplash

Global stock markets appeared poised to extend their recent rally after President Donald Trump softened his stance on imposing tariffs on Europe, alleviating worries about a potential escalation in transatlantic trade disputes. European equity futures surged over 0.7%, while Asian markets followed Wall Street's lead, buoyed by Trump's remarks. U.S. stock futures also pointed to further gains, suggesting the upbeat momentum could carry into the trading session.

Technology stocks spearheaded the rally, with semiconductor companies enjoying a significant boost. Nvidia’s CEO, Jensen Huang, struck an optimistic note about artificial intelligence during his address at the World Economic Forum in Davos, fuelling investor enthusiasm. Japan’s Disco soared an impressive 17%, Samsung advanced nearly 2%, and South Korea’s main stock index—often regarded as a barometer for global tech demand—reached a new all-time high. The improved sentiment took a toll on safe-haven assets. Gold dipped 0.2% as appetite for riskier investments grew, while the U.S. dollar remained steady, and Treasury yields edged higher. Meanwhile, Japanese government bonds continued their recovery for a second consecutive day. In Australia, three-year bond yields climbed to their highest level since late 2023, driven by an unexpected drop in unemployment for December. This has sparked speculation that the Reserve Bank of Australia might raise interest rates as early as next month. On the cryptocurrency front, digital assets faced some pressure amid indications that U.S. legislation aimed at regulating the sector could be delayed. Bitcoin hovered around the $90,000 mark, reflecting cautious sentiment in the market.

Domestically, the UK government borrowed £11.6bn in December, according to the ONS. With adjustments to previous months, the fiscal year-to-date borrowing total (PSNB) for 2025-26 has reached £140.2bn. This figure already surpasses the upwardly revised full-year target of £138.3bn set during November’s Budget. To prevent borrowing from exceeding this new target, the typical January pattern of strong tax receipts yielding a surplus will need to occur again. However, the cash accounting measure of public finances (CGNCR) offers a slightly more positive outlook. The year-to-date cash requirement stands at £138.3bn, nearly £4bn below the level anticipated by the OBR at this stage, even before the upward revisions made in November’s Budget (see chart). This indicates a limited risk of needing to increase the gilt financing programme in the Spring Statement to cover any funding shortfall for the 2025-26 fiscal year. Further insights will emerge later this morning when the OBR releases its monthly commentary, which will include updated monthly deficit progress profiles aligned with the new Budget targets. A broader concern remains the persistent pressure from high public spending, coupled with the risk of slower growth and moderating inflation potentially weakening tax receipts, which have so far performed well against expectations.

Global markets have been feeling the strain this week due to concerns surrounding Greenland, leading to a 1.9% drop in the STOXX 600 index. However, a brighter opening seems to be on the horizon—Euro STOXX 50 futures are climbing 0.8%, DAX futures are up 0.9%, and FTSE futures are showing a 0.6% increase. On the corporate front, Volkswagen has delivered some good news, reporting stronger-than-expected net cash flow projections for 2025. Meanwhile, French market research firm Ipsos has announced plans to invest €1.2 billion ($1.4 billion) over the next five years, focusing on artificial intelligence and acquisitions. In the banking sector, Spain's Bankinter revealed a 25% surge in fourth-quarter net profit compared to the same period in 2024, driven by higher fee income. British retailers are under scrutiny as well. After issuing a profit warning earlier this month, Associated British Foods confirmed that its Primark clothing division saw a 2.7% drop in underlying sales during the Christmas quarter. Adding to the retail woes, B&M has also downgraded its profit forecast.

Overnight Headlines

- Trump Backs Off Greenland Tariffs, Citing ‘Framework’ Deal

- Australia’s Unemployment Drops To 4.1% In Dec, Fuels Hike Bets

- Trump Signals Favourite For Fed Chair: ‘Down To Maybe One’

- Deutsche Boerse Reaches $6.2B Buyout Deal For Allfunds

- Anthropic’s Revenue Run Rate Tops $9B As VCs Pile In

- OpenAI Courts Middle East Investors For $50B Fundraise

- Global Chip Stocks Soar As Nvidia CEO Fuels AI Euphoria At Davos

- Apple To Revamp Siri As Built-In Chatbot To Fend Off OpenAI

- VW Reports Stronger Cash Flow After Cutting Spending

- Venezuelan Crude Heads To Europe For First Time In A Year

- Goldman Sachs Raises Year-End Gold Forecast To $5,400/oz

- Crypto Bill Delayed As Senate Panel Pivots To Trump’s Housing Push

- Japan Exports Rise For Fourth Straight Month; Trade Balance Misses

- JGBs Steady As BoJ’s Two-Day Policy Meeting Kicks Off

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD:1.1600-05 (4.4BLN), 1.1630-40 (1.3BLN), 1.1650-55 (432M)

- 1.1670-75 (787M), 1.1700 (2.6BLN), 1.1725 (388M), 1.1760 (556M), 1.1800 (1.2BLN)

- USD/CHF: 0.7900 (540M), 0.7950 (200M), 0.8000-10 (1.1BLN)

- EUR/CHF (0.9250 (187M), 0.9300 (251M)

- GBP/USD: 1.3225 (353M), 1.3495 (467M), 1.3550 (323M)

- AUD/USD: 0.6750 (274M). AUD/NZD: 1.1600 (741M)

- USD/CAD: 1.3760-65 (671M), 1.3850-60 (530M), 1.3900 (238M), 1.3930 (491M)

- USD/JPY: 157.50 (628M), 158.00 (580M), 158.30-35 (478M), 158.75 (460M)

- 159.00 (1.2BLN), 159.50 (403M), 160.00 (1.1BLN)

CFTC Positions as of January 16th:

- Speculators have reduced their net short positions in CBOT US Treasury futures as follows: 5-year Treasury futures by 43,633 contracts to 2,269,120, 10-year Treasury futures by 45,047 contracts to 870,505, 2-year Treasury futures by 41,774 contracts to 1,304,880, and UltraBond Treasury futures by 10,650 contracts to 235,097. Additionally, speculators have shifted to a net long position of 13,835 contracts in CBOT US Treasury bonds futures, compared to 6,832 net shorts the previous week.

- Bitcoin net long position stands at 69 contracts. The Swiss franc shows a net short position of -43,392 contracts, the British pound at -25,270 contracts, the euro with a net long position of 132,656 contracts, and the Japanese yen at -45,164 contracts.

Technical & Trade Views

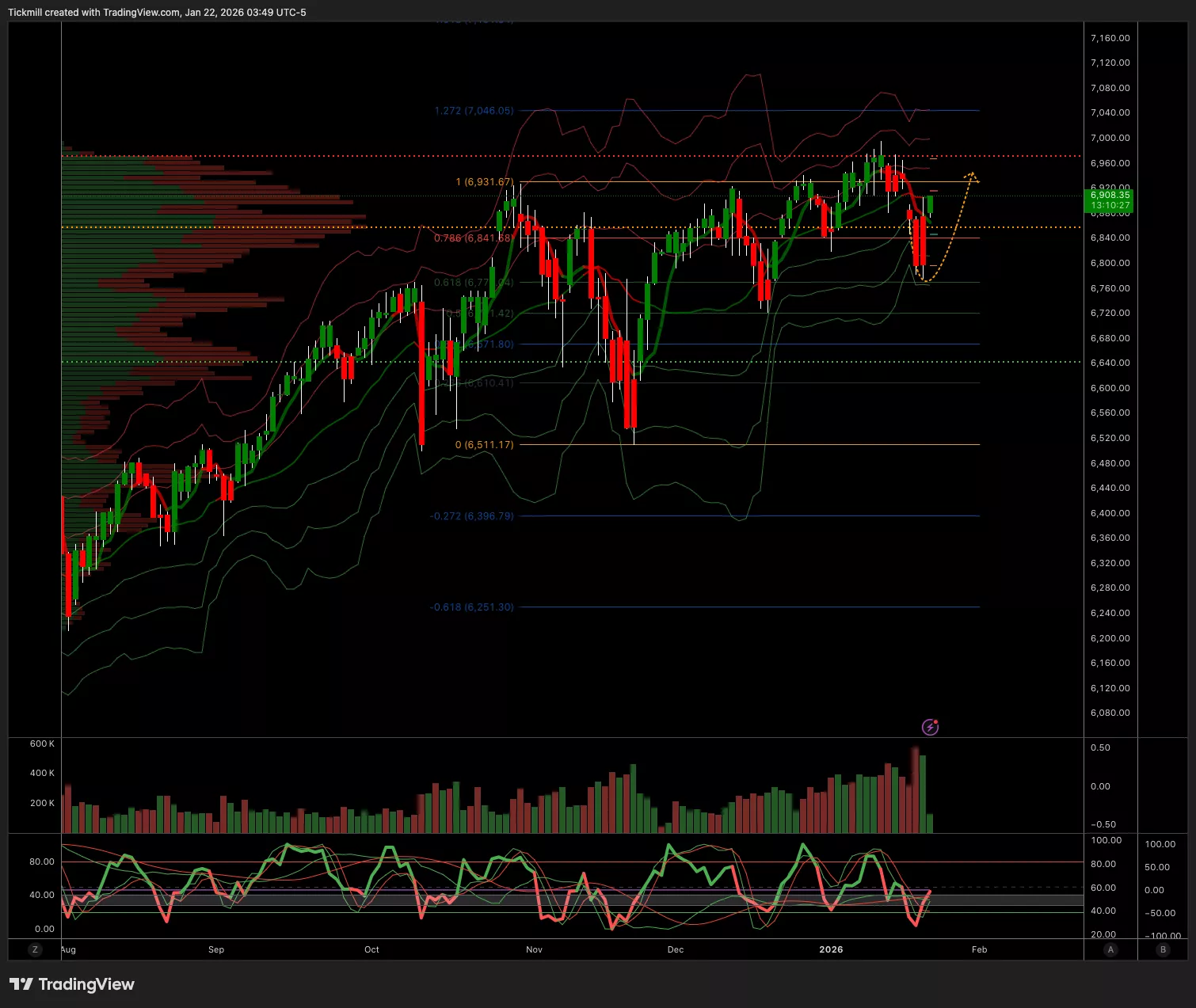

SP500

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 6860 Target 6950

- Below 6848 Target 6797

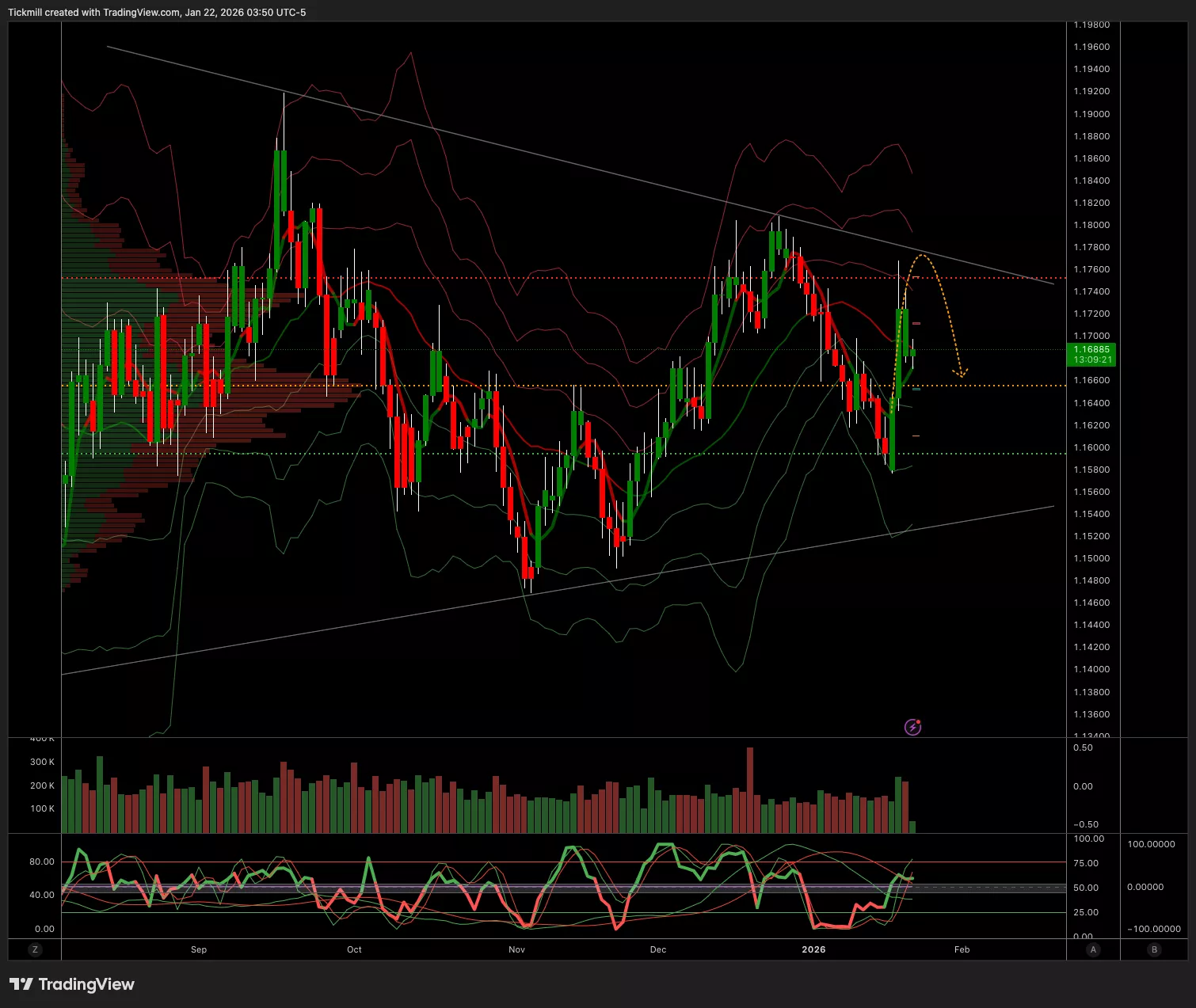

EURUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 1.1670 Target 1.1780

- Below 1.1650 Target 1.1590

GBPUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 1.3420 Target 1.3494

- Below 1.34 Target 1.3290

USDJPY

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 158.19 Target 160

- Below 158 Target 157.46

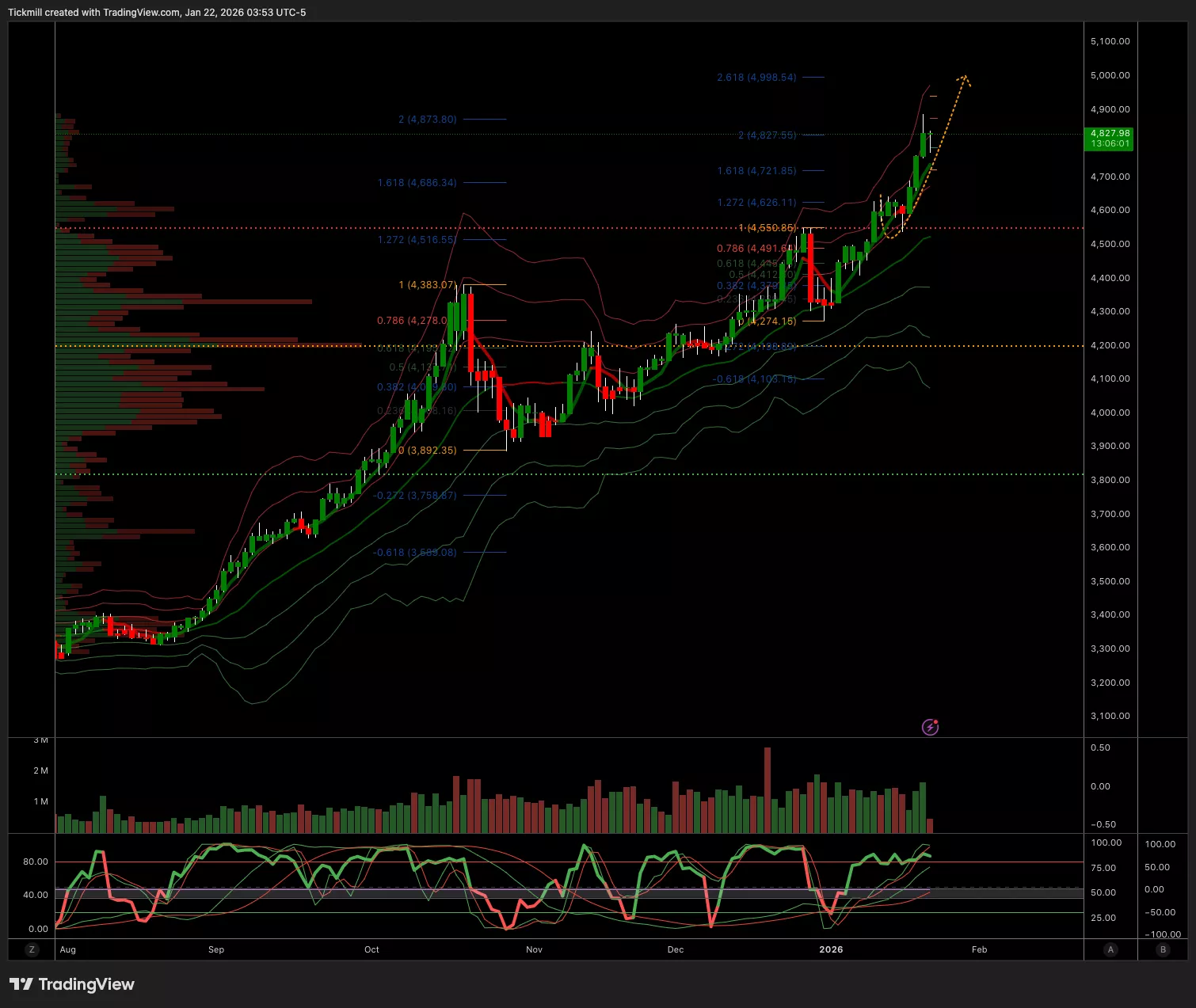

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 4740 Target 5000

- Below 4720 Target 4638

BTCUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 91k Target 94k

- Below 90.5k Target 85k

More By This Author:

The FTSE 100 Finish Line - Wednesday, Jan. 21

Daily Market Outlook - Wednesday, Jan. 21

The FTSE 100 Finish Line - Tuesday, Jan. 20