Daily Market Outlook - Tuesday, April 22

Image Source: Pexels

On Monday, Wall Street experienced significant selling, with long-term Treasuries joining stocks and the dollar in a steep decline as Trump dismissed Jerome Powell's interest-rate approach, raising concerns among investors already dealing with a global trade conflict. Trump's claims that tariff negotiations were progressing did little to stop the downward trend. The S&P 500 and other major US stock indexes dropped roughly 2.5% each in light trading, while the dollar index fell to a 15-month low. The yield on the benchmark 10-year note fell to 4.4%. As investors moved away from US securities, safe-haven assets gained value. Gold reached a record high of over $3,500 per ounce, and the Swiss franc appreciated by about 1% against the dollar. The turmoil extended to the US credit market. In derivatives, the cost of insuring a range of high-grade credit securities against default rose to its highest point in more than a week. Three investment-grade companies considered issuing bonds on Monday, but upon assessing the market conditions, two opted to wait, with only American Express moving forward with the offering.

Asian markets struggled on Tuesday after a significant sell-off in U.S. assets impacted Wall Street and weakened the dollar, while worries regarding the Federal Reserve's autonomy added more pressure on Treasuries. Despite relatively modest declines in Asia, speculation arose that funds might be reallocating their investments to equities in the region, although the effect of tariffs on economic growth continued to be a significant concern. President Donald Trump's increasingly confrontational remarks toward Fed Chair Jerome Powell for not lowering interest rates led to a drop of approximately 2.4% in Wall Street indexes on Monday, with the dollar reaching its lowest level in three years. Chinese blue-chip stocks rose by 0.2% as Beijing cautioned other nations against forming trade agreements that could disadvantage the United States at China’s cost. The market is poised for another challenge this week due to earnings reports, with 27% of the S&P 500 companies expected to release their results. Tesla will report later in the session, having already lost nearly 6% on Monday over concerns regarding production delays. Other companies reporting this week include Alphabet along with several prominent industrial firms like Boeing, Northrop Grumman, Lockheed Martin, and 3M.

Overnight Newswire Updates of Note

- Trump Warns Of Slowdown Unless Fed Cuts Rates, Triggering Selloff

- Dollar Hits 3Y Low As Trump Attacks Threaten Fed's Independence

- World Is ‘Lining Up’ To Work With Europe Amid Trump’s Trade War

- Toyota, Daimler Near Merger Of Truck Units, Eyeing Tokyo Listing

- Tesla's Robotaxis In Focus; Backlash, Competition Hurt EV Demand

- Bertelsmann Chief Seeks To Revive €3.6B French TV Merger

- Macquarie To Sell US, European Public Assets Unit To Nomura

- Google Paid Samsung ‘Enormous Sums’ For Gemini AI App Installs

- Offshore Yuan Funding Costs In Hong Kong Sink To Record Low

- China Warns Against Trade Deals With US That Harm Its Interests

- Japanese Investors Sold $20B Of Foreign Debt On Tariffs Shock

- JGB Futures Fall Ahead Of Japan’s Liquidity Enhancement Auction

- Japan Carmakers’ US Success Could Become A Liability

- Japan PM Pens Letter To Xi As Japan Aims To Avoid Trade Crossfire

- US, Ukraine, Europe Allies To Meet Wednesday On Peace Plan

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0900 (EU1.27b), 1.0625 (EU1.02b), 1.0525 (EU862.6m)

- USD/JPY: 149.20 ($710.3m), 145.00 ($632.2m), 147.25 ($450.3m)

- USD/CAD: 1.4400 ($1.15b), 1.4315 ($1.06b), 1.4285 ($785m)

- AUD/USD: 0.6400 (AUD800.6m), 0.6350 (AUD493.1m), 0.6300 (AUD410.5m)

- USD/CNY: 7.1200 ($600m), 7.3000 ($585.8m), 7.0000 ($500m)

- EUR/GBP: 0.8700 (EU680.5m), 0.8220 (EU527.8m)

- NZD/USD: 0.5600 (NZD459.6m), 0.5700 (NZD381.5m), 0.5630 (NZD311.9m)

- USD/BRL: 6.3000 ($311m)

CFTC Data As Of 18/4/25

- The Euro's net long position is at 69,280 contracts, while Bitcoin holds a net long position of 586 contracts. The Japanese yen shows a strong net long position of 171,855 contracts, in contrast to the Swiss franc's net short position of 28,584 contracts. The British pound has a net long position of 6,509 contracts.

- Equity fund speculators have decreased their S&P 500 CME net short position by 47,956 contracts, lowering it to 239,649. In contrast, equity fund managers have increased their S&P 500 CME net long position by 1,812 contracts, bringing it to 805,062.

- Speculators have expanded the net short position in CBOT US 5-Year Treasury futures by 40,000 contracts to 2,061,575, while reducing the CBOT US 10-Year Treasury futures net short position by 140,715 contracts to 937,755. Additionally, the net short position for CBOT US 2-Year Treasury futures has risen by 56,664 contracts to 1,254,773. Speculators have also increased the net short position for CBOT US Ultrabond Treasury futures by 19,747 contracts to 220,057, and for CBOT US Treasury bonds futures by 82,631 contracts to 100,785.

Technical & Trade Views

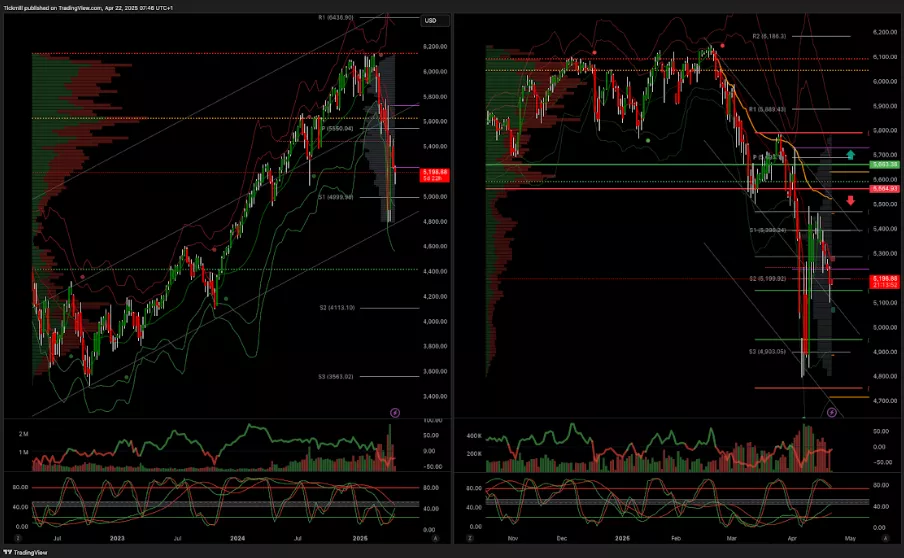

SP500 Pivot 5610

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 5665 target 5792

- Below 5000 target 4755

(Click on image to enlarge)

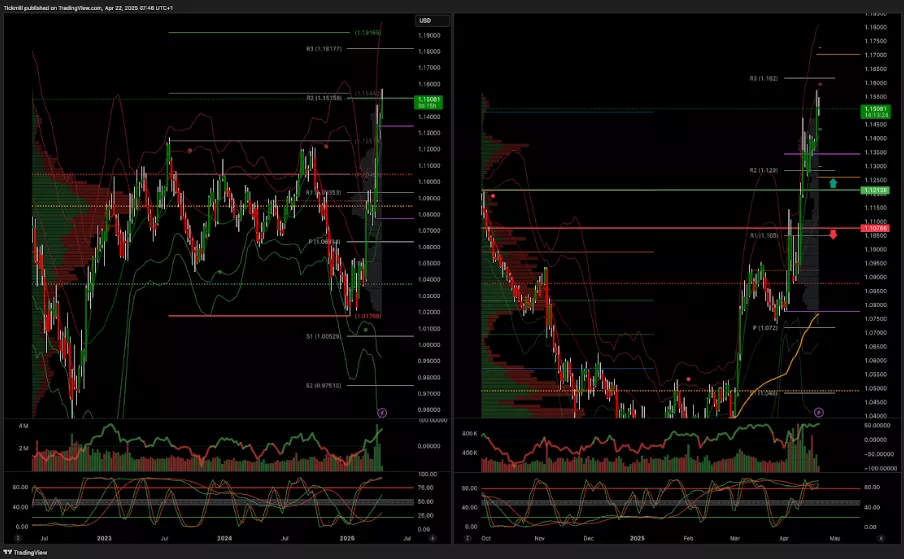

EURUSD Pivot 1.11

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into the end of April

- Above 1.12 target 1.15

- Below 1.1070 target 1.0945

(Click on image to enlarge)

GBPUSD Pivot 1.28

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 1.2850 target 1.32

- Below 1.2790 target 1.2660

(Click on image to enlarge)

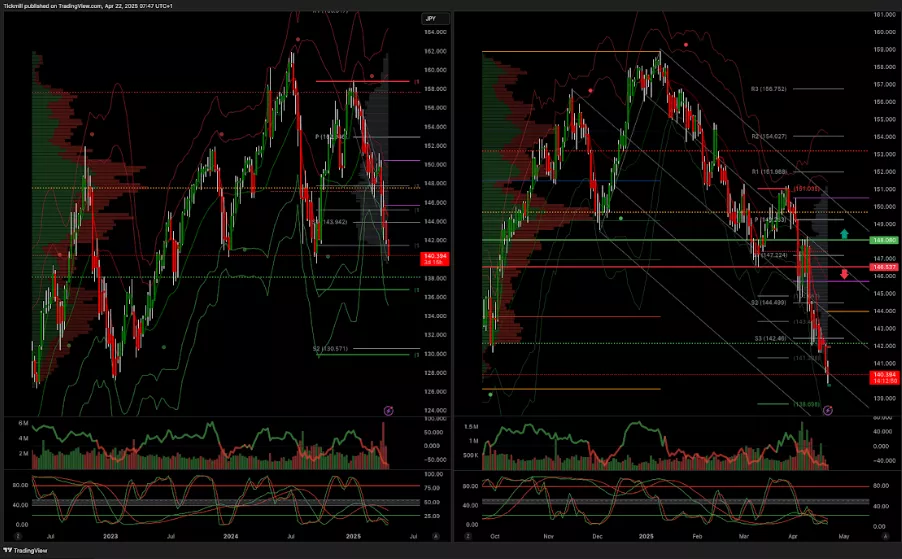

USDJPY Pivot 147.70

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bearishness into early May

- Above 1.52 target 153.80

- Below 146.53 target 140

(Click on image to enlarge)

XAUUSD Pivot 3100

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into mid/late April

- Above 2900 target 3280

- Below 2880 target 2835

(Click on image to enlarge)

BTCUSD Pivot 90k

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into mid/late April

- Above 97k target 105k

- Below 95k target 65k

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Thursday, April 17

The FTSE Finish Line - Wednesday, April 16

Daily Market Outlook - Wednesday, April 16