Daily Market Outlook - Thursday, April 17

Image Source: Pixabay

Asian markets saw a slight uptick, while the yen weakened as investors responded positively to the initial round of trade talks between the US and Japan. Japanese stocks posted modest gains after President Donald Trump announced significant progress in discussions aimed at preventing higher tariffs on Japan. The yen depreciated following remarks from Japan's chief trade negotiator, who clarified that currency issues were not part of the talks, alleviating concerns that the US might demand a stronger yen. Meanwhile, gold saw increased demand as a safe-haven asset, and both Treasury yields and the dollar index experienced slight rises. Following recent turbulence from broad US tariffs, global investors are now concentrating on the progress of country-specific negotiations before making major investment decisions. A significant uncertainty remains regarding talks with China, as Beijing has expressed the need for certain actions from Trump's administration before agreeing to trade discussions. The two-day stock consolidation ended on Wednesday after the US escalated trade tensions by imposing restrictions on some Nvidia Corp. chip exports. Fed Chair Powell's comments after the London market close, which warned of a stagflationary outlook, further unsettled markets as he emphasised the importance of price stability in the Fed's dual mandate. Following an already challenging day, US equities declined further, with the S&P 500 falling by 2.2%. The Bank of Korea, like the Bank of Canada, opted to maintain interest rates at its latest meeting, despite expectations of a cut from some quarters, choosing to adopt a wait-and-see approach until trade uncertainties clear up.

The European Central Bank's (ECB) rate decision is the main macro mover today, with dual risks arising from tariffs. Despite vague guidance, a 25 basis point rate cut is anticipated. The ECB is expected to make a decisive move, unlike the Bank of Canada, which kept its policy rate at 2.75% amidst uncertainty about US trade policy and its economic impact. Market expectations are firmly set on a 25 basis point cut, reducing the deposit rate to 2.25%. Any deviation could disrupt fragile financial market sentiment. Progress in inflation, particularly a slowdown in services prices, and the demand-negative impact of the US trade situation support the case for a rate cut. However, some members of the Governing Council may advocate for defence-led fiscal stimulus and highlight the inflationary impact of trade barriers. This internal division suggests that the ECB's guidance may become even less clear, following the previous statement that policy is 'becoming meaningfully less restrictive'.

Overnight Newswire Updates of Note

- WTO Slashes Global Trade Outlook On Trump Tariff Disruptions

- China Seeks Reset With EU Amid Donald Trump’s Trade War

- ECB To Cut Rates Again As Tariffs Imperil Growth

- Italy’s Meloni Seeks To Jump-Start US-EU Trade Talks

- Traders Keep Bets On Fed Cuts This Year From June

- Fed Chief: Tariffs ‘Highly Likely’ To Raise Inflation In Short Term

- Trump’s Tariff Threats Boost Demand For Currency Hedging

- US, Japan Begin Formal Tariff Talks Without Discussing FX

- Asian Bond Curves Set To Steepen More As Trade War Rages On

- Japan Exports Rise 3.9% Year – On –Year In March

- BoK Holds Rates, Country Grapples With Tariffs, Upcoming Election

- OpenAI And Softbank Weigh UK Investment For Stargate AI Project

- Binance Acting As Adviser To Governments On Crypto Regulations

- Israel To Expand Ground Operation, Take Over New Swathes Of Gaza

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1190-00 (1.5BLN), 1.1215-25 (1.3BLN)

- 1.1250 (877M), 1.1275 (293M), 1.1300-15 (550M)

- 1.1350-60 (1.4BLN), 1.1475 (352M), 1.1500 (781M)

- GBP/USD: 1.3100 (241M), 1.3300 (433M), 1.3400 (238M)

- AUD/USD: 0.6300 (557M), 0.6350-60 (536M)

- 0.6375 (458M), 0.6390-00 (1.21BLN), 0.6450 (452M)

- NZD/USD: 0.5800 (306M)

- USD/CAD: 1.3950 (1.2BLN), 1.3985-90 (920M), 1.4000 (2.0BLN)

- USD/JPY: 141.00 (350M), 142.00-05 (600M), 142.75-80 (675M)

- 142.95-143.00 (527M), 143.50 (853M)

- GBP/JPY: 190.20 (445M)

CFTC Data As Of 11/4/25

- S&P 500 CME net long position was reduced by 75,583 contracts by equity fund managers to 803,250, while S&P 500 CME net short position was increased by 22,408 contracts to 287,605 by equity fund speculators.

- CBOT Speculators reduce their net short position in US Treasury bond futures by 14,494 contracts to 18,154. CBOT Speculators reduce their net short position in US Ultrabond Treasury futures by 53,719 contracts to 200,310. CBOT Speculators reduce their net short position in US 2-year Treasury futures by 28,282 contracts to 1,198,109 CBOT Speculators' net short position in US 5-year Treasury futures increased by 102 contracts to 2,021,575 Japanese yen net long position is 147,067 contracts, while CBOT US 10-year Treasury futures net short position is 215,207 contracts to 1,078,470.

- 17,310 contracts make up the British pound net long position.

- There are 59,980 contracts in the Euro net long position.

- The net short position of the Swiss franc is -30,277 contracts.

- 1,332 contracts make up the Bitcoin net long position.

Technical & Trade Views

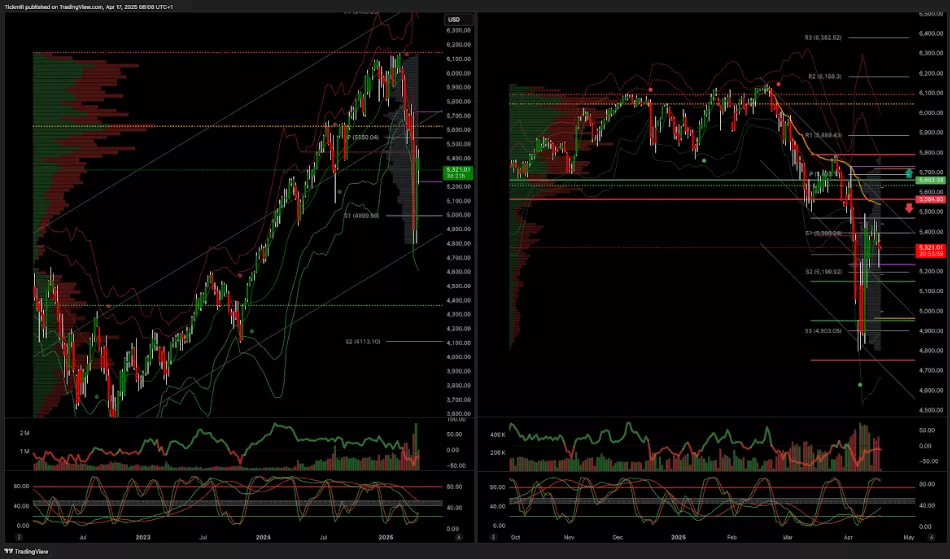

SP500 Pivot 5610

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 5665 target 5792

- Below 5000 target 4755

(Click on image to enlarge)

EURUSD Pivot 1.11

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into the end of April

- Above 1.12 target 1.15

- Below 1.1070 target 1.0945

(Click on image to enlarge)

GBPUSD Pivot 1.28

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 1.2850 target 1.32

- Below 1.2790 target 1.2660

(Click on image to enlarge)

USDJPY Pivot 147.70

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bearishness into early May

- Above 1.52 target 153.80

- Below 146.53 target 140

(Click on image to enlarge)

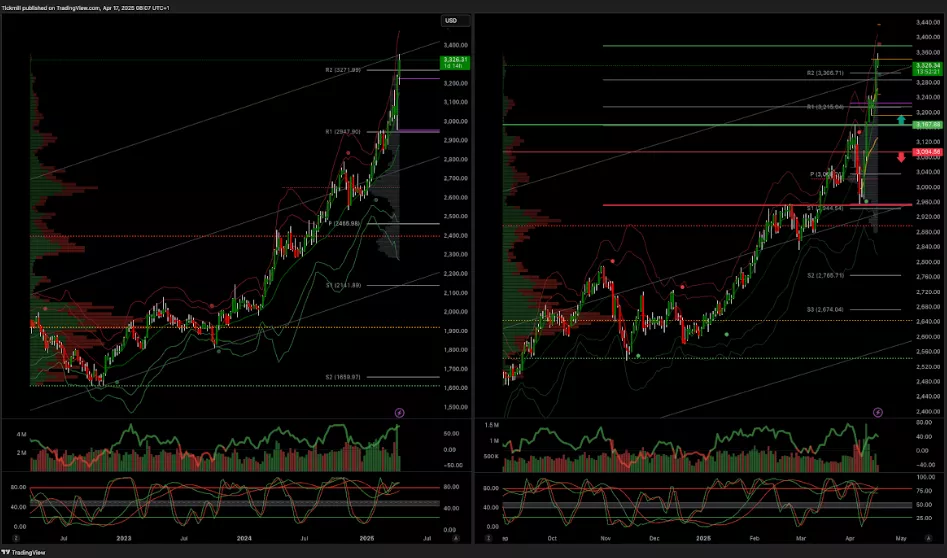

XAUUSD Pivot 3100

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into mid/late April

- Above 2900 target 3280

- Below 2880 target 2835

(Click on image to enlarge)

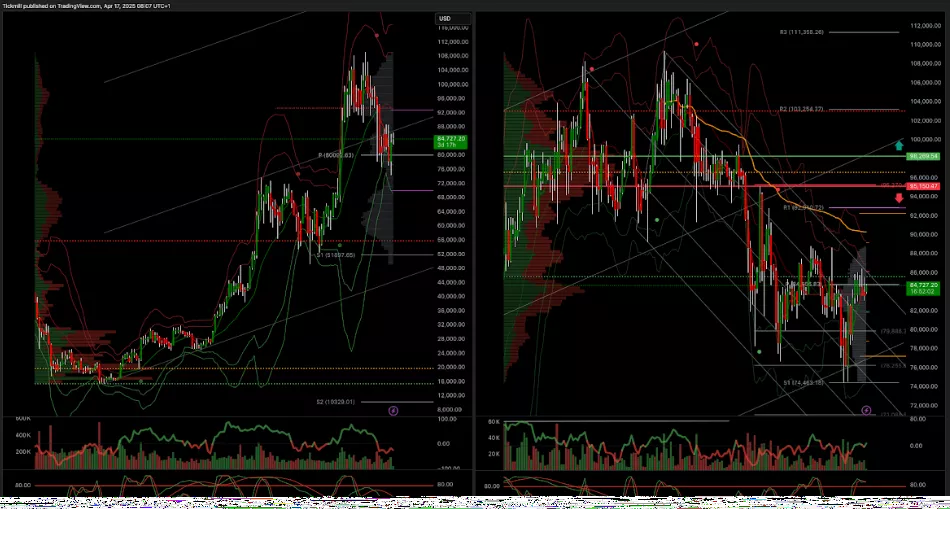

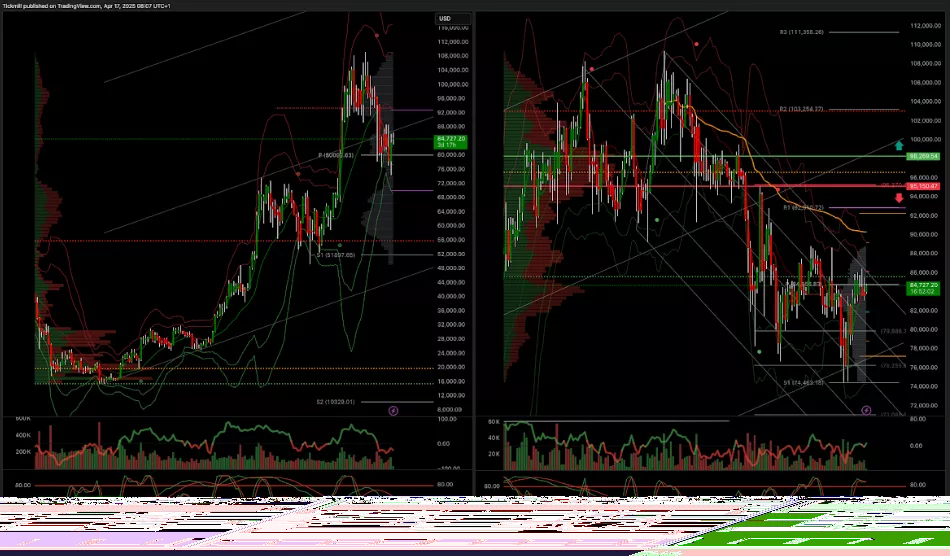

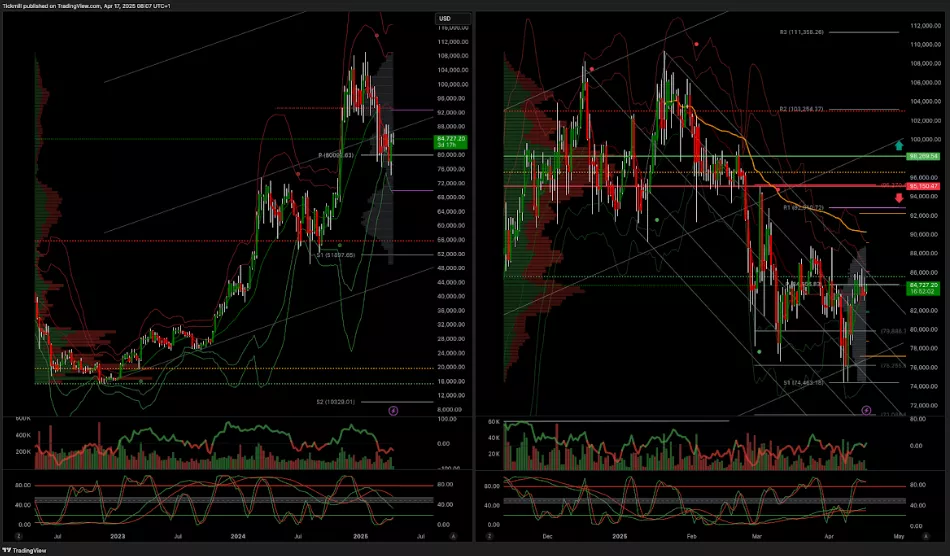

BTCUSD Pivot 90k

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into mid April

- Above 97k target 105k

- Below 95k target 65k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Wednesday, April 16

Daily Market Outlook - Wednesday, April 16

The FTSE Finish Line - Tuesday, April 15