Daily Market Outlook - Thursday, Sep. 18

Image Source: Pixabay

Markets are responding to the U.S. central bank rate decision, which saw the Federal Open Market Committee implement a widely anticipated 25 basis point rate cut on Wednesday, with only new Governor Stephen Miran opposing, advocating for a larger 50 basis point cut. For those keeping score: the Bank of Canada reduced rates, the People's Bank of China maintained its position, the Hong Kong Monetary Authority had to align with the Fed, the Bank of England will announce later today, and the Bank of Japan will follow suit tomorrow. After some volatility on Wall Street, Asian markets seized the opportunity on Thursday, pushing S&P 500 e-minis up and Nasdaq futures also traded higher. This risk-on posture appears poised to carry over into Europe. New Zealand's bonds traded higher, while the currency weakened amid weaker economic data that spurred expectations for a significant rate reduction to be in the offing.

The Federal Reserve was widely anticipated to cut interest rates on Wednesday, with the weakening labor market providing justification for such a move. However, the deterioration wasn’t significant enough to warrant more than a modest 25 basis-point reduction. Overall, the outlook shifted only slightly—another rate cut was penciled in for this year (making it two more in total), along with one additional cut in each of the next two years as projections were adjusted downward. While Miran’s aggressive stance on how much rates should decline by year-end stood out, it didn’t alter the median consensus that rates should follow a more gradual downward trajectory. Although labor market pressures had intensified—marked by a sharper drop in demand compared to the decline in supply—the Fed signaled its willingness to respond as needed. However, uncertainty surrounding the impact of tariffs on inflation remained a concern. As Chair Powell noted, while the effect on PCE inflation had been measured, firms were inclined to pass on those costs to consumers when conditions allowed, posing a risk of inflation persistence. That said, these inflation worries had eased since July, while risks tied to the labor market had grown. This raises the question: Was the 25 basis-point reduction sufficient as a “risk management” measure given the evolving employment data beyond just payroll figures? Or is the Fed now constrained by political pressures to ease rates, opting to move cautiously until the data compels action? If the latter is true, policy adjustments could end up being delayed. Powell attempted to frame the decision through the lens of uncertainties stemming from an unusual economic environment, emphasizing data dependence. However, President Trump may view this approach as “TOO LATE,” accusing the Fed of gambling with timing.

The UK labour market and inflation data released this week have closely aligned with expectations, leaving minimal room for new guidance on the timing of future rate cuts. As a result, attention shifts to the annual gilt QT pace announcement. Bank of England watchers anticipate the Monetary Policy Committee (MPC) will vote to reduce gilt holdings by approximately £75bn over the next year—a view that aligns closely with the consensus reflected in the Bank of England's survey of market participants. However, there has been notable debate regarding the distribution of active QT across the maturity spectrum of the (>3yr) portfolio. Many expect the BoE to avoid active QT in longer maturities to mitigate risks of market disruption. Should the BoE skew QT toward shorter maturities, it could face scrutiny over whether fiscal considerations influenced monetary policy decisions. The primary risks are, firstly, the possibility of less or no active QT, and secondly, the potential for QT operations to be weighted away from longer maturities. The most surprising outcome for markets would likely be a continuation of the current pace of £100bn per year.

Overnight Headlines

- Cooling Wages, Steady Inflation To Keep BoE On Hold Ahead Of QT Review

- UK Touts $205B US Investment As King Charles Fetes Trump

- Palantir Expands UK Defence Deal, Investments Amid Trump Visit

- Apple Explores Possible Test Production Of Foldable iPhone In Taiwan

- Hong Kong Central Bank Cuts Interest Rate, Tracking Fed Move

- China Tells Companies To Stop Buying Nvidia’s Repurposed AI Chip

- China Drops Google Antitrust Probe During US Trade Talks

- Google, PayPal Ink Multiyear Partnership On Digital Commerce

- Puma Surges After Report CVC, Authentic Brand Preparing Takeover Bid

- Blackstone And TPG Revive Interest In Acquiring Medtech Hologic

- Crypto-Exchange Bullish Swings To Profit In First Report As Public Company

- Novo Nordisk’s Alzheimer’s Trial A ‘Lottery Ticket’, Senior Executive Says

- Mexico Begins Public Consultation Process For USMCA Ahead Of Review

- Surging US Power Costs Defy Donald Trump’s Pledge To Halve Bills

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1700 (3.8BLN), 1.1710-20 (1.5BLN), 1.1750-55 (753M), 1.1800 (3.2BLN)

- 1.1805-10 (633M), 1.1825 (321M), 1.1850 (941M), 1.1900 (3.2BLN)

- USD/CHF: 0.7925 (330M). GBP/USD: 1.3530-40 (460M)

- EUR/GBP: 0.8675 (494M), 0.8690 (249M), 0.8745 (645M)

- AUD/USD: 0.6600 (1.3BLN), 0.6615 (347M), 0.6650-60 (1.6BLN)

- NZD/USD: 0.5900 (385M), 0.5930-40 (1.6BLN)

- USD/CAD: 1.3750 (316M), 1.3790-1.3800 (529M)

- USD/JPY: 146.00 (1.3BLN), 146.45-50 (560M), 145.55-60 (785M), 146.75 (440M)

- 147.00 (323M), 147.20-25 (1.4BLN), 147.50-55 (515M), 148.00 (590M)

- EUR/JPY: 171.00 (550M)

CFTC Positions as of the Week Ending 12/9/25

- Speculators have raised their net short position in CBOT US Treasury bonds futures by 21,340 contracts, bringing the total to 98,608. They have also increased their net short position in CBOT US Ultrabond Treasury futures by 2,262 contracts, resulting in a total of 265,481. On the other hand, there has been a reduction in the net short position for CBOT US 10-year Treasury futures by 10,386 contracts, now totaling 857,972. Similarly, speculators have cut their net short position in CBOT US 5-year Treasury futures by 127,224 contracts, bringing it down to 2,554,763. Conversely, there is an increase in the net short position for CBOT US 2-year Treasury futures by 78,878 contracts, now totaling 1,374,961.

- In the equity market, fund managers have lifted their S&P 500 CME net long position by 31,521 contracts to a total of 882,560, while equity fund speculators have raised their S&P 500 CME net short position by 43,737 contracts, reaching 419,631.

- The Japanese yen net long position stands at 91,643 contracts, with the euro's net long position at 125,677 contracts. The British pound has a net short position of -33,605 contracts, while the Swiss franc shows a net short position of -28,839 contracts. Lastly, Bitcoin has a net short position of -468 contracts.

Technical & Trade Views

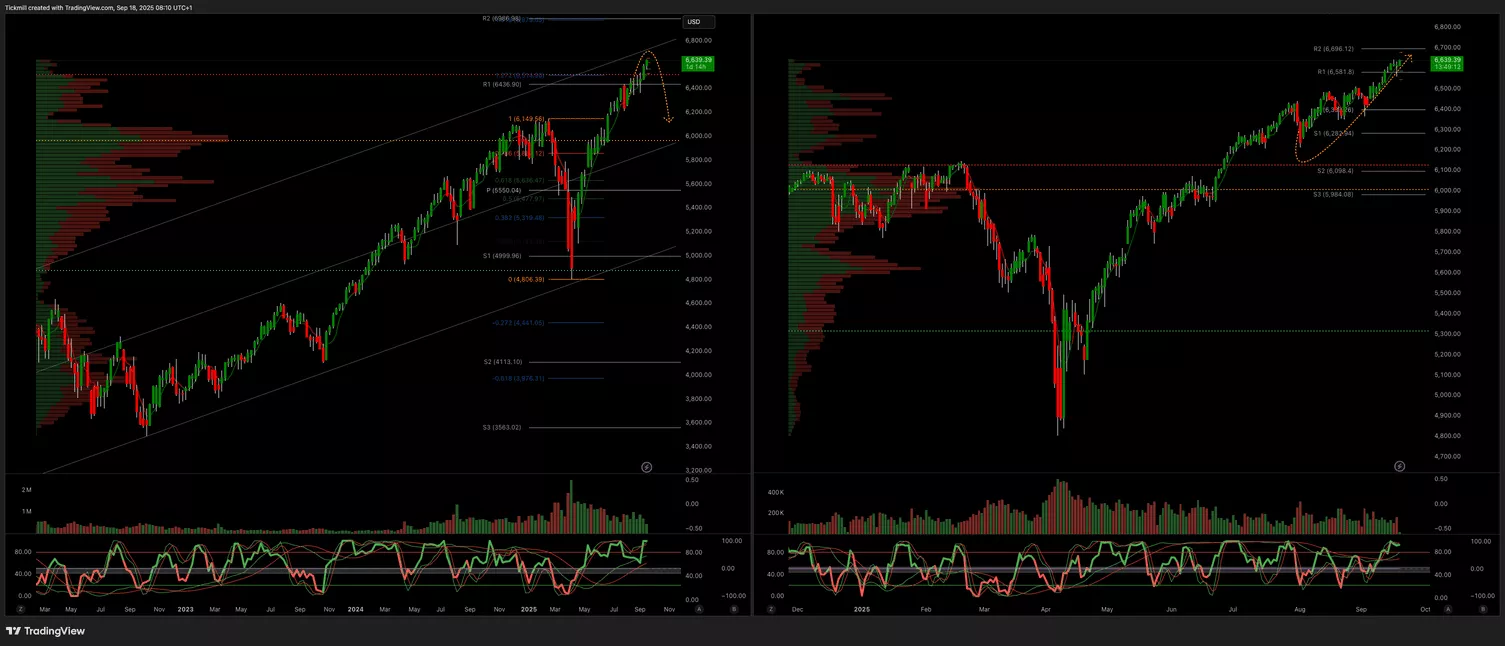

SP500

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 6440 Target 6666

- Below 6420 Target 6370

(Click on image to enlarge)

EURUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Below 1.1750 Target 1.15

- Above 1.18 Target 1.1910

(Click on image to enlarge)

GBPUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Below 1.36 Target 1.30

- Above 1.3650 Target 1.3850

(Click on image to enlarge)

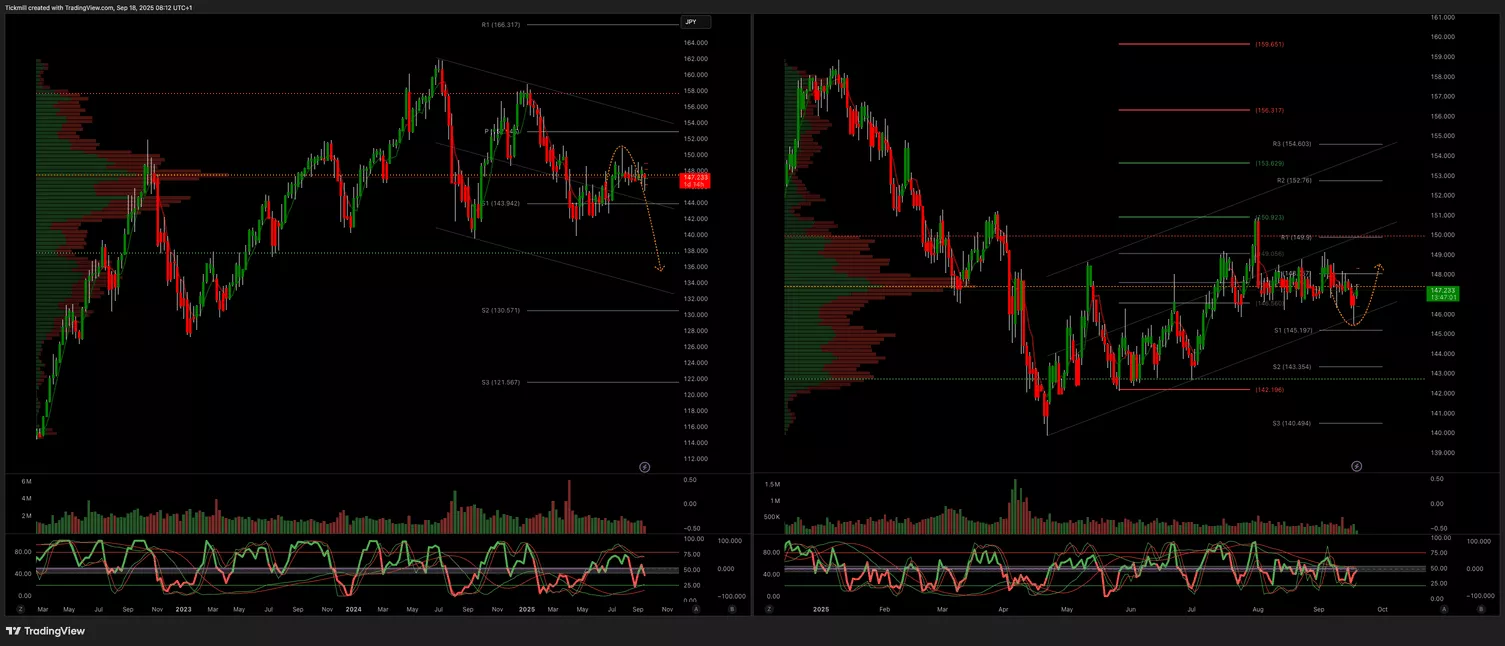

USDJPY

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Below 1.49 Target 1.45

- Above 1.51 Target 1.54

(Click on image to enlarge)

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 3500 Target 3700

- Below 3400 Target 3300

(Click on image to enlarge)

BTCUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 110k Target 118k

- Below 109k Target 105k

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Wednesday, Sep. 17

Daily Market Outlook - Monday, Sep. 15

Daily Market Outlook - Friday, Sep. 12