Daily Market Outlook - Friday, Sep. 12

Image Source: Pixabay

Asian stock markets saw gains, with MSCI's regional index nearing a record high, following US inflation and jobless claims reports that bolstered expectations of an interest rate cut by the Fed next week. Key stock indices in Japan, South Korea, Australia, and Hong Kong all advanced, offsetting the mixed performance of mainland China stocks. Notable boosts came from chipmakers like SK Hynix, Samsung, and TSMC. Alibaba's shares surged. The MSCI regional equity index has climbed over 20% this year and is now just 0.3% short of its all-time high reached in 2021. The positive momentum on Friday followed new record highs set by the S&P 500, tech-heavy Nasdaq 100, and the MSCI global share index on Thursday. Oil prices fell for a second consecutive day as the IEA predicted a larger surplus for next year, with this gloomy projection overshadowing concerns about global geopolitical tensions. Gold is on track to experience its fourth consecutive weekly rise.

The two key events on Thursday – September’s ECB meeting and August's US CPI release – carried more potential to influence markets than initially suggested by their muted reception, as neither delivered surprises against consensus expectations. The ECB maintained rates at 2% and provided a more balanced risk assessment. President Lagarde emphasized that the Governing Council believes inflation has returned to target and is expected to remain stable over the forecast horizon, signaling the end of disinflation. Growth projections for 2025 were revised upward, reflecting improved economic balance, supported by reduced trade uncertainty and fiscal policy measures. However, elevated uncertainties persist, keeping the overall outlook steady. The eurozone’s monetary policy appears well-calibrated, prompting markets to scale back expectations for rate cuts later this year. Meanwhile, the US CPI data is unlikely to alter expectations for a Fed rate cut next week, though markets remain focused on deciphering the longer-term trajectory. Headline CPI showed a modest uptick driven by food prices, while core inflation trends stayed benign. Tariff impacts were visible in household goods but limited elsewhere, and easing shelter costs helped keep service prices under control. Taken together, the events painted a slightly hawkish outlook for Europe and a more dovish tone for the US, although EUR/USD responded only modestly for now.

UK GDP in July remained flat at 0.0% m/m, as reported by the ONS, though the index slipped slightly from 102.9 to 102.8 due to rounding. Industrial production fell 0.9% m/m, contrary to expectations of no change, driven by a reversal of June’s strong manufacturing output in certain sub-sectors. Meanwhile, the services sector grew 0.1% m/m, with only half of its sub-sectors expanding. Despite a flat start to Q3, June’s strong 0.4% m/m growth provides a favorable handover, meaning modest growth in August and September (e.g., 0.2% and 0.1% m/m) could still meet the BoE’s Q3 projection of 0.3% q/q. This data is unlikely to surprise the MPC ahead of next week’s meeting. The UK Budget is scheduled for Wednesday, 26 November, and several key issues are expected to impact market participants. One concern is the potential spill-over from other bond markets. If the UK and France are perceived as the new ‘periphery,’ fiscal shocks in France could influence UK gilts alongside domestic Budget developments. Additionally, global factors such as economic dynamics in Japan or the US may play a role. Another significant aspect is the likely revisions to the OBR growth forecasts. A downgrade in medium-term growth projections could shape political challenges, lead to fiscal tightening measures like tax hikes, and affect the Bank of England’s monetary policy response. Lastly, the use of ‘financial transactions’ via gilts is noteworthy. Public Sector Net Financial Liabilities (PSNFL) rules permit increased gilt issuance without adding to PSNFL. Recent examples include the Sizewell C investment and the Spending Review, suggesting the possibility of further transactions of this nature.

Overnight Headlines

- ECB Can Deliver 2% Inflation Without More Cuts, Says Patsalides

- Morgan Stanley: Pound Now Trades Like A Less Liquid Currency

- Dollar Under Pressure As Fed Looks Poised To Cut While EU Holds

- UK And US Restart Steel Talks Ahead Of Trump’s State Visit

- US, China Officials To Discuss Trade And TikTok In Madrid

- Firm Inflation, Soft Jobs Data Pull Fed In Opposing Directions

- Trump Withdraws Nomination Of China Hawk In US–Sino Tech Battle

- Boeing Falling Behind Certification Timeline For 777X Jet

- SK Hynix Hits Record After AI Memory Milestone

- OpenAI, Nvidia CEOs Set To Announce UK Data Centre Investments

- Paramount, Skydance Prepare Ellison-Backed Bid For Warner Bros

- Canada To Champion Mining, Energy, Port Projects In Economic Revamp

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- USD/JPY: 146.00 (1.2BLN), 146.50 (271M), 146.80 (400M)

- 147.00 (354M), 147.20-31 (1.2BLN), 147.40-50 (3.82BLN)

- 147.85 (250M), 148.00 (207)

- GBP/USD: 1.3400 (220M), 1.3415-20 (207M), 1.3540-50 (212M)

- 1.3635-45 (305M). EUR/GBP: 0.8625 (200M), 0.8725-35 (1.12BLN)

- AUD/USD: 0.6535-45 (584M), 0.6570-80 (1.3BLN), 0.6585-00 (784M)

- 0.6625 (265M), 0.6650 (274M)

- USD/CAD: 1.3735-40 (610M), 1.3775-80 (938M), 1.3795-00 (402M)

- 1.3850 (441M), 1.3875 (423M), 1.3890 (270M)

- USD/ZAR: 17.50-60 (214M)

CFTC Positions as of the Week Ending 5/9/25

- Equity fund speculators have reduced their net short position in the S&P 500 CME by 52,369 contracts, bringing the total to 375,892 contracts. Equity fund managers have also decreased their net long position in the S&P 500 CME by 16,318 contracts, now totaling 851,040 contracts.

- Speculators have increased their net short position in CBOT US 5-year Treasury futures by 218,016 contracts, reaching 2,681,987 contracts. Net short positions in CBOT US 10-year Treasury futures have been trimmed by 15,471 contracts to a total of 868,358. Additionally, net short positions in CBOT US 2-year Treasury futures have increased by 33,001 contracts, leading to a total of 1,296,083 contracts. The net short position in CBOT US UltraBond Treasury futures has also risen by 14,274 contracts to 263,219. Speculators have upped their net short position in CBOT US Treasury bonds futures by 41,255 contracts, resulting in 77,268 contracts.

- In the cryptocurrency realm, the net short position in Bitcoin stands at -902 contracts. The Swiss franc shows a net short position of -25,888 contracts, while the British pound reports a net short position of -33,140 contracts. On the other hand, the Euro has a net long position of 119,592 contracts and the Japanese yen shows a net long position of 73,258 contracts.

Technical & Trade Views

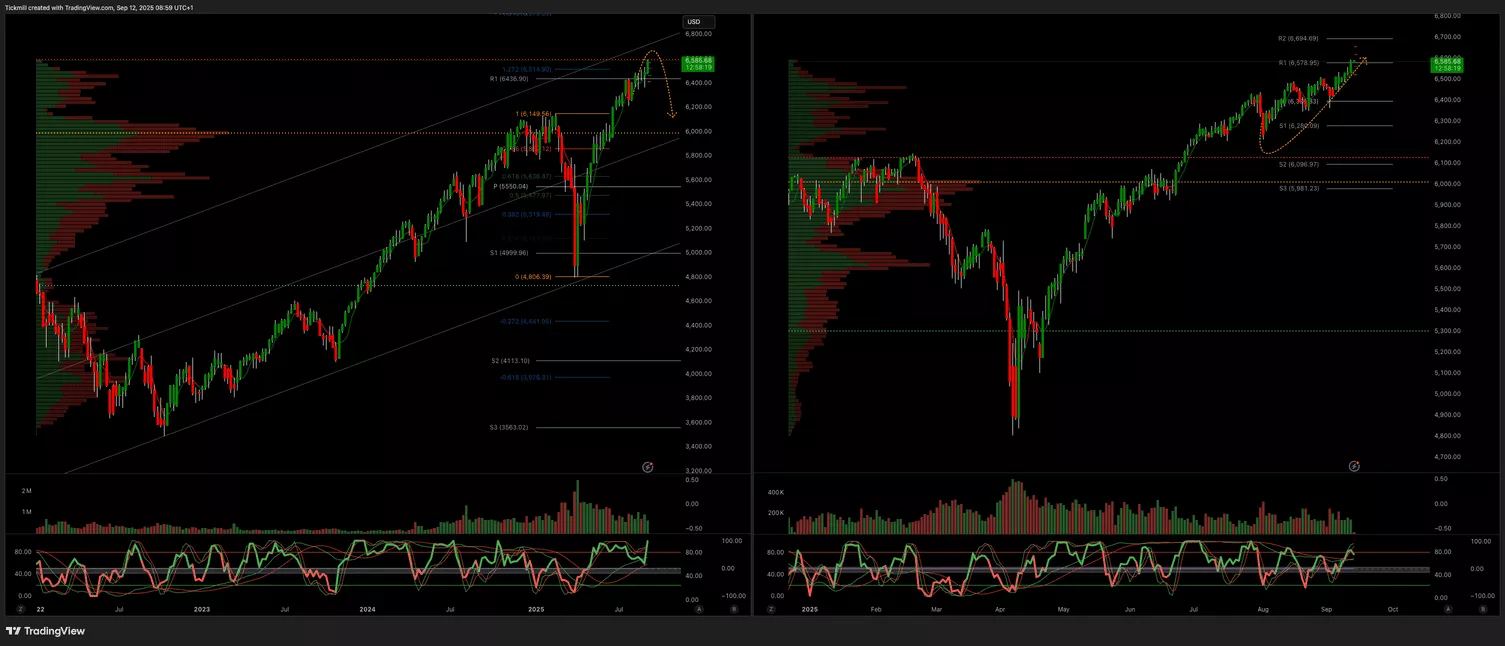

SP500

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 6440 Target 6600

- Below 6420 Target 6370

(Click on image to enlarge)

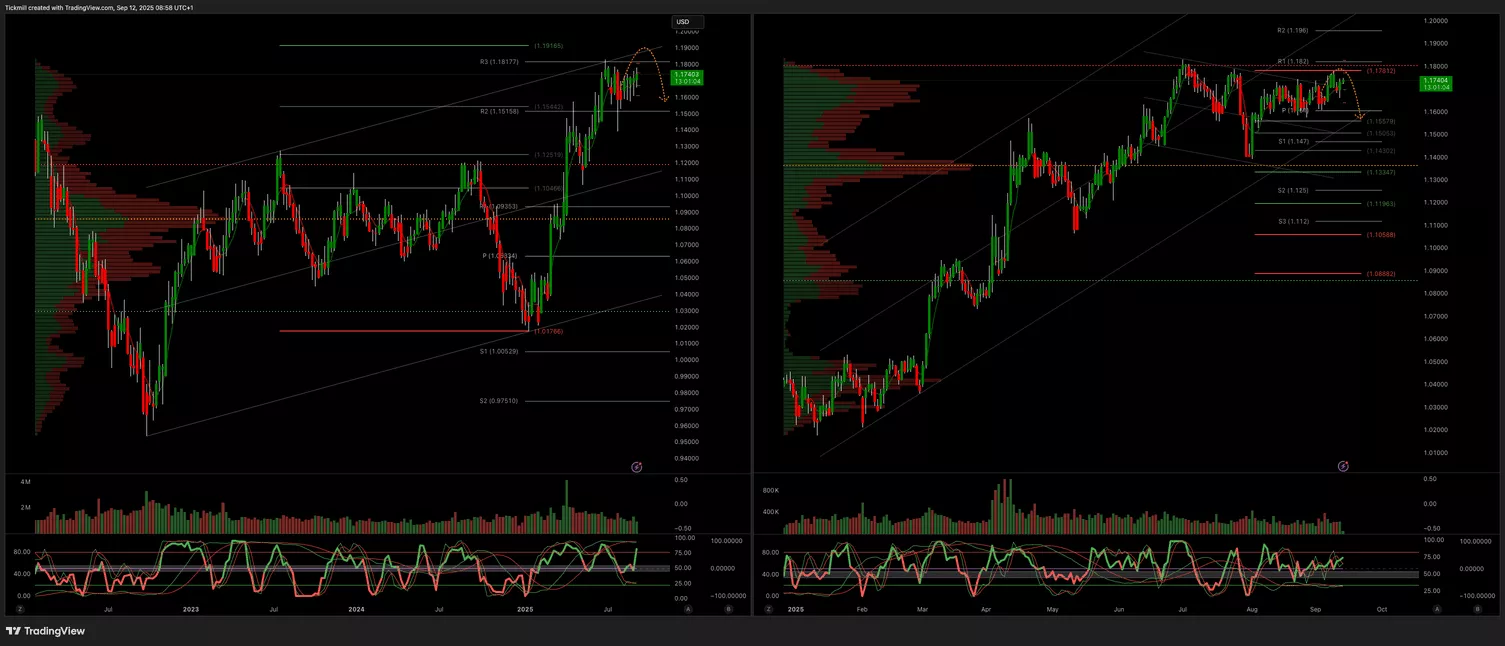

EURUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Below 1.1750 Target 1.15

- Above 1.18 Target 1.1910

(Click on image to enlarge)

GBPUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Below 1.36 Target 1.30

- Above 1.3650 Target 1.3850

(Click on image to enlarge)

USDJPY

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Below 1.49 Target 1.45

- Above 1.51 Target 1.54

(Click on image to enlarge)

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 3500 Target 3700

- Below 3400 Target 3300

(Click on image to enlarge)

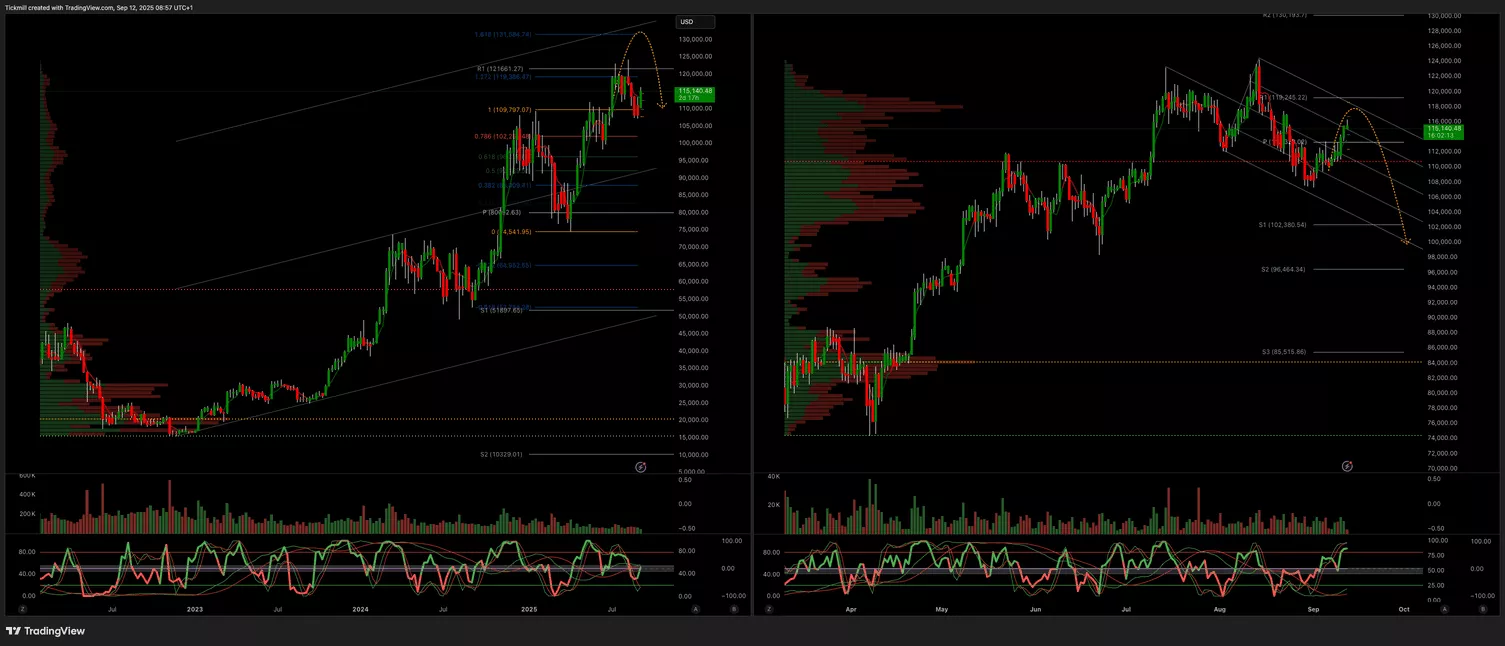

BTCUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 110k Target 118k

- Below 109k Target 105k

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Thursday, Sep. 11

The FTSE Finish Line - Wednesday, Sep. 10

Daily Market Outlook - Wednesday, Sep. 10