Daily Market Outlook - Thursday, Sep. 11

Image Source: Pixabay

US and European futures showed limited appetite for directional trade overnight, ahead of the highly anticipated US inflation report scheduled for later Thursday, while Asian markets witnessed gains driven by tech giants. Futures for the S&P 500 and Nasdaq 100 pared back earlier gains during Asian trading hours. Major stock indexes in Japan, South Korea, and mainland China advanced, whereas those in Australia and Hong Kong declined. MSCI's Asia-Pacific index held steady after five consecutive days of growth. Treasuries remained stable following Wednesday’s broad-based increases, while Australian and New Zealand government bonds climbed on Thursday. The Dollar index saw minimal change, with the Yen maintaining strength against the Dollar. Meanwhile, Mexico is considering imposing tariffs of up to 50% on automobiles, auto parts, steel, and textiles imported from China and other countries without trade agreements, according to Economy Minister Marcelo Ebrard.

Following a softer-than-expected PPI report on Wednesday, attention now shifts to the August consumer price index (CPI) release. Both headline and core CPI are projected to rise by 0.3% month-over-month, which would increase the annual CPI rate to 2.9% from 2.7%, while the ex-food-and-energy measure is expected to remain steady at 3.1% year-over-year. This data has been bolstered by a slowdown in shelter costs, which is expected to persist, aided by base effects. The moderation in shelter costs has helped mask tariff impacts thus far, as hinted at by the PPI data, and this trend may continue. Although firms are grappling with higher input costs, passing these costs onto consumers has proven challenging. Political concerns, such as avoiding public backlash, and softer demand conditions, as highlighted in the Beige Book survey, are limiting some businesses’ ability to raise prices. As a result, companies are absorbing these costs through reduced profit margins, potentially curbing investment and hiring. This dynamic could provide the Federal Reserve, which has shifted its focus to labor market risks, greater confidence to overlook short-term inflation persistence when setting policy.

The European Central Bank (ECB) is in a relatively comfortable position heading into its September meeting, where interest rates are expected to remain unchanged at 2%. The Governing Council appears satisfied with the inflation outlook, as President Christine Lagarde recently noted that inflation is now back at target. Although preliminary August data showed headline HICP edging up slightly to 2.1%, this minor increase is unlikely to raise concerns given the broader macroeconomic environment. The structure of inflation continues to improve, with services prices—which were stubbornly elevated last year—showing moderation. Updated macroeconomic projections are unlikely to significantly alter forecasts, with inflation expected to undershoot next year before converging back to target over the medium term. While near-term growth prospects appear fragile, earlier policy easing and increased fiscal spending, particularly in Germany, are expected to support broader economic recovery over the coming years. Although hawkish policymakers may worry about inflation risks tied to expansionary fiscal policies, these concerns are mitigated by the focus on capital expenditure, which enhances supply-side capacity. Discussions about tariff risks persist, with Isabel Schnabel recently highlighting potential upside risks, though these are unlikely to shift the overall outlook. Lagarde is well-positioned to communicate a balanced and adaptive approach to policy as the ECB enters a phase of stability.

Overnight Headlines

- BoJ Watchers Now Expect Hike By January, 36% Say October

- China’s $4.5T Capital Flows Mark Tipping Point In Market Opening

- Fed Seen On Course For Cuts After Softer PPI Data

- UK Chancellor Vows To ‘Take Out’ More Regulators Amid Growth Push

- Macron’s Fixer Sent To Tackle Political Quagmire

- VW Vows To Defend Europe Crown In Fightback Against Chinese EVs

- Japan’s Nikkei Hits New High As SoftBank Surges Nearly 10%

- Boeing Reaches Tentative Deal With Striking Defence Workers

- Oracle, OpenAI Sign $300B Cloud Computing Deal, Largest In History

- Klarna Rises 15% In NYSE Trading Debut, Boosting Fintech Optimism

- Big Banks Nearly Shut Out Of Treasury 10-Year Auction

- Novo Nordisk To Cut 9,000 Jobs, Slashes Profit Forecast

- Chipotle Plans Asia Debut With Stores In Singapore And South Korea

- Netflix Chief Product Officer Eunice Kim Steps Down

- Phillips 66 Considers Buying US LNG, Hires Staff In New Energy Push

- PNC CEO Says Bank Aims To Double Size To $1T

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1635-45 (3.9BLN), 1.1650-55 (1.6BLN), 1.1675-80 (1.5BLN)

- 1.1700 (1.5BLN), 1.1735-40 (1.4BLN), 1.1745-50 (1.3BLN), 1.1775 (657M)

- 1.1800 (1.6BLN), 1.1825 (2.5BLN)

- USD/CHF: 0.8000 (724M), 0.8030 (630M), 0.8060 (450M). EUR/CHF: 0.9325 (385M)

- EUR/GBP: 0.8650 (232M), 0.8725 (838M)

- GBP/USD: 1.3460 (214M), 1.3515-25 (673M), 1.3570-80 (835M), 1.3600 (608M)

- AUD/USD: 0.6555-60 (445M), 0.6600 (352M), 0.6615-20 (381M), 0.6650 (697M)

- NZD/USD: 0.5920-25 (354M)

- USD/CAD: 1.3760-65 (702M), 1.3825 (504M), 1.3880 (407M), 1.3910 (210M)]

- USD/JPY: 147.00-10 (1.3BLN), 147.20-25 (882M), 147.45-50 (1.6BLN)

- 147.70-75 (1.2BLN), 147.85-149.00 (818M)

CFTC Positions as of the Week Ending 5/9/25

- Equity fund speculators have reduced their net short position in the S&P 500 CME by 52,369 contracts, bringing the total to 375,892 contracts. Equity fund managers have also decreased their net long position in the S&P 500 CME by 16,318 contracts, now totaling 851,040 contracts.

- Speculators have increased their net short position in CBOT US 5-year Treasury futures by 218,016 contracts, reaching 2,681,987 contracts. Net short positions in CBOT US 10-year Treasury futures have been trimmed by 15,471 contracts to a total of 868,358. Additionally, net short positions in CBOT US 2-year Treasury futures have increased by 33,001 contracts, leading to a total of 1,296,083 contracts. The net short position in CBOT US UltraBond Treasury futures has also risen by 14,274 contracts to 263,219. Speculators have upped their net short position in CBOT US Treasury bonds futures by 41,255 contracts, resulting in 77,268 contracts.

- In the cryptocurrency realm, the net short position in Bitcoin stands at -902 contracts. The Swiss franc shows a net short position of -25,888 contracts, while the British pound reports a net short position of -33,140 contracts. On the other hand, the Euro has a net long position of 119,592 contracts and the Japanese yen shows a net long position of 73,258 contracts.

Technical & Trade Views

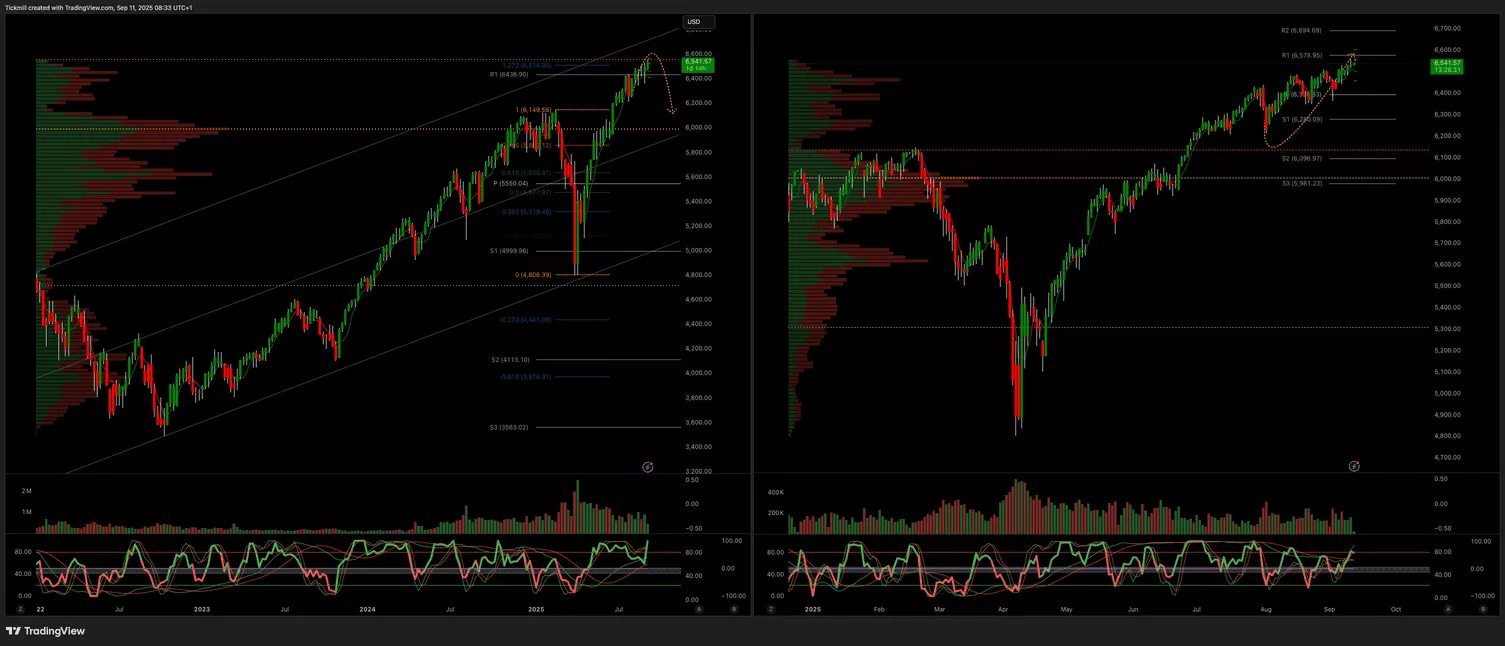

SP500

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 6440 Target 6600

- Below 6420 Target 6370

(Click on image to enlarge)

EURUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Below 1.1750 Target 1.15

- Above 1.18 Target 1.1910

(Click on image to enlarge)

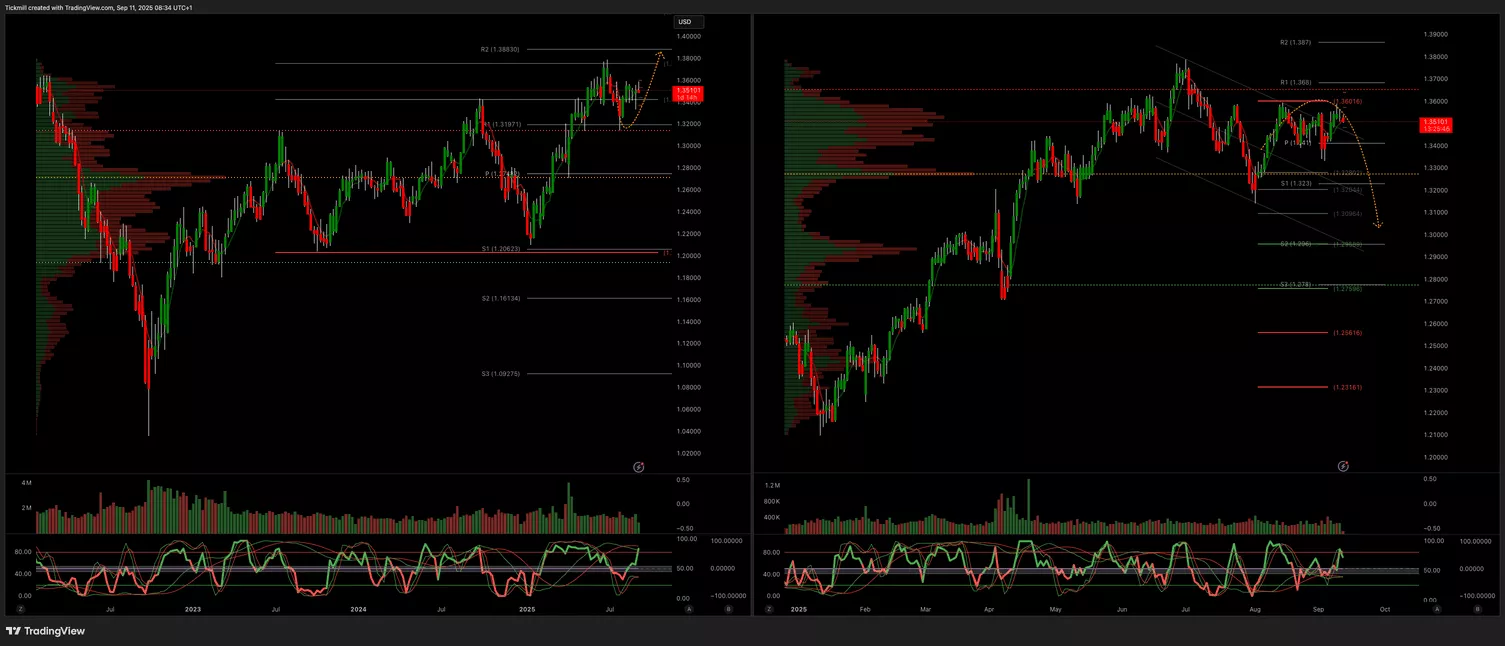

GBPUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Below 1.36 Target 1.30

- Above 1.3650 Target 1.3850

(Click on image to enlarge)

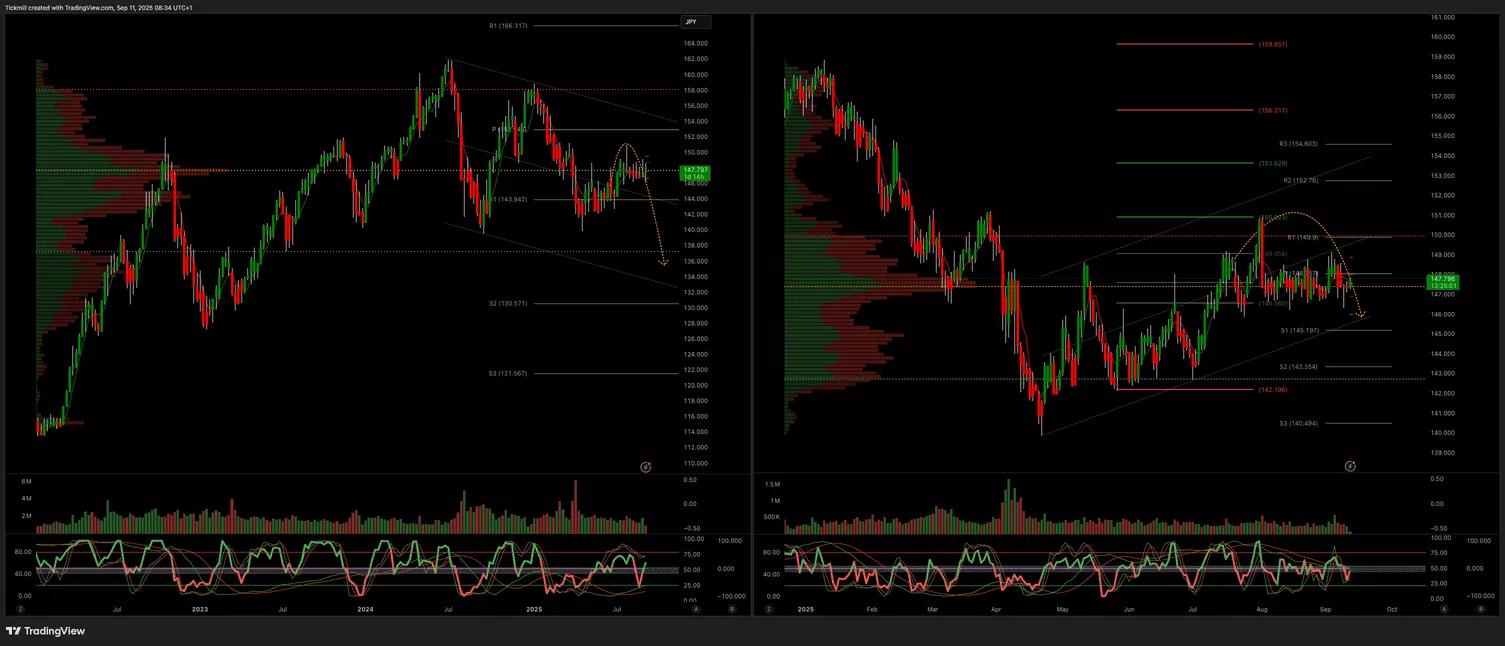

USDJPY

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Below 1.49 Target 1.45

- Above 1.51 Target 1.54

(Click on image to enlarge)

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 3500 Target 3700

- Below 3400 Target 3300

(Click on image to enlarge)

BTCUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 110k Target 118k

- Below 109k Target 105k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Wednesday, Sep. 10

Daily Market Outlook - Wednesday, Sep. 10

The FTSE Finish Line - Tuesday, Sep. 9