Daily Market Outlook - Monday, Sep. 15

Image source: Pixabay

Asian markets joined the global surge in shares, with investors expecting a rate cut from the Federal Reserve later this week. In China, economic activity decelerated more than anticipated for the second consecutive month, accompanied by a significant drop in investment. The MSCI Asia Pacific Index closed above its record high set in February 2021. The global equity index maintained stability after hitting a record high on Friday. There were no Treasury cash transactions in Asia due to Japan being closed for a holiday. Chinese stocks increased by 0.9% despite poor industrial and consumer data. The Hong Kong Dollar continued its upward trend, reaching a four-month peak as the currency supply tightened towards the quarter's end. French bond futures opened largely steady during Asian trading following Fitch Ratings' downgrade of France from AA- to A+. France’s 10-year benchmark bonds provide one of the highest yields in the eurozone, comparable to those of Lithuania, Slovakia, and Italy. The yield premium over German bonds has nearly doubled since President Macron's election last year, indicating a decline in investor confidence.

Friday’s BoE/Ipsos Inflation Attitudes survey highlighted concerns raised by MPC members. At the Treasury Select Committee, MPC member Greene noted food and energy prices significantly influence inflation expectations. These CPI components remain elevated, driving households to anticipate inflation at 3.6% over the next year, up from 3.2% in May’s survey. Longer-term expectations rose 0.2ppts to 3.8%, matching the series high. BoE Governor Bailey expressed uncertainty about the timing of rate cuts, a sentiment reinforced by rising inflation expectations. Reports of a potential VAT cut on energy bills may reflect government efforts to avoid delaying monetary easing.

This week is pivotal for central bank meetings, featuring the Federal Reserve (Wed), Bank of Canada (Wed), Norges Bank (Thu), Bank of England (Thu), and Bank of Japan (Fri), listed in descending order of market-implied rate cut probabilities. While the Fed is expected to deliver a 25bp rate cut, the updated Summary of Economic Projections may carry a stagflationary undertone. For the Bank of England, attention will centre on the annual quantitative tightening (QT) vote, with expectations of a reduction in gilt holdings to approximately £75bn, down from £100bn this year. The Bank of Japan is unlikely to raise rates this time, but markets will closely watch for stronger signals of a potential hike in October. In addition to central bank decisions, the UK will release a slew of data. Labour market figures (Tue) may take a backseat to August inflation data (Wed), given both data quality concerns and the Monetary Policy Committee's focus on near-term CPI trends. A headline inflation undershoot below 3.8% y/y could sustain hopes for a November rate cut. Retail sales (Fri) and public finances data (Fri) will also be in focus, with the deficit for 2025-26 so far tracking close to Office for Budget Responsibility (OBR) projections. In the U.S., retail sales data (Tue) and various surveys are on the docket, while the euro area will release final August CPI figures (Wed) alongside the ECB wage tracker.

Overnight Headlines

- Fed Debate Turns To Pace Of Cuts Amid Heavy Trump Pressure

- Markets Gear Up For Series Of Fed Cuts With Bullish Bets At Risk

- Bond Investors To Focus On Fed Policy Path And Powell’s Tone

- Options Traders Craving Volatility Look Past Fed To Jobs Data

- US–China Talks Head Into Second Day With Trade, TikTok On Agenda

- China’s Economy Slows As Consumers Tighten Belts, Tariff Risks Mount

- China Bond Slump Fuels Speculation PBoC Will Resume Debt Buying

- Fitch Downgrades Crisis-Strained France

- Swiss Bank UBS Mulls Move To US To Avoid New Rules, NYP Reports

- Canada’s PM Carney Unveils $9.4B Plan To Build Affordable Homes

- German Far Right Triples Support In Vote In Merz’s Home State

- UK FinTech SumUp Explores Listing At Up To $15B Valuation

- Crypto Groups Hit Out At BoE Plan To Limit Stablecoin Ownership

- Brookfield In Talks To Buy Yes! Communities For Over $10B

- Sony’s ‘Demon Slayer’ Sets Anime Record In Box Office Debut

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1650 (1BLN), 1.1675 (395M), 1.1690-1.1700 (2.7BLN), 1.1720 (471M)

- 1.1735 (308M), 1.1750 (712M), 1.1800 (755M)

- USD/CHF: 0.7860 (300M), 0.8005 (254M), 0.8125 (296M)

- GBP/USD: 1.3500 (1.3BLN), 1.3580 (160M), 1.3600 (182M), 1.3650 (600M)

- AUD/USD: 0.6600 (296M), 0.6625 (247M), 0.6700 (194M)

- AUD/NZD: 1.1200 (330M). USD/CAD: 1.3850 (460M)

- USD/JPY: 146.50-55 (770M), 147.50 (420M), 147.70 (650M)

CFTC Positions as of the Week Ending 12/9/25

- Speculators have raised their net short position in CBOT US Treasury bonds futures by 21,340 contracts, bringing the total to 98,608. They have also increased their net short position in CBOT US Ultrabond Treasury futures by 2,262 contracts, resulting in a total of 265,481. On the other hand, there has been a reduction in the net short position for CBOT US 10-year Treasury futures by 10,386 contracts, now totaling 857,972. Similarly, speculators have cut their net short position in CBOT US 5-year Treasury futures by 127,224 contracts, bringing it down to 2,554,763. Conversely, there is an increase in the net short position for CBOT US 2-year Treasury futures by 78,878 contracts, now totaling 1,374,961.

- In the equity market, fund managers have lifted their S&P 500 CME net long position by 31,521 contracts to a total of 882,560, while equity fund speculators have raised their S&P 500 CME net short position by 43,737 contracts, reaching 419,631.

- The Japanese yen net long position stands at 91,643 contracts, with the euro's net long position at 125,677 contracts. The British pound has a net short position of -33,605 contracts, while the Swiss franc shows a net short position of -28,839 contracts. Lastly, Bitcoin has a net short position of -468 contracts.

Technical & Trade Views

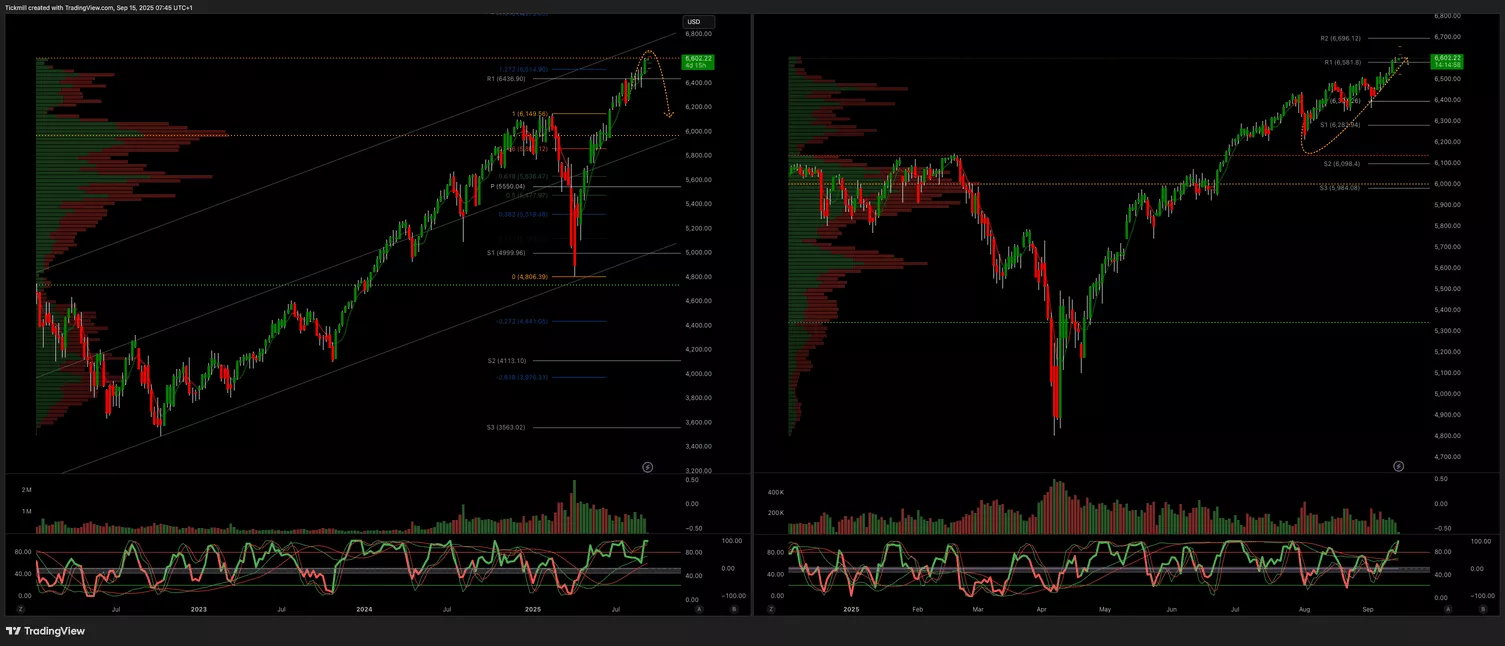

SP500

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 6440 Target 6600

- Below 6420 Target 6370

(Click on image to enlarge)

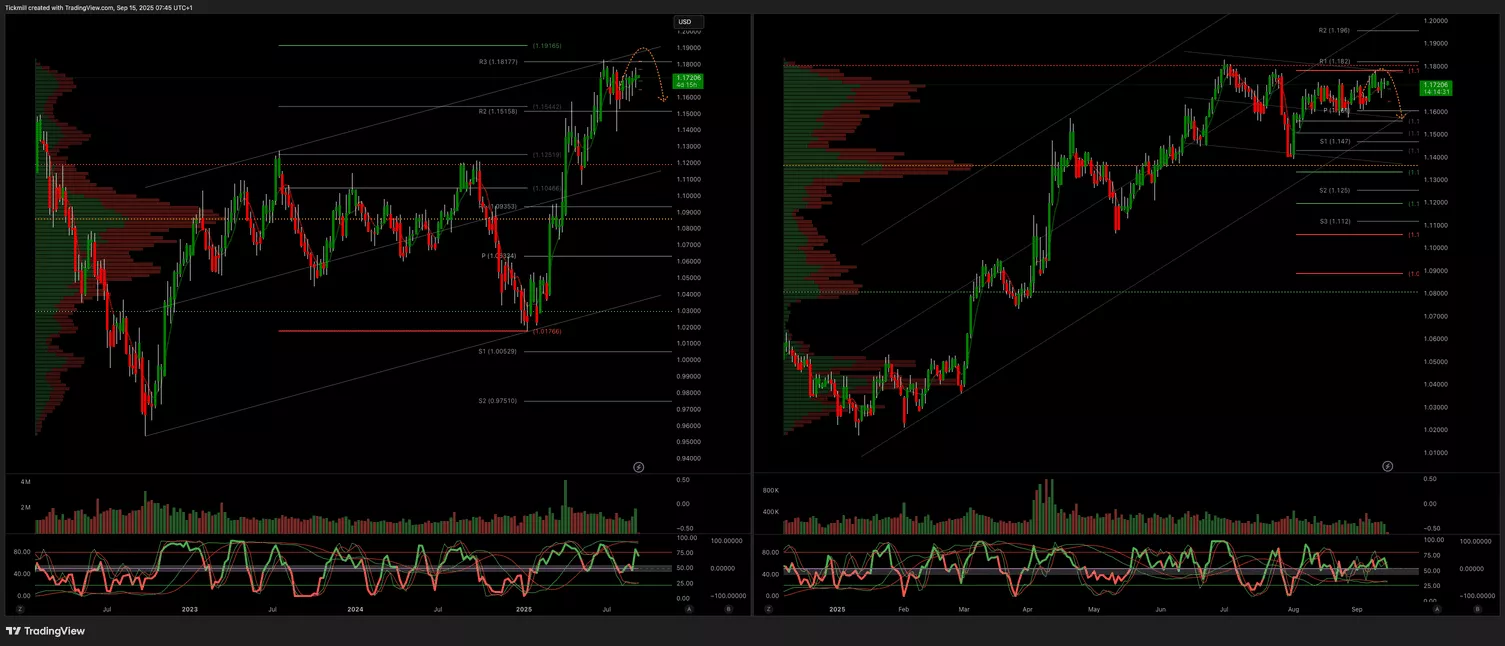

EURUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Below 1.1750 Target 1.15

- Above 1.18 Target 1.1910

(Click on image to enlarge)

GBPUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Below 1.36 Target 1.30

- Above 1.3650 Target 1.3850

(Click on image to enlarge)

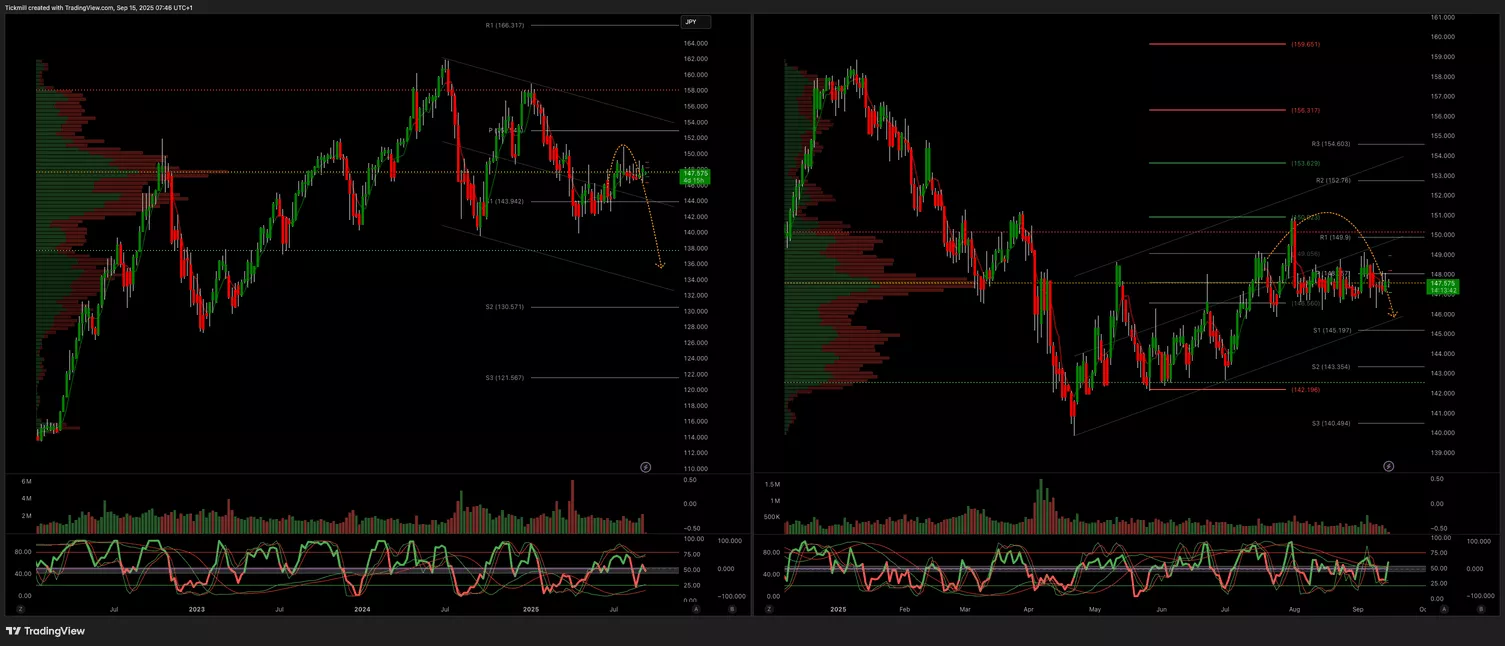

USDJPY

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Below 1.49 Target 1.45

- Above 1.51 Target 1.54

(Click on image to enlarge)

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 3500 Target 3700

- Below 3400 Target 3300

(Click on image to enlarge)

BTCUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 110k Target 118k

- Below 109k Target 105k

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Friday, Sep. 12

Daily Market Outlook - Thursday, Sep. 11

The FTSE Finish Line - Wednesday, Sep. 10