Daily Market Outlook - Thursday, May 29

Image Source: Pexels

Stocks rose in the late hours, fuelled by speculation that positive earnings from Nvidia Corp. could bolster the artificial intelligence-driven rally. The S&P 500 saw an increase after regular trading hours, with the world's leading chipmaker gaining around 5% after providing a favourable revenue outlook for the upcoming period, despite facing challenges from a slowdown in China. This forecast indicates that Nvidia is increasing production of its newest semiconductor design, Blackwell. During regular trading hours, stocks extended their losses towards the end of US trading, with the S&P 500 finishing 0.6% lower. Reports indicating that the Trump administration plans to limit the sale of chip design software to China led to a significant drop in shares of Cadence Design Systems and Synopsys. Meanwhile, Tesla is reportedly set to launch its robotaxi service in Austin starting June 12. Treasury yields decreased after strong demand from investors in a $70 billion auction of five-year notes demonstrated ongoing interest in shorter-term securities. As predicted, the minutes from the latest Federal Reserve policy meeting revealed a cautious stance. The dollar index increased by 0.3%, while oil prices rose as traders considered potential risks to supplies from Iran and Russia.

The overnight market activity was initially focused on the Fed minutes and Nvidia's earnings, but it was overshadowed by the US Court of International Trade's decision declaring Trump's tariff programme illegal, as it exceeds the President's power under the International Emergency Economic Powers Act. The Administration promptly filed an appeal. The court set a ten-day timeframe to suspend many tariff measures, leading to increased uncertainty during the appeal process, while the government may seek alternative methods to navigate around the ruling. This situation could impact the passage of the 'big, beautiful bill' due to new concerns regarding tariff revenue assumptions and deficit effects. Coupled with Nvidia's revenue surpassing expectations, the market's response to the tariff obstacles has lifted equity markets and the Dollar, partially reversing the 'sell America' trend. The yield curve has flattened, enabling the 30-year US Treasury yield to remain just below 5%.

On Monday, ECB President Lagarde echoed sentiments previously expressed by some colleagues, indicating that the shift in US foreign policy presents an “opportunity for Europe,” especially for the EUR currency. Since the launch of the single currency, the share of international FX reserves held in US dollars has decreased from approximately 70% to just under 60% currently. While the EUR initially gained some market share—from 18% to a peak of 28% in 2009—the Euro-sovereign debt crisis caused a reversal, with its share dropping back to about 20%, where it has remained for the last decade. This leaves it significantly trailing behind the dominant US dollar. There has been anecdotal discussion about decreasing US asset holdings, including statements from certain country officials. However, it is crucial to point out that a major limitation is the challenge of finding large high-quality liquid asset markets outside of the US. For example, the total of high-quality Euro-sovereign debt (defined here as having a minimum rating of AA-) is less than 30% of the US Treasury market size, as illustrated in the accompanying chart. Therefore, while there is potential for EUR assets to attract diversification from USD assets, it is constrained by the relatively smaller availability of stock.

Today's calendar features key events: US Q1 GDP, Jobless Claims, and speeches from Fed officials Barkin, Goolsbee, and Daly.

Overnight Headlines

- US Court Rules Trump Lacks Authority To Impose April 2 Tariffs

- Nvidia Rev Surges 70% On AI Demand, Despite China Export Hit

- Elon Musk Tried To Block Sam Altman’s AI Deal In Middle East

- Trump Orders US Chip Designers To Halt Sales To China

- Fed Feared Loss Of Haven Status Would Harm US Economy

- Fed Minutes Highlight Rising Inflation, Stability, Recession Risks

- BoK Cuts Rates For Fourth Time As Growth Concerns Deepen

- Trump Warns Netanyahu Not To Strike Iran Amid US–Tehran Talks

- Japan Expands Military Push Amid US Doubts On China Strategy

- Salesforce: AI Adoption Reduces Need For Engineers, Service Staffs

- US VP Hails Pro-Trump Crypto Investors, Cites Bitcoin’s Emergence

- HP To Raise Prices, Shift Output From China Due To Tariff Risks

- Oil Gains As Trade Court Blocks Trump Tariffs, OPEC+ Holds Quotas

- UK Seeks To Speed Up Implementation Of US Trade Deal

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1190-00 (1.7BLN), 1.1250 (942M), 1.1300-15 (512M)

- 1.1315-25 (350M), 1.1400 (387M), 1.1415-20 (320M)

- 1.1450 (250M), 1.1500 (643M)

- USD/JPY: 143.00 (790M), 144.00 (474M), 144.80-85 (600M)

- 144.90-00 (2.9BLN)

- EUR/JPY: 162.10 (492M), 162.75 (351M)

- USD/CHF: 0.8200. (360M), 0.8300 (290M)

- GBP/USD: 1.3340-50 (363M), 1.3410-15 (262M)

- AUD/USD: 0.6370-75 (792M), 0.6550-55 (861M)

- NZD/USD: 0.5975 (440M), 0.6050 (294M)

- USD/CAD: 1.3780 (448M), 1.3800 (367M), 1.3820 (282M)

- 1.3900 (239M), 1.3925 (430M), 1.3950 (250M), 1.3965 (495M)

CFTC Data As Of 23/5/25

- Speculators have increased their net short position in CBOT US 5-year Treasury futures by 95,898 contracts, bringing the total to 2,275,941. They have reduced their net short position in CBOT US 10-year Treasury futures by 38,920 contracts to 851,431. Additionally, speculators raised their net short position in CBOT US 2-year Treasury futures by 45,099 contracts to 1,267,331. Meanwhile, they cut their net short position in CBOT US Ultrabond Treasury futures by 15,087 contracts to 246,135 and trimmed their net short position in CBOT US Treasury bonds futures by 5,596 contracts to 72,033.

- Equity fund speculators have increased their net short position in S&P 500 CME futures by 9,949 contracts to 297,229, while equity fund managers have elevated their net long position in S&P 500 CME futures by 14,799 contracts to 872,421.

- The net long position for the Japanese yen stands at 167,330 contracts, the euro at 74,453 contracts, the British pound at 23,993 contracts, and the Swiss franc holds a net short position of -23,767 contracts. Lastly, the net short position for Bitcoin is recorded at -1,952 contracts..

Technical & Trade Views

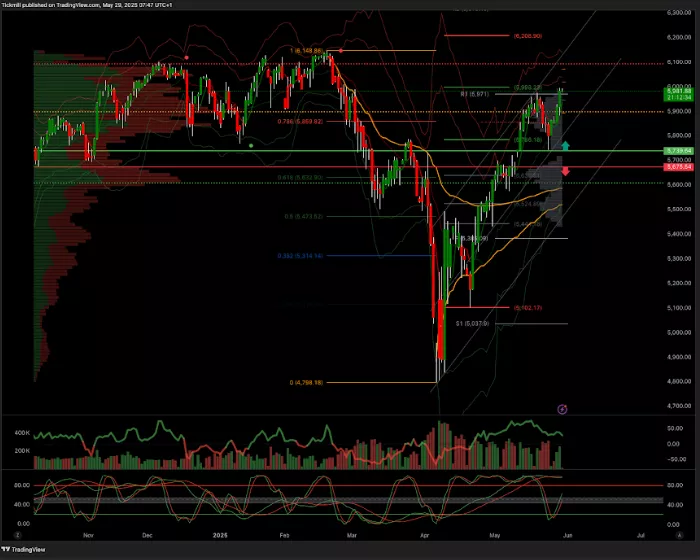

SP500 Pivot 5900

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 5900 target 6100

- Below 5500 target 5385

(Click on image to enlarge)

EURUSD Pivot 1.11

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 1.12 target 1.19

- Below 1.1070 target 1.0945

(Click on image to enlarge)

GBPUSD Pivot 1.3290

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 1.34 target 1.38

- Below 1.29 target 1.27

(Click on image to enlarge)

USDJPY Pivot 147.70

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.52 target 153.80

- Below 146.53 target 139

(Click on image to enlarge)

XAUUSD Pivot 3100

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 3200 target 3640

- Below 3000 target 2950

(Click on image to enlarge)

BTCUSD Pivot 105k

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 105k target 118k

- Below 100k target 96.7k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Wednesday, May 28

Daily Market Outlook - Wednesday, May 28

Daily Market Outlook - Tuesday, May 27