Daily Market Outlook - Thursday, May 1

Image Source: Unsplash

US equity futures surged on Thursday, fuelled by stronger-than-expected tech earnings and hints that the Trump administration might soon announce initial trade agreements to lower proposed tariffs. Futures for the S&P 500 and Nasdaq 100 climbed over 1%, supported by post-market gains in Microsoft Corp. and Meta Platforms Inc. shares following their positive financial results. Microsoft reported sales exceeding expectations, while Meta also surpassed analysts' forecasts, suggesting robust consumer demand despite tariff concerns. This rise in US futures came after the S&P 500 rebounded from an intraday drop of more than 2% on Wednesday, closing 0.2% higher. Japanese and Australian markets posted modest gains on Thursday. Asian markets, including Mainland China, Hong Kong, Singapore, and India, were closed for holidays. The yen weakened for a third consecutive day as the Bank of Japan kept its benchmark rate at 0.5% and postponed its timeline for achieving its inflation target. Treasury yields in Asia dipped slightly, while the dollar index increased. Investor sentiment towards US equities improved on Wednesday after President Donald Trump's trade representative suggested the country was close to unveiling its first set of trade agreements, which would involve reducing planned tariffs on trading partners. Trump acknowledged potential political risks from his extensive tariff policy but emphasised he would not rush deals just to appease anxious investors.

Last month's ETF flows reveal a trend of net buying in US equities despite a spike in volatility. The tariff-driven market environment provides valuable insights into investor behaviour. Although ETFs represent only about 20% of overall equity trading volumes, as estimated by SIFMA last year, they offer timely updates on market activity. The US ETF market reveals several noteworthy observations. Firstly, there was significant net buying of equities as prices dropped sharply and volatility surged during the first week of April, with the largest daily net buying flow coinciding with the announcement of a tariff pause on April 9. Secondly, despite Treasuries selling off alongside other US financial assets, there was limited selling of fixed income assets earlier in the month. Thirdly, the largest selling flows in both asset classes occurred during the calmer latter two-thirds of the month, though overall net flows during this period remained broadly flat. While strong conclusions can't really be made without understanding the specific drivers behind these flows—such as speculation, hedging, or asset allocation rebalancing—and given that ETFs are only a small part of the overall market, it is evident that there was some level of investor support over the past month despite high uncertainty.

Today's macro slate includes: UK Lending and Money Supply, ISM Manufacturing, Challenger Job Cuts, Weekly Jobless Claims. Micro focus will be firmly on Apple and Amazon earnings, especially given the stellar results and performance from Meta and Microsoft overnight.

Overnight Newswire Updates of Note

- Bank Of Japan Keeps Rates Unchanged As Tariffs Cloud Outlook

- Yen Weakens Modestly As BoJ Keeps Rates Unchanged

- Gold Falls As Prospect Of US-China Trade Talks Cuts Haven Demand

- Microsoft Reports Strong Quarterly Sales Fueled By Cloud Growth

- Meta Boosts Capex Forecast In Push To Be An ‘AI Leader’

- Tesla Board Opened Search For A CEO To Succeed Elon Musk

- Nvidia CEO Urges Trump To Change Rules For AI Chip Exports

- Goldman’s Waldron: WH’s Early Trade Deals To ‘Serve As A Template’

- Trump's Economic Agenda Faces Early Setback As US GDP Shrinks

- US And Ukraine Sign Agreement On Access To Natural Resources

- US Senate Republicans Block Rebuke Of Trump’s Tariffs

- Oil Holds April’s Slump As Saudis Signal Increased OPEC+ Supply

- Trump Says Tariffs Politically Risky, But He’s Not Rushing Deals

- Aussie’s Trade Surplus Climbs To 6,900M Mom In March

- S. Korea’s Exports Unexpectedly Rose In April; Deters Tariff Pinch

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1200 (1.6BLN), 1.1250 (1.2BLN), 1.1270 (1.8BLN), 1.1285 (337M)

- 1.1300 (331M), 1.1330 (1.2BLN),1.1350 (627M), 1.1375-85 (1.3BLN)

- USD/CHF: 0.8200 (370M), 0.8250 (200M), 0.8300 (200M)

- EUR/GBP: 0.8485 (250M), 0.8500 (895M), 0.8600 (341M)

- AUD/USD: 0.6325 (350M), 0.6365 (254M), 0.6410-15 (675M), 0.6420-25 (675M)

- NZD/USD: 0.5790 (337M), 0.6005 (560M)

- USD/CAD: 1.3780-85 (460M)

- USD/JPY: 143.00-10 (2BLN), 143.50 (1.1BLN), 144.00 (1.1BLN)

- 144.50 (437M), 144.75-80 (1.5BLN), 145.00 (1.5BLN)

- EUR/JPY: 160.95-161.05 (631M), 164.00 (500M)

- AUD/JPY: 91.50 (326M), 92.30 (300M)

CFTC Data As Of 25/4/25

- Speculators in equity funds have boosted their net short position on the S&P 500 CME by 19,828 contracts, reaching a total of 259,476 contracts. In contrast, equity fund managers have increased their net long position on the S&P 500 CME by 2,780 contracts, bringing the total to 807,842 contracts.

- Speculators have also raised their net short position in CBOT US Treasury bonds futures by 6,902 contracts to reach 107,687 contracts, while they increased their net short position in CBOT US Ultrabond Treasury futures by 27,545 contracts, totaling 247,602 contracts.

- Speculators have reduced their net short position in CBOT US 10-year Treasury futures by 31,649 contracts, leading to a revised total of 906,106 contracts. They raised their net short position in CBOT US 5-year Treasury futures by 129,859 contracts, bringing the total to 2,191,434 contracts.

- Speculators increased their net short position in CBOT US 2-year Treasury futures by 43,222 contracts, reaching 1,297,995 contracts. The net long position in Japanese yen stands at 177,814 contracts, while the euro's net long position is 65,028 contracts. The British pound has a net long position of 20,490 contracts. In contrast, the Swiss franc shows a net short position of -25,474 contracts, and the net short position for Bitcoin is -806 contracts..

Technical & Trade Views

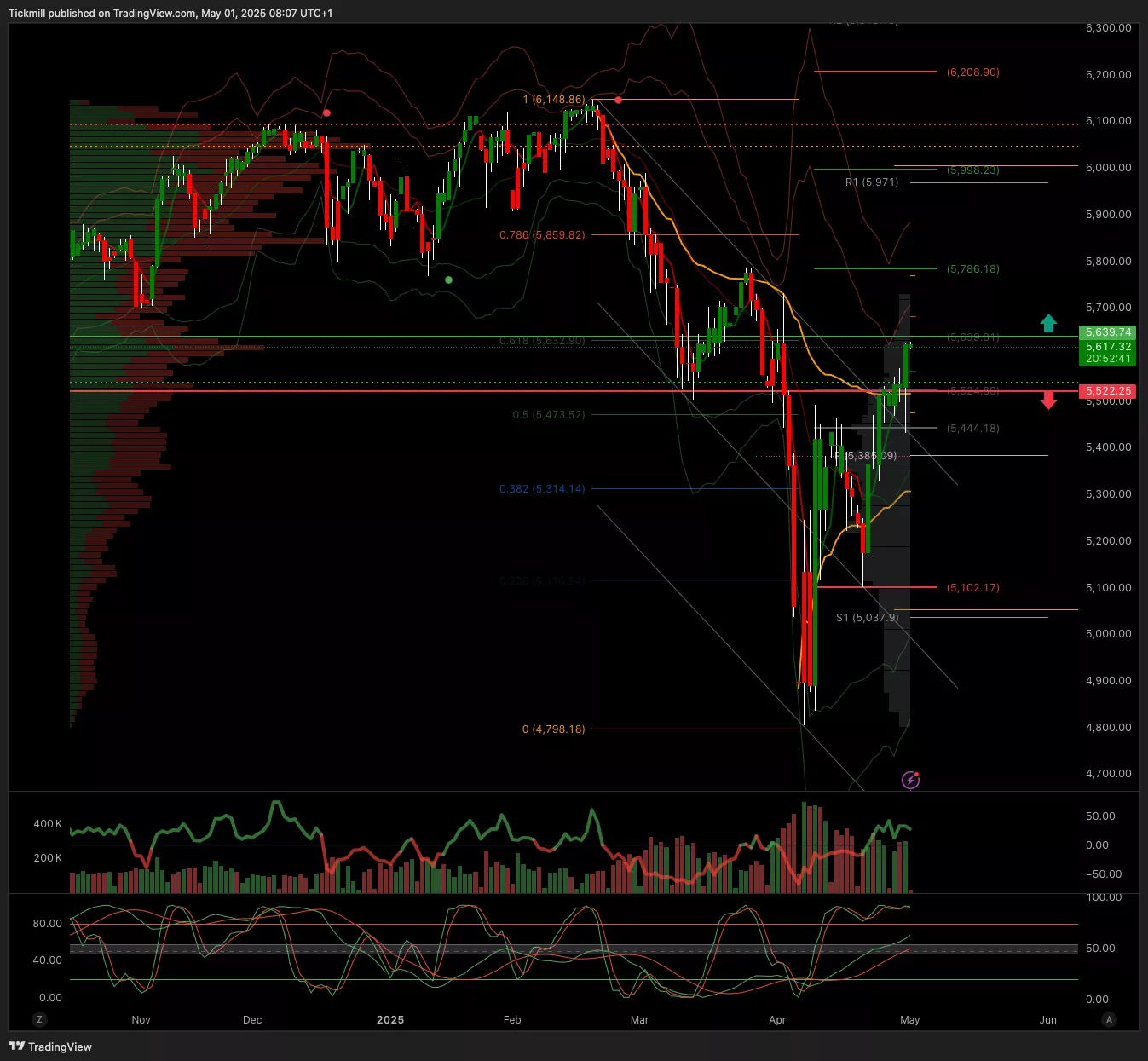

SP500 Pivot 5610

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 5640 target 5790

- Below 5500 target 5385

(Click on image to enlarge)

EURUSD Pivot 1.11

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bearishness into the end of April

- Above 1.12 target 1.19

- Below 1.1070 target 1.0945

(Click on image to enlarge)

-

GBPUSD Pivot 1.28

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 1.34 target 1.38

- Below 1.29 target 1.27

(Click on image to enlarge)

-

USDJPY Pivot 147.70

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bearishness into early May

- Above 1.52 target 153.80

- Below 146.53 target 139

(Click on image to enlarge)

-

XAUUSD Pivot 3100

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bearishness into late April

- Above 3200 target 3640

- Below 3000 target 2950

(Click on image to enlarge)

-

-

BTCUSD Pivot 96.7k

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 97k target 105k

- Below 95k target 65k

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Wednesday, April 30

The FTSE Finish Line - Tuesday, April 29

Daily Market Outlook - Tuesday, April 29