Daily Market Outlook - Wednesday, April 30

Image Source: Pixabay

China's manufacturing sector has entered its most significant contraction since December 2023, highlighting the initial impact of the trade conflict with the US on the world's second-largest economy. The gloomy stats impeded a rise in Chinese stocks, causing the CSI300 blue-chip index to reverse its earlier gains and close down. Meanwhile, Hong Kong's Hang Seng Index inched up by 0.1%. Despite Trump's attempt to mitigate the impact of his auto tariffs and indications of progress in ongoing trade talks, specific details remain limited, with Commerce Secretary Howard Lutnick mentioning he had secured a deal with a foreign nation. Compounding the tariff concerns, investors are also contending with worsening U.S. economic data as Trump's significant tariffs affect businesses and consumers domestically. In Japan, factory production saw a decline last month, suggesting weakening momentum for manufacturers as they navigated uncertainties related to Donald Trump's extensive tariff initiatives. Trump renewed his criticism of Federal Reserve Chairman Jerome Powell while promoting his economic policies and tariff strategy during an event marking his 100th day in office. He signed two directives aimed at mitigating the effects of his tariffs on the automotive industry, responding to weeks of vigorous lobbying from automakers, parts suppliers, and dealers who warned that excessive tariffs could lead to increased vehicle prices, factory closures, and job losses.

Yesterday was a significant day for U.S. economic data. The March trade report revealed a notable increase in imports as companies rushed to stockpile inventory and inputs ahead of impending tariffs. This trend poses a downside risk to today’s initial Q1 GDP figures. With the consensus predicting only a 0.3% quarter-over-quarter annualized growth rate, any negative surprises could result in a negative figure. However, this may be a temporary anomaly, as Q2 is expected to show a reversal in trade trends, with imports likely to exert less of a drag. Nonetheless, market sentiment could still be affected, especially since yesterday’s data also suggested a potential softening in the economic outlook. Job openings at the end of March fell short of expectations, registering at 7.2 million, with a downward revision to the previous month’s figures. The most striking figure, however, was the expectations component of the Consumer Confidence report. There are few comparable readings in the survey’s long history, and even fewer that occur outside of a recession.

The BoE's observation window for financial market variables influencing the May MPR projections closed yesterday. At the two-year horizon, the market-implied Bank Rate is ~50bps lower than in February, which typically signals upward pressure on CPI inflation. However, this analysis seems secondary due to potential disruptions in international trade from the 2 April announcements. Oil prices have dropped ~$10/bbl since February, reflecting reduced global demand, while the GBP remains strong, aiding disinflation through imports. The BoE has previously discussed growth risks from trade barriers, but Bailey's emphasis is notable. Greene highlights tariffs' impact on inflation through trade diversion, suggesting the MPC might deliver a different message. The case for a faster-than-gradual rate cut is strengthening, as indicated by the flash April PMIs dropping below 50.

Today's macro slate includes the April CPI for Germany, Italy, and France, Q1 GDP for Germany, Italy, and the US, as well as the US PCE and Employment Cost Index. Attention will continue on micro with 40% of S&P market capitalization reporting this week, including MSFT (Wednesday), AMZN (Thursday), and AAPL (Thursday). The positive news is that TMT (communications services + information technology) are leading the market in terms of EPS (and Revenue) surprises so far during the 1Q EPS season. According to Goldman Sachs equity trading desk the unfortunate reality is that earnings beats are not receiving the acknowledgment they typically do. In the current macroeconomic landscape, earnings beats are underperforming on T+1, with the median stock exceeding expectations by just 50 basis points, compared to the historical average of 101 basis points. Conversely, misses are lagging behind by 247 basis points, against a historical average of 206 basis points.

Overnight Newswire Updates of Note

- Eurozone Q1 GDP Likely Improved Due To Tariff-driven Frontloading

- JPM Chief Dimon Backs UK Chancellor Reeves’ ‘Pro-Growth Agenda’

- Trump Bashes Powell, Touts Tariffs At 100 Day Rally In Michigan

- Trump Adviser Struggled To Soothe Investors In Talks After Market Tumult

- Nucor CEO Backs Tariffs: Steel Order Backlog Is The Largest In Its History

- Chinese Manufacturing Shrinks Most Since 2023 As US Tariffs Hit

- Japan Factory Output Falls In Sign Of Frailty Before Tariffs

- Australia First-Quarter Inflation Holds Steady At 4-year Low Of 2.4%

- Huawei Delivers Adv AI Chip To Chinese Clients Cut Off From Nvidia

- TSMC Starts Building Third Arizona Fab To Ramp Up US Expansion

- Samsung’s Chips Business Beats Estimates After Stockpiling Push

- Super Micro Plunges After Preliminary Results Miss Estimates

- Starbucks Says Turnaround On Track As Sales Decline Persists

- Visa Earnings Top Estimates As Spending On Network Stays Strong

- UPS To Cut 20K Jobs On Reduced Amazon Deliveries; US Tariffs Weigh

- Amazon Scraps Plan To List Tariff Costs After WH Calls It ‘Hostile”

- McDonald’s, Coca-Cola Still See Risks To Operating In Russia

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1250 (1.7BLN) , 1.1330-40 (624M), 1.1375-85 (1.6BLN)

- 1.1390 (1.3BLN), 1.1425 (686M), 1.1450 (620M)

- USD/CHF: 0.8250 (365M), 0.8300 (280M)

- GBP/USD: 1.3300-10 (227M)

- AUDUSD: .6320 (431M), .6350 (293M), .6450 (243M), .6475 (277M), .6500 (550M)

- NZD/USD: 0.5950 (521M). USD/SEK: 9.6900 (260M)

- USD/CAD: 1.3800 (224M), 1.3820-25 (565M), 1.3855 (387M), 1.3940 (301M)

- USD/JPY: 140.50 (2.1BLN), 141.00 (532M), 141.50 (676M), 142.00 (2BLN)

- 143.50 (628M), 144.00 (670M), 144.40-50 (1.1BLN), 145.00 (1.8BLN)

Barclays is the first to unveil its preliminary model forecasts for month-end FX flow. The model anticipates a robust demand for USD across all leading currencies. This comes in the wake of the 2nd April liberation day, which caused a global risk-off sentiment and a decline in stock markets. Conventional safe havens, such as US Treasuries and the USD, experienced significant declines as well. This situation resulted in an unexpected expansion of U.S. swap spreads and a spike in credit spreads. The trade-weighted USD dropped by 4.6% in April, prompting a rebalancing that drove USD demand

Credit Agricole’s FX Month-End model signals real money USD buying versus corporate GBP selling and EUR buying

CFTC Data As Of 25/4/25

- Speculators in equity funds have boosted their net short position on the S&P 500 CME by 19,828 contracts, reaching a total of 259,476 contracts. In contrast, equity fund managers have increased their net long position on the S&P 500 CME by 2,780 contracts, bringing the total to 807,842 contracts.

- Speculators have also raised their net short position in CBOT US Treasury bonds futures by 6,902 contracts to reach 107,687 contracts, while they increased their net short position in CBOT US Ultrabond Treasury futures by 27,545 contracts, totaling 247,602 contracts.

- Speculators have reduced their net short position in CBOT US 10-year Treasury futures by 31,649 contracts, leading to a revised total of 906,106 contracts. They raised their net short position in CBOT US 5-year Treasury futures by 129,859 contracts, bringing the total to 2,191,434 contracts.

- Speculators increased their net short position in CBOT US 2-year Treasury futures by 43,222 contracts, reaching 1,297,995 contracts. The net long position in Japanese yen stands at 177,814 contracts, while the euro's net long position is 65,028 contracts. The British pound has a net long position of 20,490 contracts. In contrast, the Swiss franc shows a net short position of -25,474 contracts, and the net short position for Bitcoin is -806 contracts..

Technical & Trade Views

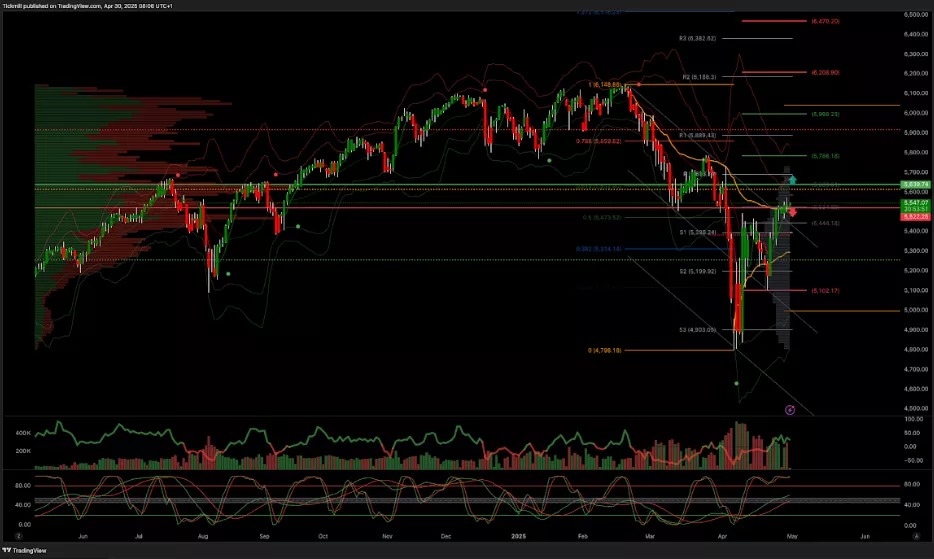

SP500 Pivot 5610

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 5640 target 5790

- Below 5500 target 5385

(Click on image to enlarge)

EURUSD Pivot 1.11

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into the end of April

- Above 1.12 target 1.19

- Below 1.1070 target 1.0945

(Click on image to enlarge)

GBPUSD Pivot 1.28

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 1.34 target 1.38

- Below 1.29 target 1.27

(Click on image to enlarge)

USDJPY Pivot 147.70

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bearishness into early May

- Above 1.52 target 153.80

- Below 146.53 target 139

(Click on image to enlarge)

XAUUSD Pivot 3100

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bearishness into late April

- Above 3200 target 3640

- Below 3000 target 2950

(Click on image to enlarge)

BTCUSD Pivot 96.7k

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 97k target 105k

- Below 95k target 65k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Tuesday, April 29

Daily Market Outlook - Tuesday, April 29

The FTSE Finish Line - Monday, April 29