Daily Market Outlook - Thursday, July 11

Image Source: Unsplash

Ahead of the expected US consumer pricing data on Thursday, Asian stocks saw an increase, driven by a surge in the world's largest tech companies, leading to record highs in global shares.

China, Australia, and Japan all experienced stock market gains on Wednesday following a positive session on Wall Street. The decline of the Dollar against most major currencies prior to significant US inflation data suggests a potential reduction in price pressure and an increased likelihood of interest rate cuts by the Fed. Anticipation for the upcoming US consumer pricing data contributed to the rise in Asian stocks, fueled by the strong performance of the world's biggest tech firms, which propelled global shares to all-time highs. Taiwan Semiconductor Manufacturing, the exclusive supplier of Nvidia and Apple's most advanced chips, reached record highs after reporting its second-quarter revenue growth at the highest rate since 2022. Sony Group, Tencent Holdings, and Korean chipmaker SK Hynix were also key contributors to the regional stock index increase, with SK Hynix trading at its highest levels since 2000.

In May, the UK's GDP grew by 0.4% month-on-month, surpassing expectations and posing an upside risk to the Bank of England's Q2 GDP forecast. The service sector and construction contributed significantly to this growth, with retail showing a rebound from a wet April. Despite potential factors like National Insurance rate changes and erratic weather, the broader picture indicates a 0.9% GDP growth over the past three months, primarily driven by the service sector. This growth is considered above-trend. While upcoming labor market and inflation data are important for the August Monetary Policy Committee vote, recent comments from certain members suggest that the data does not support an increased probability of an early rate cut.

Since 2021, US CPI has often surprised to the upside, indicating a shift in the Fed's policy outlook. However, the recent soft news on fuel and airfares is not expected to repeat. Markets expect a slight increase in June CPI, with annual rate estimates slightly above the median forecast. While Powell is considering a potential rate cut, some argue it may be premature. The reliance on flexible prices to reduce inflation poses a risk, and more progress is needed on sticky items. Small upside surprises this month could cause uncertainty in the market regarding the timing of the first rate cut.

Overnight Newswire Updates of Note

- BoK Extends Rate Freeze Into Longest Period Amid Slow Inflation, Rising Debts

- Keir Starmer Eyes Quick UK-EU Pact on Defence and Security

- Ukraine Is Fighting Russia With Toy Drones And Duct-Taped Bombs

- Yellen, Isreal’s Katz Discussed West Bank Financial Stability

- New Zealand Food Prices (M/M) Jun: 1% (prev -0.2%)

- Australian CBA Household Spending (Y/Y) Jun: 4.3% (prevR 4.0%)

- Japanese Core Machine Orders (M/M) May: -3.2% (est 0.8%; prev -2.9%)

- Australian Consumer Inflation Expectation Jul: 4.3% (prev 4.4%)

- Bank of Korea Leaves Key Interest Rate Unchanged At 3.50%

- Japan’s Tokyo Avg Office Vacancies Jun: 5.15% (prev 5.48%)

-

Sweden PES Unemployment Rate Jun: 3.4% (prev 3.2%)

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0760-70 (3BLN), 1.0775-85 (1.4BLN), 1.0790-1.0800 (1.1BLN)

- 1.0805-15 (1.3BLN), 1.0845-50 (1BLN), 1.0860-65 (1.6BLN), 1.0900 (1.3BLN)

- USD/CHF: 0.8935 (696M), 0.8950 (1.7BLN), 0.8975 (352M), 0.8995-0.9000 (660M)

- GBP/USD: 1.2835 (222M), 1.2845-55 (407M)

- EUR/GBP: 0.8425 (300M), 0.8450-60 (2.1BLN)

- AUD/USD: 0.6725-30 (701M), 0.6760 (633M), 0.6775-85 (661M)

- NZD/USD: 0.6125 (1.6BLN), 0.6150 (1.6BLN)

- USD/CAD: 1.3620 (240M), 1.3650 (633M), 1.3775 (1.2BLN)

- USD/JPY: 161.00 (1.6BLN), 161.50 (900M), 162.35 (690M)

- EUR/JPY: 171.00 (400M), 174.50 (400M)

CFTC Data As Of 5/7/24

- JPY: -184,223 contracts

- EUR: -9,519 contracts

- GBP: 62,041 contracts

- CHF: -43,443 contracts

- Bitcoin: -912 contracts

- Equity fund managers cut S&P 500 CME net long position by 24,005 contracts to 953,130

- Equity fund speculators trim S&P 500 CME net short position by 5,025 contracts to 293,675

Technical & Trade Views

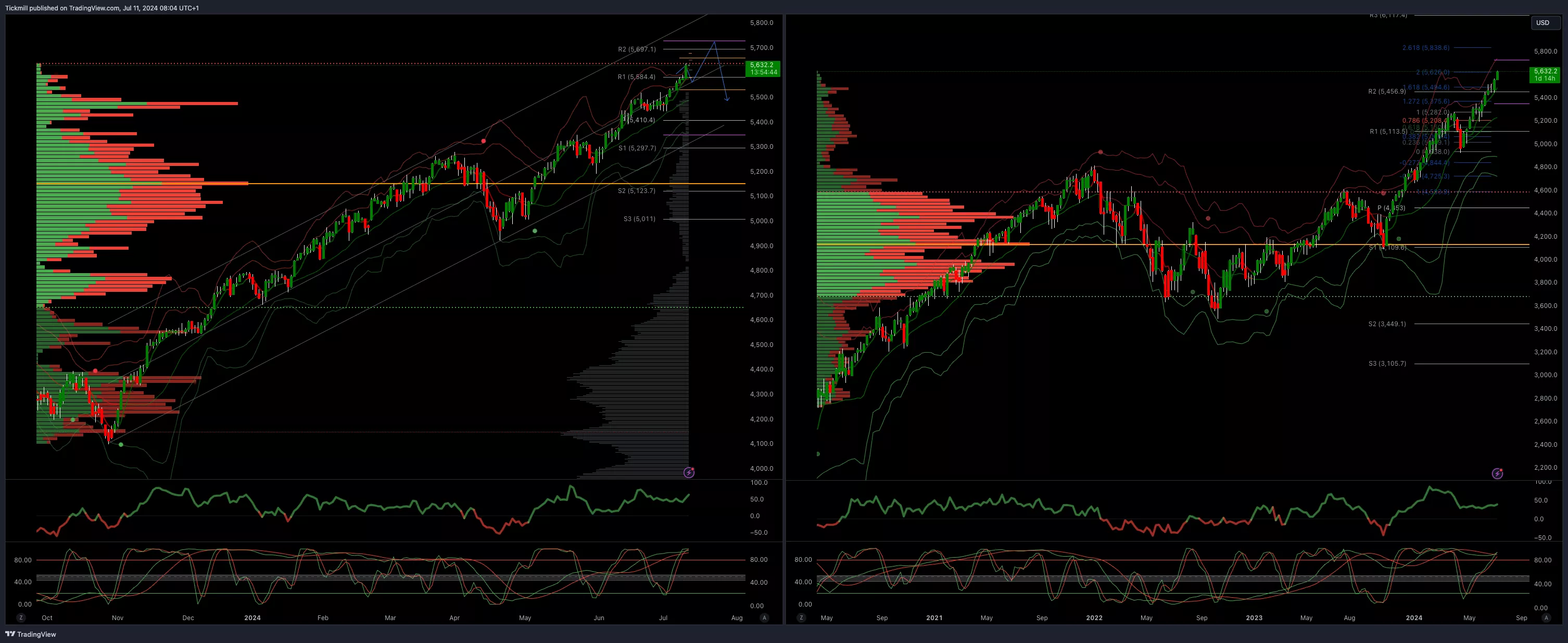

SP500 Bullish Above Bearish Below 5550

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 5475 opens 5450

- Primary support 5400

- Primary objective is 5700

(Click on image to enlarge)

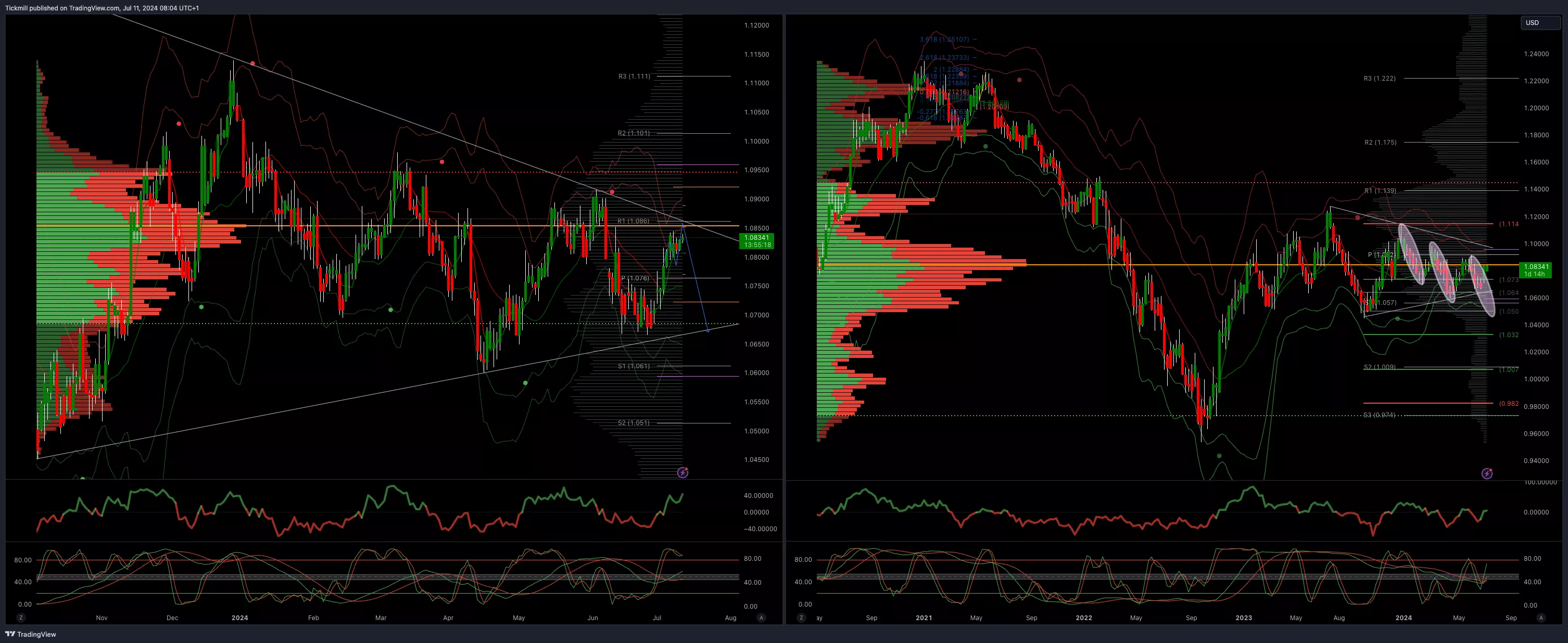

EURUSD Bullish Above Bearish Below 1.0750

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 1.880 opens 1.0940

- Primary resistance 1.0981

- Primary objective is 1.0650

(Click on image to enlarge)

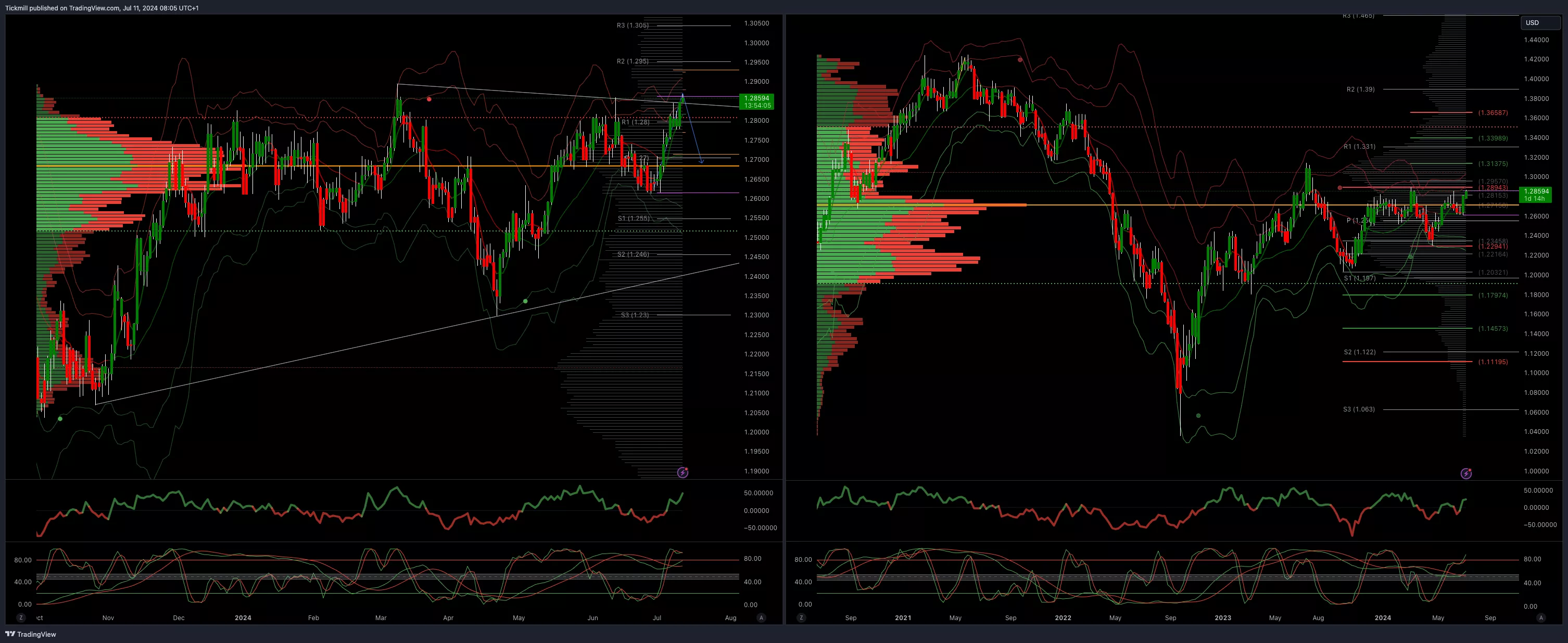

GBPUSD Bullish Above Bearish Below 1.27

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.29 opens 1.3130

- Primary resistance is 1.2890

- Primary objective 1.2570

(Click on image to enlarge)

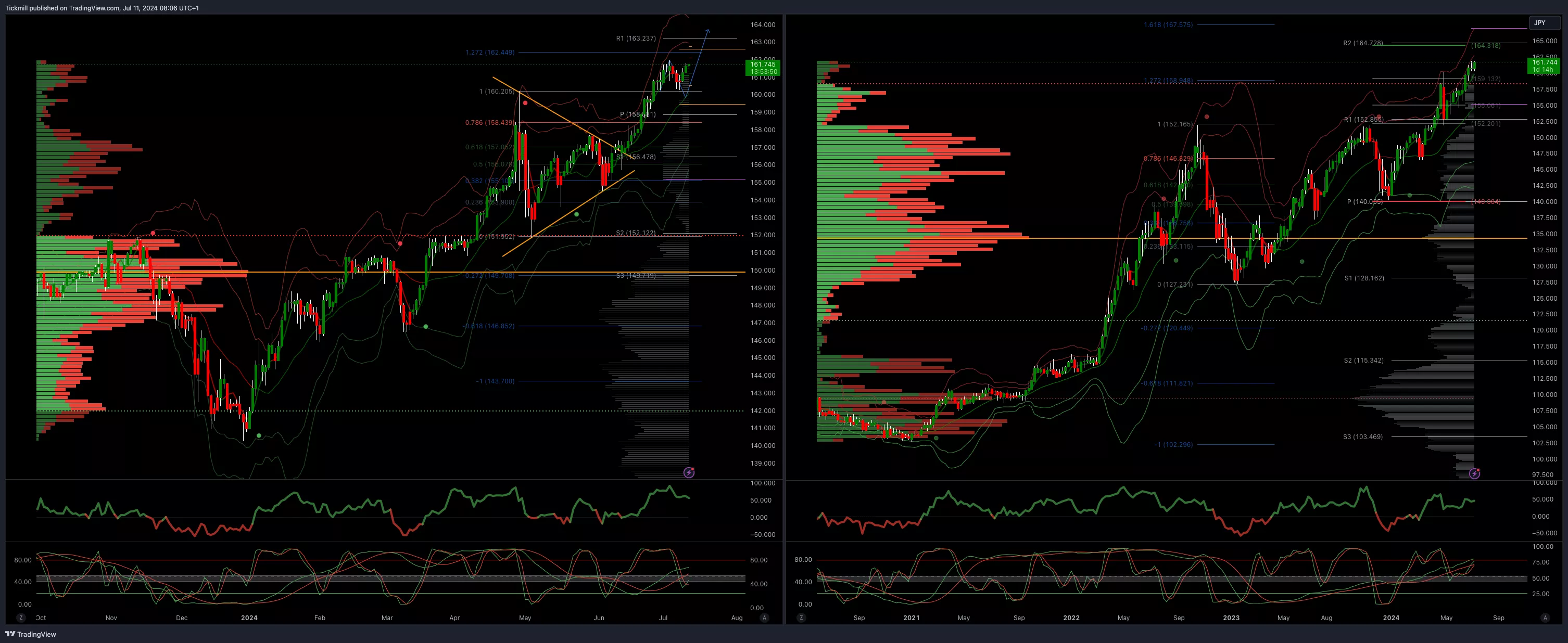

USDJPY Bullish Above Bearish Below 160

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 157.60 opens 157.10

- Primary support 152

- Primary objective is 164

(Click on image to enlarge)

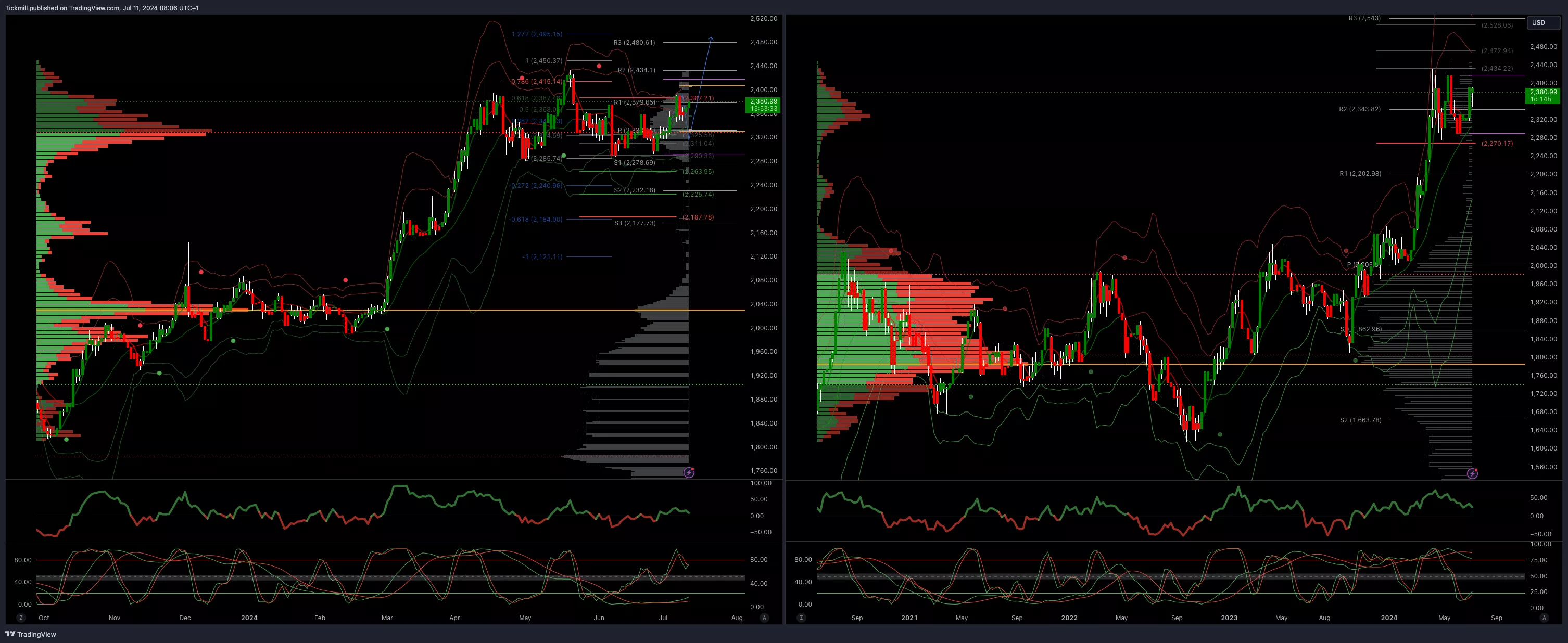

XAUUSD Bullish Above Bearish Below 2345

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 2415 opens 2495

- Primary resistance 2387

- Primary objective is 2262

(Click on image to enlarge)

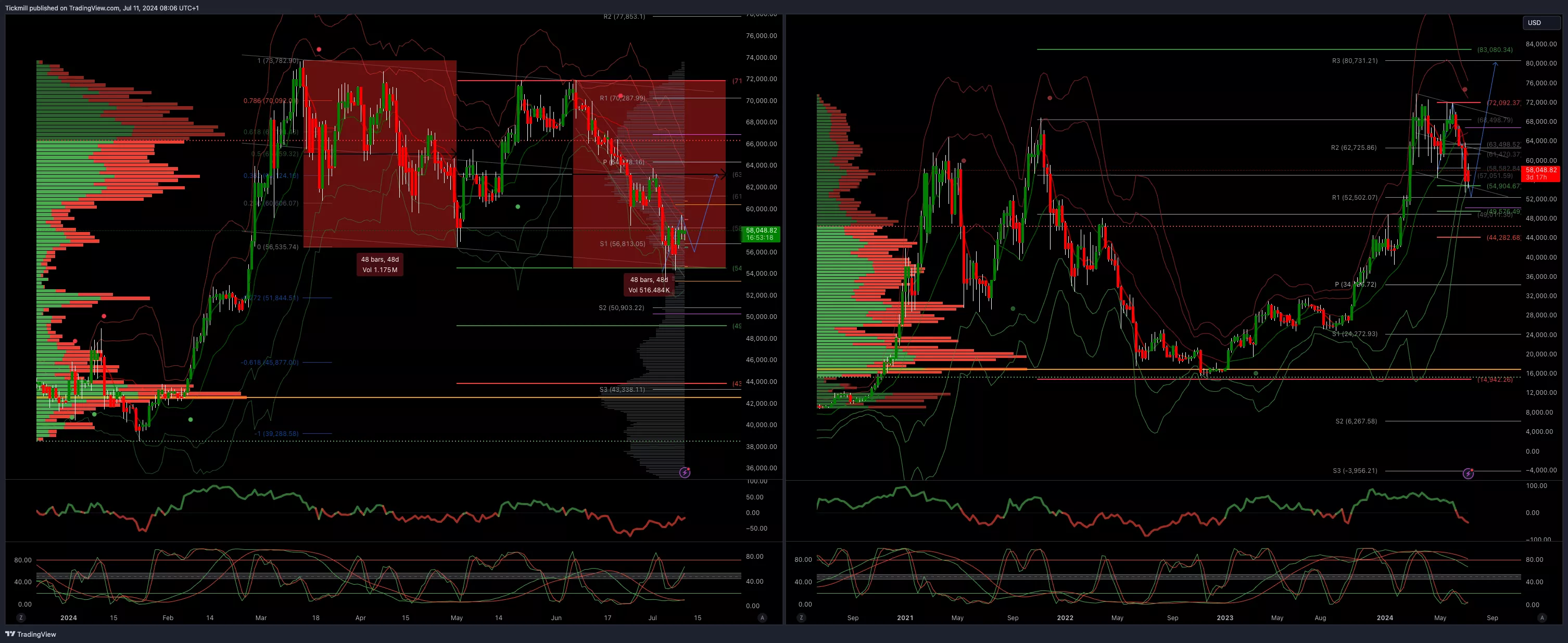

BTCUSD Bullish Above Bearish below 60000

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 67000 opens 70000

- Primary support is 50000

Primary objective is 54500 - TARGET ACHIEVED NEW PATTERN EMERGING

(Click on image to enlarge)

More By This Author:

FTSE Rebounds After Tuesday Marked Worst Day In Month

Daily Market Outlook - Wednesday, July 10

BP Earnings Disappointment Weighs On The Blue Chip Benchmark