Daily Market Outlook - Thursday, Feb. 27

Photo by Dmitry Demidko on Unsplash

The U.S. dollar gained strength in Asian markets on Thursday, accompanied by a rise in Treasury yields, as investors weighed the economic implications of tariffs under President Donald Trump. Asian stocks exhibited overall weakness amid volatile trading, with regional technology stocks showing limited reaction to Nvidia’s strong earnings report. Nvidia, a leading U.S. chipmaker and AI frontrunner, saw its shares dip 1.5% in after-hours trading following a 3.7% gain during regular trading on Wednesday. Despite releasing an optimistic growth forecast for the first quarter, Nvidia’s results seemed to fall short of the high expectations investors have come to anticipate. Bitcoin hovered near the 86k level, while gold, a traditional safe-haven asset, continued its retreat from it's all-time high. Concerns over the ongoing trade war continued to unsettle market sentiment. President Trump appeared to grant Canada and Mexico a temporary one-month reprieve from 25% tariffs, extending the deadline to April 2. However, a White House representative later suggested reverting to the original deadline of March 4. Meanwhile, Europe emerged as a potential target, with Trump proposing a 25% "reciprocal" tax on cars and other goods, details of which remain undisclosed. While Trump’s trade policies are expected to inflict more damage on their targets, they are also likely to hurt the U.S. economy. Recent weak economic data, compounded by Treasury Secretary Scott Bessent's remarks about the economy being "brittle beneath" the surface, have further fueled concerns. The dollar and U.S. bond yields have faced downward pressure recently due to disappointing economic reports and growing unease over Trump's tariff strategies. Traders have raised their expectations for Federal Reserve interest rate cuts, now forecasting two quarter-point reductions this year—one in July and another potentially as early as October. Markets are closely watching Thursday’s GDP and durable goods orders data for clearer signs of an economic slowdown, while the Fed’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) index, is set for release on Friday.

On Thursday, European investors will have a considerable amount of economic data to assess, including employment statistics from Germany, producer prices from France, and consumer inflation figures from Spain. Beyond the European Union, Switzerland will also release its GDP data. In a week, the European Central Bank (ECB) will commence its next series of central bank meetings, with market expectations currently indicating a quarter-point rate cut at that time, followed by two additional cuts by September. Nonetheless, internal conversations within the ECB focus on how much lower interest rates should go, given that inflation remains slightly elevated and the economy is facing challenges.

Investment banks project USD demand for February's month-end rebalancing. Deutsche Bank's model anticipates moderate USD buying, driven by U.S. equity underperformance and European equity outperformance, signaling EUR/USD selling. Seasonal trends also highlight potential NZD/USD and AUD/USD declines around month-end. Conversely, Credit Agricole notes a global equity downturn in February and a significant USD drop, suggesting weak USD rebalancing flows, particularly against SEK. While EUR selling is possible, no clear trading signals or recommendations are provided for February.

Overnight Newswire Updates of Note

- BTC, Market Dips After Trump Plans To Impose 25% Tariffs On EU

- Michelin CEO: France Is ‘Killing’ Its Industry With Taxes

- Mercedes Set To Cut Jobs In China As Local Competition Heats Up

- Nvidia Sales Up 78% On AI Demand, Co Gives Strong Guidance

- Salesforce Profit Rises, Revenue Misses

- eBay Falls After Projected Sales For Current Period Disappoint

- China Puts The Breaks On US Stock Listings For Domestic Firms

- Hong Kong Stock Exchange Reports Record Profits After Stimulus

- Australia New Capital Expenditure Falls 0.2 Per Cent

- ANZ: NZ Business Confidence Rises As Economy Recovers

- Shorter Tenor Asian Bonds Are Showing Resilience To Tariff Risk

- Israel, Hamas: Hostage And Prisoner Swap To Go Ahead

- Gold Prices Slip, Investors Eye Upcoming US PCE Data

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0425-30 (1.3BLN), 1.0440-50 (1.7BLN), 1.0450 (1.3BLN)

- 1.0470-75 (2BLN), 1.0525 (408M), 1.0545-50 (674M)

- USD/CHF: 0.8915 (568M), 0.8950 (523M), 0.9040 (626M)

- GBP/USD: 1.2595-1.2600 (557M), 1.2685 (202M), 1.2700 (935M)

- AUD/USD: 0.6245 (626M), 0.6320-25 (350M), 0.6345-50 (850M)

- USD/CAD: 1.4325 (538M), 1.4350-60 (1.7BLN), 1.4365-70 (1.2BLN)

- USD/JPY: 148.00 (1.3BLN), 150.00 (2.8BLN), 151.00-05 (1.7BLN)

- EUR/JPY: 154.00 (401M), 156.00 (200M). AUD/JPY: 93.50 (275M)

CFTC Data As Of 21/2/25

- Positions Report from the CFTC for the Week Ending February 18th

- The net short position in euros stands at -51,420 contracts.

- The net long position for the Japanese Yen stands at 60,569 contracts.

- The Swiss franc has recorded a net short position of -38,359 contracts.

- The net short position for the British pound stands at -579 contracts.

- The net short position for Bitcoin stands at -367 contracts.

- Equity fund managers have increased their S&P 500 CME net long position by 18,069 contracts, bringing the total to 948,011. Meanwhile, equity fund speculators have reduced their S&P 500 CME net short position by 332 contracts, resulting in a total of 365,901.

- Speculators have raised their positions on CBOT. The net long position in US Treasury Bonds futures has risen by 3,780 contracts, reaching a total of 47,781. Speculators are increasing their activity on the CBOT. US Ultrabond Treasury futures net short position decreased by 6,301 contracts, totalling 246,242. Speculators have reduced their positions. Chicago Board of Trade US 2-Year Treasury futures have seen a net short position decrease of 9,093 contracts, bringing the total to 1,289,519. Speculators are reducing their positions on the CBOT. The net short position in US 10-Yr Treasury futures has decreased by 41,507 contracts, bringing the total to 709,527. Meanwhile, speculators have reduced their net short position in CBOT US 5-Yr Treasury futures by 124,202 contracts, resulting in a total of 1,737,533.

Technical & Trade Views

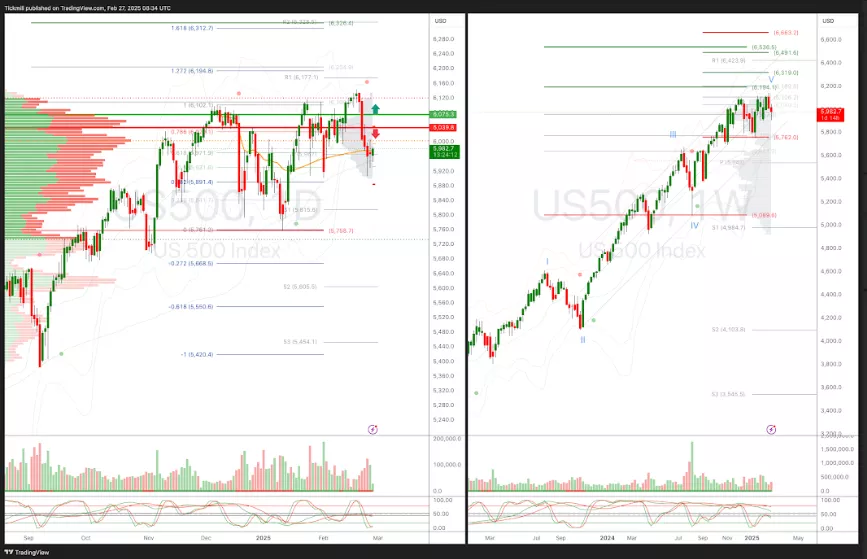

SP500 Pivot 6040

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bearishness Into March 7th

- Long above 6075 target 6195

- Short Below 6045 target 5743

(Click on image to enlarge)

EURUSD Pivot 1.0435

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 30th

- Above 1.0505 target 1.0634

- Below 1.0435 target 0.9758

(Click on image to enlarge)

GBPUSD Pivot 1.2614

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 10th

- Above 1.2685 target 1.2812

- Below 1.2615 target 1.1878

(Click on image to enlarge)

USDJPY Pivot 153.77

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 1.5377 target 165.50

- Below 152.41 target 150

(Click on image to enlarge)

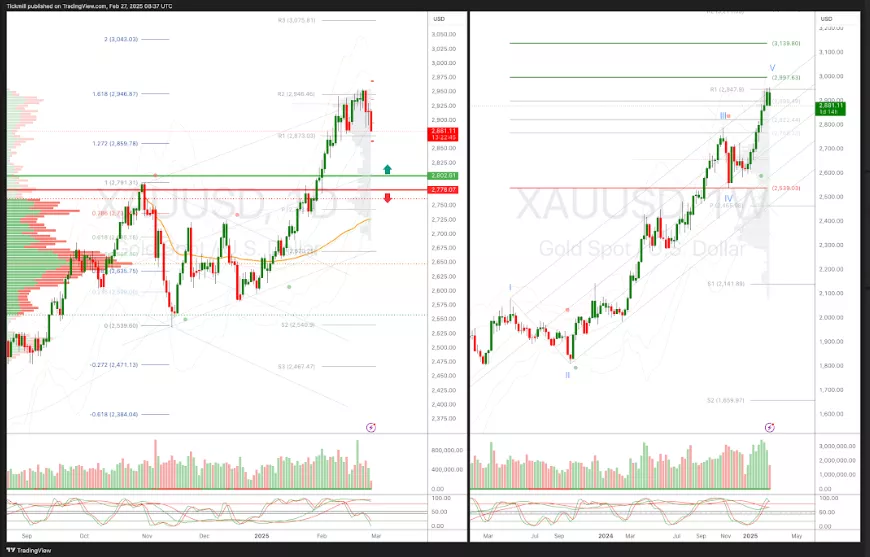

XAUUSD Pivot 2692

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests volatile bullishness into Feb 22nd

- Above 2725 target 2997

- Below 2692 target 2475

(Click on image to enlarge)

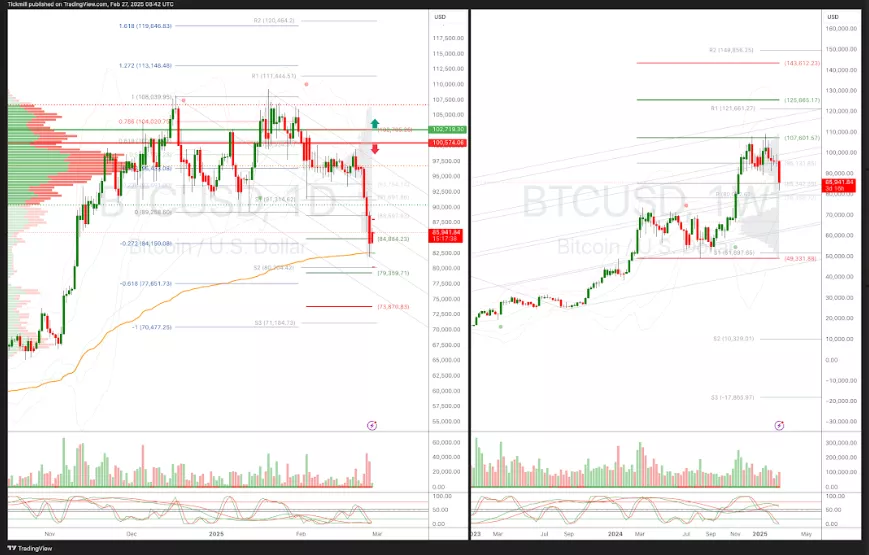

BTCUSD Pivot 101,960

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 104,020 target 110,000

- Below 101,942 target 879,359

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Wednesday, Feb. 26

Daily Market Outlook - Wednesday, Feb. 26

The FTSE Finish Line - Tuesday, Feb. 25