Daily Market Outlook - Thursday, Aug. 8

Image Source: Pexels

Despite assurances from US Fed officials that the world's largest economy is not headed for a recession, stocks wilted under pressure amid concerns about the outlook for the U.S. economy. As a result, Asian stock markets are trading mostly lower on Thursday, following the generally weak handover from Wall Street overnight. In addition, increased geopolitical tensions are negatively impacting the markets. The Japanese market is sharply lower on Thursday, reversing some of the gains from the previous two sessions. The Nikkei 225 is declining below the 35k handle as a result of weakness in most industries, with financial and technology companies leading the decline.

The US 10yr yield shot up about 9 basis points to 3.977% overnight as a result of bond investors' panic over Wednesday's botched 10-year Treasury auction, but more than half of that move was reversed in early Thursday trading. There is a strong list of reasons to exit investments that may have gotten over their skies, including concerns about an AI bubble, a U.S. hard landing, and a significant unwind of yen carry positions.

Today's noteworthy events in Europe consist mostly of a few earnings reports from companies like Deutsche Telekom and Allianz. This shifts the macro focus to the weekly unemployment claims data from the United States later in the day, following last week's notable slowdown in payroll growth that heightened fears of a global economic slowdown. Thomas Barkin of the Richmond Fed is speaking today after declaring last week that he will not make any assumptions about the direction of monetary policy.

Overnight Newswire Updates of Note

- Stripe, Bitstamp Partnership To Ease EU Crypto Transactions

- RBA Bullock: Won’t Hesitate To Raise Rates Again

- BoJ Reassurance Fades, Defenses Still Up

- Trump: ‘I Do Want To Debate’ Harris

- Kamala Harris Seeks Centre Left Sweet Spot In US Election

- Berkshire Hathaway Owns More Short-term Notes Than Fed

- Google And Meta Struck Secret Ads Deal To Target Teenagers

- Intel Shareholders Sued After Job Cuts Caused Stock Plunge

- Sony Rules Out Renewing Offer For Paramount

- Warner Bros. Discovery Posts Nearly $10 Billion Loss

- KKR Eyes $4B Buyout To Take Japan's Fuji Soft Private

- SoftBank Restates Faith In AI Amid Global Market Anxiety

- US Sends Another Carrier From Asia To Middle East

- Malaysia And China Deepen Chip Cooperation

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0790-1.0800 (3.12BLN), 1.0825-35 (2.21BLN)

- 1.0840 (4.2BLN), 1.0850 (1.5BLN), 1.0855-60 (1.8BLN)

- 1.0870 (477M), 1.0900 (1.23BLN), 1.0930 (764M)

- 1.0940-50 (1.42BLN), 1.0955-65 (2.1BLN), 1.1000 (329M)

- USD/JPY: 144.00-05 (600M), 144.25 (226M), 144.45 (425M)

- 144.90-00 (924M), 146.00 (385M), 147.00 (241M)

- 148.45-50 (1.43BLN)

- EUR/JPY: 158.65 (513M), 163.60 (561M)

- USD/CHF: 0.8590-00 (255M). EUR/CHF: 0.9340 (520M)

- 0.9485 (520M)

- GBP/USD: 1.2780 (576M), 1.2815 (301M)

- EUR/GBP: 0.8530 (255M, 0.8600-05 (963M)

- AUD/USD: 0.6520-25 (1.05BLN), 0.6535 (242M)

- 0.6540-50 (387M, 0.6645-50 (870M)

- NZD/USD: 0.5900 (200M), 0.6070-80 (200M)

- AUD/NZD: 1.0900 (200M), 1.1000 (516M)

- USD/CAD: 1.3675 (923M), 1.3700 (1.06BLN)

- 1.3710-20 (439M), 1.3750 (1.0BLN), 1.3800-10 (975M)

- 1.3830-35 (471M), 1.3900 (1.42BLN)

- Based on historical data, the U.S. dollar often strengthens against a basket of currencies in August. The daily technical chart suggests that this seasonal pattern might hold true this year. In 14 of the last 24 years, including in 2021, 2022, and 2023, the USD index—which compares the value of the dollar to a basket of six other currencies—has increased in August, indicating an underlying upward tendency. Seasonality is a helpful tool, but it should not be used in isolation; it needs to be supported by other elements.

CFTC Data As Of 30/7/24

- Equity fund managers CUT S&P 500 CME net long position by 55,687 contracts to 938,842

- Equity fund speculators trim S&P 500 CME net short position by 32,188 contracts to 248,167

- Euro net long position is 17,799 contracts

- Japanese yen net short position is -73,460 contracts

- Swiss franc posts net short position of -34,520

- British pound net long position is 111,471 contracts

- Bitcoin net short position is -1,002 contracts

Technical & Trade Views

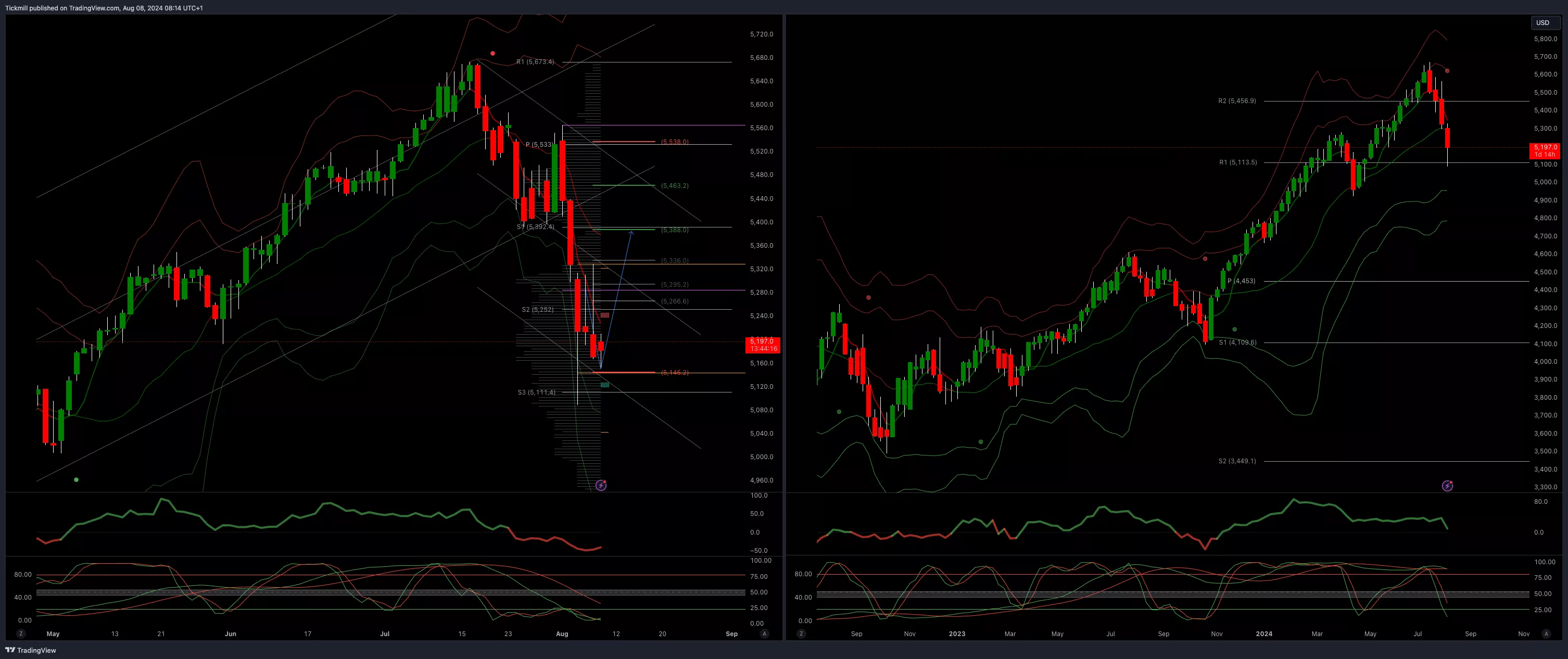

SP500 Bullish Above Bearish Below 5150

- Daily VWAP bearish

- Weekly VWAP bearish

- Below 5400 opens 5289

- Primary resistance 5470

- Primary objective is 5000

(Click on image to enlarge)

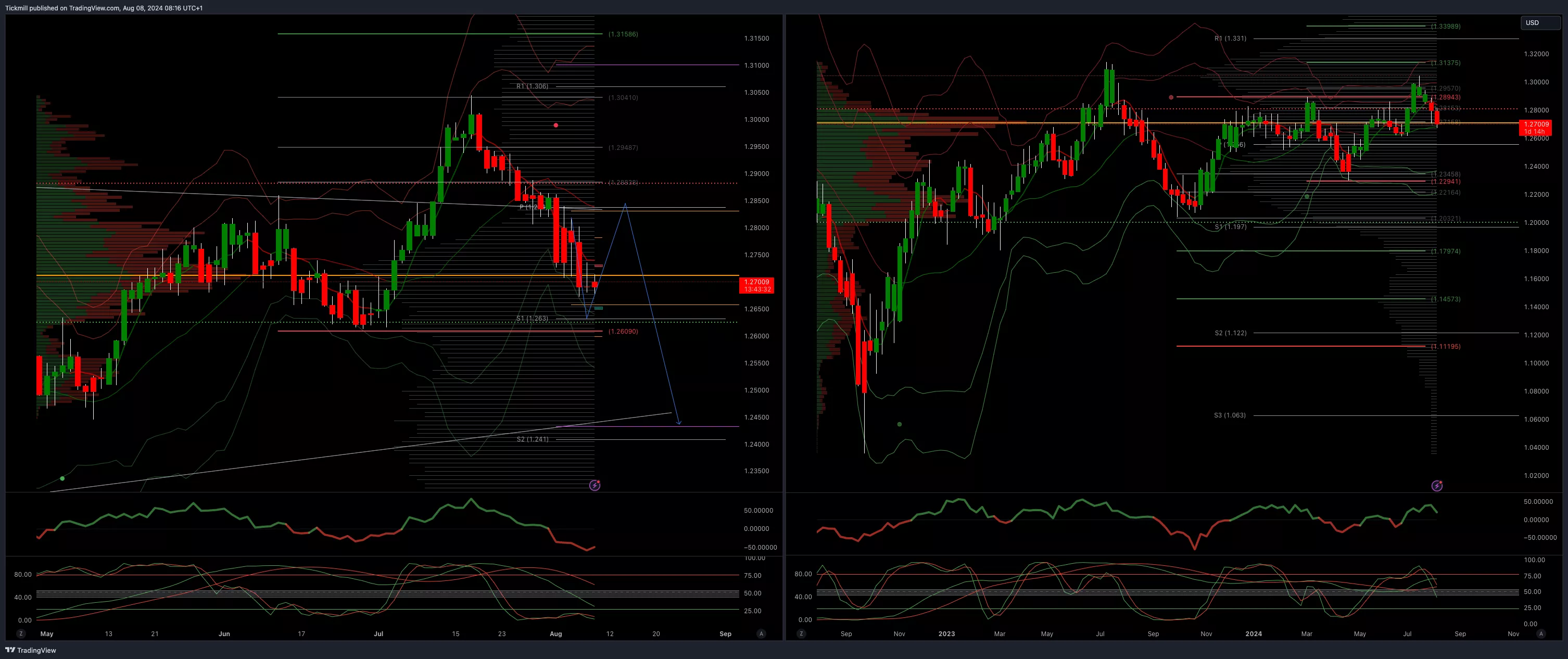

EURUSD Bullish Above Bearish Below 1.09

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.0975 opens 1.1075

- Primary resistance 1.0981

- Primary objective is 1.07

(Click on image to enlarge)

GBPUSD Bullish Above Bearish Below 1.29

- Daily VWAP bearish

- Weekly VWAP bearish

- Below 1.2670 opens 1.2450

- Primary support is 1.2690

- Primary objective 1.2450

(Click on image to enlarge)

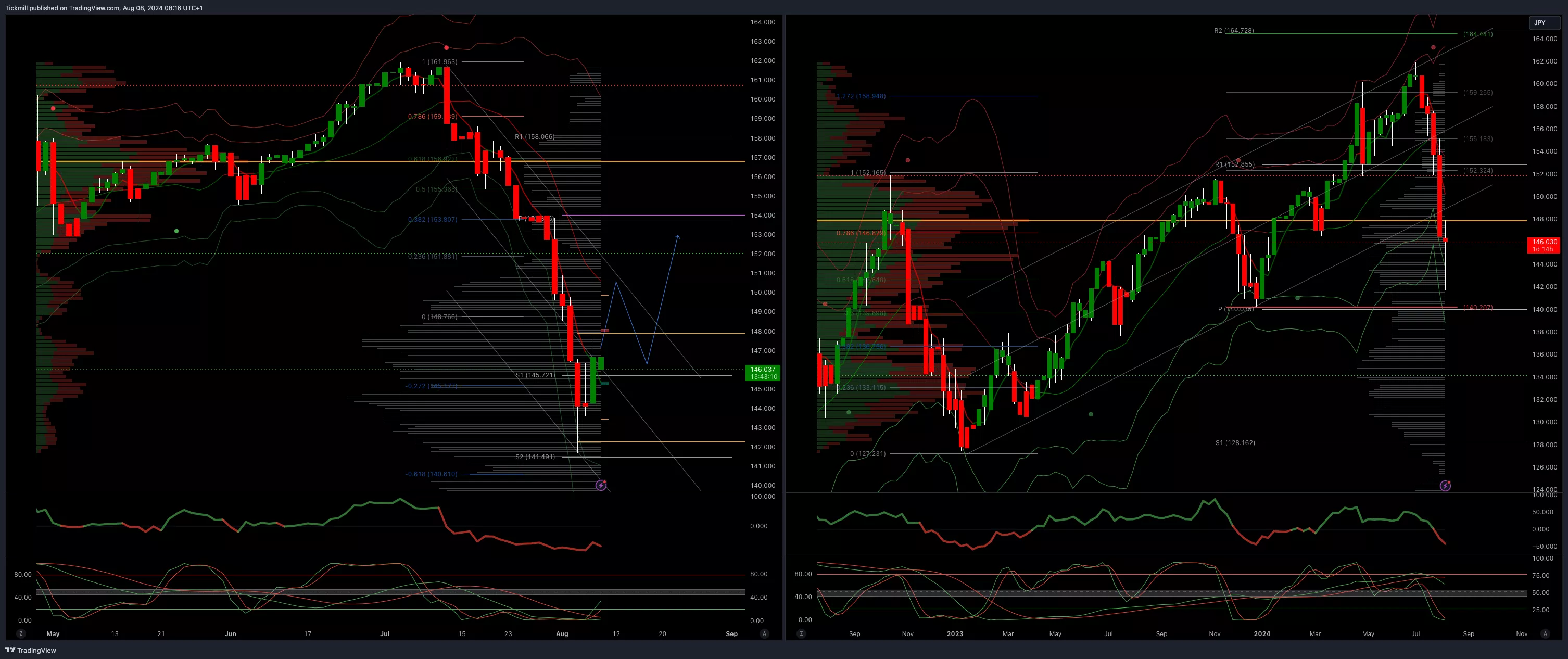

USDJPY Bullish Above Bearish Below 149

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 150 opens 153

- Primary support 140

- Primary objective is 153

(Click on image to enlarge)

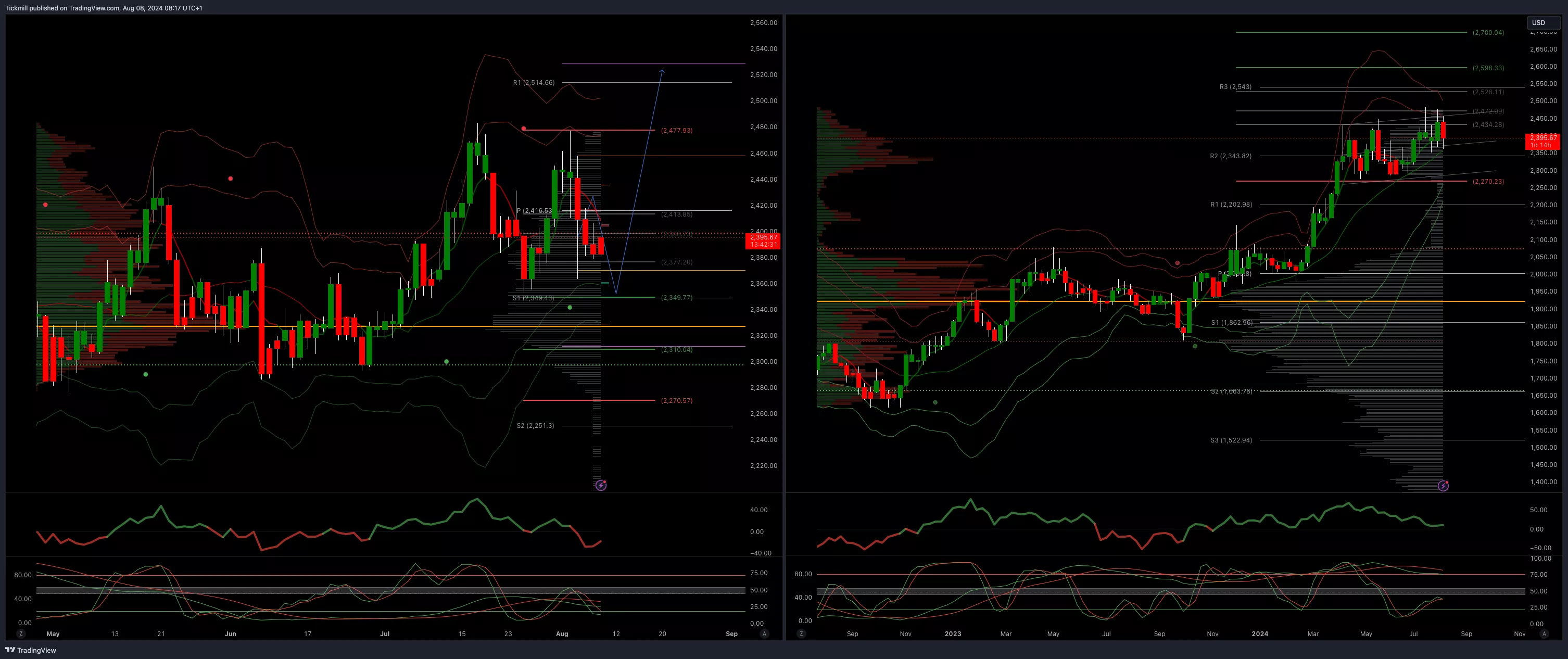

XAUUSD Bullish Above Bearish Below 2345

- Daily VWAP bearish

- Weekly VWAP bullish

- Below 2400 opens 2330

- Primary support 2300

- Primary objective is 2598

(Click on image to enlarge)

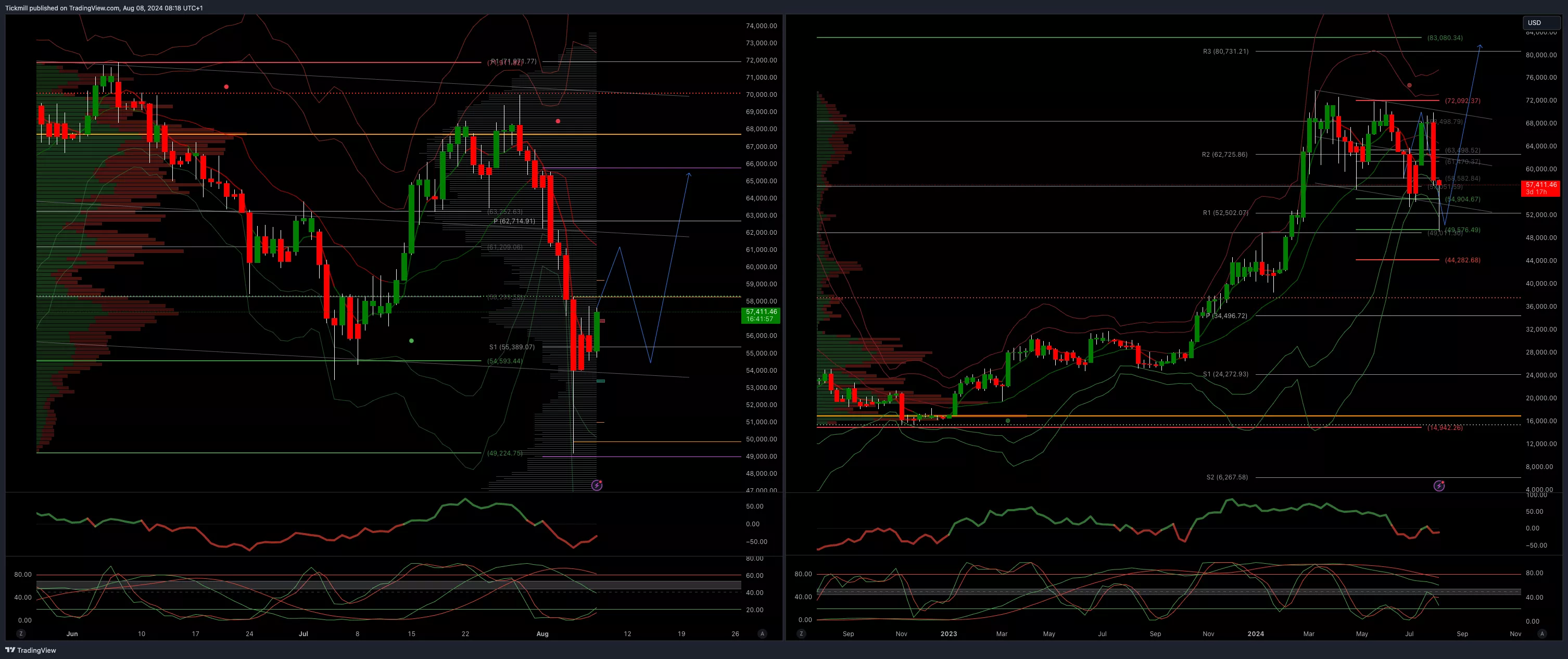

BTCUSD Bullish Above Bearish below 55000

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 61000 opens 68000

- Primary support is 50000

- Primary objective is 70000

(Click on image to enlarge)

More By This Author:

FTSE Rebound Gains Traction With Homebuilders And Banks Supporting

SP500 Daily Trade Plan - Wednesday, August 7

Daily Market Outlook - Wednesday, Aug. 7