Daily Market Outlook - Wednesday, Aug. 7

Image Source: Unsplash

After Wall Street's generally positive cues overnight, Asian stock markets are basically up on Wednesday. Traders are buying equities at a discount following the recent sharp sell-off that was sparked by concerns that the largest economy in the world will enter a recession.

The Bank of Japan appears to have taken on the role of the infamous ‘Plunge Protection Team’ from the Federal Reserve, as Nikkei investors hope. After an early 3% decline, the Nikkei rebounded 2.8% and nearly returned to its pre-Monday 13% crash level. BOJ Deputy Governor Shinichi Uchida's statement that the central bank would not raise interest rates amid market volatility saved the day and perhaps the fate of the yen carry trade. The dollar surged 2% against the yen, Japanese yields fell, and the probability of a BOJ rate hike in October dropped to just one-in-four, a marked change from last week when the BOJ hiked rates by 15 basis points and signaled further tightening, leading to a surge in the yen and the unraveling of the yen carry trade. As a result, the yen saw a spike in value and the collapse of the yen carry trade, in which investors borrowed money at cheap interest rates to purchase assets with greater yields. Almost everything was rose. Even China's trade figures surprised to th eupside with how strong domestic demand was, as imports exceeded forecasts. Export growth was strong even though it fell short of expectations.

Datawise trade numbers from Germany and the UK's home prices for July. Central banks speakers include Elizabeth McCaul, a board member of the European Central Bank, participating in a panel discussion, and Olli Rehn, the ECB, opens the Bank of Finland seminar.

Today's big earnings in Europe are mixed bag Siemens Energy increased its forecast for free cash flow for the second time in three months, while Novo Nordisk missed its profit margin for the second quarter. In the UK, Lloyd's of London insurer Hiscox H1 earnings is up 7%, while Legal & General has reported operating profit for H1 that is better than anticipated.The Financial Times also revealed that Swiss drugmaker Roche is thinking of selling off its cancer data expert Flatiron Health.

Overnight Newswire Updates of Note

- BoJ Deputy Gov: Won’t Raise Rates When Markets Unstable

- China Exports Growth Slows Slightly While Imports Boom

- SEC Investigating Wall Street Banks Over Lost Interest Payments

- New Goldman Sachs Index, Financial Stress Relatively Normal

- IMF Reports Progress In El Salvador Talks, Flags Bitcoin Risks

- Australian RBA 'Near-Term' Interest Rate Cuts Not On Agenda

- US Has Communicated To Not Escalate Conflict

- Hamas Picks Yahya Sinwar As New Political Leader

- China Implements Tech Innovation National Guarantee Fund

- Oil Prices Settle Higher; Signs Of Tighter Supply

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0825-35 (1.2BLN), 1.0840-45 (1.04BLN)

- 1.0850-55 (1.64BLN), 1.0900 (468M), 1.0945-55 (1.13BLN)

- 1.0960-70 (359M)

- USD/CHF: 0.8555-60 (922M), 0.8725 (480M), 0.8750 (310M)

- 0.8825 (250M), 0.9000 (1.0BLN)

- GBP/USD: 1.2650 (450M), 1.2750 (230M), 1.2830 (656M)

- EUR/GBP: 0.8400 (557M), 0.8485 (907M), 0.8620 (669M)

- AUD/USD: 0.6525-35 (539M), 0.6550 (301M), 0.6660-70 (497M)

- 0.6745 (861M). NZD/USD: 0.5870-80 (701M)

- 0.5950 (331M), 0.6015-20 (288M), 0.6085 (300M)

- AUD/NZD: 1.0925 (380M), 1.0950-60 (1.04BLN), 1.0975 (382M)

- 1.1000 (263M)

- USD/CAD: 1.3625 (729M), 1.3695 (230M), 1.3735 (220M)

- 1.3750 (620M), 1.3800-10 (377M), 1.3875 (631M)

- USD/JPY: 146.00 (500M), 147.25-35 (1.57BLN)

- 147.75 (220M), 149.00 (600M), 149.25 (1.32BLN)

- 150.00 (427M)

CFTC Data As Of 30/7/24

- Equity fund managers CUT S&P 500 CME net long position by 55,687 contracts to 938,842

- Equity fund speculators trim S&P 500 CME net short position by 32,188 contracts to 248,167

- Euro net long position is 17,799 contracts

- Japanese yen net short position is -73,460 contracts

- Swiss franc posts net short position of -34,520

- British pound net long position is 111,471 contracts

- Bitcoin net short position is -1,002 contracts

Technical & Trade Views

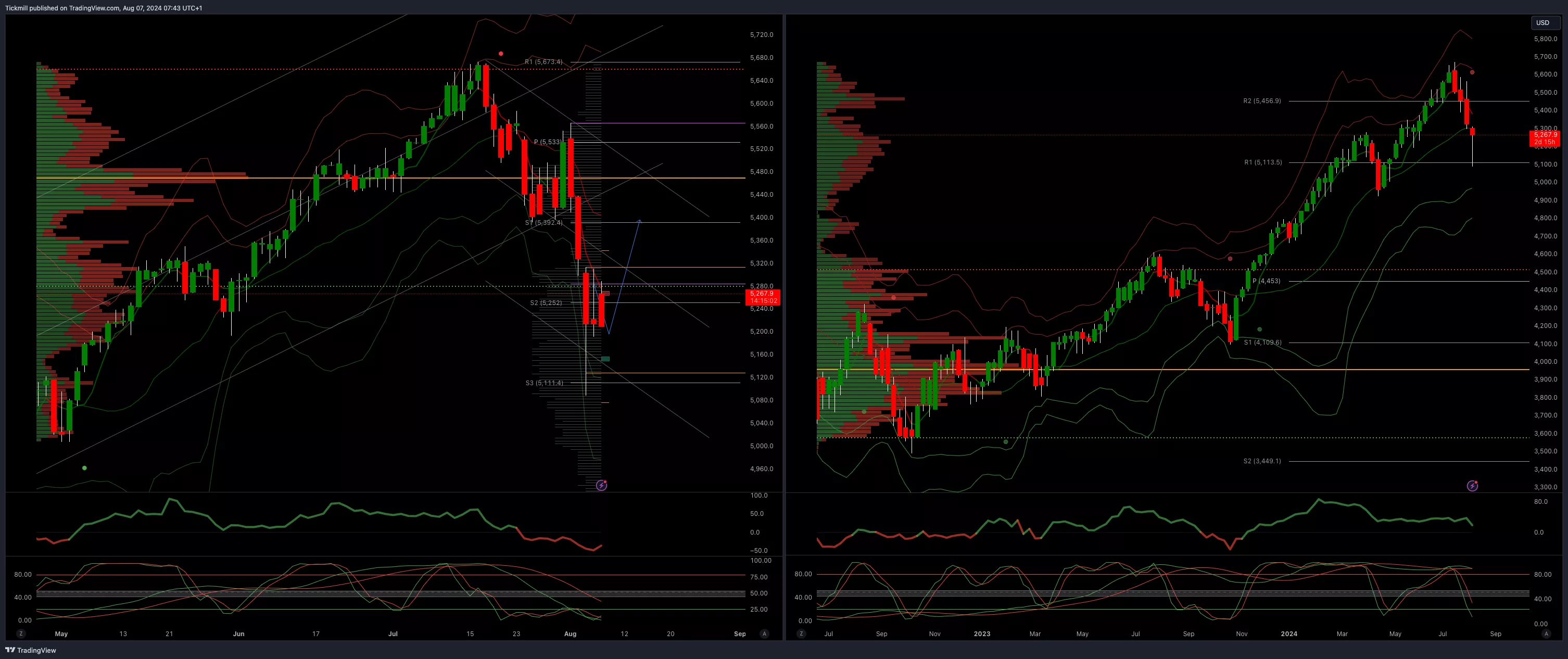

SP500 Bullish Above Bearish Below 5350

- Daily VWAP bearish

- Weekly VWAP bearish

- Below 5400 opens 5289

- Primary resistance 5470

- Primary objective is 5000

(Click on image to enlarge)

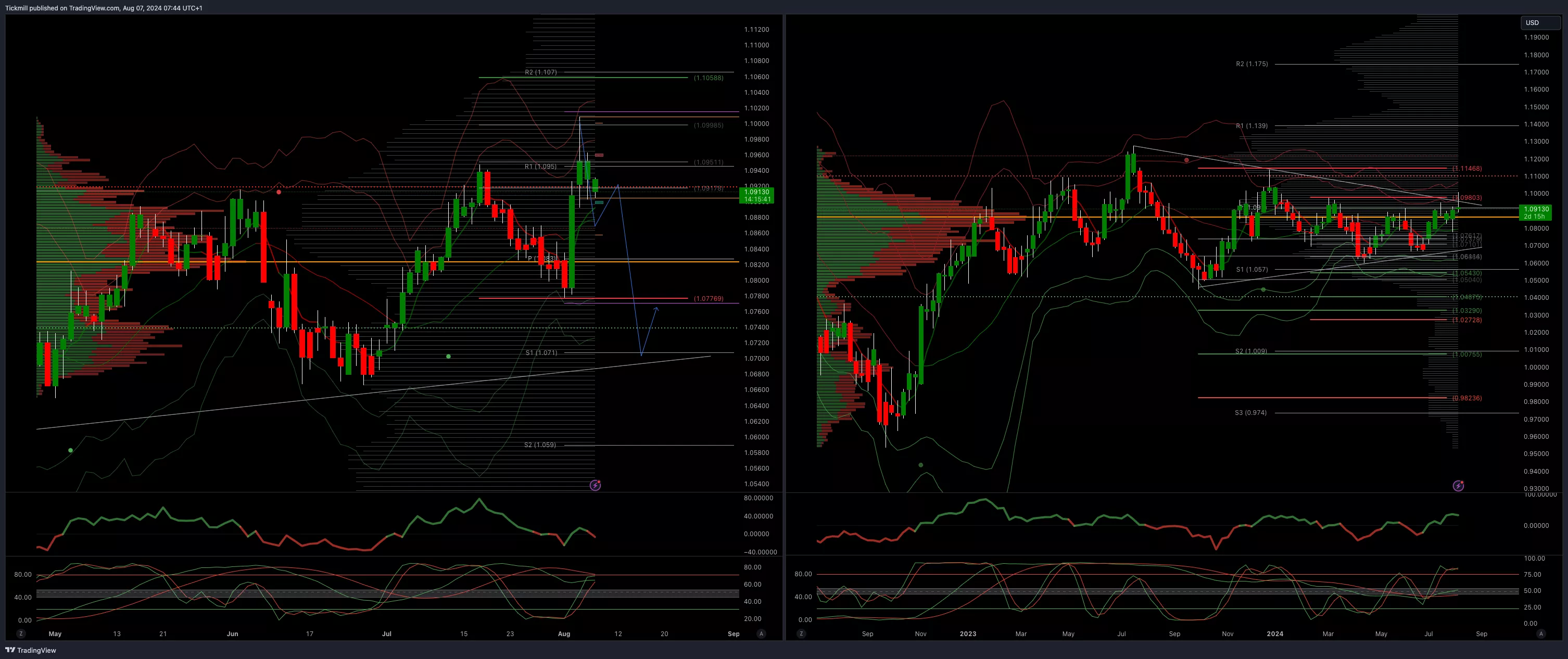

EURUSD Bullish Above Bearish Below 1.09

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.0975 opens 1.1075

- Primary resistance 1.0981

- Primary objective is 1.07

(Click on image to enlarge)

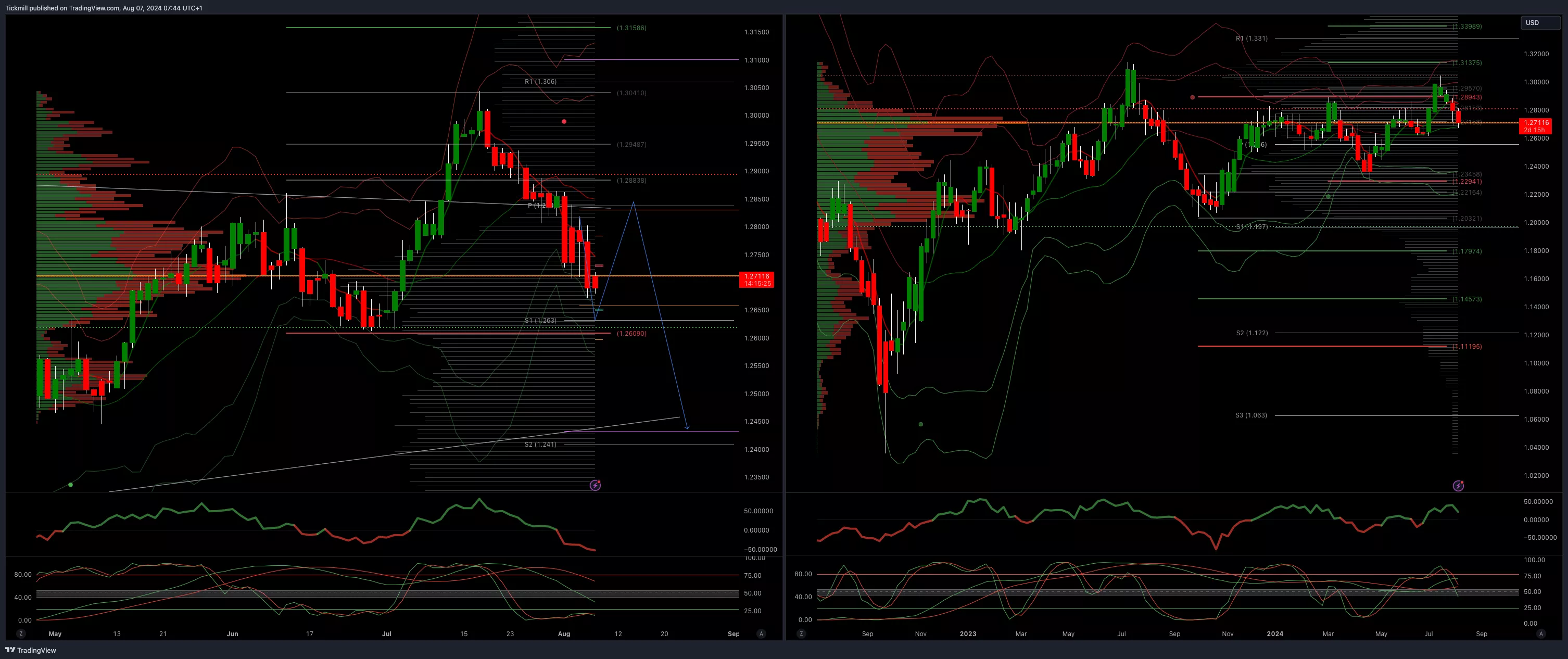

GBPUSD Bullish Above Bearish Below 1.29

- Daily VWAP bearish

- Weekly VWAP bearish

- Below 1.2670 opens 1.2450

- Primary support is 1.2690

- Primary objective 1.2450

(Click on image to enlarge)

USDJPY Bullish Above Bearish Below 149

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 150 opens 153

- Primary support 140

- Primary objective is 153

(Click on image to enlarge)

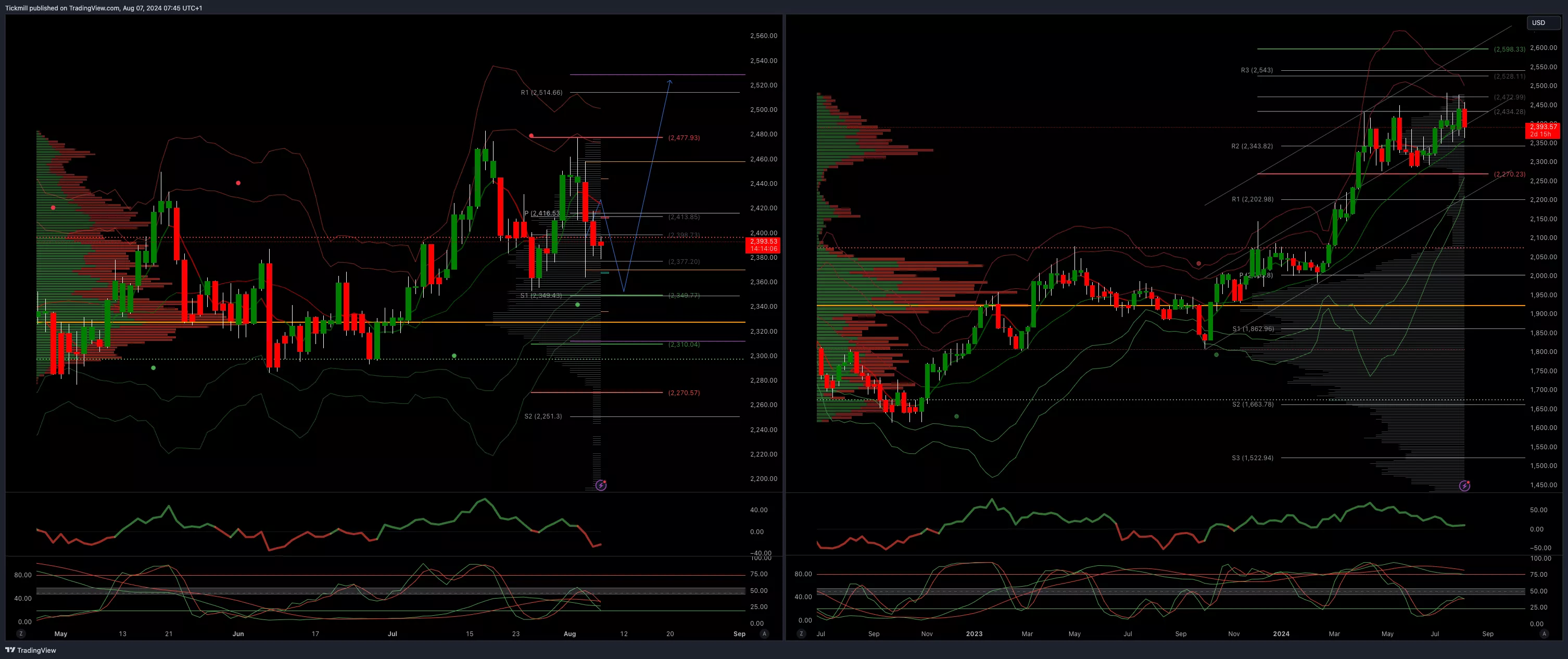

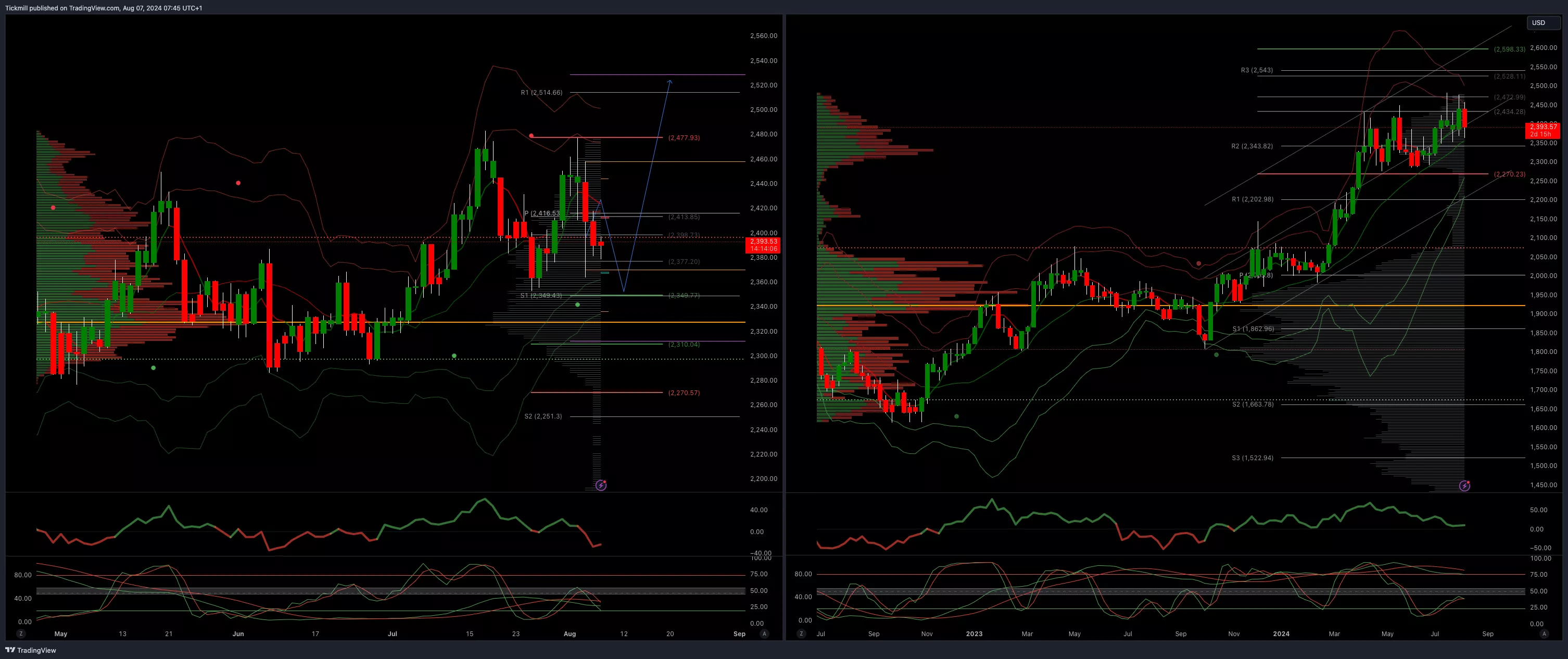

XAUUSD Bullish Above Bearish Below 2345

- Daily VWAP bearish

- Weekly VWAP bullish

- Below 2400 opens 2330

- Primary support 2300

- Primary objective is 2598

(Click on image to enlarge)

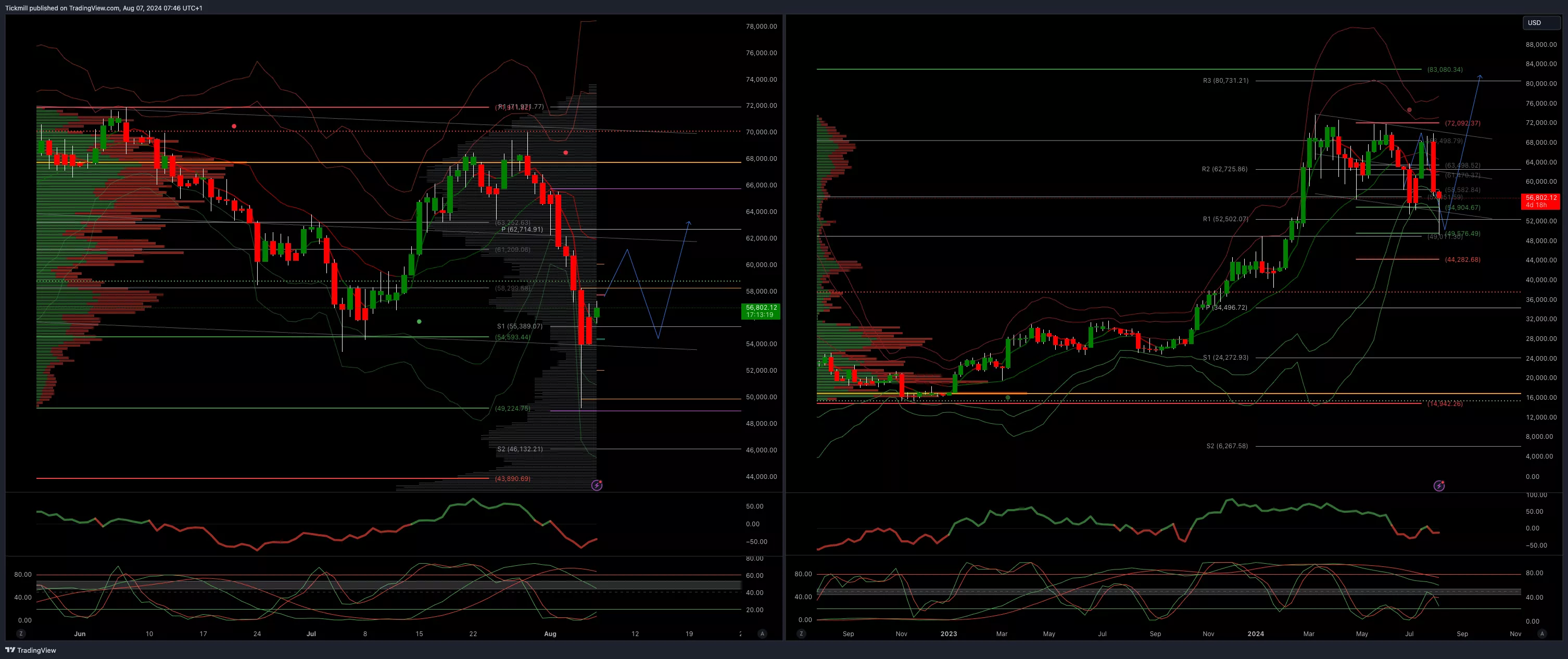

BTCUSD Bullish Above Bearish below 55000

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 61000 opens 68000

- Primary support is 50000

- Primary objective is 70000

(Click on image to enlarge)

More By This Author:

FTSE Turn Around Tuesday... Just

Daily Market Outlook - Tuesday, Aug. 6

FTSE Margin Call Monday