FTSE Rebound Gains Traction With Homebuilders And Banks Supporting

Image Source: Pexels

Following a sell-off in global stocks earlier this week, markets steadied and London stocks rose for a second session on Wednesday, helped by financial companies and corporate profits. The blue-chip FTSE 100 index had gained 1.15%. Banks were among the top gainers, up 1.4%. In the prior session, they increased by 0.4%. The investment banking and brokerage industry saw a 1.7% increase, driven by a 4.5% rise in wealth management Quilter, which exceeded estimates for its half-year profitability and revealed higher net cash inflows.

The UK housebuilders' index rose 1.5% after mortgage lender Halifax reported a 2.3% annual increase in British house prices in July, the largest yearly rise since January, suggesting renewed momentum in the property market. Vistry, an FTSE 100 homebuilder, was the top performer in the sector index, gaining 2.5%, while its blue-chip peers Persimmon, Taylor Wimpey, and Barratt gained between 1.6% and 1.9%. Midcap player Crest Nicholson also rose 1.5%.

With a 13.5% increase to 239.50p, TP ICAP Group Plc's shares became the largest percentage gainer on the FTSE 250 index. Since May 2021, the stock has reached its highest point. Driven by good performance in its energy and commodities division, the British inter-dealer broker reported a 10% increase in its half-year pre-tax profit, slightly beating market forecasts. Against a market forecast of 156 million pounds, the company's adjusted half-year profit before tax is 160 million pounds. With the gains from this session included, the stock is up almost 23% for the year.

UK advertising group WPP's shares fell after it reported weaker-than-expected first-half results and cut its annual revenue growth forecast. The company cited pressure in China and project-related businesses, as well as an uncertain macroeconomic environment, as reasons for moderating its full-year expectations. WPP also announced the sale of a controlling stake in its PR agency FGS Global to KKR for $775 million.

Coca Cola HBC's stock price declines after warning of macroeconomic challenges in the second half of the year. The company expects the macroeconomic and geopolitical environment to remain challenging, but it has increased its annual operating profit and revenue forecast. Geopolitical issues and elections in major economies are also creating uncertainty and volatility. The stock is up nearly 19% so far this year.

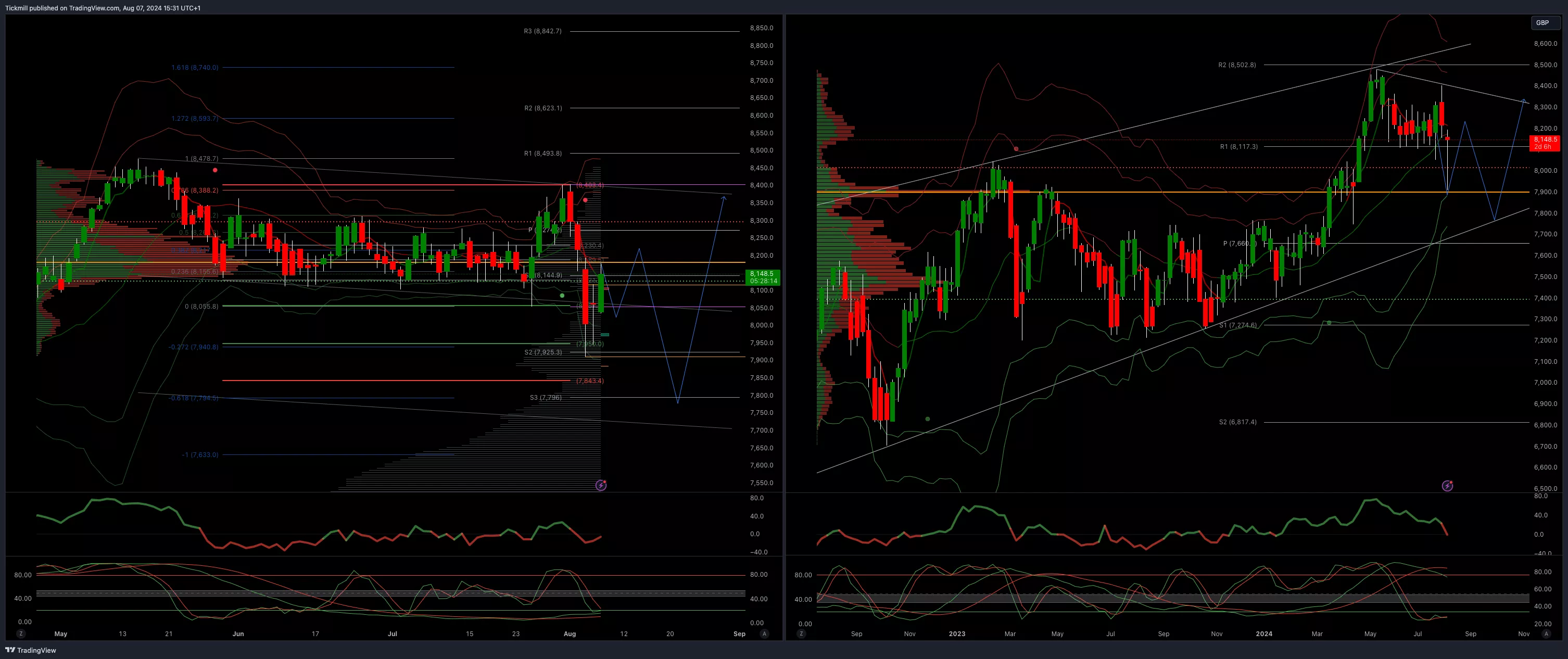

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

- Primary resistance 8400

- Primary objective 7750

- Daily VWAP Bearish

- Weekly VWAP Bearish

(Click on image to enlarge)

More By This Author:

SP500 Daily Trade Plan - Wednesday, August 7

Daily Market Outlook - Wednesday, Aug. 7

FTSE Turn Around Tuesday... Just