Daily Market Outlook - Monday, Sep. 22

Image Source: Pexels

Asian stocks advanced following a rally on Wall Street, with Japanese shares climbing as concerns eased over the Bank of Japan's intention to liquidate its extensive exchange-traded fund holdings. The MSCI regional stock index advanced, and the Nikkei-225 index surged as much as 1.6%. The Yen weakened against the Dollar, which typically favours exporters. Indian IT companies saw declines as traders evaluated the effects of the significant rise in H-1B visa application fees. The Dollar index appreciated, marking its fourth consecutive day of gains. Treasuries slipped, with the 10-year yield edging up 1 basis point to 4.14%. Oil prices rose by 0.6% after a minor dip last week, while silver peaked at its highest since 2011. Futures for US and European equities showed little movement. Global stock markets are hitting all-time highs, and with earnings season approaching, increasing optimism about corporate profit growth in America suggests the upward trend may persist. Market sentiment also improved after Trump acknowledged advancements on China-related matters and confirmed plans to meet with Xi Jinping after a phone conversation between the two. In other political news, the leadership race within Japan's ruling party commenced on Monday, drawing significant market attention, as the outcome is likely to influence who will lead the country following PM Ishiba's decision to step down.

Last week, two major developments shaped expectations for ‘effective’ gilt supply, encompassing DMO primary issuance and BoE secondary market operations. First, the MPC’s annual decision on quantitative tightening (QT) set the stage for £21bn of active gilt sales over the next twelve months, alongside £49bn of passive QT. Second, it emerged that the government’s deficit for 2025-26 is running over £11bn higher than anticipated. While the overall QT size wasn’t surprising, the decision to allocate 20% of active QT to long-maturity gilts raised eyebrows, as many had expected the focus to remain on short and medium maturities. However, given current market valuations, the total long-dated QT of approximately £1.65bn over the year is unlikely to pose significant challenges. On the deficit side, though the borrowing figures caught some off guard, they arguably shouldn’t have; the cash requirement overshoot in prior months had already hinted at a drift in headline borrowing figures, now confirmed. Despite the negative headlines surrounding gilt supply, there remains a possibility of issuance declining modestly from current levels—even with the prospect of an upward revision in issuance at the upcoming Budget (see chart). This nuance may have been overshadowed by last week’s news.

Following a busy week with decisions from the Fed, BoE, BoC, Norges Bank, and BoJ, the upcoming data and events calendar appears lighter. However, central bank activity continues with rate decisions from the Riksbank on Tuesday and the SNB on Thursday, though markets are not anticipating rate cuts in either case. On the data front, attention will centre on the S&P Global September flash PMIs (Tuesday). While final August data suggested moderate growth in Q3 for the US and UK, the euro area's expansion was notably weaker. With tariff effects unfolding, the US survey may highlight divergences between employment prospects and price trends. Similarly, the August PCE report (Friday) will be closely watched, as core inflation remains around 3% y/y, raising concerns about weaker employment potentially impacting income and spending. Several regional Fed surveys will also be released throughout the week. In the UK, the data calendar shifts from a busy period to a quieter one, though BoE speakers will return, including Bailey (Monday), Pill (Monday and Tuesday), and Greene (Wednesday). Meanwhile, Australia will release its August CPI figures on Wednesday, coinciding with Germany's September IFO report.

Overnight Headlines

- Lagarde: ECB Has Hit Inflation Goal But Uncertainty Remains

- ECB Officials Focus On December To Confirm 2% Inflation Target

- UK PM Allies Scramble To Avoid Budget Blowup As Pressure Mounts

- Trump Renews Pressure On Europe To Stop Buying Russian Oil

- Trump’s $100K H-1B Visa Fee Woes Rattle Corporate America

- UK Explores Plan To Drop Visa Fees For Top Global Talent

- Pfizer Closes In On $7.3B Takeover Of Anti-Obesity Drugmaker Metsera

- Porsche’s EV Pullback Highlights Cracks In German Auto Empire

- Nvidia Supplier Ibiden To Expand IC Substrate Output Amid AI Boom

- Samsung Shares Rise To Year’s High On Nvidia Quality Test Report

- Bitcoin, Ethereum And Ripple Dips As Bearish Pressure Lingers

- Switzerland In Fresh Push To Woo Trump On Tariff Relief

- China Keeps LPR Unchanged In September As Trade Tensions Ease

- Global Funds Cut Holdings Of Chinese Bonds To Lowest Since 2021

- BoJ Removes Stock Overhang With Gradual ETF Sell-Down

- RBA’s Bullock: Board Will Weigh Stronger Data Next Week

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- USD/JPY: 146.00 (474M), 146.85 (480M), 147.00 (419M), 147.25-35 (612M)

- 147.50 (304M), 148.00 (257M), 148.35 (350M), 148.50 (249M), 149.50 (236M)

- 149.75 (250M), 150.25 (250M)

- USD/CHF: 0.7795-00 (630M), 0.7865-75 (600M), 0.7905 (600M), 0.7920 (225M)

- 0.7950 (301M)

- GBP/USD: 1.3275 (220M), 1.3500 (410M), 1.3585 (260M)

- AUD/USD: 0.6510 (452M), 0.6520-30 (1.12BLN), 0.6560-65 (409M)

- 0.6600 (715M), 0.6625 (354M), 0.6685 (200M), 0.6700 (276M)

- NZD/USD: 0.6020 (374M)

- USD/CAD: 1.3620 (330M), 1.3795-00 (757M), 1.4000 (298M)

CFTC Positions as of the Week Ending 1/9/25

- Equity fund speculators have boosted their net short position in the S&P 500 CME by 55,766 contracts, bringing it to a total of 475,397 contracts. At the same time, equity fund managers have increased their net long position in the S&P 500 CME by 9,074 contracts, now totaling 891,634 contracts.

- Speculators have reduced their net short position in CBOT US 5-year Treasury futures by 117,989 contracts, resulting in a total of 2,436,774 contracts. They have also decreased their net short position in CBOT US 10-year Treasury futures by 38,673 contracts, now at 819,299 contracts. Conversely, speculators have raised their net short position in CBOT US 2-year Treasury futures by 28,509 contracts, reaching 1,403,470 contracts. Additionally, there has been an increase in net short position in CBOT US UltraBond Treasury futures by 12,686 contracts, totaling 278,167 contracts. Speculators have trimmed their net short position in CBOT US Treasury bonds futures by 4,470 contracts, reducing it to 94,138 contracts.

- The net long position for Bitcoin stands at 20 contracts. The Swiss franc has registered a net short position of -26,040 contracts, while the British pound's net short position is -6,580 contracts. The euro has a net long position of 117,759 contracts, and the Japanese yen holds a net long position of 61,411 contracts..

Technical & Trade Views

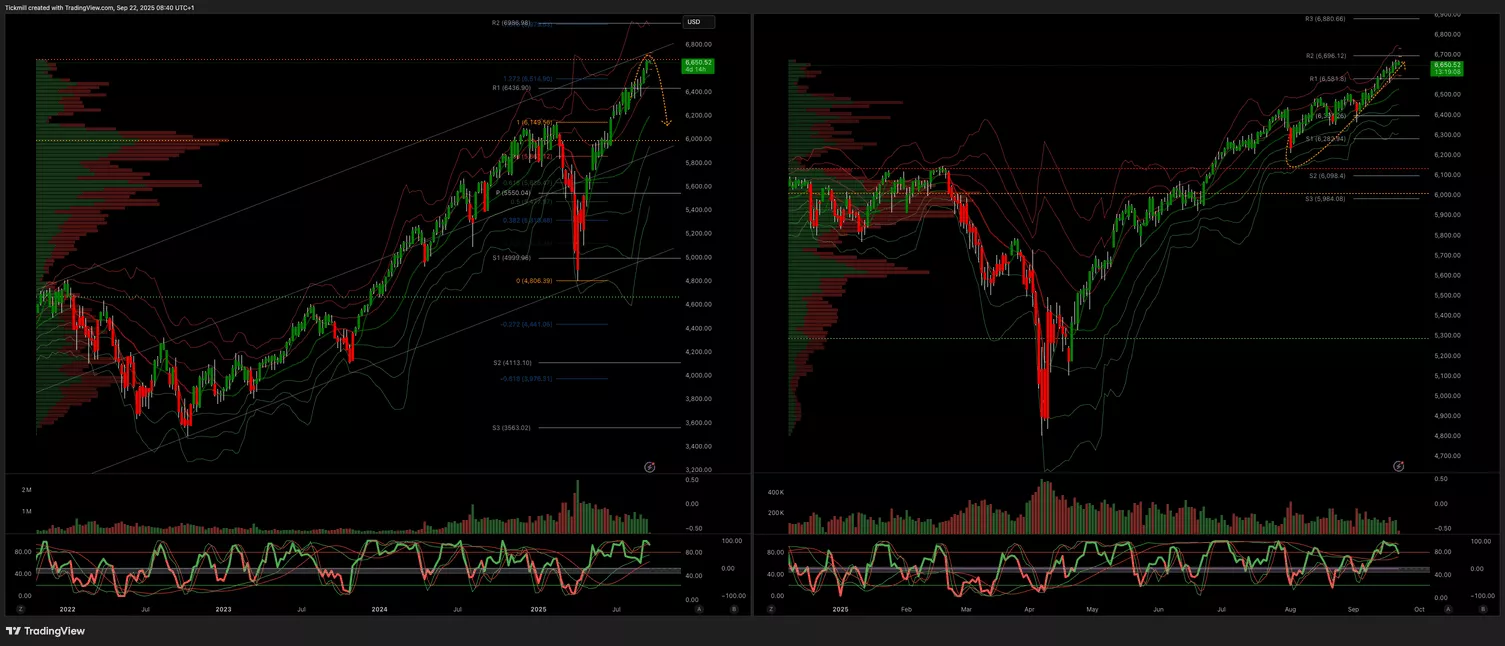

SP500

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 6440 Target 6666

- Below 6420 Target 6370

(Click on image to enlarge)

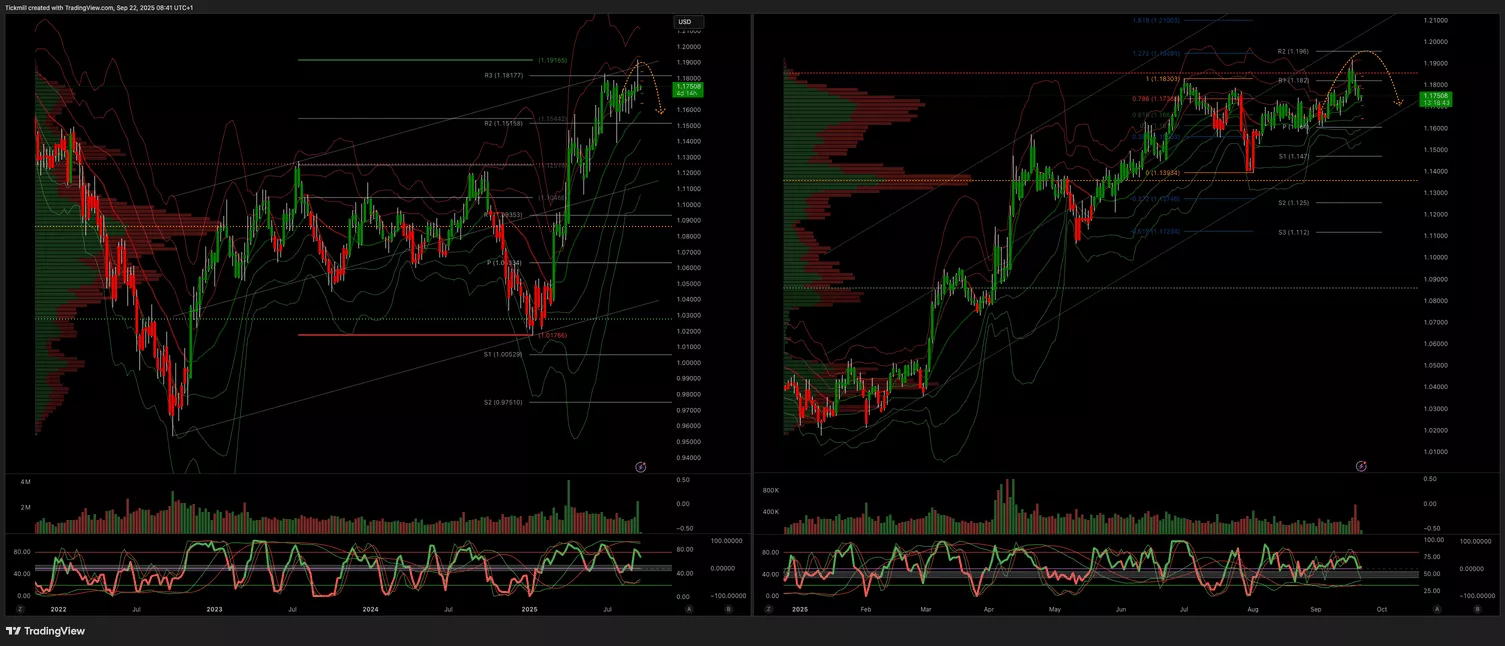

EURUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Below 1.1750 Target 1.15

- Above 1.18 Target 1.1910

(Click on image to enlarge)

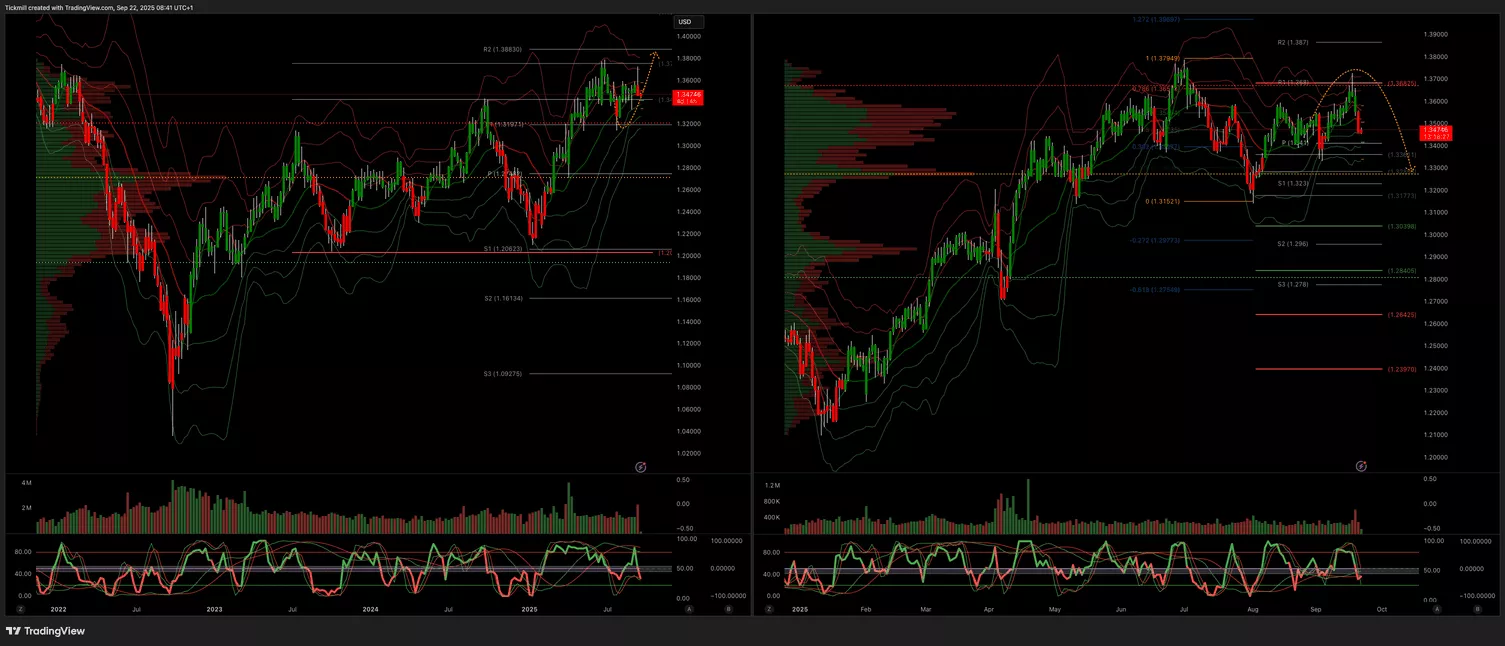

GBPUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Below 1.36 Target 1.30

- Above 1.3650 Target 1.3850

(Click on image to enlarge)

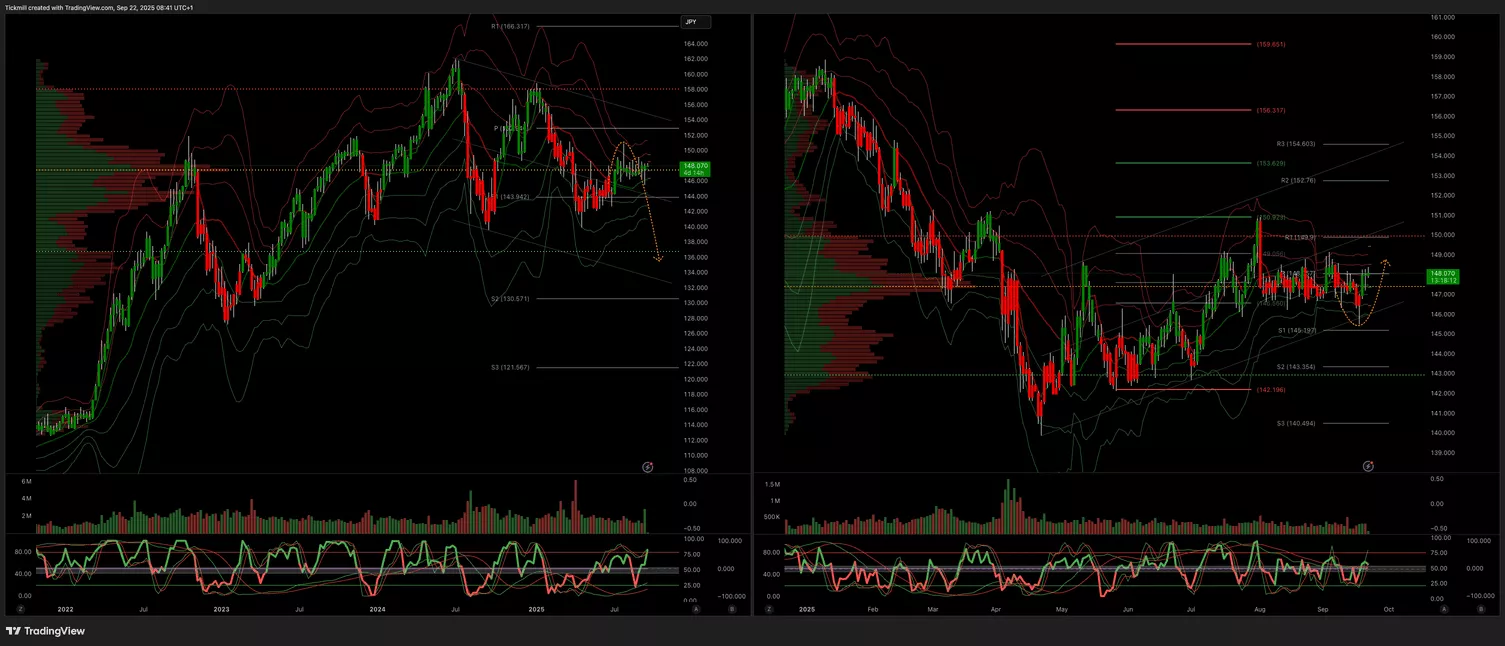

USDJPY

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Below 1.49 Target 1.45

- Above 1.51 Target 1.54

(Click on image to enlarge)

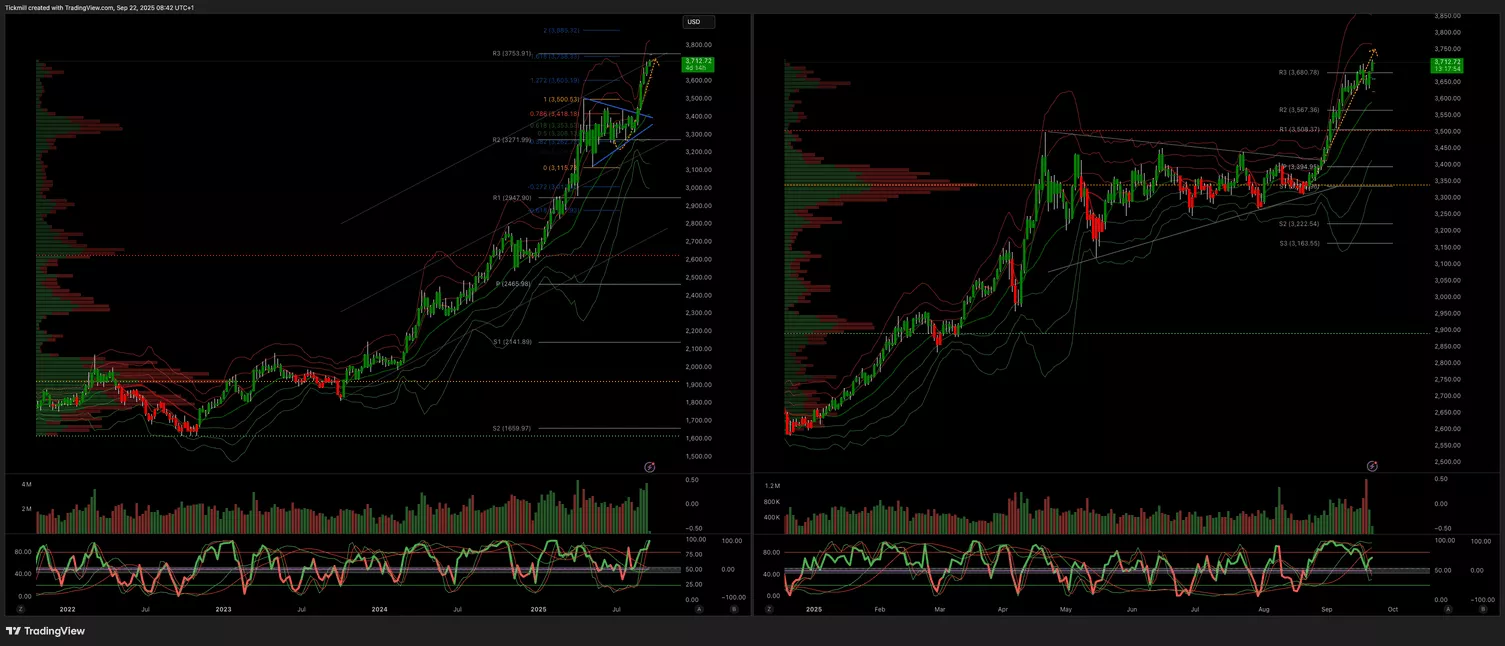

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 3500 Target 3700

- Below 3400 Target 3300

(Click on image to enlarge)

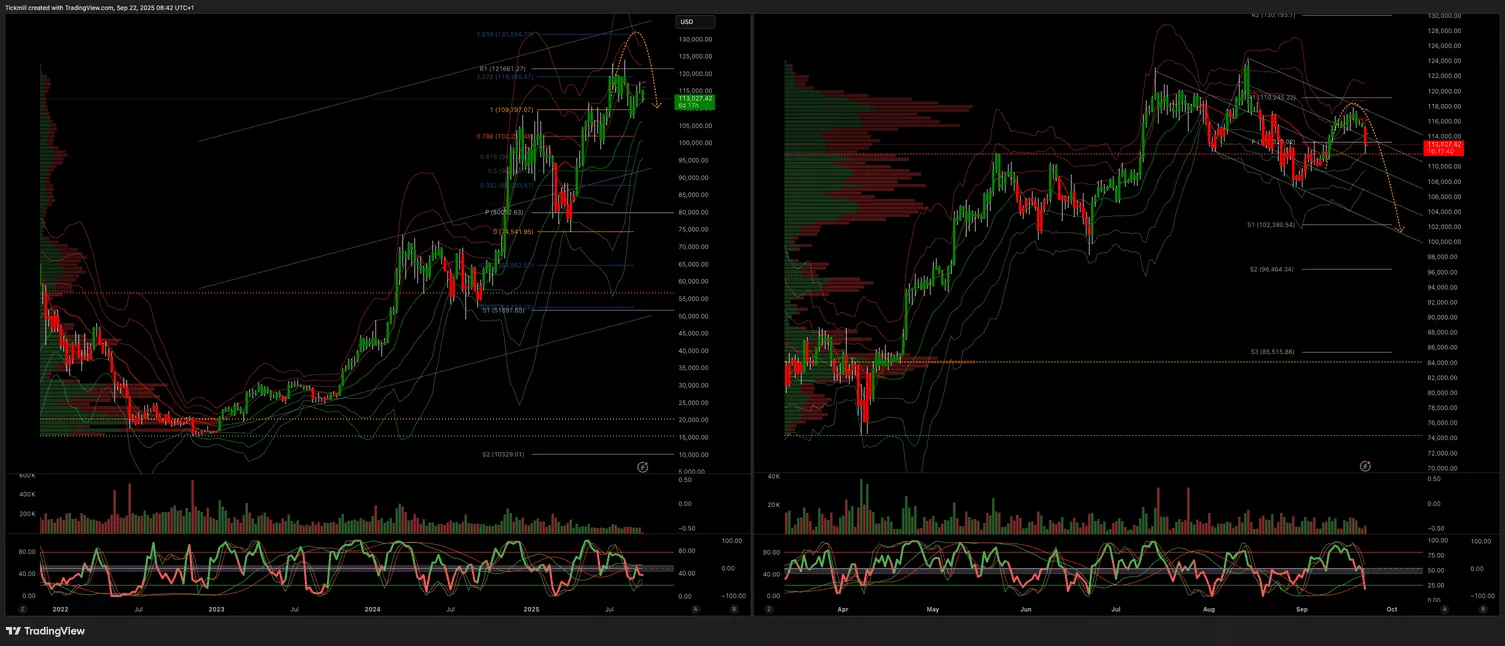

BTCUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 110k Target 118k

- Below 109k Target 105k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Friday, Sep. 19

Daily Market Outlook - Friday, Sep. 19

Emini S&P 500 Live Market & Trade Analysis