Daily Market Outlook - Friday, Sep. 19

Image Source: Unsplash

A record-setting global stock surge encountered a setback following the Bank of Japan's (BoJ) announcement to start liquidating its substantial exchange-traded fund (ETF) holdings, which pulled Asian markets down. The MSCI Asia Pacific Index fell by 0.4%, and the Nikkei-225 Stock Average declined nearly 0.7%. Initially, Asian markets had risen after four major US stock indices reached record highs simultaneously for the first time since November 2021. Gold prices increased while Treasury yields saw a slight drop. Futures for US and European equities also experienced a downturn. Japanese shares reversed their earlier upward trend after the BoJ disclosed its approach to sell ETFs at a scale reminiscent of stock disposals from banks back in the 2000s. The central bank maintained its policy rate at 0.5% as anticipated, following a 7-2 vote. The yen appreciated by 0.3% against the dollar, and two-year bond yields in Japan reached their highest levels since 2008. There is growing apprehension regarding the S&P 500’s relentless ascent to new highs, with concerns that it may lead to a bubble due to its inflated valuations. Investors also have their eyes on an upcoming phone call between Trump and Chinese President Xi, scheduled for later Friday. This discussion may influence the outcome for TikTok and potentially alleviate trade frictions between the two largest economies in the world.

The UK has had a busy morning for economic data. The Office for National Statistics (ONS) reported that retail sales volumes rose by 0.5% month-on-month in August at the headline level, aligning closely with expectations after modest revisions to July's figures. However, the more critical update in the lead-up to November’s Budget came from the August public finances data. It revealed a public sector net borrowing (PSNB) deficit of £18 billion for the month—£5.5 billion higher than the Office for Budget Responsibility's (OBR) Spring forecast. Further revisions to previous months, following a thorough review by the ONS, show the government’s cumulative deficit now stands at £83.8 billion—£11.4 billion more than anticipated for this point in the 2025-26 fiscal year. This marks a notable shift, as the deficit had previously been tracking in line with expectations. The combination of higher borrowing in August and unfavourable adjustments to earlier data is likely to draw attention, particularly given the constraints surrounding the upcoming Budget. Despite the concerning optics, the implications for gilt supply are less severe than they might appear. The key metric for gilt issuance is the government’s cash requirement (CGNCR), rather than the headline borrowing figure. The CGNCR has deteriorated slightly, moving from £9 billion above plan last month to £10 billion this month for the cumulative 2025-26 position. While this marginal increase may not significantly impact gilt supply, the overall outlook for public finances remains bleak..

Overnight Headlines

- BoJ Maintains Short-term Interest Rate Target At 0.5%, As Expected

- Fed Cut Sets Stage For Asia’s Next Easing Wave Amid Trade Strains

- Foreign Holdings Of US Treasuries Reach Record Even As China Sells

- Canada Ends Fight Against US Lumber Duties, Seeking Wider Deal

- UK Chancellor Faces £18B Shortfall If Productivity Bet Fails

- Trump Leans On Europe To Use Oil As Pressure Point On Putin

- China Seeks Trade Edge By Shunning US Soy In First Since 1990s

- Asian-American Firms Decimated By Trump Tariffs, Lawmakers Warn

- Deutsche Bank CEO Set To Face Multimillion-Pound Lawsuit

- Hyundai Motor To Invest $55B, Increase US Production By 2030

- Nvidia Plans $5B Investment In Rival Intel, Spends $900M On Enfabrica

- Microsoft Boosts Wisconsin Data Centre Spending To $7B

- Lennar’s Profit Sinks As Housing Market Remains Stalled

- FedEx Profit, Sales Rise On Improvement In US Shipping

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1745-50 (3.6BLN), 1.1775 (626M), 1.1785-90 (586M)

- 1.1800 (2.8BLN), 1.1825-30 (1.4BLN), 1.1850 (1.3BLN)

- USD/CHF: 0.7850 (430M), 0.7910 (497M), 0.7950 (300M)

- EUR/CHF: 0.9275 (360M), 0.9320-25 (560M), 0.9375 (352M)

- EUR/GBP: 0.8650 (853M), 0.8725 (360M)

- GBP/USD: 1.3525 (400M), 1.3550 (440M), 1.3600 (275M)

- AUD/USD: 0.6600 (863M)

- USD/CAD: 1.3785-1.3800 (1.3BLN), 1.3820-30 (647M)

- USD/JPY: 147.0 (1.1BLN), 147.45-55 (1.6BLN), 148.00-10 (550M)

- EUR/JPY: 174.25 (328M), 174.50 (240M), 175.00 (401M)

CFTC Positions as of the Week Ending 12/9/25

- Speculators have raised their net short position in CBOT US Treasury bonds futures by 21,340 contracts, bringing the total to 98,608. They have also increased their net short position in CBOT US Ultrabond Treasury futures by 2,262 contracts, resulting in a total of 265,481. On the other hand, there has been a reduction in the net short position for CBOT US 10-year Treasury futures by 10,386 contracts, now totaling 857,972. Similarly, speculators have cut their net short position in CBOT US 5-year Treasury futures by 127,224 contracts, bringing it down to 2,554,763. Conversely, there is an increase in the net short position for CBOT US 2-year Treasury futures by 78,878 contracts, now totaling 1,374,961.

- In the equity market, fund managers have lifted their S&P 500 CME net long position by 31,521 contracts to a total of 882,560, while equity fund speculators have raised their S&P 500 CME net short position by 43,737 contracts, reaching 419,631.

- The Japanese yen net long position stands at 91,643 contracts, with the euro's net long position at 125,677 contracts. The British pound has a net short position of -33,605 contracts, while the Swiss franc shows a net short position of -28,839 contracts. Lastly, Bitcoin has a net short position of -468 contracts.

Technical & Trade Views

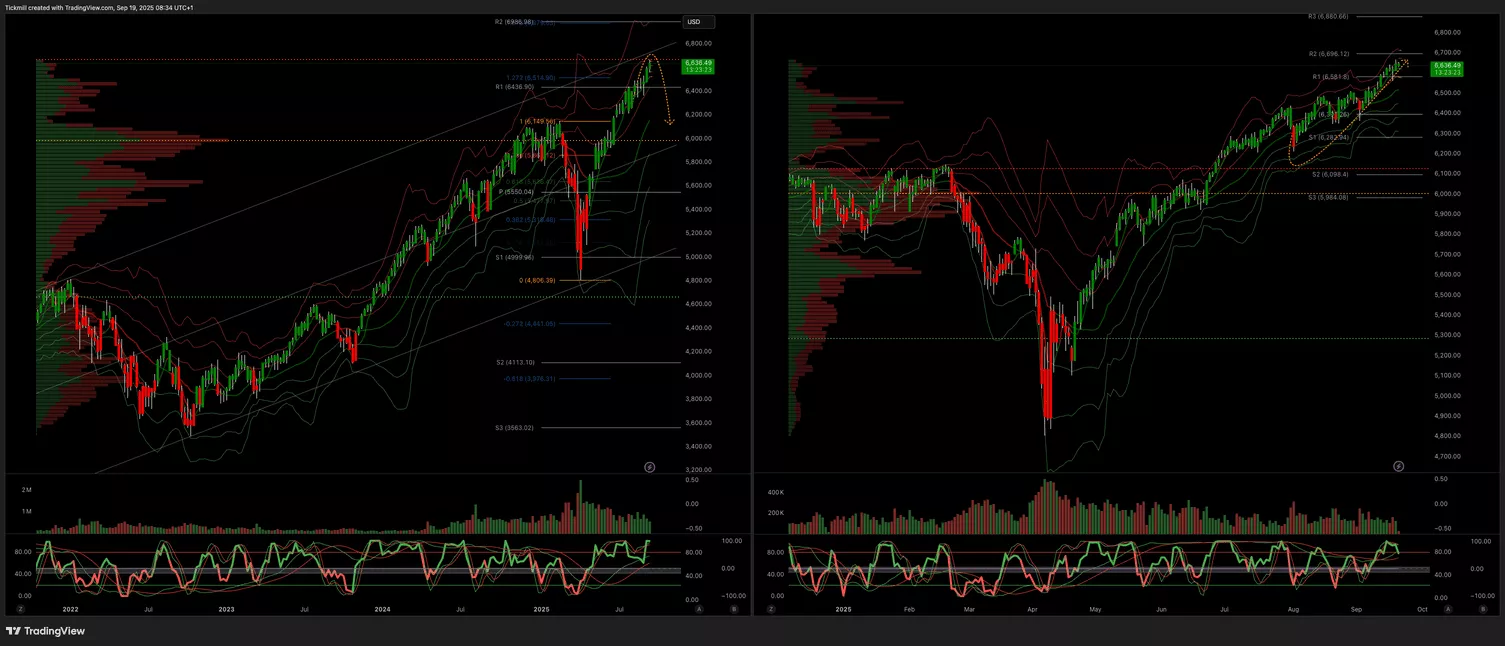

SP500

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 6440 Target 6666

- Below 6420 Target 6370

(Click on image to enlarge)

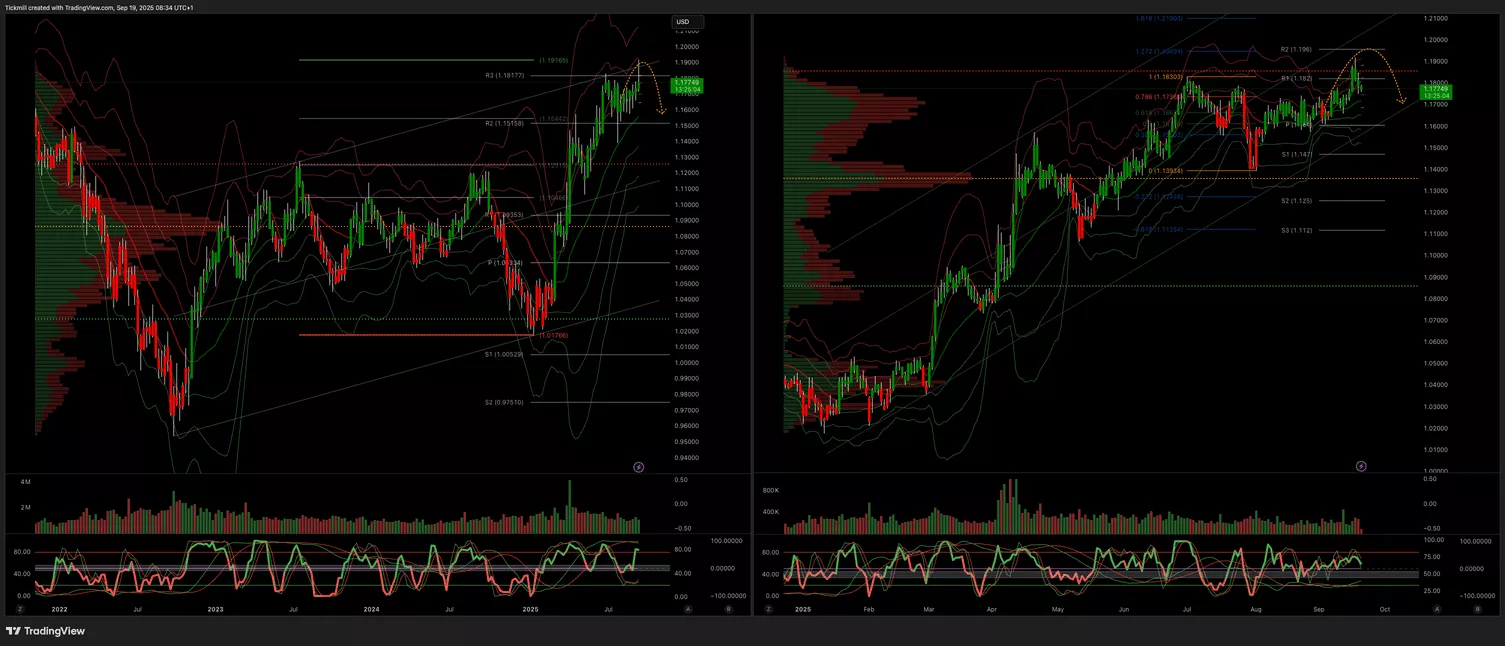

EURUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Below 1.1750 Target 1.15

- Above 1.18 Target 1.1910

(Click on image to enlarge)

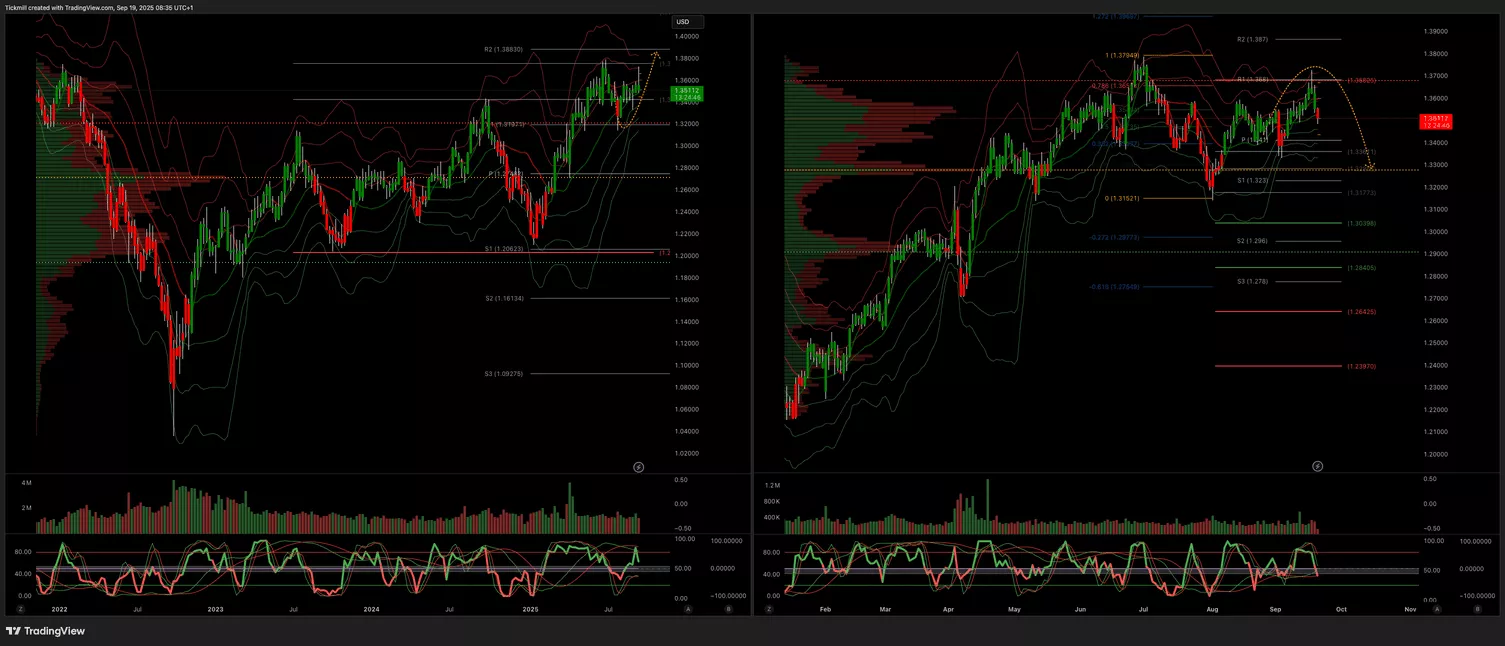

GBPUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Below 1.36 Target 1.30

- Above 1.3650 Target 1.3850

(Click on image to enlarge)

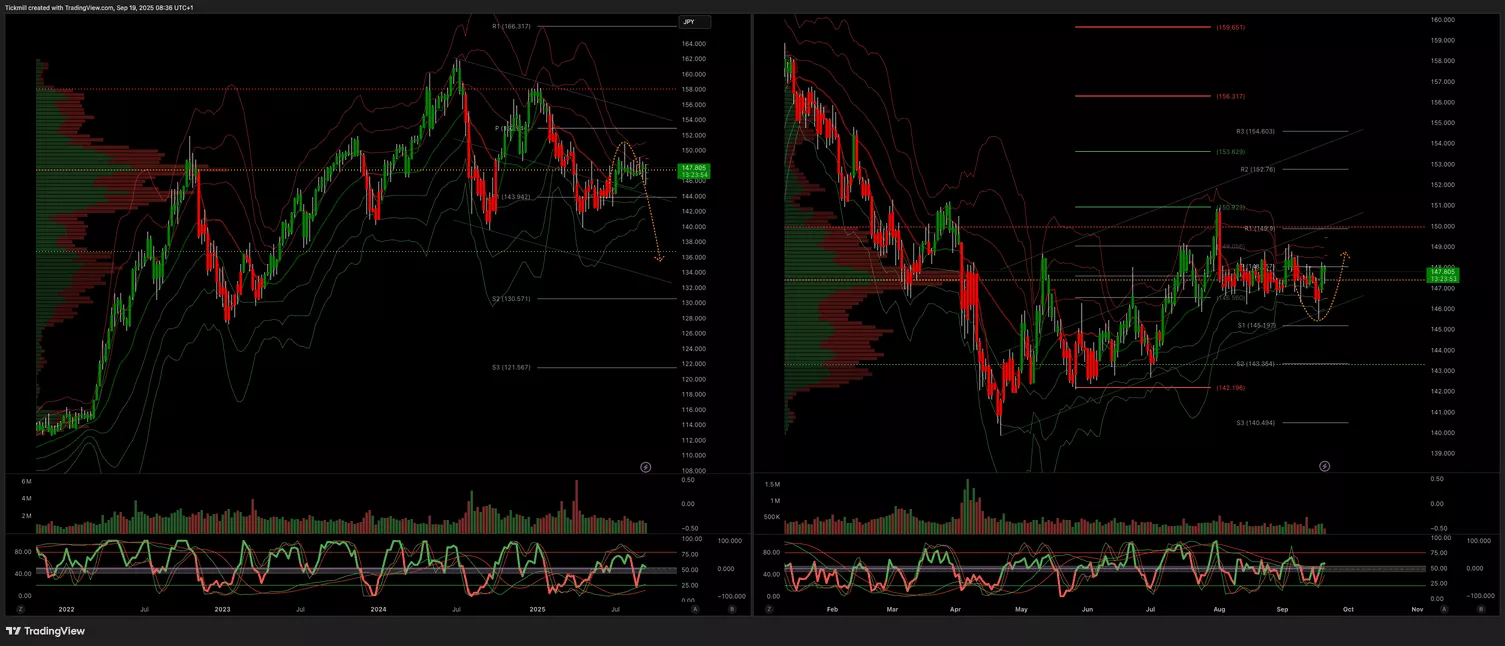

USDJPY

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Below 1.49 Target 1.45

- Above 1.51 Target 1.54

(Click on image to enlarge)

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 3500 Target 3700

- Below 3400 Target 3300

(Click on image to enlarge)

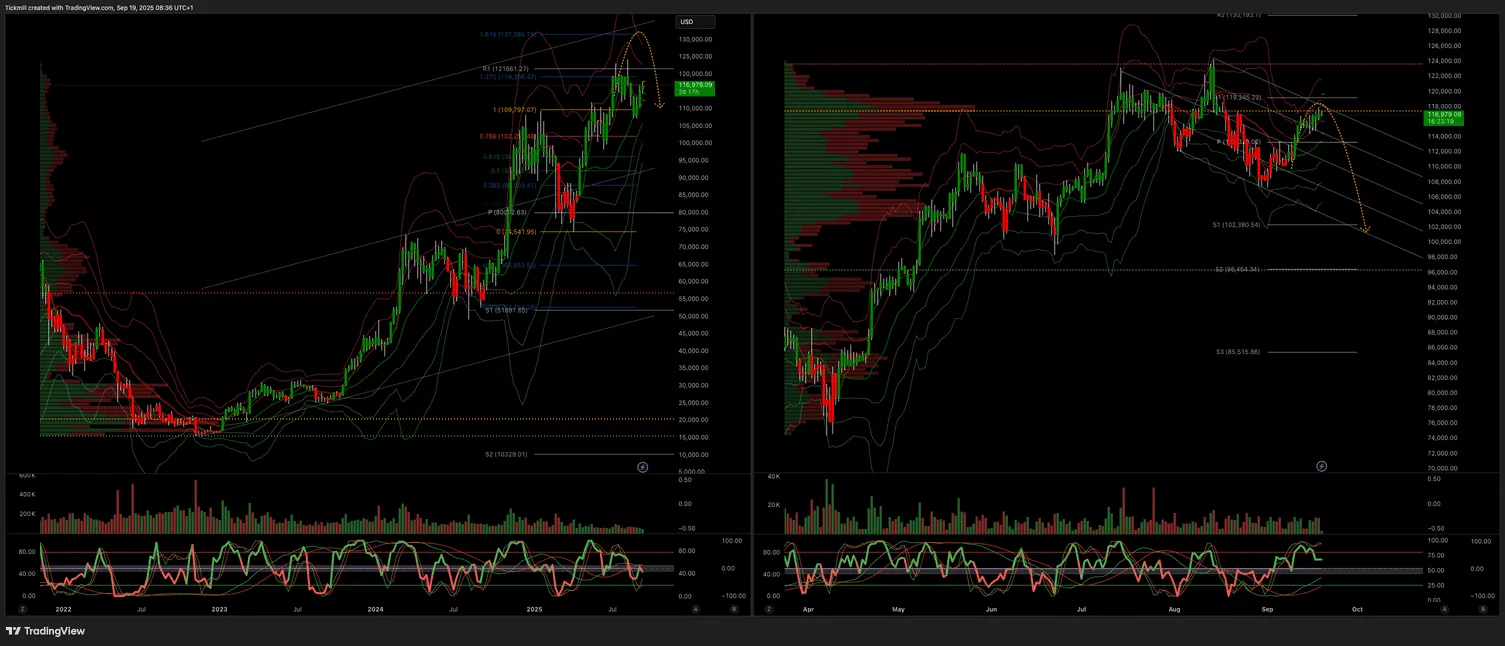

BTCUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 110k Target 118k

- Below 109k Target 105k

(Click on image to enlarge)

More By This Author:

Emini S&P 500 Live Market & Trade Analysis

Daily Market Outlook - Thursday, Sep. 18

Daily Market Outlook - Wednesday, Sep. 17