The FTSE Finish Line - Friday, Sep. 19

Image Source: Pexels

London stocks were poised to conclude an eventful week with a slight decline on Friday. This downturn comes as investors take stock of the recent decisions made by various central banks, placing particular emphasis on the actions of the U.S. Federal Reserve, which has been the focal point of attention. The week has seen considerable fluctuations in the market as traders react to economic indicators and monetary policy shifts, reflecting broader concerns about inflation, interest rates, and economic growth. The Bank of England’s anticipated pause on Thursday came after its quarter-point reduction in August, as it deals with persistent inflation and an unpredictable outlook for growth and employment. Major financial institutions such as Goldman Sachs, Citigroup, and J.P. Morgan foresee no further interest rate cuts by the BoE for the remainder of this year, following the central bank’s decision to maintain its key rate. A recent survey indicated that British sentiment has become more pessimistic this month, and the likelihood of tax hikes in Finance Minister Rachel Reeves’s November budget could further undermine confidence. In contrast, central banks in the United States, Canada, and Norway have lowered interest rates, raising expectations for additional easing ahead. The Fed's 25 basis point rate reduction, its first since December, had a positive impact on riskier assets in the prior session. The UK faces a busy week of macroeconomic updates, with the Financial Times highlighting the upcoming OBR productivity growth forecast as a key element of the Budget. This development is expected to have significant implications. Nonetheless, it is not the only factor to consider. Although public finance data for 2025-26 has been disappointing thus far, there is a chance that the peak in effective gilt supply may already be behind us. Participants in the gilt market will need to balance the medium-term fiscal sustainability challenges stemming from the OBR’s productivity revision against the relatively low probability of substantial upward revisions to near-term gilt supply.

Close Brothers' shares have dropped 6.6% to 464.4p, making it the biggest loser on the FTSE midcap 250 index. The British lender has postponed its preliminary results for 2025 by a week to 30 September 2025, as the group's auditor has requested more time to finalize standard audit procedures. As of the last closing, CBRO's stock has increased by 110.4% year-to-date.

Spire Healthcare's shares rise 5.8% to 229p, making it the leading percentage gainer on the FTSE midcap index. The company has initiated discussions with multiple parties to consider strategic options, such as a possible sale. The review is still in its early phases; no decisions have been made and no proposals have been received, according to Spire. SPI has gained approximately 4% year-to-date.

Technical & Trade View

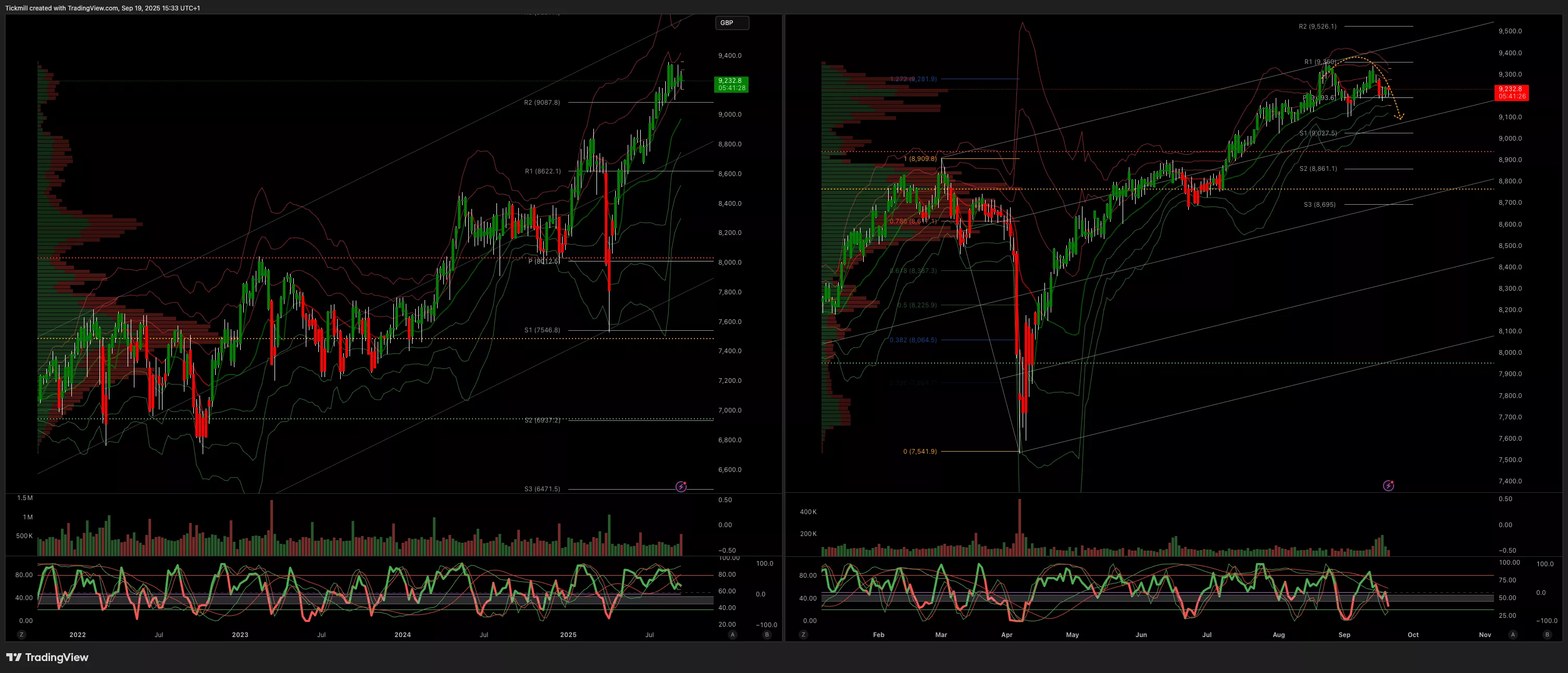

FTSE Bias: Bullish Above Bearish below 9000

- Primary support 9000

- Below 8900 opens 8600

- Primary objective 9600

- Daily VWAP Bullish

- Weekly VWAP Bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Friday, Sep. 19Emini S&P 500 Live Market & Trade Analysis

Daily Market Outlook - Thursday, Sep. 18