Daily Market Outlook - Monday, Nov. 17

Image Source: Pixabay

US equity futures are on the rise, fuelled by gains in Asian tech stocks, as investors gear up for a crucial week featuring Nvidia’s earnings and the long-awaited release of US economic data.

After last week’s subdued finish, risk sentiment has picked up. S&P 500 futures climbed 0.4%, while Nasdaq 100 futures rose 0.6%. South Korean chipmakers like Samsung Electronics and SK Hynix saw gains after unveiling new investment plans. European futures hinted at a quiet start, while Asia’s benchmark index dipped 0.2%. Japanese stocks lagged behind as the nation’s economy contracted for the first time in six quarters, with tourism-related sectors under pressure amid growing tensions with China. This week promises a wave of long-overdue US economic data, as federal agencies resume reporting after weeks of disruption. Key employment numbers and other reports will provide clarity on the Federal Reserve’s next policy moves at a time when optimism around AI-driven stocks continues to lift broader market sentiment. Gold extended its losing streak to a third session, while the dollar ticked up 0.1%. Treasuries held steady as traders awaited insights from the upcoming data releases. Federal Reserve officials have struck a cautious tone regarding a potential rate cut in December. Despite some market speculation, Chair Jerome Powell recently stressed that such a move is “far from certain.” The minutes from the Fed’s late October meeting, due this week, may offer a glimpse into the divided opinions within the central bank. Last week, market odds for a December rate cut dropped below 50%. In commodities, crude oil slipped following reports that operations resumed at Russia’s key Black Sea port of Novorossiysk, which had temporarily halted shipments after a Ukrainian strike.

Bitcoin has seen a sharp reversal in fortunes, wiping out over 30% of the gains it had registered earlier this year. This downturn comes just over a month after reaching an all-time high, as optimism surrounding the pro-crypto stance of the Trump administration wanes. The deepening bear market has triggered significant liquidation among both retail and institutional investors. On Sunday, the cryptocurrency benchmark briefly dipped below $93,000, falling beneath the closing level recorded at the end of last year when financial markets surged following President Donald Trump’s election victory. After reaching a record $126,000 on October 6, Bitcoin began its downward spiral just four days later, spurred by unexpected remarks on tariffs from Trump that sent global markets into turmoil.

The reopening of the US government has paved the way for the Bureau of Labor Statistics to release the September employment report this Thursday. However, given its somewhat dated nature, the new weekly ADP employment indicator on Tuesday might attract more attention. Other key events include the Fed minutes on Wednesday and a series of speeches by Fed officials, primarily on Thursday and Friday, alongside updates on the resumption of other data releases. Globally, it’s a significant week for inflation data. The final euro area inflation print for October is due Wednesday, followed by Japan’s figures on Thursday, which could impact the December BoJ decision. The UK CPI release on Wednesday will also be closely watched. In the UK, Friday brings October public finances data, which may influence forecasts for the gilt remit revision expected at the upcoming Budget, as well as the retail sales report. A possible Treasury Select Committee hearing on the BoE’s November MPR could be added to the schedule. The weekend press offered little new UK Budget speculation or leaks, though Saturday papers noted Friday's gilt market turbulence, with 30-year yields seeing their largest spike since July 2. A leaked decision to scrap an income tax rate hike was viewed by some as a panic move, while the alternative approach of raising revenue through smaller tax bases is seen as riskier. On Friday, the OBR opted to use a later market rate window for its fiscal forecast, potentially reducing the debt interest bill by up to £2bn in 2029-30. Despite some favourable forecast tweaks, a significant tax-raising Budget, possibly exceeding £30bn in measures, remains likely. Additionally, Friday will feature the flash November PMIs, highlighting a faster pace of economic expansion in the US compared to the UK and the euro area. The ECB’s Q3 negotiated wage rates estimate is also set for release on Friday.

Overnight Headlines

- Bond Traders Eye Make-Or-Break Data To Chart The Fed’s Next Move

- As Fed Hawks Press Their Case, Traders Bet Against December Cut

- Japan GDP Shrinks 1.8% In Q3, First Contraction In Six Quarters

- China Escalates Japan Spat With Threats Of Economic Retaliation

- Germany Finance Chief Demands Fair Trade Ahead Of China Visit

- Dutch C.Bank Chief Warns ECB May Rethink Rates If Stablecoins Spark A Run

- Berlin, Paris Clash Over €100B Defence Pact Amid Airbus–Dassault Feud

- Boeing Aims To Smooth Relations With Buyers Over 777X Delays

- Spain’s Deficit To Fall Below Germany’s For First Time In Two Decades

- UK Bond Market Wades Through Budget Uncertainty

- Multimillion-Pound Home Sales Drop Sharply Before UK Budget

- Meta Opens Pop-Up Stores To Build Buzz For Its AI Glasses

- Tesla Wants Its American Cars Built Without Any Chinese Parts

- Apple CEO Succession Plans Accelerate

- Bitcoin Erases 2025 Gain As Crypto Bear Market Deepens

- Oil Falls As Russia’s Novorossiysk Port Resumes Operations

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1550 (893M), 1.1600 (266M), 1.1700 (1.1BLN)

- USD/CHF: 0.8000 (300M). EUR/CHF: 0.9235-40 (550M)

- EUR/GBP: 0.8830 (476M)

- AUD/USD: 0.6525 (270M)

- USD/CAD: 1.3970-80 (801M), 1.4000 (517M)

- USD/JPY: 154.70 (200M), 155.00 (530M), 155.30 (200M)

CFTC Positions as of the Week Ending 9/10/25

-

October 1, 2025: During the shutdown of the federal government, Commitments of Traders Reports will not be published

Technical & Trade Views

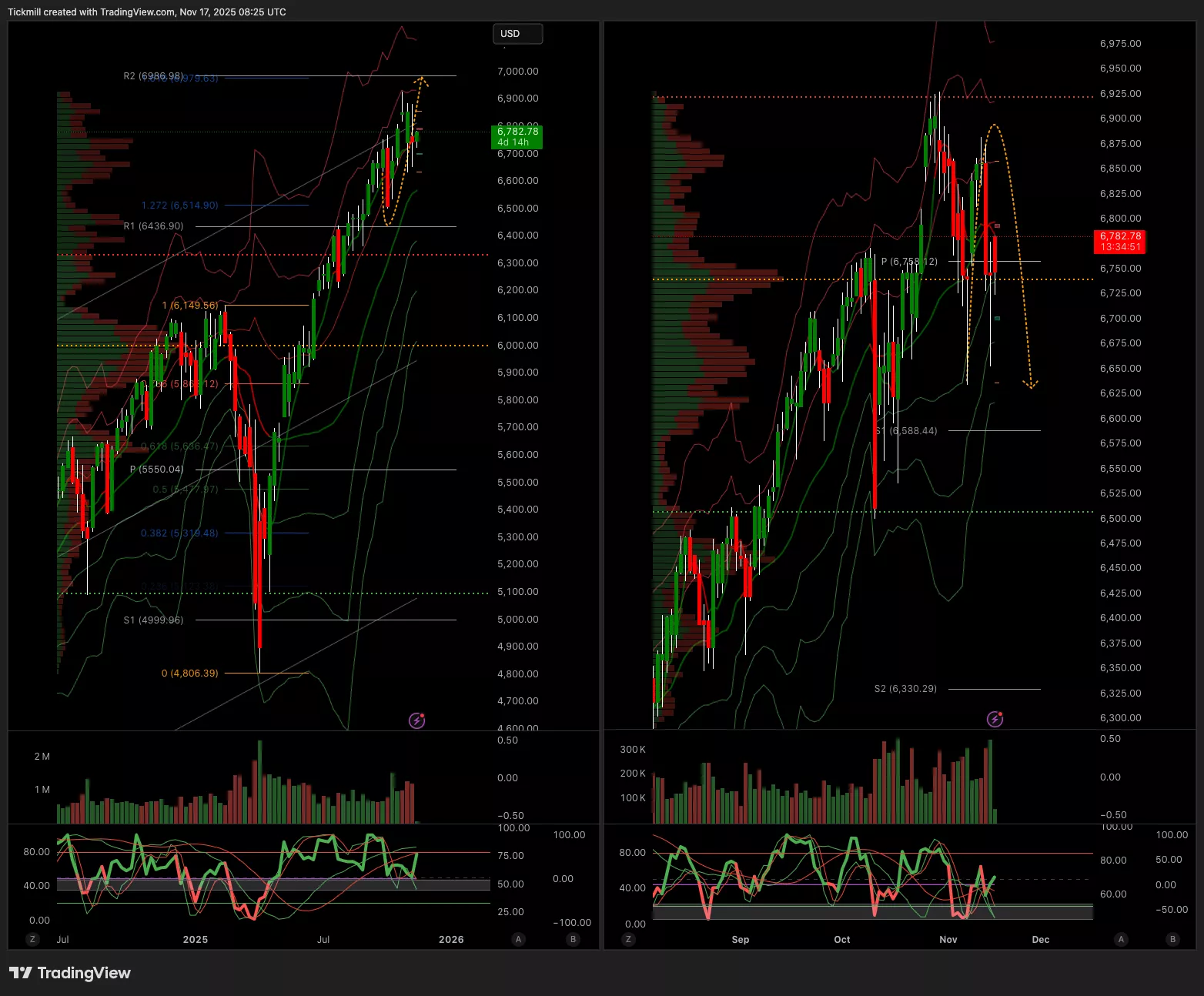

SP500

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 6778 Target 6933

- Below 6750 Target 6566

(Click on image to enlarge)

EURUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 1.1613 Target 1.1679

- Below 1.1586 Target 1.1492

(Click on image to enlarge)

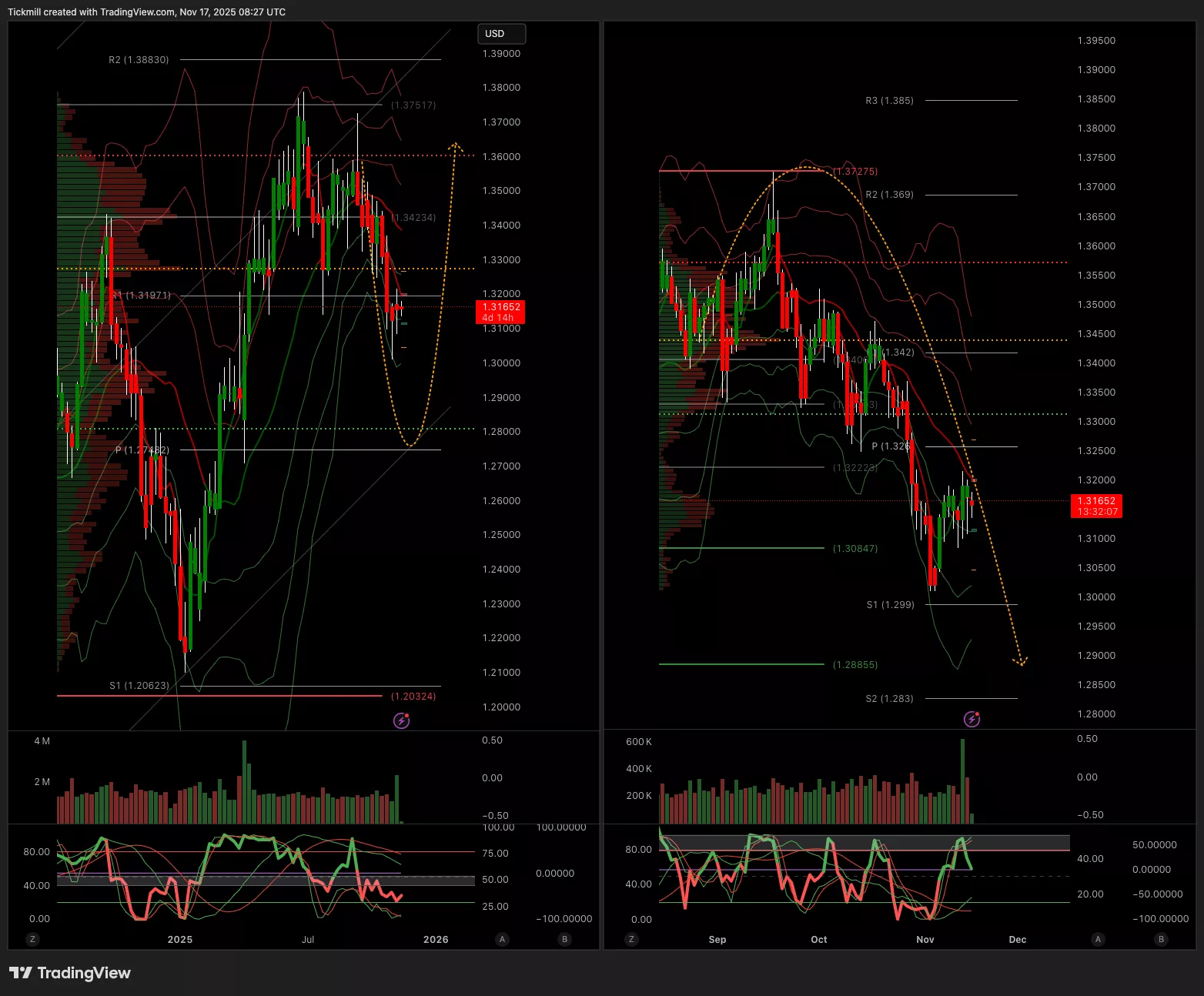

GBPUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 1.3203 Target 1.3295

- Below 1.369 Target 1.311

(Click on image to enlarge)

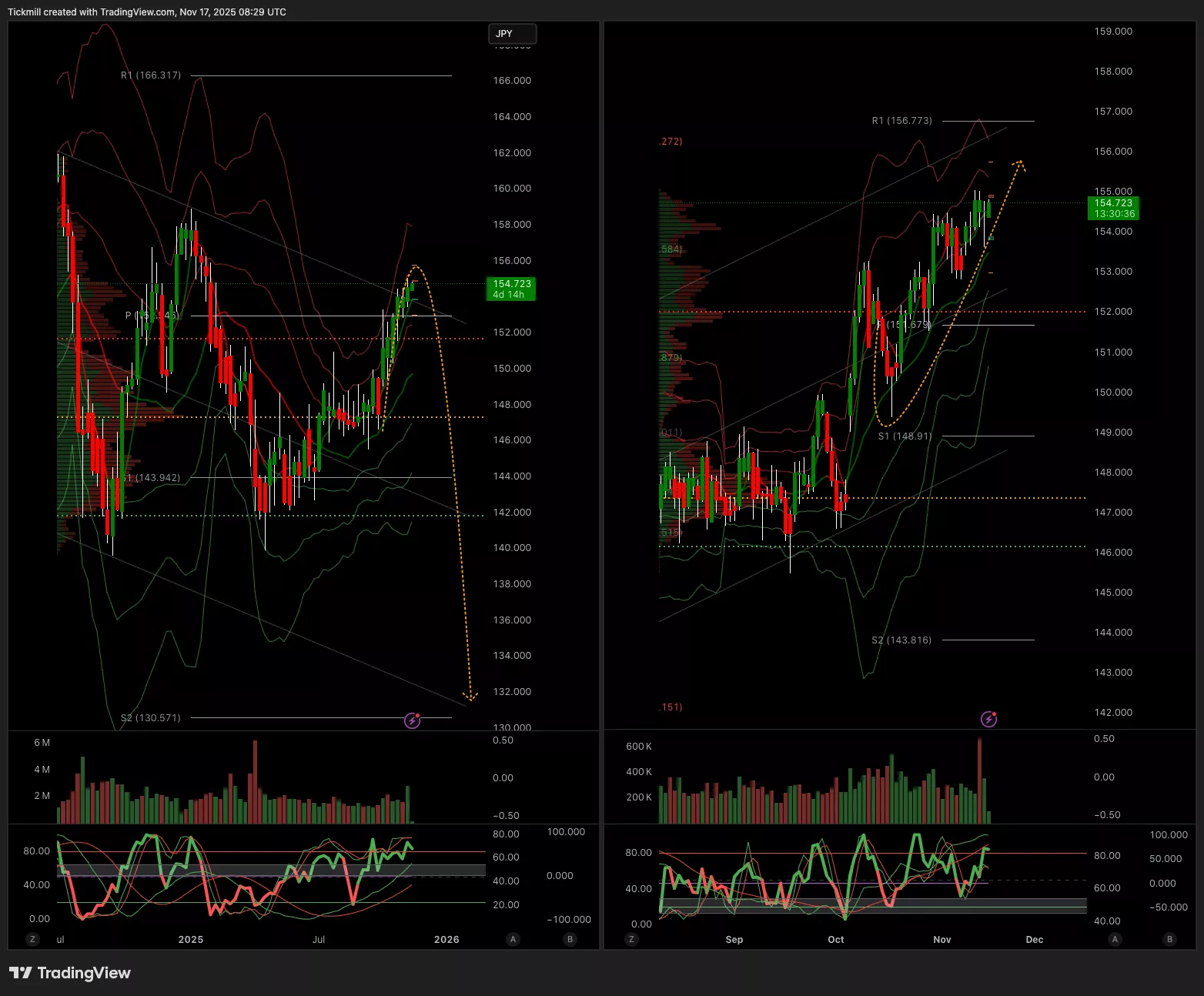

USDJPY

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 154.50 Target 156.29

- Below 153.47 Target 152.53

(Click on image to enlarge)

XAUUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 4058 Target 4123

- Below 3817 Target 3511

(Click on image to enlarge)

BTCUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 98.5k Target 104.6k

- Below 98k Target 91k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Friday, Nov. 14

Daily Market Outlook - Friday, Nov. 14

The FTSE Finish Line - Thursday, Nov. 13