Daily Market Outlook - Friday, Nov. 14

Photo by Jakub Żerdzicki on Unsplash

Wall Street faced a sharp sell-off once again, ending a brief respite that followed the reopening of the U.S. government. Hawkish remarks from Federal Reserve officials, combined with anticipation of upcoming economic data, spurred traders to shed riskier assets, ranging from tech stocks to cryptocurrencies. With the optimism surrounding the government shutdown’s resolution already baked into the market, concerns over lofty valuations reemerged. This led to a notable pullback in high-flying tech stocks, while some analysts noted a shift toward more defensive sectors. The S&P 500 experienced its third drop of over 1% in just two weeks, a stark contrast to the previous three months, during which such declines happened only once. President Trump signed a bill to end the longest government shutdown in U.S. history, though it may take time for federal agencies to fully resume normal operations. Notably, the upcoming October jobs report will not include the unemployment rate, according to U.S. Chief Economic Adviser Kevin Hassett in an interview with Fox News’ America’s Newsroom. As for the Federal Reserve, traders are split on whether the central bank will cut interest rates in December. Fed Chair Jerome Powell previously stated that another rate reduction is “not a foregone conclusion”, emphasising that future decisions will depend on incoming data. However, some investors are concerned that missing economic data due to the shutdown could bolster arguments for maintaining current policy. Adding to the mix, Fed officials shared differing views in separate comments. The Fed’s Musalem urged caution given inflation remains above target, while the Fed’s Hammack suggested monetary policy should stay “somewhat restrictive”. On the other hand, the Fed’s Kashkari revealed he opposed the last rate cut and remains undecided about December’s decision.

Asian shares fell sharply on Friday, with MSCI's broadest index of Asia-Pacific stocks outside Japan dropping 1.6%. This decline followed Wall Street's abrupt end to a four-day winning streak, as U.S. markets experienced their steepest single-day drop since April's tariff-related turmoil. Japan's Nikkei index slid 2%, while Australia's resource-heavy stocks lost 1.4%. South Korean markets saw a steep plunge of up to 3.6%, with losses intensifying throughout the day. In China, stocks dipped 0.9% after monthly activity data revealed slower-than-expected growth in October’s industrial production and retail sales. The disappointing figures quickly erased a brief rally in equity markets. October credit growth in China was notably weak, with total aggregate financing reaching RMB30.9trn from Jan-Oct, up from RMB27.1trn last year, but the monthly flow was disappointing. Credit growth for October was RMB815bn, the lowest since 2015. RMB loans contracted by -RMB20.1bn m/m, and government bond issuance slowed sharply to RMB489.3bn, the weakest since April ’24. Household borrowing continued to decline amid housing market struggles, while corporate lending remained flat, skewed towards SOEs. Despite slower credit growth, debt is rising faster than the economy, now at 314% of GDP (up from 301% last year). Most of this increase stems from government bond issuance, highlighting growing imbalances and reliance on exports.

Bitcoin has plunged further below 100K as the crypto benchmark trades in bear market territory, impacted by a new wave of risk aversion and a downturn in tech stocks that has revived concerns on Wall Street. The cryptocurrency dropped by as much as 3.9%, deepening a decline that has erased over $450 billion in value since early October. Previously reliable support sources—such as major investment funds, ETF investors, and corporate treasuries—have retreated, taking away a crucial support pillar for this year's rally and initiating a fresh period of market vulnerability.

Overnight Headlines

- Sluggish UK Economy Puts Reeves, BoE Under Pressure Before Budget

- UK PM Starmer, Chancellor Reeves Drop Plan To Raise Income Tax Rates

- China’s Economy Falters With Growth Hurt By Investment Slump

- Bitcoin Sinks Deeper Below $100,000 As Bear Market Grips Crypto

- Fed’s Kashkari Did Not Support Oct Rate Cut, Undecided On Dec

- BoC Restarts Treasury Bill Purchases Amid Financial System Strains

- Germany Rethinks China Policy As Trade Squeeze Exposes Vulnerabilities

- Trump Lifts More Oil Drilling Curbs On Millions Of Arctic Acres

- Goldman Follows IEA With Revised Bullish Outlook On Oil Demand

- Siemens Energy Boosts Outlook On Turbine, Data Center Demand

- Applied Materials Sales Decline, With Rebound Predicted For 2026

- Disney Shares Slump As Sales At Film And TV Units Slide

- Paramount, Comcast, Netflix Bid For Warner As Deadline Approaches

- Oracle Hit Hard In Tech Sell-Off Over Huge AI Bet

- South Korea Says Fact Sheet With US On Trade, Security Finalised

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1600-10 (1BLN), 1.1625 (1.3BLN), 1.1650 (327M), 1.1700 (731M)

- EUR/CHF: 0.9355 (477M). EUR/GBP:0.8850 (360M)

- AUD/USD: 0.6500-10 (1BLN), 0.6540 (345M), 0.6570 (468M), 0.6600 (470M)

- AUD/NZD: 1.1500 (680M)

- USD/CAD: 1.4015 (313M), 1.4020-30 (2.1BLN), 1.4035 (276M)

- USD/JPY: 153.80 (250M), 155.00 (202M), 155.25-35 (282M)

CFTC Positions as of the Week Ending 9/10/25

-

October 1, 2025: During the shutdown of the federal government, Commitments of Traders Reports will not be published

Technical & Trade Views

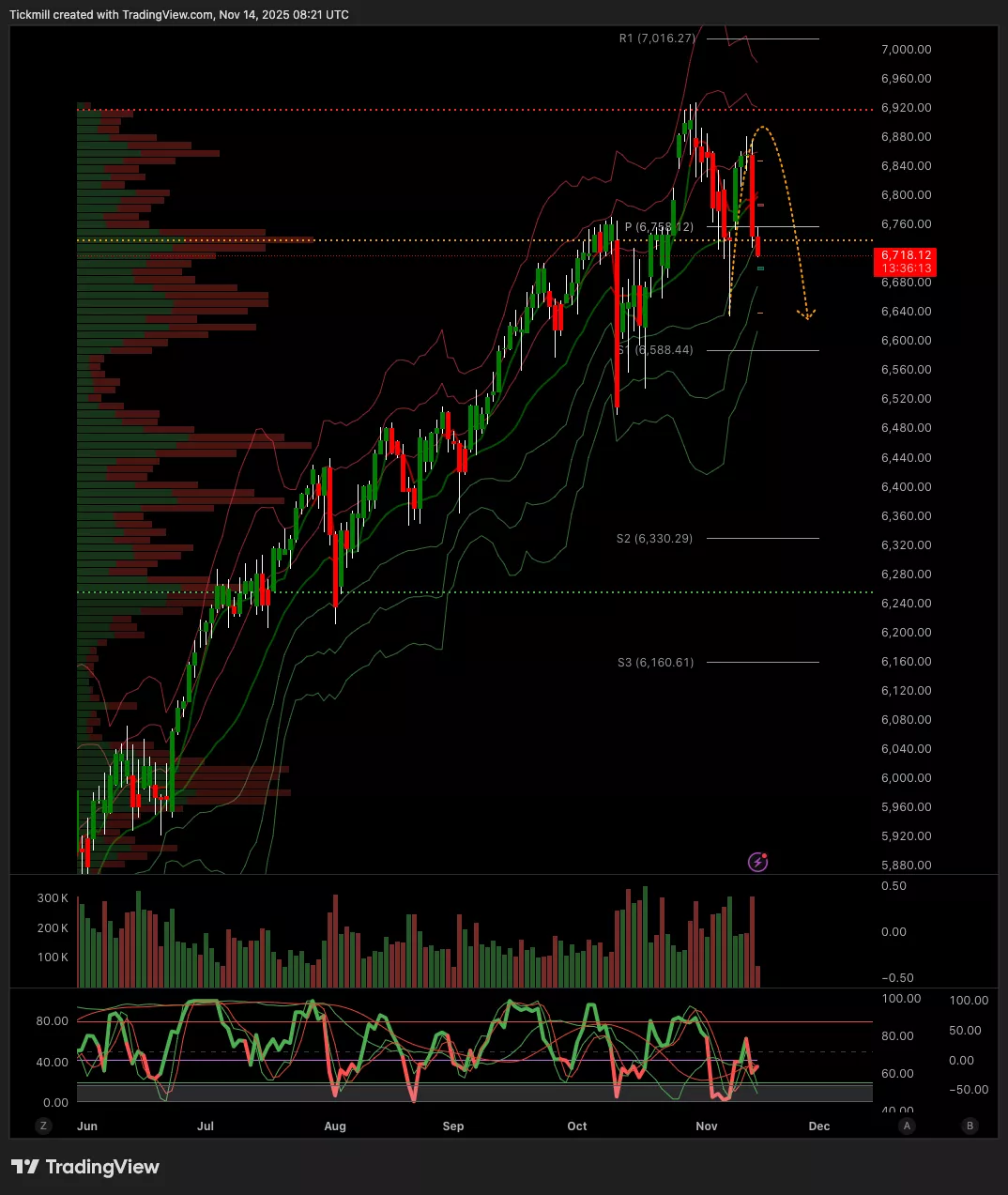

SP500

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 6805 Target 6860

- Below 6798 Target 6675

EURUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 1.1595 Target 1.1683

- Below 1.1583 Target 1.1483

GBPUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 1.3211 Target 1.3314

- Below 1.3159 Target 1.29

USDJPY

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 154.40 Target 156.35

- Below 153.19 Target 151.37

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 4158 Target 4276

- Below 4069 Target 3962

BTCUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 100.5k Target 104.9k

- Below 101k Target 95.3k

More By This Author:

The FTSE Finish Line - Thursday, Nov. 13

Daily Market Outlook - Thursday, Nov. 13

Daily Market Outlook - Wednesday, Nov. 12