The FTSE Finish Line - Thursday, Nov. 13

Image Source: Pexels

On Thursday, London's FTSE 100 dropped after achieving three consecutive days of record highs, influenced by declines in financial and energy stocks, as investors evaluated unsatisfactory third-quarter economic growth figures.

Investment banks and brokerages experienced a significant dip of 6.3%, with investment firm 3i Group plunging 14.6%. This marks its worst performance since May 2022, following the company's cautious stance on deploying capital into new ventures.

The UK economy contracted by 0.1% month-on-month in September, leaving overall GDP growth at just 0.1% for the third quarter—consistent with our forecast but below the 0.2% quarterly growth anticipated by financial markets and the Bank of England. A significant portion of September's decline stemmed from a drop in manufacturing output caused by the cyberattack-related shutdown at Jaguar Land Rover, which is expected to recover in the coming months. However, there are evident signs that the underlying growth momentum has weakened compared to the first half of the year. Additionally, August GDP was revised down to show no growth, following contractions of 0.1% in both July and September, meaning the UK economy experienced no monthly GDP increase during Q3.

The energy sector also faced challenges, slipping by 1.1%. A report indicating rising crude inventories in the U.S. heightened concerns about oversupply, leading to a drop in oil prices. Global markets, however, kept their eyes on economic updates from the U.S., as President Donald Trump signed a bill ending the nation’s longest government shutdown. The 43-day data void left both the Federal Reserve and traders grappling with uncertainty surrounding labour market conditions and inflation trends. Life insurers faced a setback, dropping 1.3%, with Aviva tumbling 4.3% after its newly revealed financial goals failed to win over investors. On the other hand, precious metal miners surged by 8.2%, buoyed by gold prices reaching their highest level in over three weeks. Homebuilder Persimmon enjoyed a 2.3% boost, thanks to an increase in forward sales despite ongoing consumer unease. Luxury fashion house Burberry saw its shares climb by 2.4%, reaching their highest point since July 29, as the brand reported its first quarterly growth in two years. In the airline industry, Wizz Air soared by an impressive 8.7% after delivering strong first-half operating profit figures, showcasing resilience amidst market uncertainty.

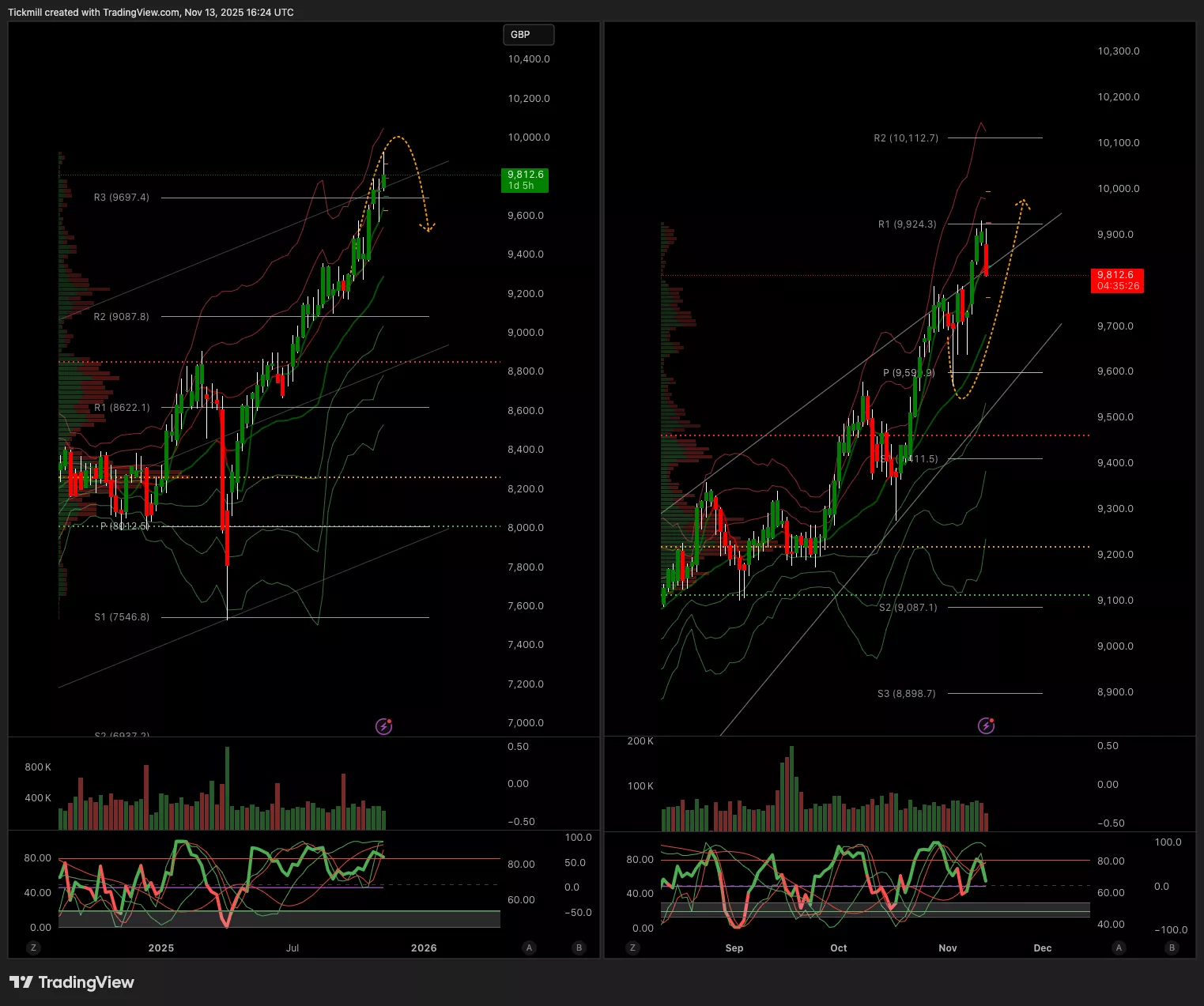

TECHNICAL & TRADE VIEW - FTSE100

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 9784 Target 9980

- Below 9626 Target 9467

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Thursday, Nov. 13

Daily Market Outlook - Wednesday, Nov. 12

The FTSE Finish Line - Tuesday, Nov. 11