The FTSE Finish Line - Tuesday, Nov. 11

Image Source: Pexels

The export-orientated FTSE 100 in London reached a new intraday high on Tuesday, supported by a declining pound following economic data that showed an increase in unemployment and sluggish wage growth, while pharmaceutical company AstraZeneca surged to a record high. Additionally, the approval of a short-term funding bill late Monday, which concluded the longest government shutdown in U.S. history, is contributing positively to market sentiment.

The latest UK labour market statistics signal a cooling jobs market. Labour Force Survey (LFS) data revealed the first employment decline since Q1 2024 over the three months to September, while more current HMRC figures showed payrolls dropped for the eleventh time in twelve months in October. Consequently, the unemployment rate increased for the second consecutive month, rising from 4.8% to 5.0%, exceeding the Bank of England's forecast of 4.9% and reaching its highest level since early 2021. With pay growth continuing to moderate, today's data reinforces expectations of ongoing disinflation, likely bolstering market anticipation that the Bank of England may opt for interest rate cuts sooner than previously projected.

AstraZeneca shares have increased by 2%, reaching a record high of 13,390p. This reinforces AZN's status as the largest stock listed in the UK by market capitalisation. The stock is one of the top performers on the FTSE 100 index, which has risen by 0.98%. The upward trend follows the company's Q3 results, which exceeded expectations last Thursday, thanks to robust sales of its key cancer and cardiovascular medications. With today's gains included, the stock is up approximately 27.8% year-to-date.

Vodafone shares rose by 5% to 93.38p, making it the top performer on the FTSE 100 index, which is up 0.83%. The company has revised its full-year projections for both earnings and cash flow after achieving growth in Germany in the second quarter. Vodafone now anticipates annual adjusted core earnings to reach the higher end of the forecast range between 11.3 billion euros and 11.6 billion euros ($13.18 billion to $13.53 billion). For FY26, the group’s adjusted free cash flow is expected to hit the upper range of 2.4 billion to 2.6 billion euros. CEO Margherita Della Valle indicated that service revenue has been accelerating in Q2, with strong performances in the UK, Turkey, and Africa, as well as a return to growth in Germany. Including today’s gains, the stock has increased approximately 30.19% year-to-date.

Shares of Croda International fell almost 4% to 2,678p, making it the largest loser on the FTSE 100 Index, which is up 0.96%. Jefferies has lowered the chemical company's price target to 3,000p from 3,100p and changed its rating from "Buy" to "Hold". Jefferies noted that Croda's emphasis on increasing volumes to enhance utilisation is delaying the clarity on additional earnings until late 2026. The firm anticipates Croda will report a fiscal year adjusted profit before tax of 261 million pounds ($350.29 million), which is close to the lower end of the company’s currency-adjusted guidance of 255–285 million pounds. Among the 14 analysts monitoring the stock, 7 have given a "buy" or better rating, 5 have rated it as "hold", and 2 have assigned "sell" or lower ratings; the median price target is 3,075 pence according to LSEG data. Year-to-date, the stock is down nearly 21% compared to the FTSE's approximately 21% gain.

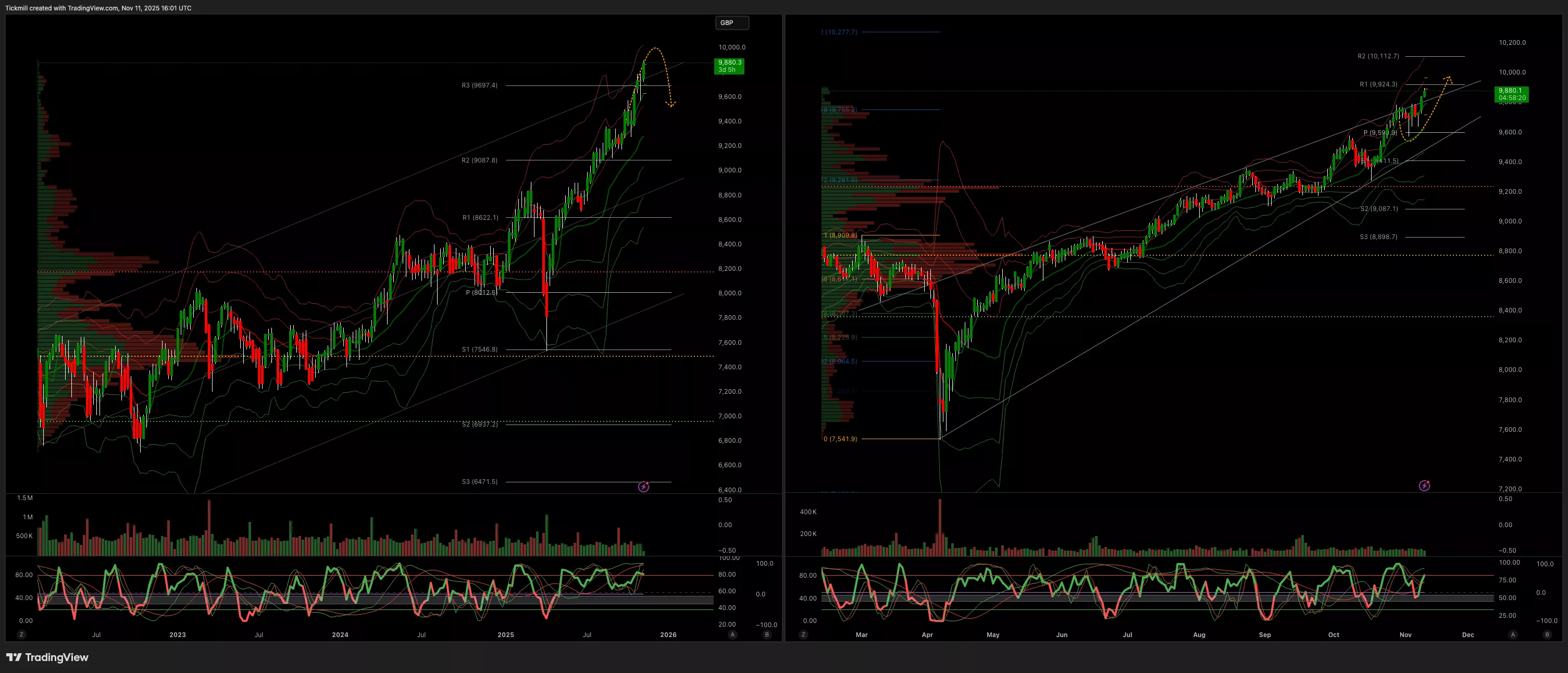

TECHNICAL & TRADE VIEW - FTSE100

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 9784 Target 9944

- Below 9626 Target 9467

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Tuesday, Nov. 11The FTSE Finish Line - Monday, Nov. 10

Emini S&P 500 Weekly Live Market & Trade Analysis - Monday, Nov. 10