Daily Market Outlook - Monday, Nov. 11

Image Source: Pexels

In contrast to Wall Street's record highs from Friday and futures suggesting more strength at the reopening, Hong Kong stocks led Asia's Monday falls as Beijing's most recent stimulus failed to meet investor expectations. The Hang Seng in Hong Kong fell 2%, while a sub-index of mainland Chinese real estate stocks fell 3.9%. The Nikkei in Japan dropped 0.3%. Taiwan's benchmark fell 0.7%, while South Korea's Kospi fell 0.9%.

With Donald Trump winning the U.S. presidential election and pro-crypto candidates being elected to Congress, Bitcoin surged to its highest level ever, raising hopes for a lax regulatory framework. In comparison to major rivals, the dollar was trading close to its four-month high last week as traders got ready for a series of Federal Reserve speakers, including Chair Jerome Powell, to share their thoughts on the economic outlook and policy. After the excitement of the U.S. election and the Federal Reserve's rate decision, this week will be an intriguing but low-key time for event risk. These developments, as well as China's announcement of fiscal stimulus measures that fell short of expectations, will continue to have an impact on markets.

Monday is Veterans Day Stateside, Wednesday is the release of the October CPI, Thursday is the PPI and weekly unemployment claims, and the week ends with retail sales and industrial production. In addition to the lending statistics anticipated throughout the week, China's economic calendar features October data on urban investment, IP, retail sales, housing prices, and unemployment on Friday. Highlights of Europe's data include the ZEW survey on Tuesday, German final October inflation, and eurozone flash Q3 GDP, industrial production, and employment on Thursday. The UK's GDP, construction, and industrial production figures come out on Friday after Tuesday's jobs report. On Thursday, UK Finance Minister Rachel Reeves will give her first "Mansion House Speech." Andrew Bailey, the governor of the Bank of England, will also speak at the event. Japan will issue Q3 GDP and core machinery orders on Friday, current account and trade data on Monday, and the Bank of Japan's summary of views from the October 30-31 meeting on Friday. On Thursday, Australia's primary releases are the Q3 Wage Price Index, the NAB business survey, and October jobs statistics.

Overnight Newswire Updates of Note

- Fed’s Kashkari: Economy Strong, But Inflation Not Vanquished

- If Trump Tries To Fire Powell, Fed Chair Is Ready For A Legal Fight

- Australia Faces Economic Pain From Trump Win, Treasurer Warns

- ECB's Holzmann: No Reason Not To Cut Rates In Dec As Of Now

- German ZEW To Edge Higher; Politics Could Reverse Forecasts

- Japanese Funds Embrace German Bonds; Shunning French Debt

- Japan PM Ishiba Cabinet Resigns Ahead Of Diet PM Votes

- BoJ Cautions On Rate Hike With No Clear Dec Hint

- Hong Kong Finance Chief Sees Growth Near Lower End of Forecast

- China Inflation Slowest Rise In 4 Months, Despite Stimulus

- China Suffers Foreign Investment Deficit For 2nd Straight Quarter

- US Ordered TSMC To Halt AI-Chips Shipments To China

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1100 (EU1.59b), 1.1050 (EU1.3b), 1.0900 (EU934.2m)

- USD/JPY: 121.18 ($500m), 151.45 ($330m)

- USD/CNY: 6.8200 ($890m), 6.9500 ($330m), 6.9000 ($300m)

- USD/CAD: 1.4065 ($1.37b), 1.3740 ($1.31b), 1.3713 ($500m)

- AUD/USD: 0.6650 (AUD608.2m), 0.6700 (AUD377.6m), 0.6415 (AUD375.7m)

- GBP/USD: 1.3025 (GBP379.2m)

- NZD/USD: 0.5940 (NZD606m)

CFTC Data As Of 8/11/24

- USD net spec G10 long -$0.31bn

- EUR +1.04% in period; specs +26.7k contracts now -21.7k

- JPY -1.19%; specs sell 19.4k contracts now -44.2k; US-JP rate divergence

- GBP +0.2%; specs sell 21.3k contracts long cut to 45.1k

- CAD -0.63%; specs sell 7.7k contracts; BoC rate well below Fed in 2025

- AUD +1.14%; specs +3.5k contracts now +31k; RBA seen as more hawkish c.bank

- BTC -4.37% in period; specs +412 contracts, now -1,457

- Equity fund speculators trim S&P 500 CME net short position by 97,351 contracts to 194,685

- Equity fund managers cut S&P 500 CME net long position by 52,438 contracts to 992,952

- Speculators trim CBOT US 10-year Treasury futures net short position by 82,913 contracts to 818,270

Technical & Trade Views

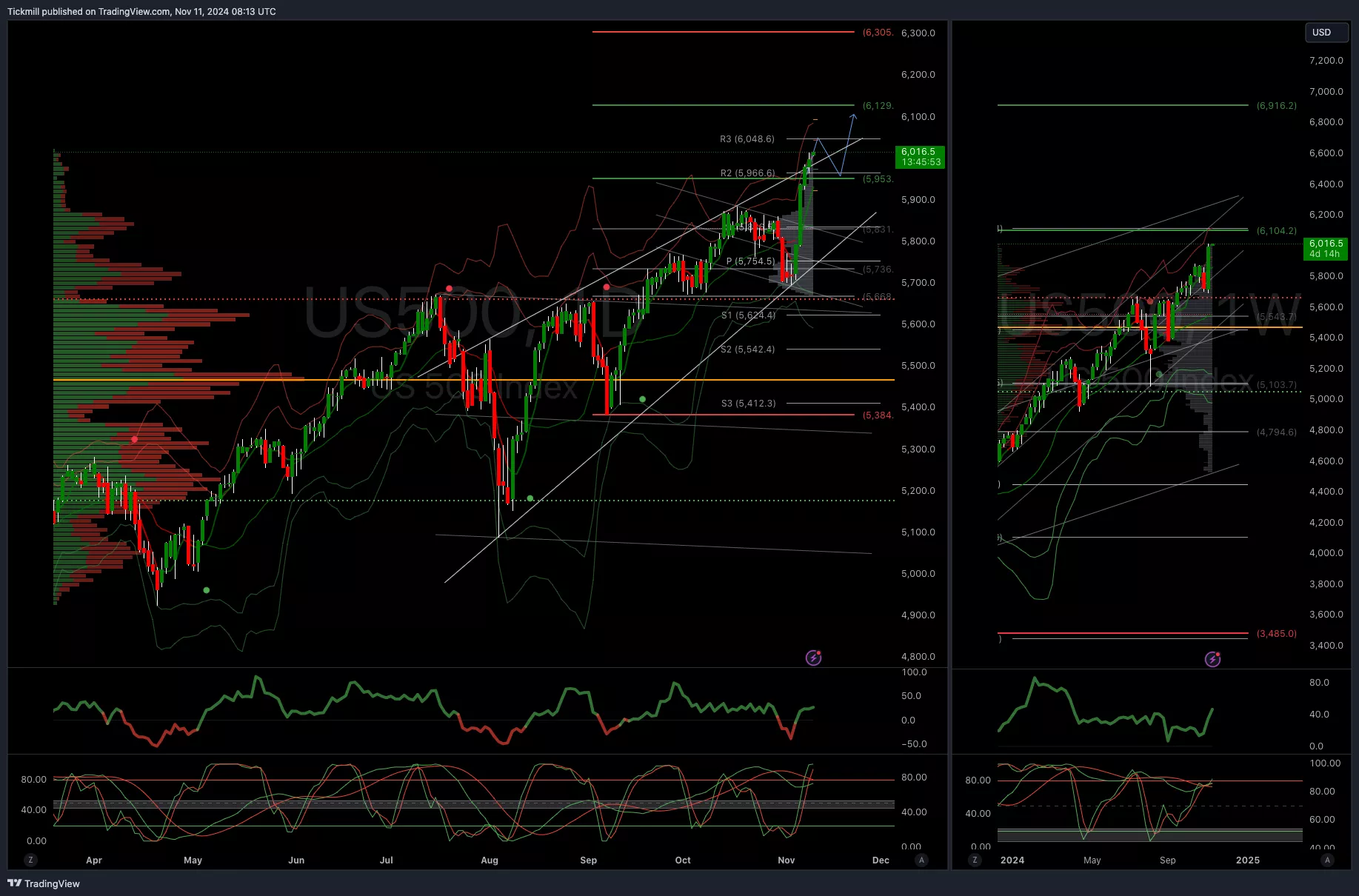

SP500 Bullish Above Bearish Below 5960

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 5550 opens 5820

- Primary support 5800

- Primary objective 6100

(Click on image to enlarge)

EURUSD Bullish Above Bearish Below 1.0810

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 1.09 opens 1.0950

- Primary resistance 1.0950

- Primary objective 1.06

(Click on image to enlarge)

.webp)

GBPUSD Bullish Above Bearish Below 1.3050

- Daily VWAP bearish

- Weekly VWAP bearish

- Below 1.29 opens 1.27

- Primary resistance 1.3050

- Primary objective 1.27

(Click on image to enlarge)

.webp)

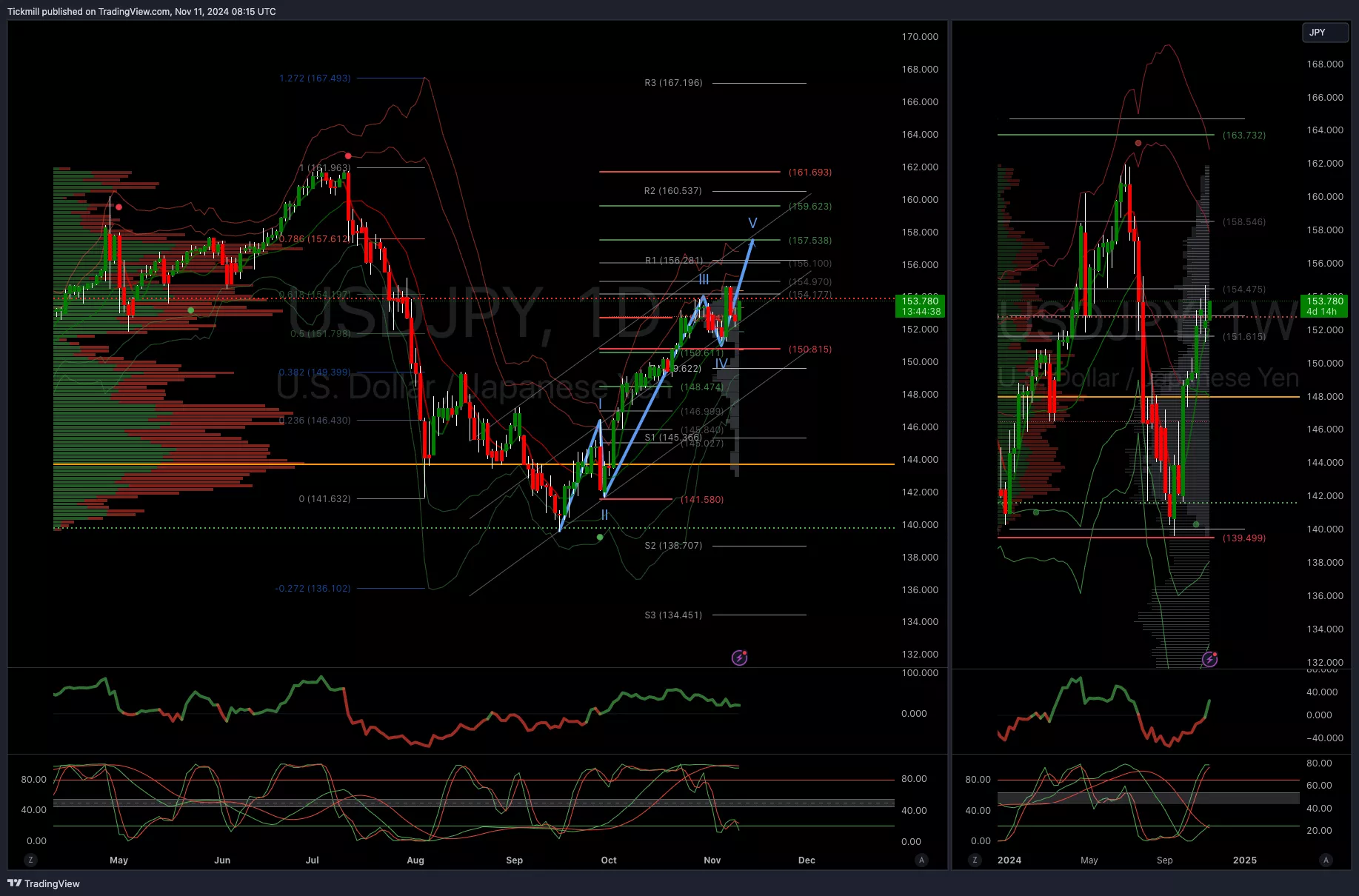

USDJPY Bullish Above Bearish Below 151

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 150 opens 148

- Primary support 148

- Primary objective is 157.50

(Click on image to enlarge)

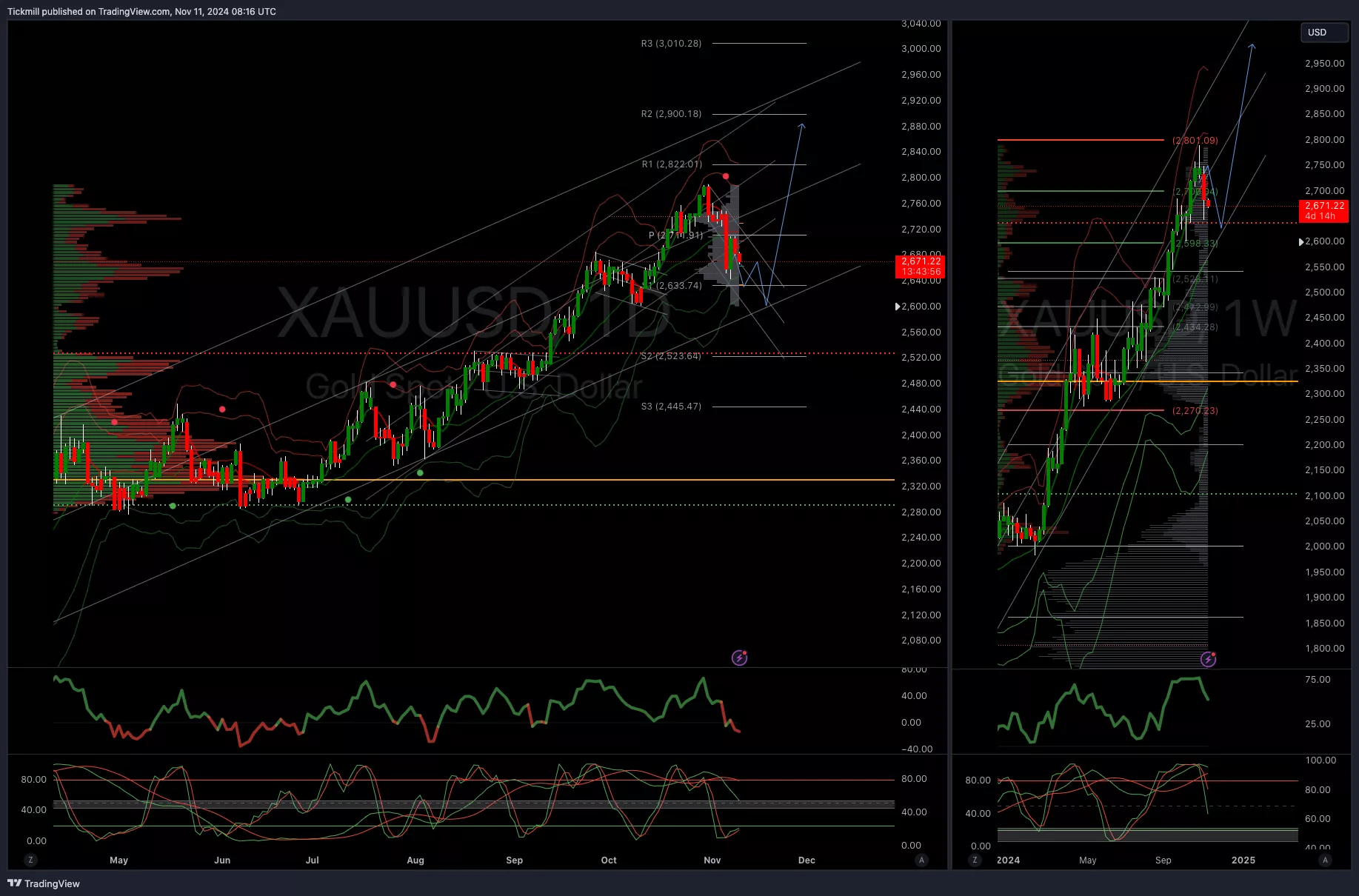

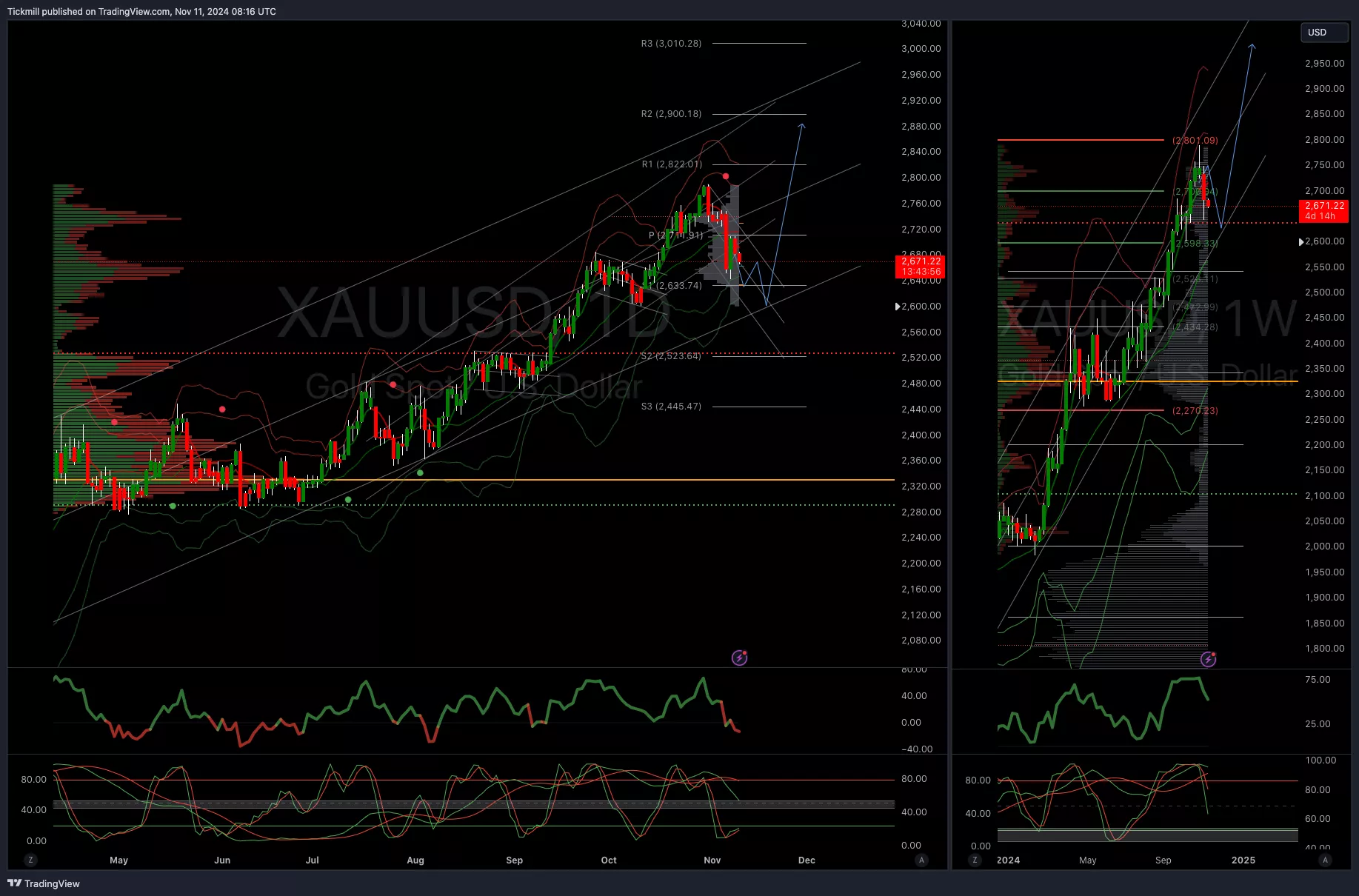

XAUUSD Bullish Above Bearish Below 2600

- Daily VWAP bearish

- Weekly VWAP bullish

- Below 2590 opens 2530

- Primary support 2600

- Primary objective is 2800

(Click on image to enlarge)

BTCUSD Bullish Above Bearish Below 76500

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 76000 opens 72000

- Primary support is 60000

- Primary objective is 80000 - TARGET HIT NEW PATTERN EMERGING

(Click on image to enlarge)

More By This Author:

FTSE To Test Pivotal 8000 Level, Closing At Three Month Lows

FX Options Insights

Daily Market Outlook - Friday, Nov. 8