FTSE To Test Pivotal 8000 Level, Closing At Three Month Lows

Image Source: Pexels

U.K. stocks finish the week firmly in the red, a day after the Bank of England lowered interest rates as anticipated but indicated more persistent inflation. The benchmark FTSE 100 index declined over 1.3% after falling 0.3% Thursday.

-

A profit warning and expense concerns cause the UK's Vistry to plummet. Vistry's stock drops 14.7%, its lowest level since December 2023. The FTSE 100 index's top percentage loser in stocks Due to increased expenses at a division, a British homebuilder issued its second FY profit warning in as many months. The firm anticipates more financial strains in the upcoming year. Compared to the 350 million pounds anticipated last month, the FY adjusted profit before tax is currently about 300 million pounds ($389 million). The stock is currently up over 16% so far this year.

-

Shares of AstraZeneca increased by 1.8%, ranking among the top gainers on the FTSE 100 index. The drugmaker's asthma medication Tezspire met both co-primary endpoints in the Phase III WAYPOINT trial for patients with chronic rhinosinusitis with nasal polyps, demonstrating a significant reduction in nasal polyp size and congestion. The safety profile and tolerability of Tezspire in the trial were consistent with its known profile. AstraZeneca's stock has declined by approximately 6% year-to-date.

-

Shares of IAG, the owner of British Airways, rose 6.2% to 232.4 pence, reaching the highest level since June 2020 and becoming the top gainer on the FTSE 100 index. IAG's third-quarter operating profit jumped by a larger-than-expected 15%, and the company announced a 350 million euros share buyback. CEO Luis Gallego stated that demand remains strong across their airlines and they expect a good final quarter of 2024 financially. Jefferies noted that IAG's margins are higher than pre-COVID and can still grow as long-haul capacity recovers and self-help opportunities materialise. IAG's London-listed peers, EasyJet and Wizz Air, also saw their shares rise by 2.1% and 1.9%, respectively.

-

Serco Group, a British outsourcing company, has experienced a 13.3% drop in its share price, reaching a one-year low, after losing its contract for onshore immigration detention facilities and detainee services in Australia. The contract loss would have contributed around £165 million in revenue and £18 million in underlying operating profit in 2025. The company also expects one-off end-of-contract cash costs of around £20 million. Additionally, the increase in national insurance contributions following the government's budget will increase Serco's direct labour costs by around £20 million per year.

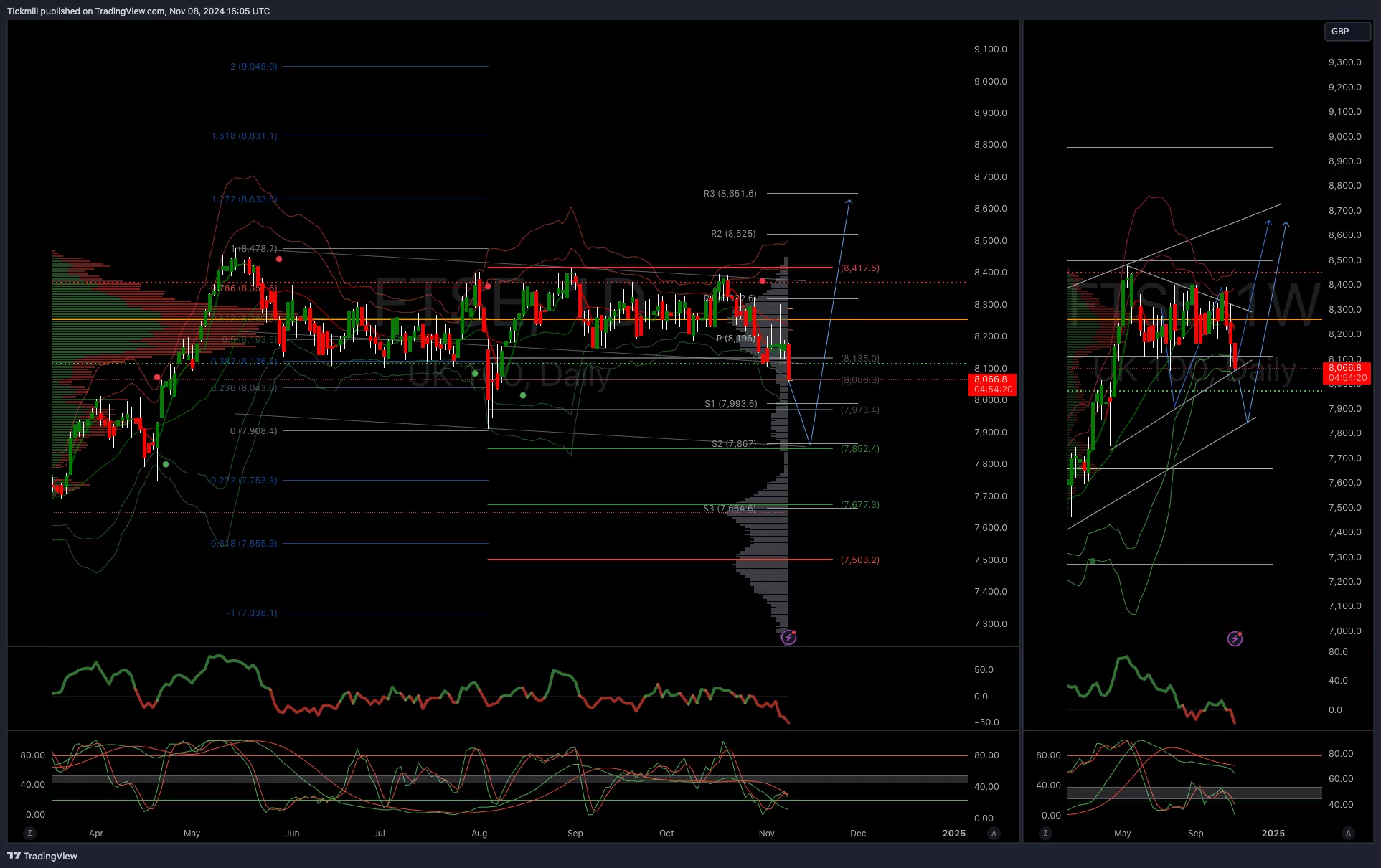

Technical & Trade View

- FTSE Bias: Bullish Above Bearish below 8225

- Primary support 8000

- Below 8000 opens 7855

- Primary objective 8600

- Daily VWAP Bearish

- Weekly VWAP Bearish

(Click on image to enlarge)

More By This Author:

FX Options Insights

Daily Market Outlook - Friday, Nov. 8

Daily Market Outlook - Thursday, Nov. 7