Daily Market Outlook - Friday, Nov. 8

Image Source: Pexels

Asian markets ex Japan sink as Chinese official once again fail to deliver on stimulus hopes, however, a miscommunication on wire reports regarding the scale of local debt reduction offers some minor relief as local markets recover from lows, the local hidden debt will be reduced from 14.3 trillion yuan to 2.3 trillion yuan, mainland markets trade just shy of 5% down on the session, According to a report by the Xinhua News Agency, China would increase the debt ceiling for local governments to 35.52 trillion yuan. This will enable them to issue six trillion yuan in additional special bonds over a three-year period in order to swap concealed debt. As China looks to reduce financial risks and support growth, the plan that was approved by the National People's Congress Standing Committee is mostly in line with what markets anticipated.

At the November meeting, the Fed Funds target rate was as anticipated lowered by 25 basis points to a range of 4.5 to 4.75%. What will happen next? The only important thing that changed in the FOMC statement was that everyone agreed to cut rates this time (last time, Bowman was against a 50bp cut and wanted only a 25bps cut). Powell's press conference gave a lot of hints that he wanted to ease again in December, but there is no "set path." In December, Powell was asked what would make the Fed stop raising rates. He replied with what would make the Fed cut rates. It was not a surprise that the answer was weak employment figures, but he would not say if they would wait if good news about the job market came out between now and then. Powell also said that they would be more likely to stop raising rates when they got closer to neutral, but his words showed that they did not think that point had been reached yet. The USD OIS market-implied odds of a ~55% chance of a 25bps December cut reflect both how uncertain the outcome really is and how slightly more likely it seems that something else will happen. Going back to watching info.

Following a hectic week that included important central bank meetings, the U.S. election, and the fall of the German government, euro zone bond rates dipped lower on Friday. This week, they were expected to climb slightly. Last week, Germany's 10-year yield was up by one basis point, down 2 basis points at 2.42%. The U.S. 10-year yield ended a tumultuous Thursday down 8 basis points and was slightly lower on Friday at 4.34%, suggesting that Friday's decline was partially a catch-up with U.S. treasuries. Italy's 10-year yield was 5 basis points lower at 3.69%, while Germany's two-year yield was 2 basis points lower at 2.41%.

Overnight Newswire Updates of Note

- Japan Opposition Camp To Chair Lower House Budget Committee

- Japan Intervened Twice Last Quarter To Bring Yen Below 160

- Japan’s Household Cut Spending Once Again As Prices Rise

- Hong Kong Follows Fed With Rate Cut In Boost For Economy

- Dollar Winds Down After Volatile Week, China NPC In Focus

- China Awaits Trump’s Approach To Tech Rivalry

- Putin: Trump’s Ukraine Proposals Merit Attention

- Powell: Won’t Step Down As Fed Chair If Asked By Trump

- Fed Cuts Rates, Notes Job Market Easing, Solid Economic Growth

- US House Control Battle Continues, Teeter On Uncounted Votes

- BoE Cuts Rates But Sees Higher Inflation After Reeves's Budget

- REC: UK Hiring Fell Most In Seven Months Ahead Of Budget

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0700 (971M), 1.0750 (1.0BLN), 1.0780-85 (1.7BLN)

- 1.0795-00 (2.2BLN), 1.0810-15 (406M), 1.0825-35 (851M)

- 1.0850-60 (1.23BLN), 1.0875-80 (547M), 1.0885-90 (1.9BLN)

- 1.0895-00 (875M), 1.0915-25 (2.0BLN)

- USD/JPY: 151.00 (935M), 151.55 (210M), 151.75 (734M)

- 152.00 (724M), 152.90-00 (900M), 154.00 (973M)

- EUR/JPY: 162.35-42 (1.55BLN). EUR/SEK: 11.6400 (387M)

- USD/CHF: 0.8675-85 (500M), 0.8750-55 (831M)

- EUR/CHF: 0.9300 (250M), 0.9590 (601M), 0.9710 (700M)

- EUR/GBP: 0.8245-50 (595M), 0.8290-00 (520M), 0.8350 (654M)

- GBP/USD: 1.2950 (215M), 1.3000 (219M), 1.3080-95 (675M)

- AUD/USD: 0.6540-55 (1.4BLN), 0.6560-65 (2.83BLN)

- 0.6590-0.6600 (788M), 0.6660-65 (392M), 0.6695-0.6700 (624M)

- AUD/JPY: 96.80 (389M), 99.70 (585M)

- NZD/USD: 0.6000 (587M), 0.6070 (211M), 0.6200-15 (1.16BLN)

- USD/CAD: 1.3750-55 (704M), 1.3800 (452M), 1.3825 (242M)

- 1.3850 (215M), 1.3885 (458M), 1.3900 (236M) 1.3920 (444M)

- 1.3975 (240M), 1.4000 (678M)

CFTC Data As Of 1/11/24

- Net USD G10 long +$8.88bn to +$18.7bn in Oct 23-29 IMM period; $IDX +0.13%

- EUR +0.17%: speculative positions decreased by 21.8k contracts, now at -50.3k, lower ECB view weighs on EUR

- JPY +1.55%; speculative positions decreased by 37.6k contracts, now at +25k, on hawkish Fed, less dovish BoJ

- GBP +0.27%; speculative positions decreased by 8.2k contracts, now at +66.4k; less-dovish BoE lends support. Note large sterling dip post-budget not accounted for in this report

- CAD +0.62%; speculative positions decreased by 26.9k contracts, now at -168k; shorts eyes July ATH -196k

- AUD -1.78%; speculative positions decreased by 163 contracts, now at +27.5k; for now RBA least dovish c.bank

- Equity fund managers cut S&P 500 CME net long position by 20,435 contracts to 1,045,389

- Equity fund speculators trim S&P 500 CME net short position by 12,576 contracts to 292,035

- Speculators increase CBOT US 10-year Treasury futures net short position by 52,992 contracts to 901,183

Technical & Trade Views

SP500 Bullish Above Bearish Below 5880

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 5870 opens 5800

- Primary support 5800

- Primary objective 5950 - TARGET HIT NEW PATTERN EMERGING

(Click on image to enlarge)

.webp)

EURUSD Bullish Above Bearish Below 1.09

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 1.09 opens 1.0950

- Primary resistance 1.0950

- Primary objective 1.0750 - TARGET HIT NEW PATTERN EMERGING

(Click on image to enlarge)

GBPUSD Bullish Above Bearish Below 1.3050

- Daily VWAP bearish

- Weekly VWAP bearish

- Below 1.29 opens 1.27

- Primary resistance 1.3050

- Primary objective 1.27

(Click on image to enlarge)

USDJPY Bullish Above Bearish Below 151

- Daily VWAP bearish

- Weekly VWAP bullish

- Below 150 opens 148

- Primary support 148

- Primary objective is 157.50

(Click on image to enlarge)

XAUUSD Bullish Above Bearish Below 2680

- Daily VWAP bearish

- Weekly VWAP bullish

- Below 2590 opens 2530

- Primary support 2600

- Primary objective is 2800

(Click on image to enlarge)

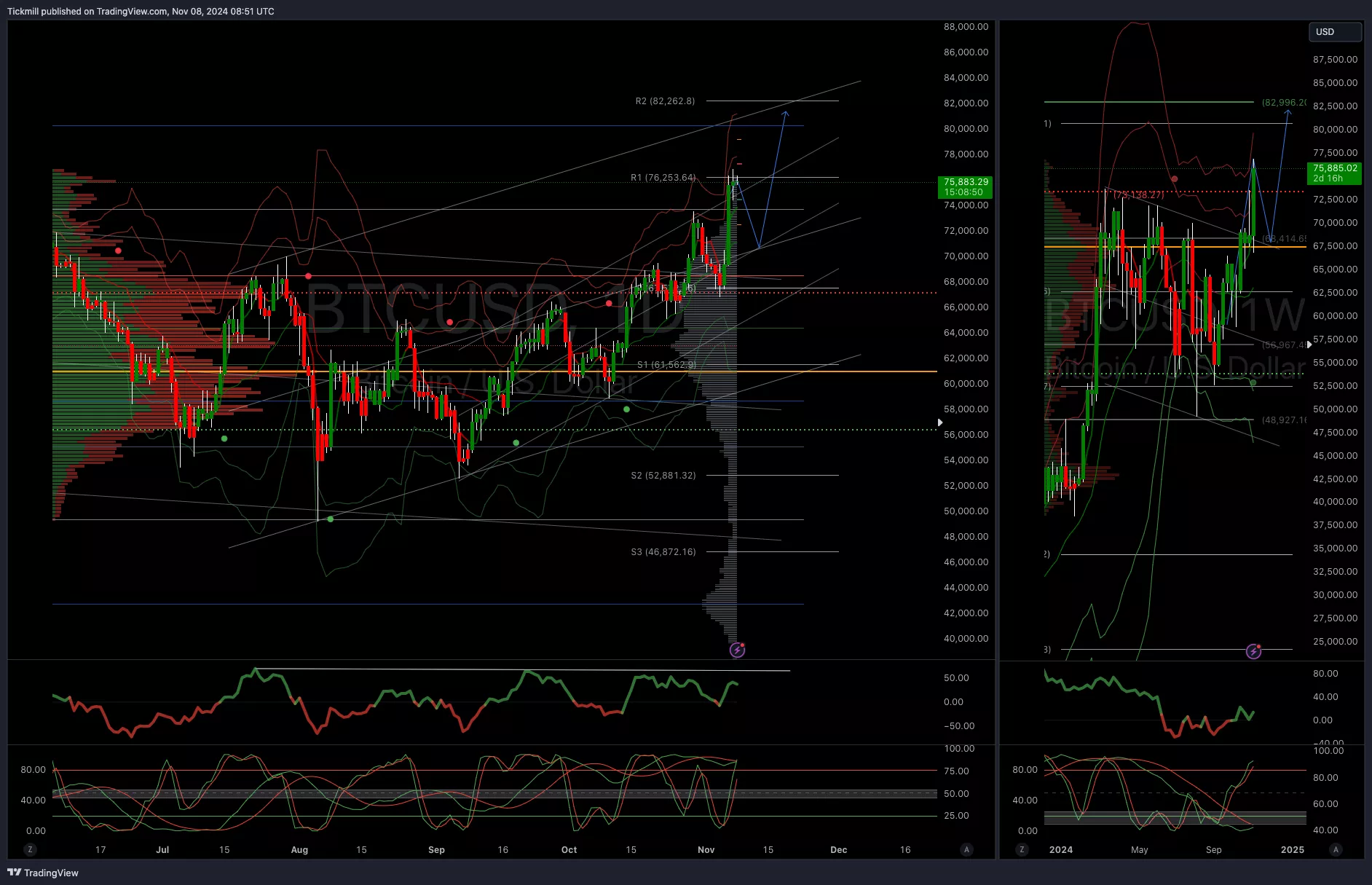

BTCUSD Bullish Above Bearish Below 71500

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 70000 opens 68000

- Primary support is 60000

- Primary objective is 80000

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Thursday, Nov. 7

FTSE Fades Into The Close After Surging On U.S. Election Outcome

Daily Market Outlook - Wednesday, Nov. 6