FTSE Fades Into The Close After Surging On U.S. Election Outcome

Image Source: Pexels

Wednesday's opening saw a sharp increase in U.K. markets as Donald Trump won 270 electoral votes and won the U.S. presidential election. Prime Minister Keir Starmer congratulated Trump on his "historic election triumph" and reaffirmed the United Kingdom's commitment to supporting the United States in upholding their common principles of democracy, freedom, and enterprise. After first rising towards 8300, the benchmark FTSE 100 index faded near the closing, turning red and losing 0.25% for the day.

In single stock stories, Persimmon Plc's shares dropped up to 5.4% to an over four-month low, the top percentage loser on the FTSE 100 index. The British home builder flags concerns about higher costs emerging in price negotiations for 2025, citing the impact of new building regulations and the employer national insurance increases announced in the recent UK budget. However, the company reports a 37% year-on-year rise in net private sales rate per outlet since the start of the second-half period on July 1. Currently, the stock is down around 5%, trimming its year-to-date gains to 0.7%.

Ashtead's shares rose 6.6% to a near 3-year high, leading the FTSE 100 index. Traders attribute the gain to the company's exposure to U.S. infrastructure and the dollar-based benefits from Trump's claimed victory in the U.S. presidential election. Ashtead is the second-largest equipment rental firm in the U.S., with operations in all 50 states, and the U.S. operations account for 86% of the group's total revenue. The stock has gained around 16% so far this year.

Lancashire Holdings, a non-life insurer, saw its shares jump 10.3% to 694p, reaching a new high in over a month. The stock was the top percentage gainer on the FTSE mid caps index. The company's gross premiums written rose by 9.0% year-over-year to $1.7 billion for the nine months ended September 30. Lancashire maintained its full-year return on equity outlook of 20% and expects its full-year combined ratio to be at the higher end of the mid-80% range it previously expected. The stock posted its biggest intraday percentage gain since March 2022, and including the session gains, the stock is up around 18%.

Technical & Trade View

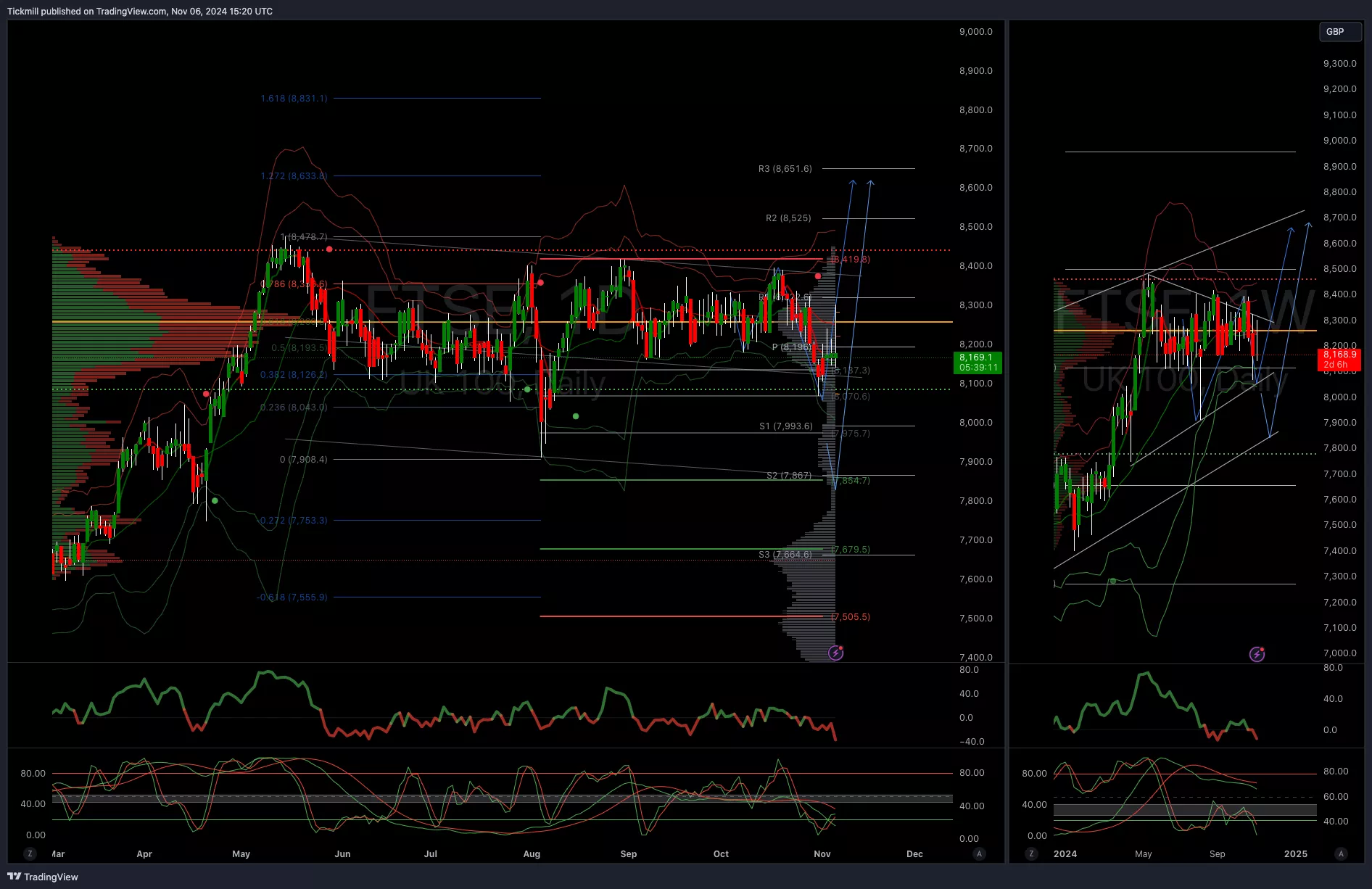

FTSE Bias: Bullish Above Bearish below 8225

- Primary support 8000

- Below 8000 opens 7855

- Primary objective 8600

- Daily VWAP Bullish

- Weekly VWAP Bearish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Wednesday, Nov. 6

FTSE Muted As Investors Eye The Pivotal U.S. Election Outcome

Daily Market Outlook - Tuesday, Nov. 5