Daily Market Outlook - Wednesday, Nov. 6

Image Source: Pixabay

The results of the US presidential election indicate that Trump will emerge victorious and the Republican Party will maintain control of the Senate. The New York Times' closely-watched 'swingometer' projected a 93% chance of Trump winning, while Treasury yields rose to four-month highs as some betting sites significantly favoured him. However, the House of Representatives is still too close to call. Four years after departing the White House, Trump has advanced to the brink of a remarkable political revival by defeating Democrat Kamala Harris in the battleground states of North Carolina, Georgia & Pennsylvania. The euro, yen, and antipodean currencies have experienced declines as a result of the 1.5% increase in the US dollar index, which is the largest increase since March 2020. The dollar's sharp increase against the offshore yuan prompted reports that Chinese banks were selling dollars to slow the yuan's decline. China is perceived as being at the forefront of tariff risk, and its currency is currently trading at a high level of uncertainty, with implied volatility against the dollar circling record highs. As investors anticipate a meeting of top policymakers in Beijing this week to sanction local government debt refinancing and spending, Chinese markets have declined from an almost one-month high.

European stock futures were less ebullient due to the potential for a global trade war and the threat to EU exports if Trump's tariff policies are implemented. Additionally, there was a possibility that Trump could disengage from NATO, which would necessitate an increase in defence expenditures in Europe and would also serve to strengthen Russia's territorial ambitions. Aside from US political developments, macro events that could potentially impact markets on Wednesday include: Services within the Eurozone Producer prices for September and PMIs for October. September industrial orders in Germany. Services provided by the United States PMI for October.

Overnight Newswire Updates of Note

- Trump Wins The Critical Battleground State Of Pennsylvania

- PBoC Affirms Supportive Monetary Policy

- Japan PM Ishiba Preps Meeting With Biden, China’s XI

- Japan PMI, Confidence Shrinks On Softer Sales

- UBS Pushes Back RBA First Rate Cut Forecast To May 2025

- NZ Unemployment Rate Rises Less Than Forecast

- Hong Kong Stocks Slide, Traders Pare Risky Bets

- US Stock, Yields Rise As Markets Await Election Outcome

- Nvidia Rides AI Wave Past Apple As World largest Company

- Crypto Surge To Record Levels On Early Trump Lead

- Spike In UK Borrowing Cost Wipes Out Fiscal Headroom

- (Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0650 (3.9BLN), 1.0700 (686M), 1.0725 (1.5BLN)

- 1.0750 (900M) 1.0800 (2.4BLN)

- USD/CHF: 0.8675 (241M), 0.8700 (1.4BLN), 0.8800 (289M)

- EUR/GBP: 0.8390-0.8400 (621M)

- GBP/USD: 1.3000 (331M)

- AUD/USD: 0.6475 (689M), 0.6510 (728M), 0.6525 (817M)

- AUD/NZD: 1.1010 (397M), 1.1100 (300M)

- USD/CAD: 1.3800 (555M), 1.3875 (420M), 1.4025 (267M), 1.4050 (442M)

- USD/JPY: 153.50 (728M), 155.65 (350M)

CFTC Data As Of 1/11/24

- Net USD G10 long +$8.88bn to +$18.7bn in Oct 23-29 IMM period; $IDX +0.13%

- EUR +0.17%: speculative positions decreased by 21.8k contracts, now at -50.3k, lower ECB view weighs on EUR

- JPY +1.55%; speculative positions decreased by 37.6k contracts, now at +25k, on hawkish Fed, less dovish BoJ

- GBP +0.27%; speculative positions decreased by 8.2k contracts, now at +66.4k; less-dovish BoE lends support. Note large sterling dip post-budget not accounted for in this report

- CAD +0.62%; speculative positions decreased by 26.9k contracts, now at -168k; shorts eyes July ATH -196k

- AUD -1.78%; speculative positions decreased by 163 contracts, now at +27.5k; for now RBA least dovish c.bank

- Equity fund managers cut S&P 500 CME net long position by 20,435 contracts to 1,045,389

- Equity fund speculators trim S&P 500 CME net short position by 12,576 contracts to 292,035

- Speculators increase CBOT US 10-year Treasury futures net short position by 52,992 contracts to 901,183

Technical & Trade Views

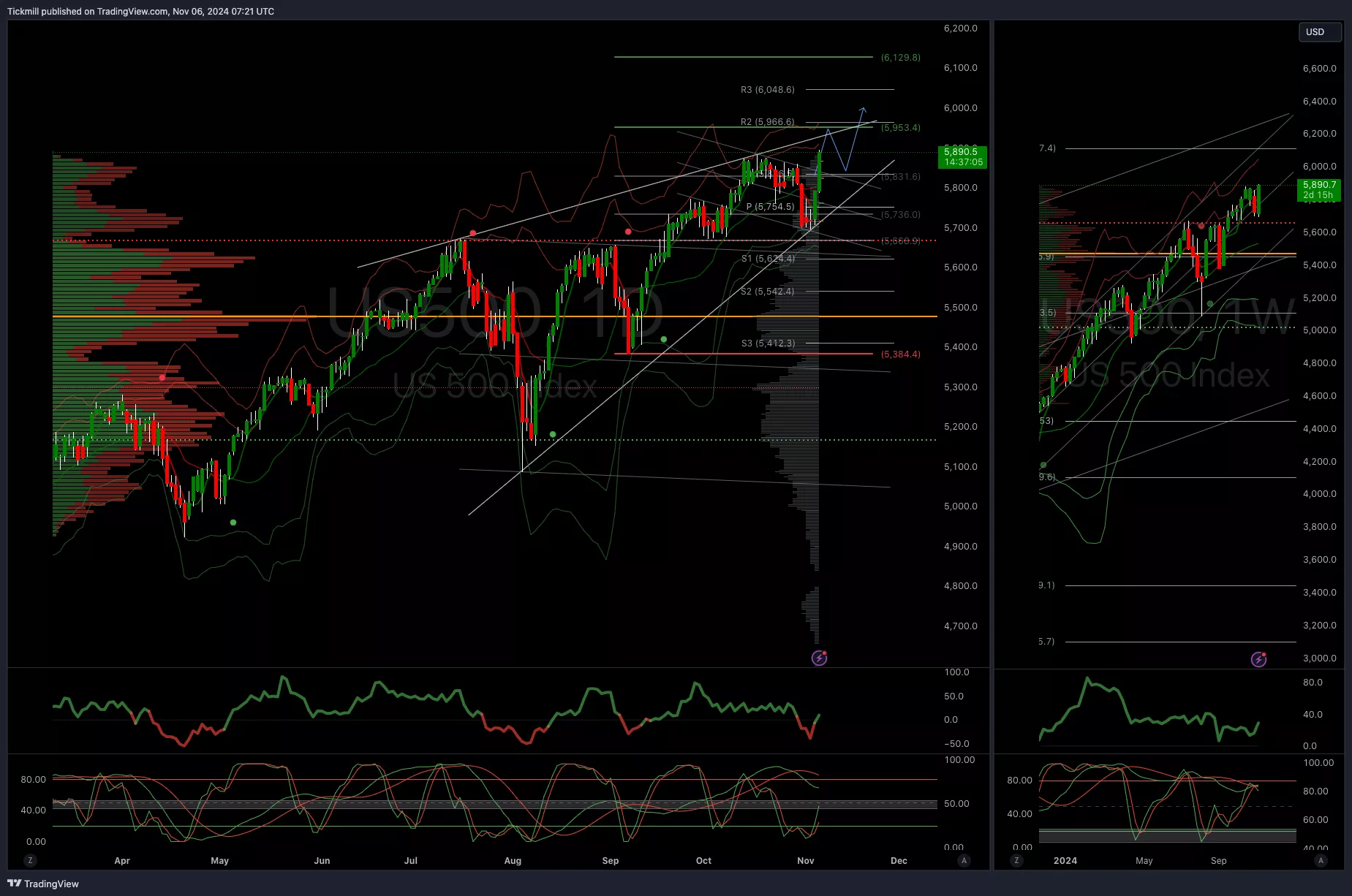

SP500 Bullish Above Bearish Below 5745

- Daily VWAP bearish

- Weekly VWAP bearish

- Below 5720 opens 5660

- Primary support 5660

- Primary objective 5950

(Click on image to enlarge)

EURUSD Bullish Above Bearish Below 1.09

- Daily VWAP bEARISH

- Weekly VWAP bearish

- Above 1.09 opens 1.0980

- Primary support 1.0750

- Primary objective 1.0750 - TARGET HIT NEW PATTERN EMERGING

(Click on image to enlarge)

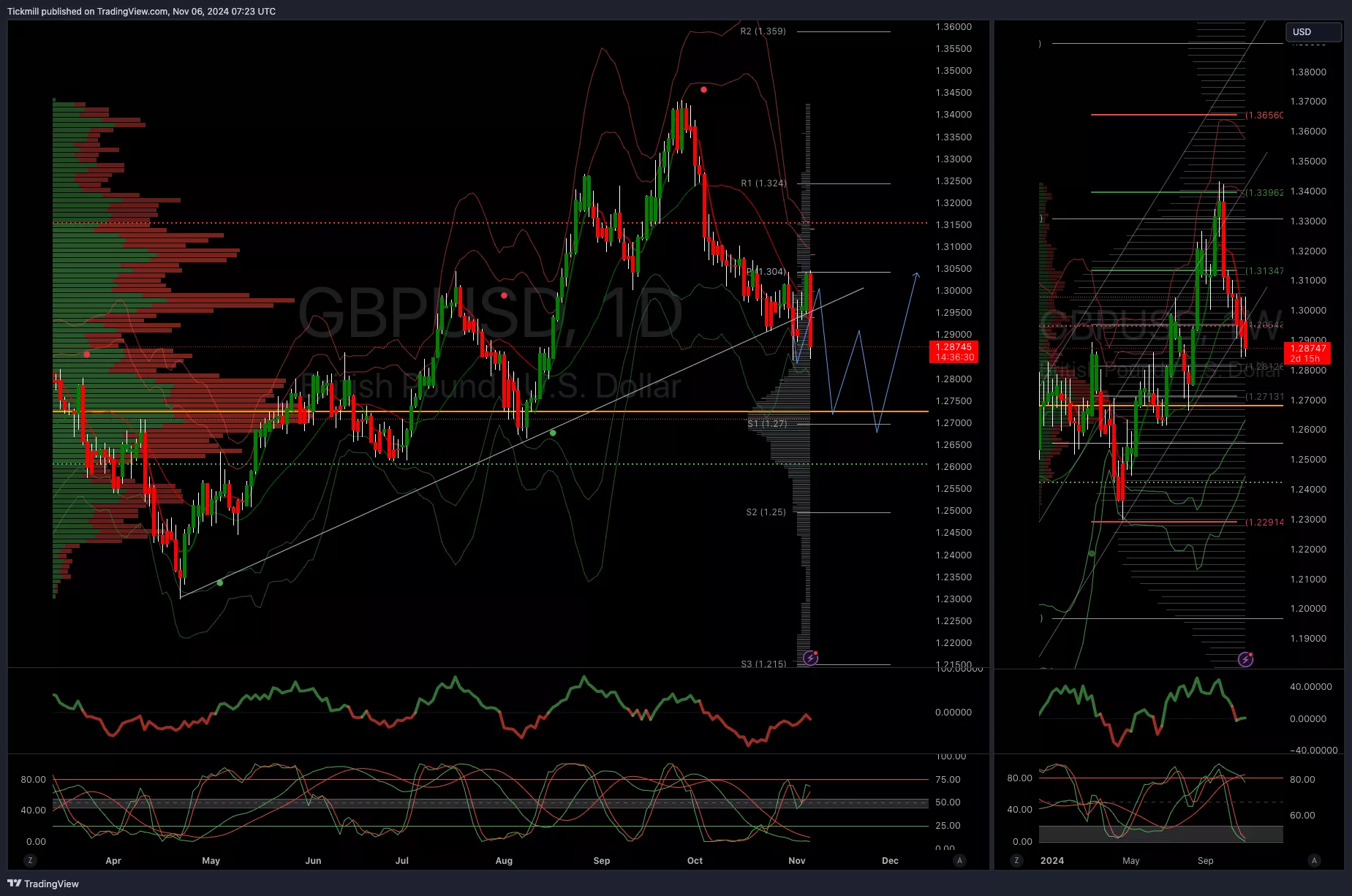

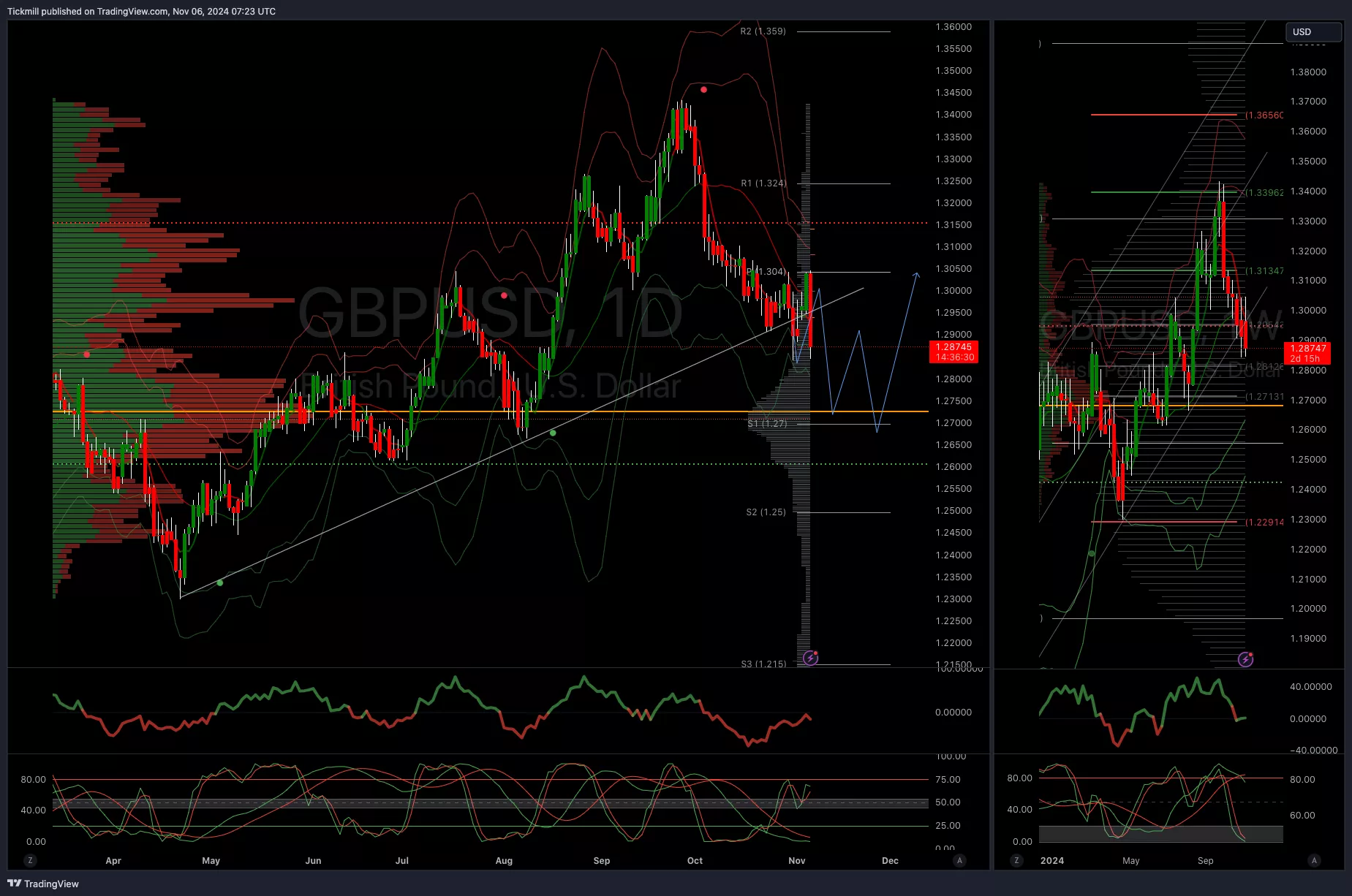

GBPUSD Bullish Above Bearish Below 1.3050

- Daily VWAP bEARISH

- Weekly VWAP bearish

- Below 1.29 opens 1.27

- Primary support is 1.29

- Primary objective 1.31

(Click on image to enlarge)

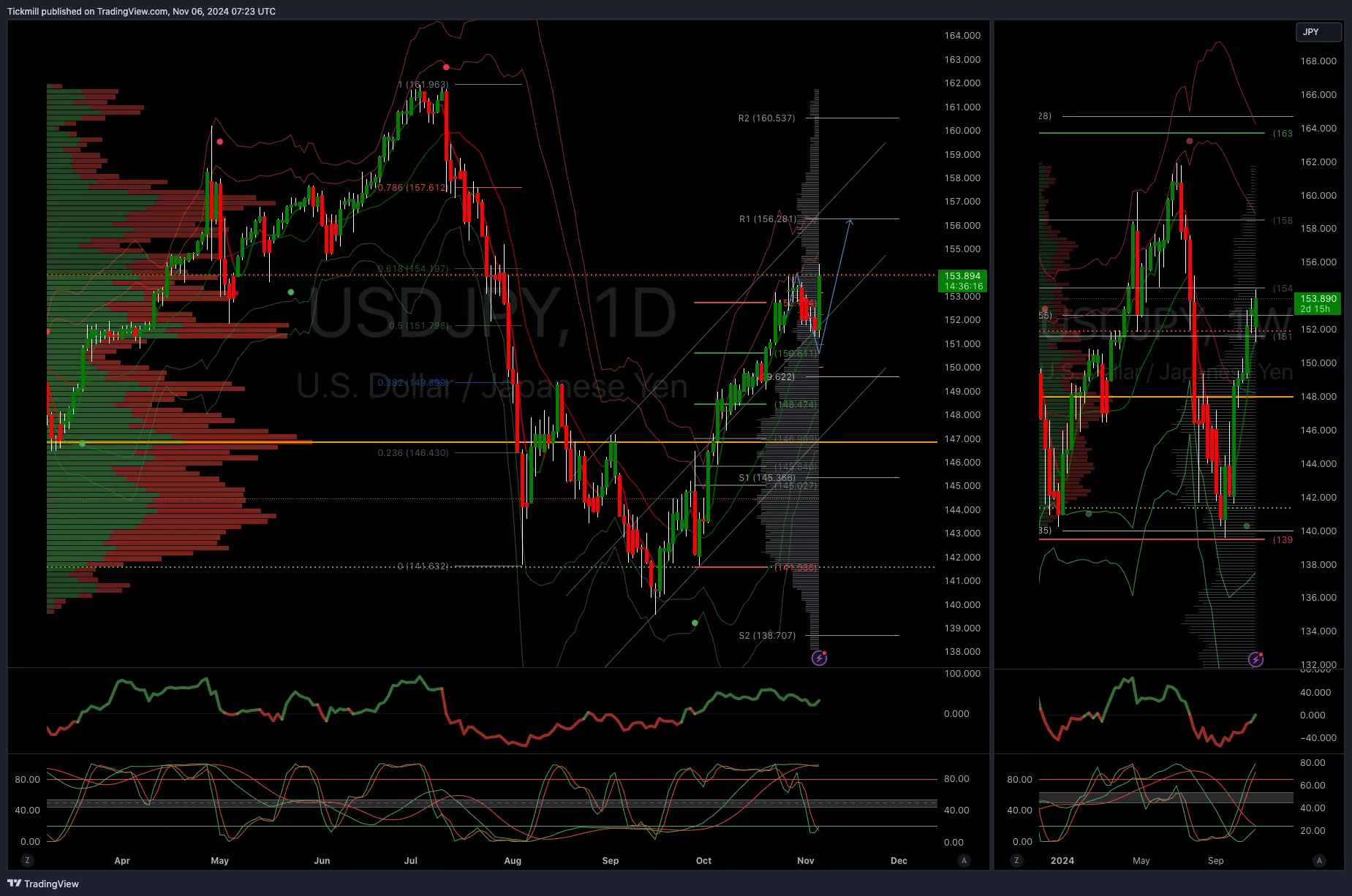

USDJPY Bullish Above Bearish Below 148

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 148 opens 144

- Primary support 148

- Primary objective is 156

(Click on image to enlarge)

XAUUSD Bullish Above Bearish Below 2680

- Daily VWAP bearish

- Weekly VWAP bullish

- Below 2670 opens 2600

- Primary support 2550

- Primary objective is 2800

(Click on image to enlarge)

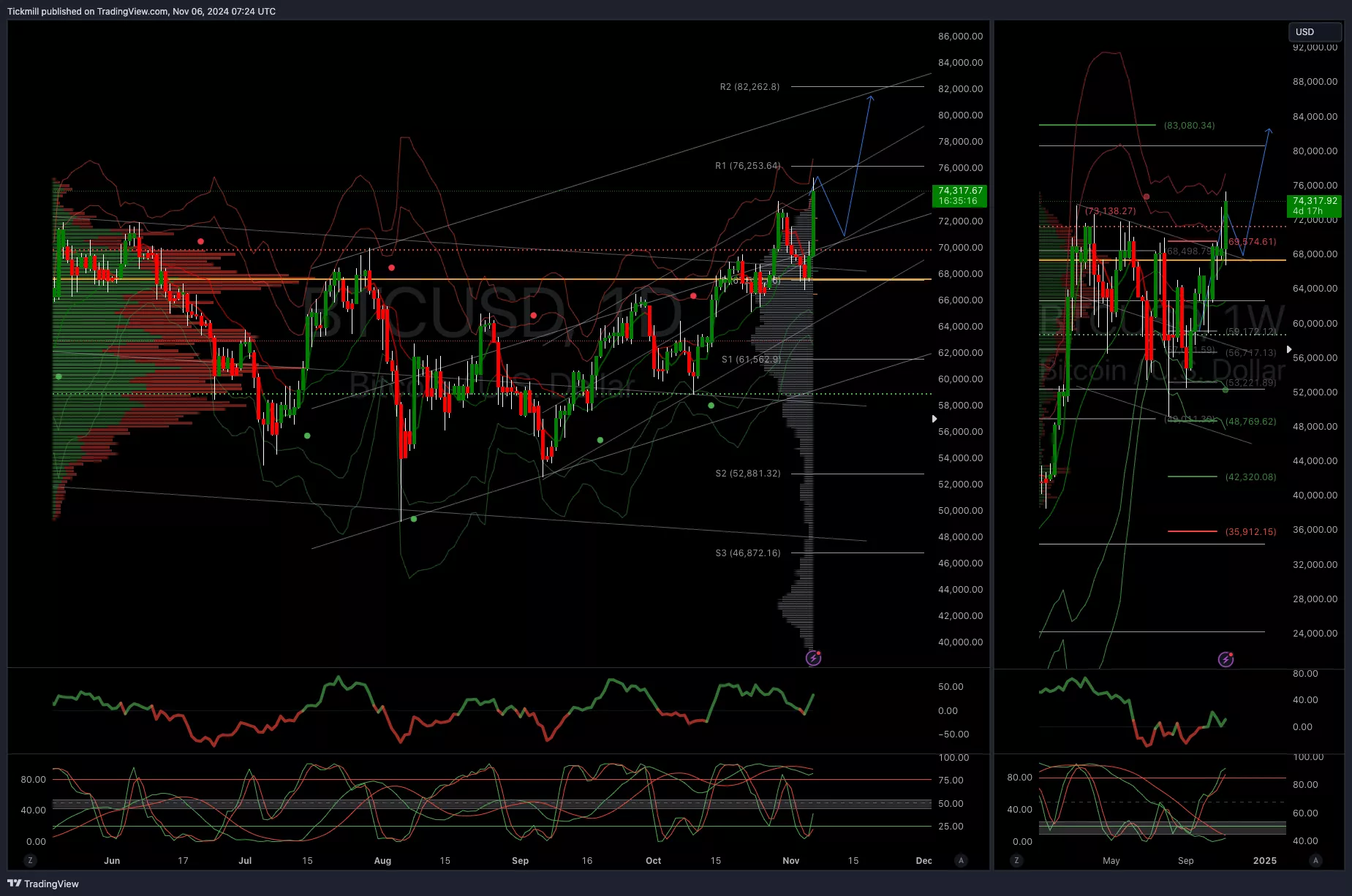

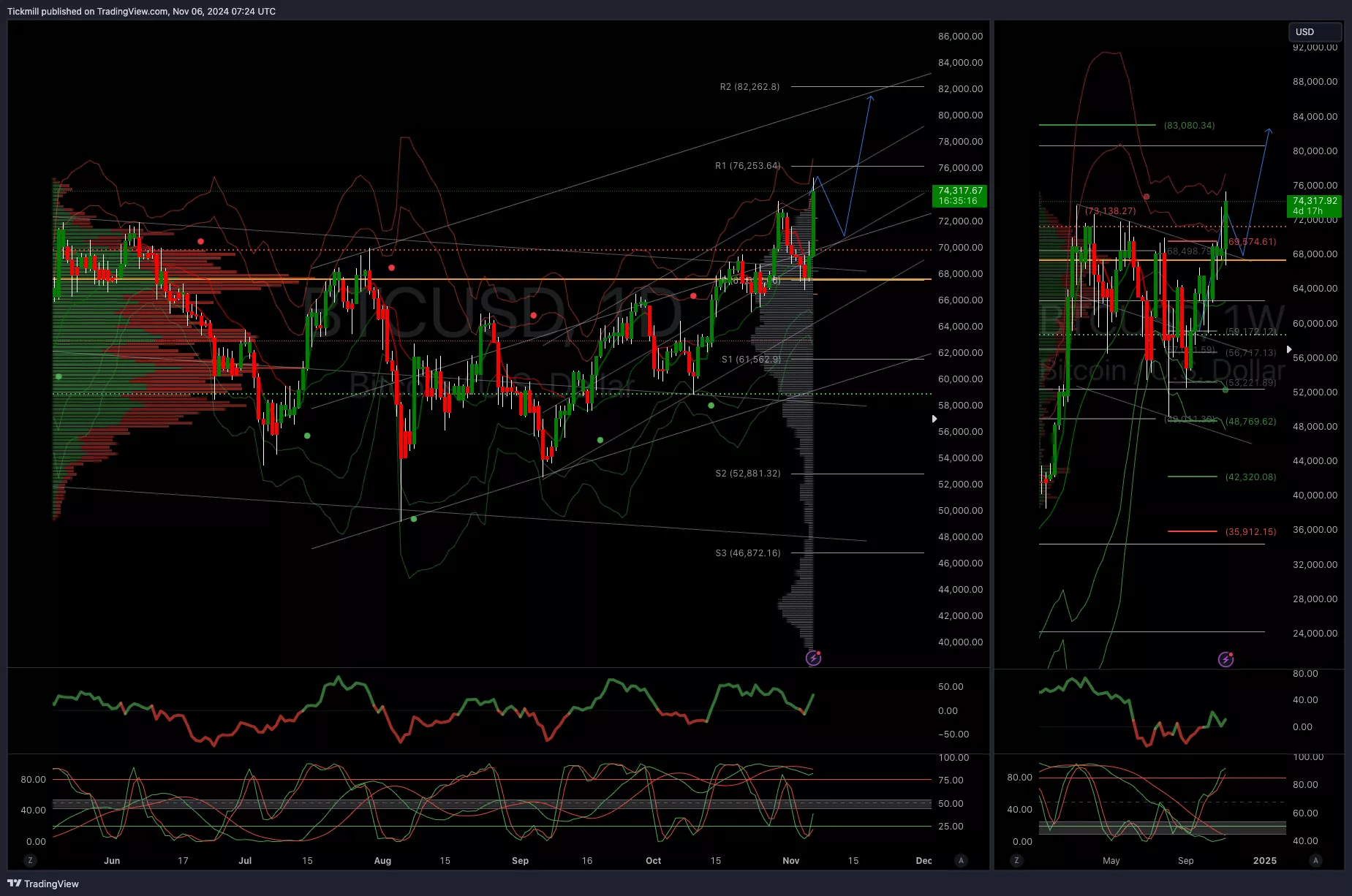

BTCUSD Bullish Above Bearish Below 69500

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 69000 opens 64000

- Primary support is 58000

- Primary objective is 80000

(Click on image to enlarge)

More By This Author:

FTSE Muted As Investors Eye The Pivotal U.S. Election Outcome

Daily Market Outlook - Tuesday, Nov. 5

FTSE Green Start To A Busy Week, NatWest At 3yr Highs On Broker Upgrade

As the US elections draw near, the financial markets are bracing for potential volatility, presenting both opportunities and challenges for traders. To help navigate this crucial period, we have ...

more