FTSE Green Start To A Busy Week, NatWest At 3yr Highs On Broker Upgrade

Image Source: Pexels

U.K. equities rose on Monday ahead of a busy week, with investors awaiting guidance from a U.S. presidential election and interest rate decisions from the Federal Reserve and Bank of England. After the nation's budget sparked fears about growing inflation pressures, the FTSE 100 and FTSE 250 indices saw weekly drops on Friday. Markets are expecting a 25 basis point rate drop when the Bank of England meets on Thursday to decide on interest rates. The October British PMI data, which is coming on Tuesday, and the anticipated house price data, which is due on Thursday, will be of particular interest to investors. The FTSE 100 benchmark index advanced 42 points, or 0.5%, to 8,219 after closing 0.8% higher on Friday. The heavyweight oil and gas sector increased by 1.5% as oil prices rose more than 2% after OPEC+ decided to delay increasing output by a month.

In single stock stories Anglo American's shares rise by 1.5% after the company announces the sale of its 33.3% minority stake in the Jellinbah Group, which owns a 70% interest in the Jellinbah East and Lake Vermont steelmaking coal mines in Australia, to Zashvin Pty Ltd for A$1.6 billion ($1.05 billion). Zashvin is an existing 33.3% shareholder in Jellinbah. Anglo American's stock is up 21.6% year-to-date.

As one of the top gainers on the FTSE midcaps index, Burberry's share price is up 3.3% after rising as much as 8% to 876.6 pence, the highest level since July 12. After dropping as much as 1.5% earlier, Moncler's shares are currently essentially steady at 50.8 euros. According to a media source, Moncler is thinking about putting in a bid for Burberry. According to Moncler, it would not address "unsubstantiated" rumours. According to a trader headquartered in Milan, Moncler might be considering Burberry, but Burberry is struggling, therefore Moncler will need to clarify the synergies they hope to accomplish. Moncler's share price has dropped 9.4% so far this year, while Burberry's has dropped over 41%.

In broker updates shares of Natwest Group rise as much as 3.7%, their highest since May 2011, leading the FTSE 100 index in percentage gains. Peel Hunt analysts raise their target price on NWG to 450p from 410p while maintaining a "buy" rating, citing the company's current momentum, scale of earnings upgrades, profitability, and low direct exposure to some UK legal and regulatory issues affecting other lenders. The stock is up 3%, pushing its year-to-date gains to around 76%.

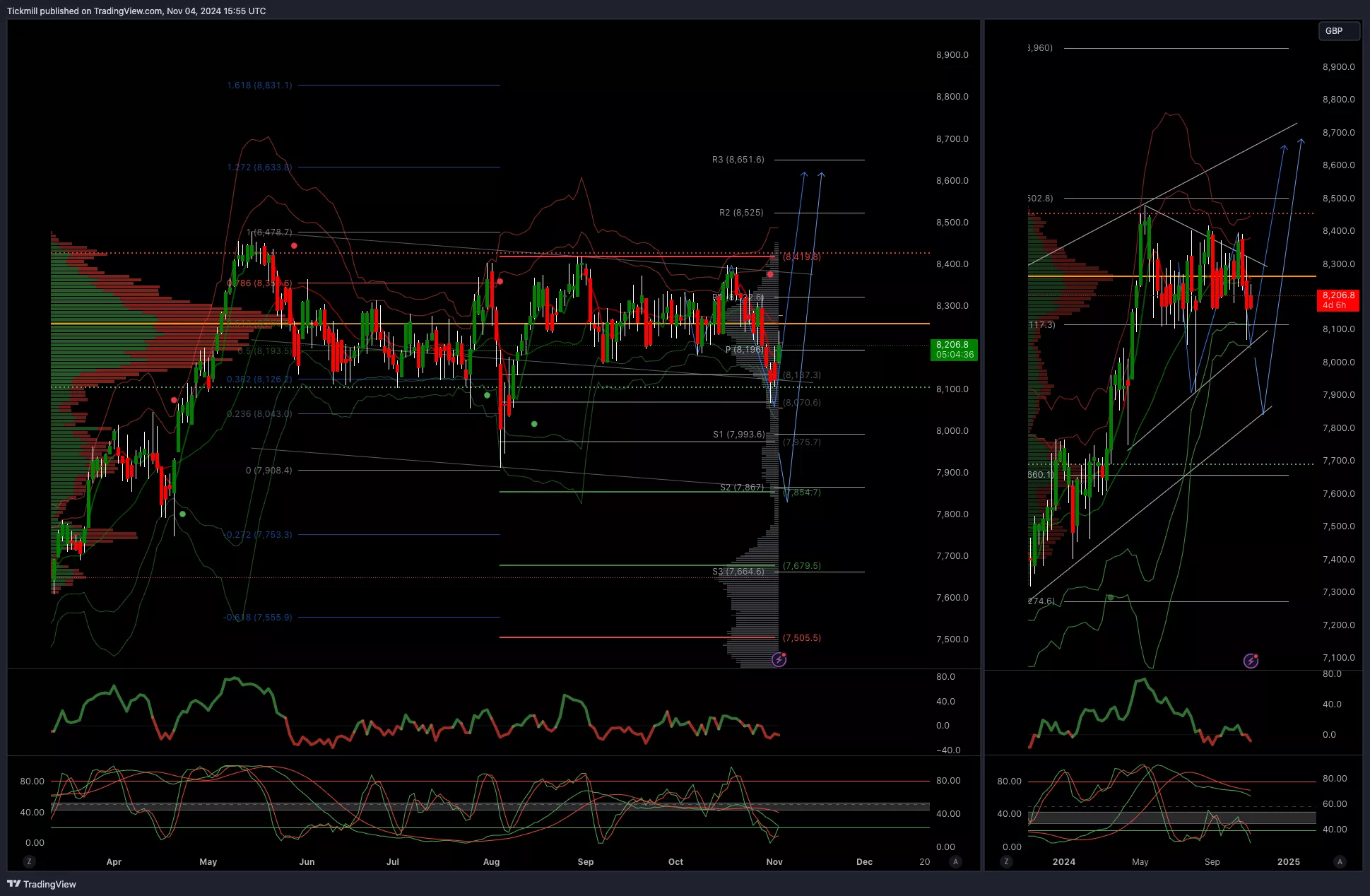

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

- Primary support 8000

- Below 8000 opens 7855

- Primary objective 8600

- Daily VWAP Bullish

- Weekly VWAP Bearish

(Click on image to enlarge)

More By This Author:

S&P 500 Weekly Action Areas & Price Objectives

Daily Market Outlook - Monday, Nov. 4

FTSE Recovers From Three Month Lows