Daily Market Outlook - Monday, June 30

Image Source: Unsplash

US stock-index futures rose, and Asian markets increased as progress in various trade talks enhanced investor confidence. Asian markets saw an uptick, with the Nikkei-225 gaining 1.1% after Japan's chief negotiator prolonged his stay in the US for additional discussions. The Canadian dollar gained strength after Canada cancelled its digital services tax to facilitate negotiations with the US. The dollar index fell as the Senate continued discussions regarding President Donald Trump's $4.5 trillion tax-cut proposal. The Dollar Index had its worst start to a year since at least 2005. Crude oil prices declined by 0.5% as traders reduced risk premiums ahead of the OPEC+ meeting. Treasury yields edged lower. US stocks reached a new all-time high on Friday for the first time since February, demonstrating confidence that the economy can withstand policy uncertainties. In April, Trump temporarily halted tariffs on numerous trade partners for three months, providing a boost to stock prices. An index of Asian stocks is projected to rise over 4% for a second consecutive month as investors overlook tariff concerns and recent Middle Eastern tensions. Canada retracted its digital services tax on tech firms to revive discussions with the US. Prime Minister Mark Carney and Trump have agreed to restart negotiations with the aim of reaching an agreement by July 21.

US economic growth will take centre stage this week, with the release of the jobs report and ISM indices. Globally, key data will include flash CPIs from Europe and PMIs from China. A major event in monetary policy will be the ECB's forum on central banking in Sintra, featuring leaders from the Fed, ECB, BoJ, and BoE. In the US, the June jobs report, set for release on Thursday ahead of the Independence Day holiday on Friday, when markets will be closed, will be a critical data point. US economists forecast payroll growth at +125k, down from +139k in May. The unemployment rate is expected to hold steady at 4.2%, while hourly earnings growth is projected to slow to +0.3% (from +0.4%). Leading up to the jobs report, additional labour market updates include the May JOLTS report on Tuesday and the ADP employment report on Wednesday. Attention will also focus on the June ISM indices, with the manufacturing index due Tuesday and the services index on Wednesday. Following last week’s stronger-than-expected flash PMIs, US economists anticipate the manufacturing gauge to rise to 49.5 (from 48.5 in May) and the services index to increase to 52.0 (from 49.9). Other notable US data releases next week include May’s international trade balance and factory orders, both scheduled for Thursday.

The ECB's forum on central banking in Sintra, running from June 30 to July 2, will be a key event in monetary policy. A policy panel on Tuesday will feature central bank leaders from the Fed, ECB, BoJ, BoE, and BoK. Additionally, the ECB will release the account of its June policy meeting on Thursday, alongside the central bank's consumer expectations survey set for Tuesday. In the UK, the BoE will publish its DMP, bank liabilities, and credit conditions surveys on Thursday. In Europe, June CPI data will remain in focus following slight inflation increases reported for France and Spain. Germany and Italy will release their CPI figures on Monday, with the Eurozone-wide data due Tuesday. Switzerland’s CPI report is scheduled for Thursday. Other economic activity indicators in the region include factory orders (Friday), Italy’s retail sales (Friday), and France’s industrial production (Friday).

Overnight Headlines

- Trump: No Plan To Extend July 9 Tariff Deadline

- Senate Races To Pass Trump’s $3T Tax Bill Before Deadline

- Fed Cut Bets Build As Bond Traders Extend Rally

- UK Ministers’ Welfare Reform Concessions Fail To Quash Rebellion

- UK Business Confidence Levels Hit Highest Since 2015, Lloyds Says

- European Companies Look To France For Domestic Rare Earths Sector

- PBoC Signals Less Urgency On RRR, Interest Rate Cuts

- China May Issue More Ultra-Long Bonds To Support Growth

- China’s Mfg Activity Contracts For Third Month Amid Deflation Woes

- Canada Rescinds Digital Services Tax To Advance US Trade Talks

- Trump Signals Iran Sanctions Relief Possible If Peaceful

- Oil Risk Premium Recedes Ahead Of OPEC+ Supply Decision

- Tesla Completes First Driverless Vehicle Delivery To Customer

- Nvidia Insiders Dump Over $1B In Stock Amid Record High

- Stablecoin Frenzy Drives Steep Stock Gains, Triggers Caution

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1650 (3.2BLN), 1.1675 (653M), 1.1700 (2.4BLN), 1.1720 (662M)

- 1.1750 (1.7BLN), 1.1775 (1BLN), 1.1800 (1.4BLN), 1.1850 (930M)

- USD/CHF: 0.8000 (2BLN), 0.8100 (290M)

- EUR/GBP: 0.8550-55 (253M), 0.8600 (282M)

- GBP/USD: 1.3600 (1BLN)

- AUD/USD: 0.6500-05 (340M), 0.6540 (212M) , 0.6620-25 (574M)

- USD/CAD: 1.3600 (800M), 1.3650 (798M), 1.3675 (400M), 1.3690-1.3705 (1.6BLN)

- USD/JPY: 143.65 (640M), 143.85 (1.1BLN), 144.00 (661M), 145.00 (720M)

CFTC Positions as of the Week Ending June 20th

- Speculators have raised the net short position in CBOT US 5-year Treasury futures by 20,348 contracts, reaching 2,463,629. They have also reduced the net short position in CBOT US 10-year Treasury futures by 72,768 contracts, bringing it down to 680,131. The net short position for CBOT US 2-year Treasury futures has increased by 63,807 contracts, totaling 1,230,204. In CBOT US UltraBond Treasury futures, the net short position is up by 19,812 contracts, now at 209,526. Additionally, the net short position for CBOT US Treasury bonds futures has increased by 27,610 contracts, amounting to 101,785.

- Equity fund speculators have decreased their net short position in the S&P 500 CME by 50,029 contracts to 269,039, and equity fund managers have lowered their net long position by 1,646 contracts to 841,226.

- The net FX long positions: Japanese yen at 132,277 contracts, Euro at 111,135 contracts, British pound at 34,395 contracts, while the Swiss franc has a net short position of -20,944 contracts and Bitcoin holds a net short position of -2,161 contracts.

Technical & Trade Views

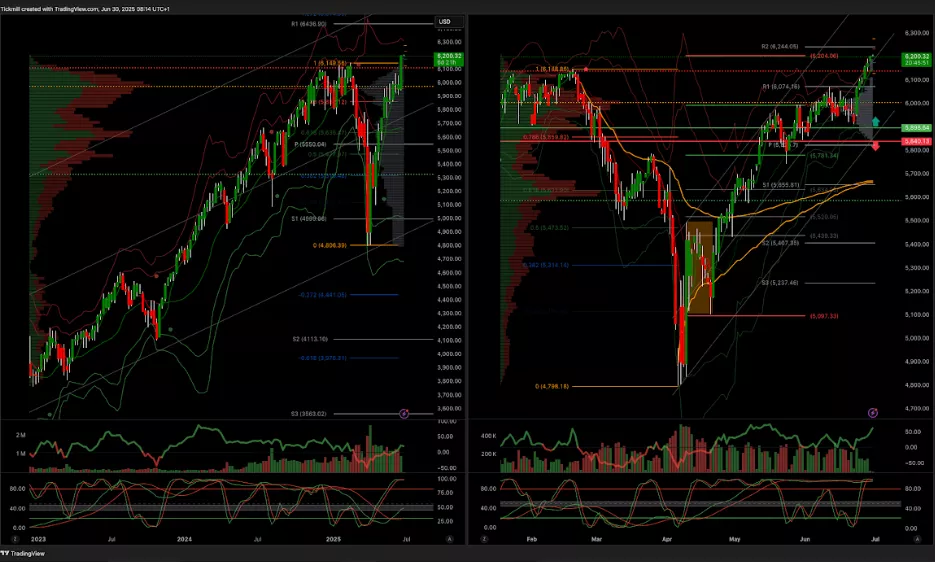

SP500 Pivot 5900

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 5900 target 6100

- Below 5800 target 5700

(Click on image to enlarge)

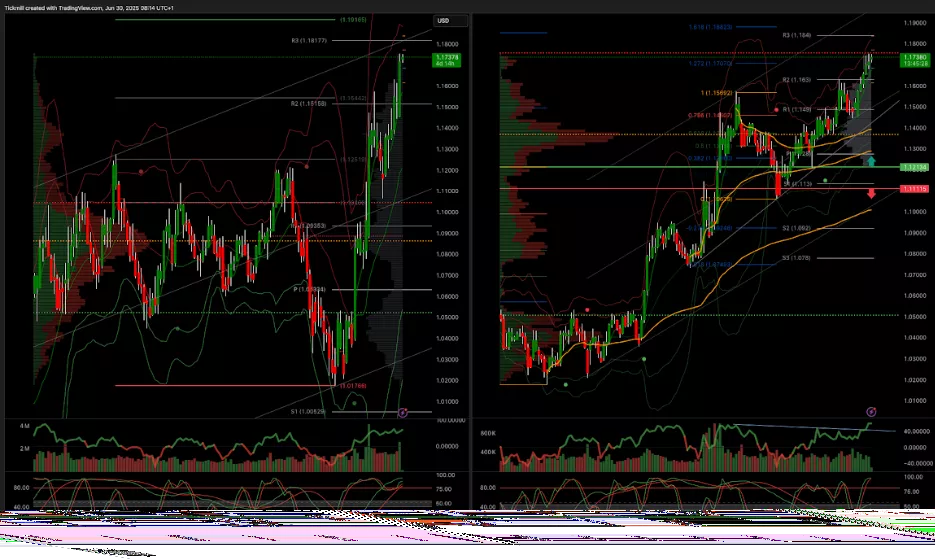

EURUSD Pivot 1.12

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.11 target 1.19

- Below 1.11 target 1.0950

(Click on image to enlarge)

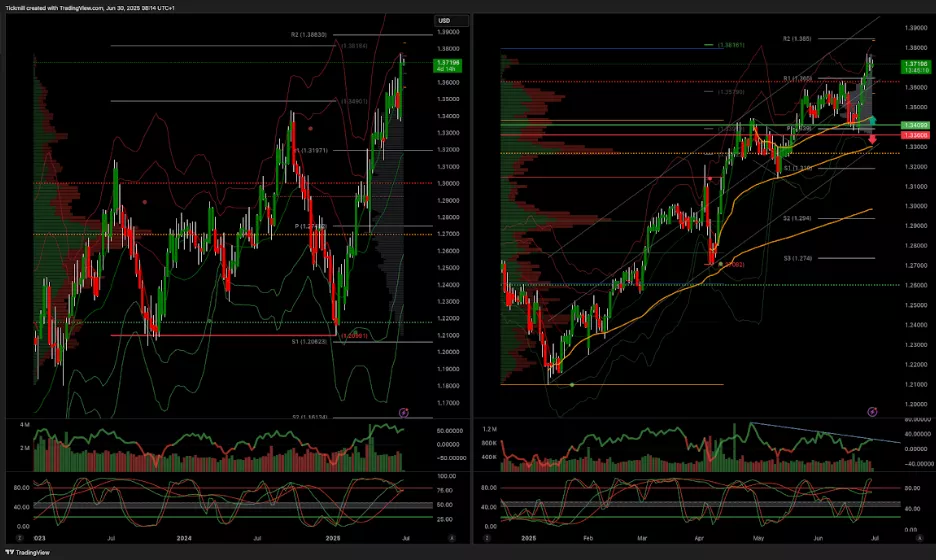

GBPUSD Pivot 1.34

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 1.34 target 1.38

- Below 1.3350 target 1.32

(Click on image to enlarge)

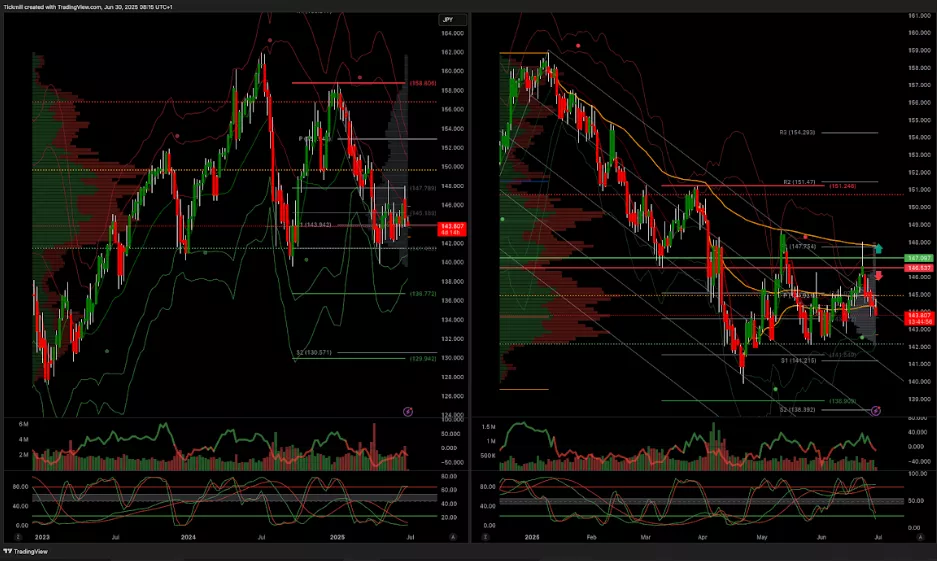

USDJPY Pivot 147

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 147.10 target 148.26

- Below 146.53 target 139

(Click on image to enlarge)

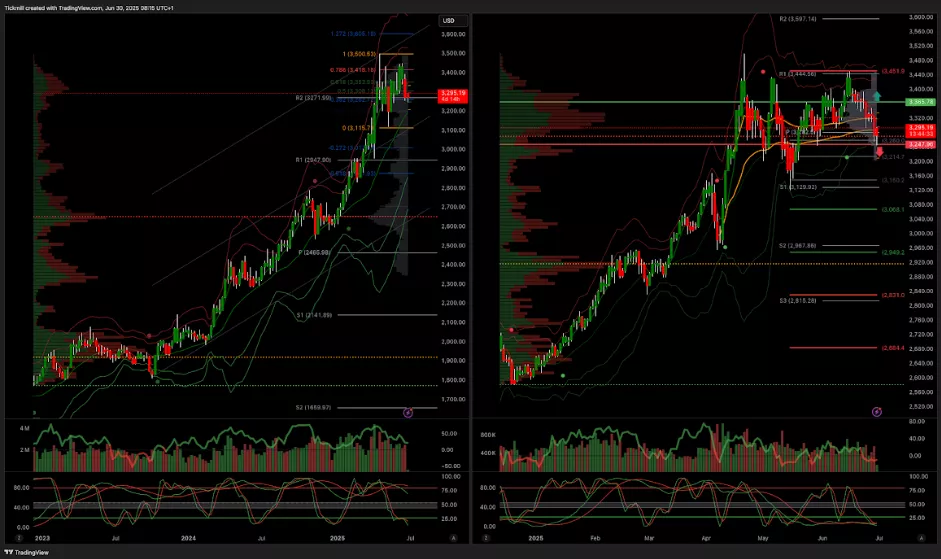

XAUUSD Pivot 3365

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 3410 target 3600

- Below 3240 target 3000

(Click on image to enlarge)

BTCUSD Pivot 105k

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 105k target 118k

- Below 98.3K target 95.5k

(Click on image to enlarge)

.webp)

More By This Author:

The FTSE Finish Line - Friday, June 27

Daily Market Outlook - Friday, June 27

Daily Market Outlook - Thursday, June 26