Daily Market Outlook - Thursday, June 26

Image Source: Pixabay

In Asia, the MSCI broad index of regional stocks gained approximately 0.5%, while US equity futures posted modest increases. Tech stocks saw support from Nvidia’s overnight rally, which propelled the chipmaker's shares to an all-time high. Meanwhile, oil prices rose for a second straight day as investors navigated a fragile ceasefire in the Middle East. Despite this stabilisation, market sentiment remains cautious, with Russia signalling openness to another production increase at the upcoming OPEC+ meeting. Overnight, the dollar weakened, and Treasury yields edged lower amid speculation of a more dovish Federal Reserve chair. The move followed reports suggesting President Donald Trump is considering an early nomination for the next Fed chair, with the leading candidates favouring more market-friendly policies. The DXY index fell to its lowest level since April 2022, with notable declines against the Japanese yen and Taiwanese dollar. Treasury yields dropped across all major maturities, with the 10-year yield slipping by two basis points to 4.27%. The Wall Street Journal reported that Trump might announce a successor to Fed Chair Powell as early as September or October, an unusually early move that could establish a shadow Fed chair, potentially shaping market sentiment. The news has fuelled expectations of earlier-than-anticipated US interest rate cuts. The dollar index, which tracks the currency against six other currencies, has fallen 10% this year and is poised for a sixth consecutive month of losses. The last time it experienced a stretch like this was in 2017. Although the "sell America" narrative has diminished somewhat recently, as shown by U.S. stocks reaching all-time highs, investors are still concerned about the dollar and the potential impact of Trump's tariff policies. With the July 9 deadline for trade agreements approaching, Trump's tariffs are re-emerging on the markets' radar.

Domestically, the UK government appears set for a challenging summer as it works towards delivering a credible Autumn Budget. Implementing spending cuts has become as much a political challenge as it is a fiscal one, with significant resistance evident. Over 100 Labour MPs have signed an amendment opposing proposed cuts to the welfare budget, following a recent reversal on the winter fuel allowance. The evidence demonstrates that the government is either unable or unwilling to push through substantial spending cuts necessary to rebuild fiscal headroom. As a result, tax increases seem increasingly likely. However, reports suggest a reconsideration of tax policy, particularly on the ‘non-dom’ issue, due to concerns over potential Laffer Curve effects. Targeting the ‘big three’ taxes—income tax, National Insurance, and VAT—would come with significant political risks, especially given existing manifesto commitments. What options remain? Any move away from spending cuts would likely lead to adjustments in fiscal rules, which could provoke a strong reaction from the gilt market, potentially as intense as the backlash from backbenchers over welfare cuts. The dilemma persists: if the Office for Budget Responsibility (OBR) uses a consensus growth forecast, the government may be able to deliver a Budget that satisfies either its MPs or gilt investors, but not both. Resolving this issue remains a key source of potential market volatility.

Overnight Headlines

- Trump Considers Naming Next Fed Chair Early To Undercut Powell

- Fed Unveils Plans To Roll Back Post-2008 Capital Rules

- Trump: US May Speak To Iran Next Week, Possible Nuclear Deal

- NATO Commits To Historic Rearmament Shift Amid Trump Pressure

- Trump Says Spain Will Pay More After NATO Target Refusal

- China’s CIC Fund Retreats From US As Decoupling Deepens

- China Opens First Offshore Gold Vault In Hong Kong

- FHFA Orders Fannie, Freddie To Treat Crypto As Mortgage Asset

- Pentagon Posts 2026 Weapons Requests As Defence Focus Grows

- Debate On US AI Regulation Tied To Broadband Funding

- Nvidia Hits Record High On Fresh AI Optimism

- Meta Poaches Three OpenAI Researchers As AI Race Heats Up

- Micron Reports Earnings Beat, Issues Strong Forecast

- Couche-Tard Misses Estimates On Lower Fuel Prices, Demand

- Invesco, Galaxy File For Solana ETF Amid Crypto Policy Shifts

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1600 (6.7BLN), 1.1625 (1.4BLN), 1.1640-50 (1.9BLN)

- 1.1675-80 (1.1BLN), 1.1700 (5.4BLN)

- USD/CHF: 0.7900 (350M), 0.8235 (1BLN),

- EUR/GBP: 0.8560 (478M), 0.8575 (202M)

- GBP/USD: 1.3600 (544M), 1.3650 (326M), 1.3670 (533M), 1.3700 (591M)

- AUD/USD: 0.6445-50 (1.4BLN), 0.6500 (2.7BLN), 0.6550 (502M)

- NZD/USD: 0.6040 (612M). AUD/NZD: 1.0800 (863M), 1.0850 (491M)

- USD/CAD: 1.3715 (910M), 1.3725 (288M), 1.3735 (916M)

- USD/JPY: 144.50 (284M), 144.95-145.00 (523M), 146.00 (469M)

CFTC Positions as of the Week Ending June 20th

- Speculators reduced their net short position in CBOT US Treasury bonds futures by 22,628 contracts, bringing the total to 79,745.

- They also trimmed their net short position in CBOT US Ultrabond Treasury futures by 24,696 contracts, now at 203,747.

- Conversely, speculators raised their net short position in CBOT US 10-year Treasury futures by 18,845 contracts to a total of 724,101.

- Increased activity also occurred in CBOT US 5-year Treasury futures, with a 74,384 contract increase in the net short position, reaching 2,470,920.

- The net short position for CBOT US 2-year Treasury futures rose by 36,591 contracts to 1,180,516.

- Equity fund managers upped their net long position in the S&P 500 CME by 10,532 contracts, now totaling 825,013.

- Equity fund speculators raised their net short position in the S&P 500 CME by 31,419 contracts, bringing it to 316,744.

- The net long position for the Japanese yen stands at 144,595 contracts, while the euro's net long position is 93,025 contracts.

- The British pound's net long position is at 51,634 contracts, and the Swiss franc has a net short position of -21,268 contracts.

- Bitcoin has a net short position of -2,009 contracts.

Technical & Trade Views

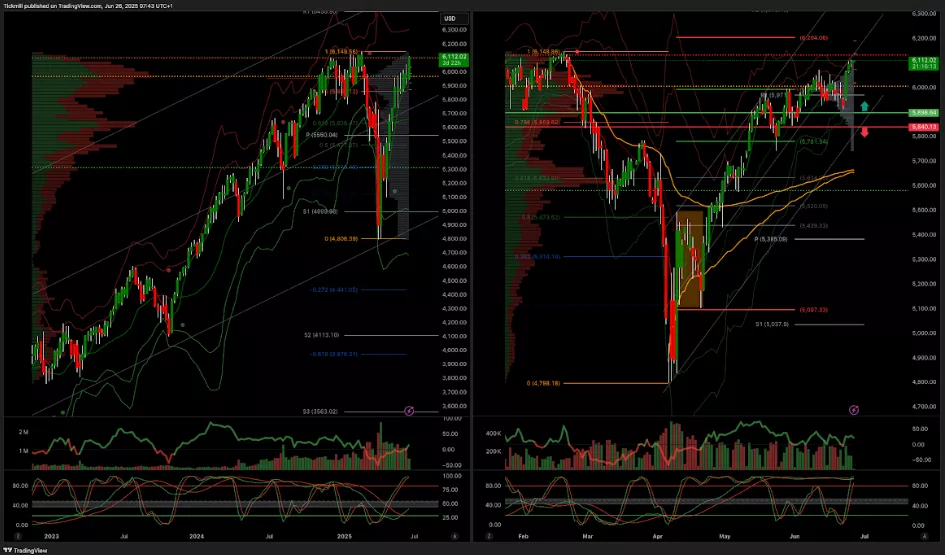

SP500 Pivot 5900

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 5900 target 6100

- Below 5800 target 5700

(Click on image to enlarge)

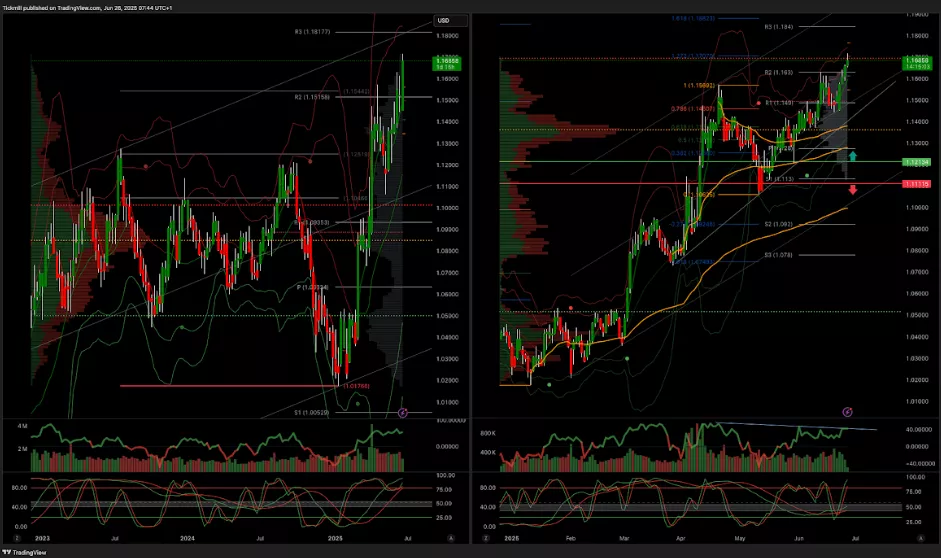

EURUSD Pivot 1.12

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.11 target 1.19

- Below 1.11 target 1.0950

(Click on image to enlarge)

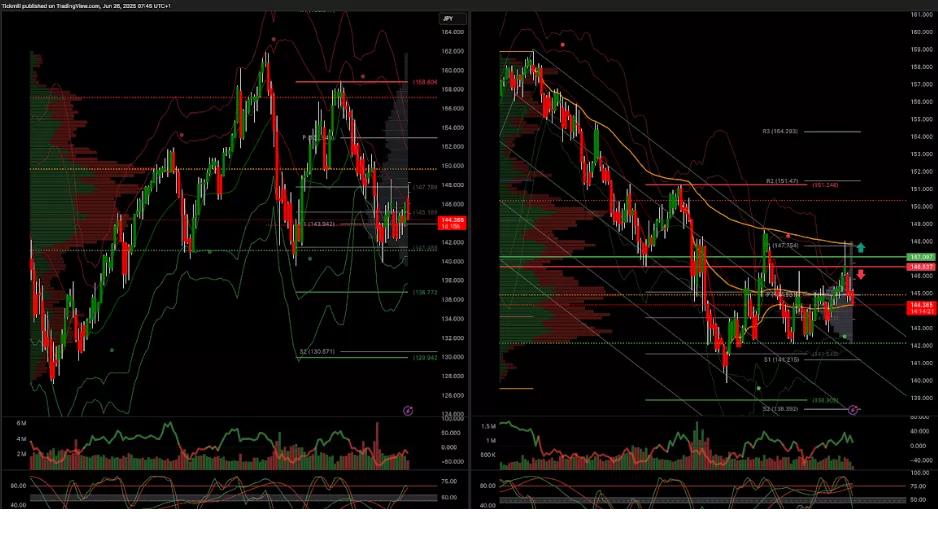

GBPUSD Pivot 1.34

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 1.34 target 1.38

- Below 1.3350 target 1.32

(Click on image to enlarge)

USDJPY Pivot 147

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 147.10 target 148.26

- Below 146.53 target 139

(Click on image to enlarge)

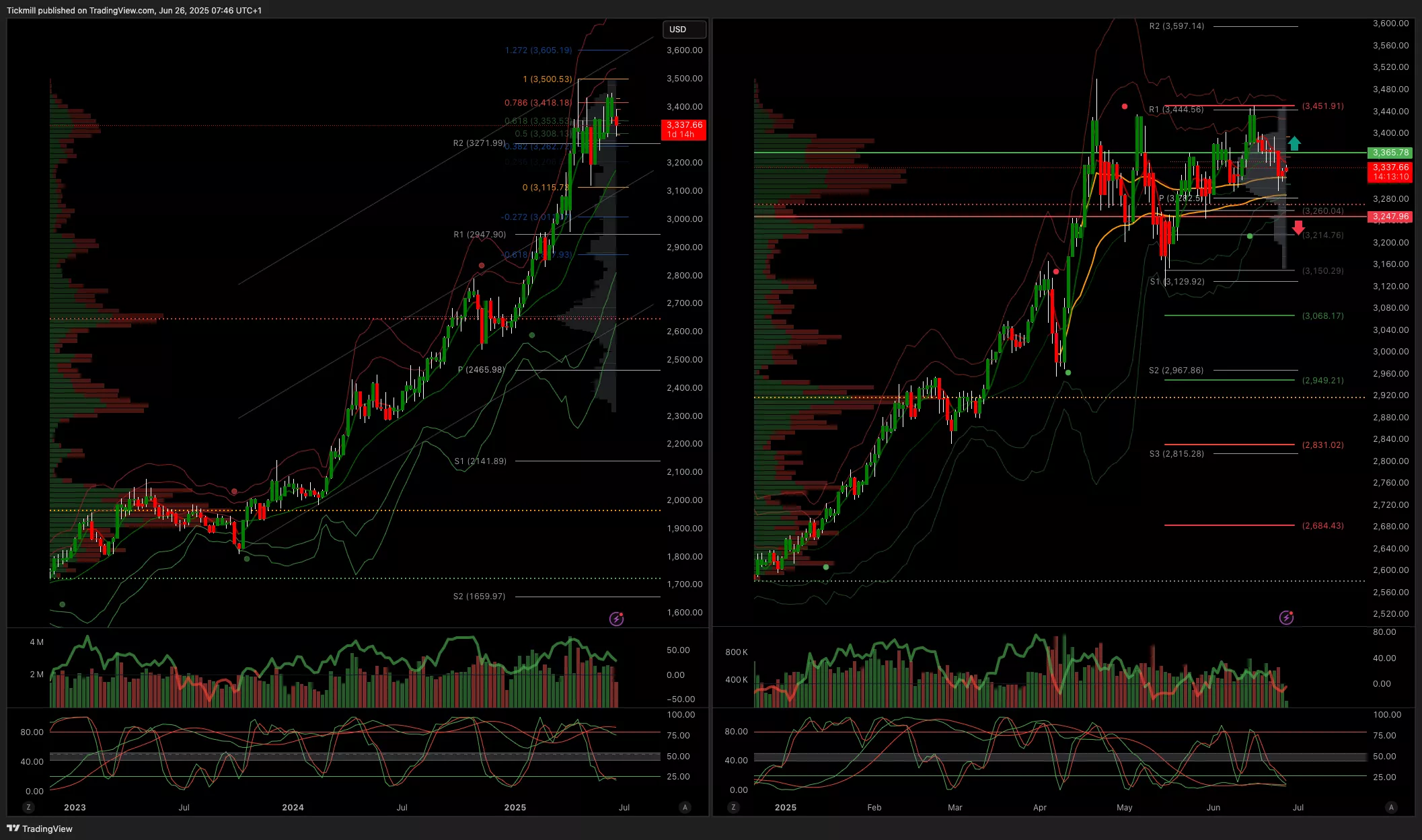

XAUUSD Pivot 3365

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 3410 target 3600

- Below 3240 target 3000

(Click on image to enlarge)

BTCUSD Pivot 105k

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 105k target 118k

- Below 98.3K target 95.5k

(Click on image to enlarge)

.webp)

More By This Author:

The FTSE Finish Line - Wednesday, June 25

Daily Market Outlook - Wednesday, June 25

The FTSE Finish Line - Tuesday, June 24