Daily Market Outlook - Friday, June 27

Image Source: Unsplash

Asian shares climbed, and a measure of global stocks was set for yet another record high, fuelled by optimism surrounding trade agreements and rising expectations for interest rate cuts by the Federal Reserve this year. Stocks in the Asia-Pacific region rose, reaching levels not seen since September 2021, after the S&P 500 increased by 0.8%, closing in on a record high. On Thursday, the Nasdaq 100 reached that milestone, which contributed to MSCI’s global shares index hitting a new peak. US stock futures showed a slight increase on Friday, while Japanese stocks saw gains, and South Korean stocks declined. US Commerce Secretary Howard Lutnick announced late Thursday that an agreement on trade had been reached between the US and China following discussions from the previous month. Additionally, the Treasury Department revealed a deal with G-7 allies that allows some US companies to be exempt from certain taxes imposed by other countries in exchange for withdrawing the “revenge tax” proposed in President Donald Trump’s tax legislation. Treasuries eased after having rallied on Thursday due to heightened expectations for Federal Reserve rate cuts. The swaps market has fully accounted for two additional rate reductions this year, with increased speculation of a third cut. The dollar index remained mostly stable after experiencing four consecutive days of decline. The movements observed on Thursday were influenced by US economic data that reinforced the case for policy adjustments. Consumer spending in the first quarter rose at the slowest rate since the pandemic began, resulting in a downward revision of the gross domestic product to an annualised decline of 0.5%. Ongoing claims for unemployment benefits reached their highest level since 2021, although initial claims decreased. A number of Federal Reserve officials indicated this week that it will take them a few more months to be assured that price increases driven by tariffs won’t lead to sustained inflation. Economists predict that the personal consumption expenditures price index, excluding food and energy, which the Fed prefers as a measure of core inflation, is expected to show the mildest three-month period since the pandemic began five years ago.

Domestically, attention is focused on the political rebellion confronting the UK government over its attempt to implement £4.8bn of annual welfare budget savings by 2029-30. As the day progressed, pressure mounted when it became clear that the rebels would prevail in next Tuesday’s vote, forcing the Prime Minister to back down. Reports from last night indicate that the concessions made by Starmer to avoid defeat are significant and could slash the planned Treasury savings by approximately half. The material impact of this U-turn is subject to debate. On one hand, some argue the entire package represents only about 0.3% of government spending. On the other hand, the intended £4.8bn savings by 2029-30—now unlikely to be fully realised—constitute roughly 50% of the government’s fiscal headroom. However, focusing too much on precise cost predictions misses the larger issue. The key takeaway from this episode is the shift in power from Downing Street to the backbenches, with MPs making it clear they will not support spending cuts. This development significantly limits the government’s options for shaping the Autumn Budget. As a result, expectations are likely to solidify around the prospect of further tax increases to rebuild fiscal headroom. However, such measures will undoubtedly come with political consequences. The critical risk for market participants to monitor is whether the government, faced with the unpopularity of these measures, might reconsider its commitment to the current fiscal rules.

US inflation dynamics have appeared relatively stable recently, with gradual disinflation remaining the dominant trend, even though core inflation has proven somewhat more persistent. This trend is expected to continue in May, despite an unfavourable base effect likely to push year-over-year rates slightly higher. Lloyds’ economists project PCE inflation at 2.3% y/y, up from 2.1%, and core PCE at 2.6%, up from 2.5%. However, with modest 0.1% m/m increases anticipated for both, the overall picture remains relatively untroubling. The Federal Reserve’s primary concern is not the current pace of price changes but rather how tariffs might alter the inflation trajectory in the future. While Fed Chair Powell appears determined to wait for greater clarity before taking action, other committee members seem more confident that the economy can absorb these additional costs. Both approaches point toward eventual rate cuts, but the timing and pace of such adjustments remain critical factors. Weaker inflation data, or any indications of softening consumer activity—such as the downgraded Q1 spending figures and hints of a cooling labour market—could trigger a positive reaction in financial markets. Conversely, evidence of tariff-related cost pass-through, although likely premature at this stage, could complicate the outlook and exert pressure on more dovish policymakers.

Overnight Headlines

- BoE Urged To Curb Bond Sales Investors Say Could ‘Reignite’ Sell-off

- ECB Beat Inflation Without Heavy Economic Costs, Says Departing Hawk

- Von Der Leyen Says EU Will Be Ready If US Trade Talks Break Down

- EU Considers Lowering Tariffs On Imports In Effort To Woo Trump

- US Finalises China Tariff Deal To Expedite Rare Earth Exports

- Treasury Deal Kills ‘Revenge Tax’ That Spooked Wall Street

- Trump Has No Imminent Plans To Refill US Emergency Oil Reserve

- Trump’s Iran Oil Comments Strain ‘Maximum Pressure’ Policy

- Gold Heads For Weekly Loss As Middle East Truce Saps Demand

- Fed Cut Bets Grow As Yields Slide, Stocks Hit Record High

- Japanese Stocks Rally, Nikkei Hits 40,000 On Fed Bets

- Tokyo Inflation Eases As Energy Costs Cool Ahead Of Election

- Apple Adjusts App Store Rules Amid EU Pressure

- Meta Rival Google Hires Oracle’s Cloud CFO

- Tesla Splits With Top Executive, Longtime Musk Fixer

- Nike Misses On Profit, Revenue As Turnaround Strategy Plays Out

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1600 (1.8BLN), 1.1625 (570M), 1.1650 (1.5BLN), 1.1700 (888M)

- 1.1725 (346M), 1.1750 (300M), 1.1800 (900M)

- USD/CHF: 0.8075 (350M), 0.8100-10 (250M). EUR/CHF: 0.9360 (390M)

- GBP/USD: 1.3600 (1BLN). EUR/GBP: 0.8525 (383M), 0.8575 (226M)

- AUD/USD: 0.6500 (491M), 0.6570 (350M). AUD/NZD: 1.0800 (350M)

- USD/CAD: 1.3600 (1.2BLN), 1.3630-40 (1.7BLN), 1.3645-50 (1.1BLN)

- 1.3670-75 (700M), 1.3700-10 (837M)

- USD/JPY: 143.50-55 (732M), 143.75 (335M), 144.00 (355M), 144.50 (731M)

- 145.00 (775M). EUR/JPY: 168.00 (300M)

CFTC Positions as of the Week Ending June 20th

- Speculators reduced their net short position in CBOT US Treasury bonds futures by 22,628 contracts, bringing the total to 79,745.

- They also trimmed their net short position in CBOT US Ultrabond Treasury futures by 24,696 contracts, now at 203,747.

- Conversely, speculators raised their net short position in CBOT US 10-year Treasury futures by 18,845 contracts to a total of 724,101.

- Increased activity also occurred in CBOT US 5-year Treasury futures, with a 74,384 contract increase in the net short position, reaching 2,470,920.

- The net short position for CBOT US 2-year Treasury futures rose by 36,591 contracts to 1,180,516.

- Equity fund managers upped their net long position in the S&P 500 CME by 10,532 contracts, now totaling 825,013.

- Equity fund speculators raised their net short position in the S&P 500 CME by 31,419 contracts, bringing it to 316,744.

- The net long position for the Japanese yen stands at 144,595 contracts, while the euro's net long position is 93,025 contracts.

- The British pound's net long position is at 51,634 contracts, and the Swiss franc has a net short position of -21,268 contracts.

- Bitcoin has a net short position of -2,009 contracts.

Technical & Trade Views

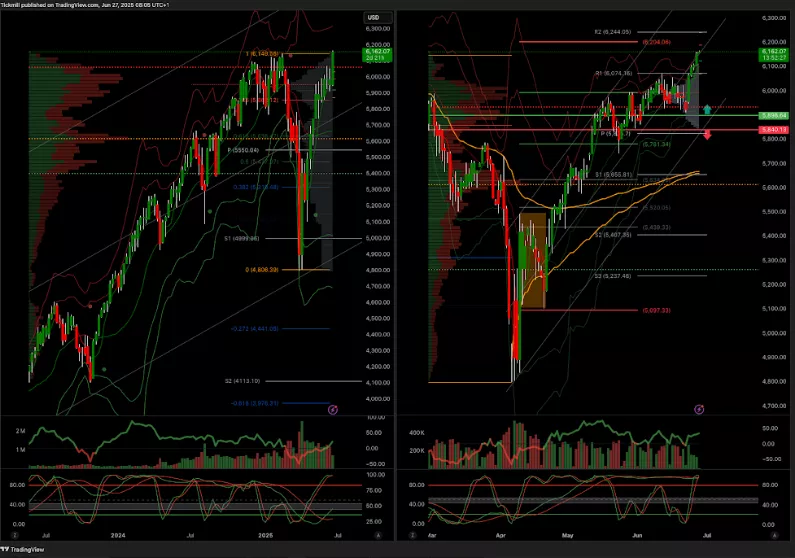

SP500 Pivot 5900

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 5900 target 6100

- Below 5800 target 5700

(Click on image to enlarge)

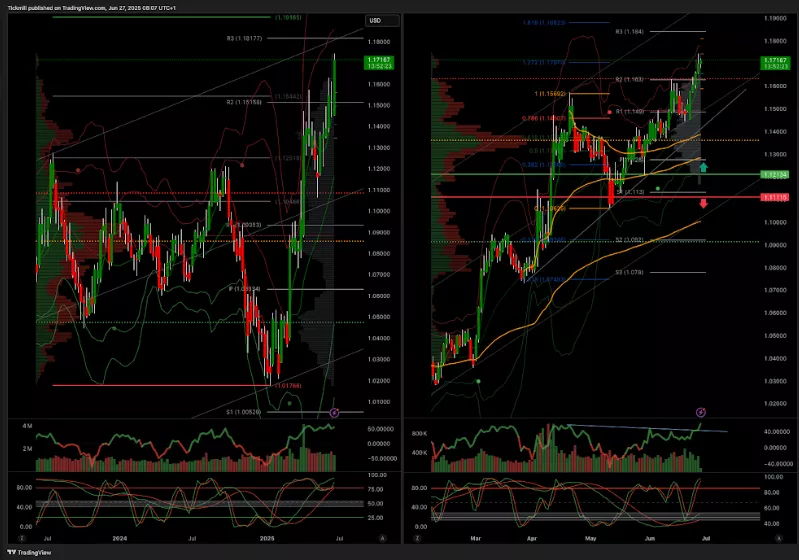

EURUSD Pivot 1.12

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.11 target 1.19

- Below 1.11 target 1.0950

(Click on image to enlarge)

GBPUSD Pivot 1.34

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 1.34 target 1.38

- Below 1.3350 target 1.32

(Click on image to enlarge)

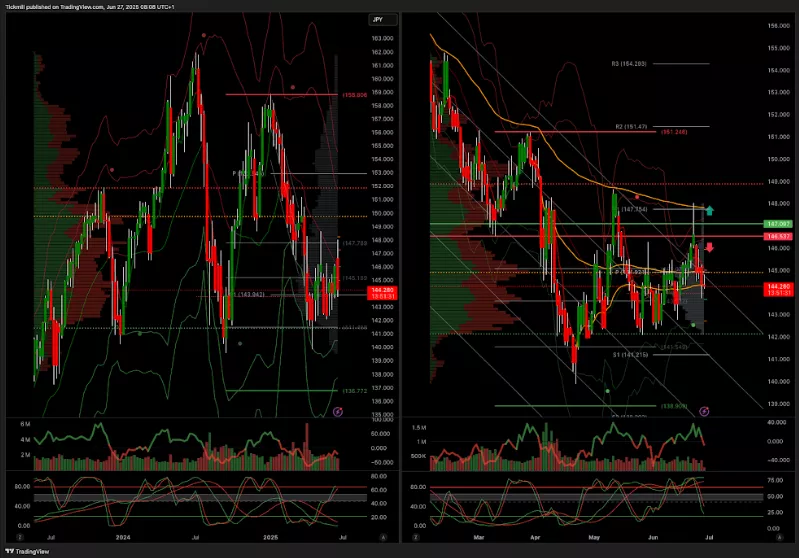

USDJPY Pivot 147

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 147.10 target 148.26

- Below 146.53 target 139

(Click on image to enlarge)

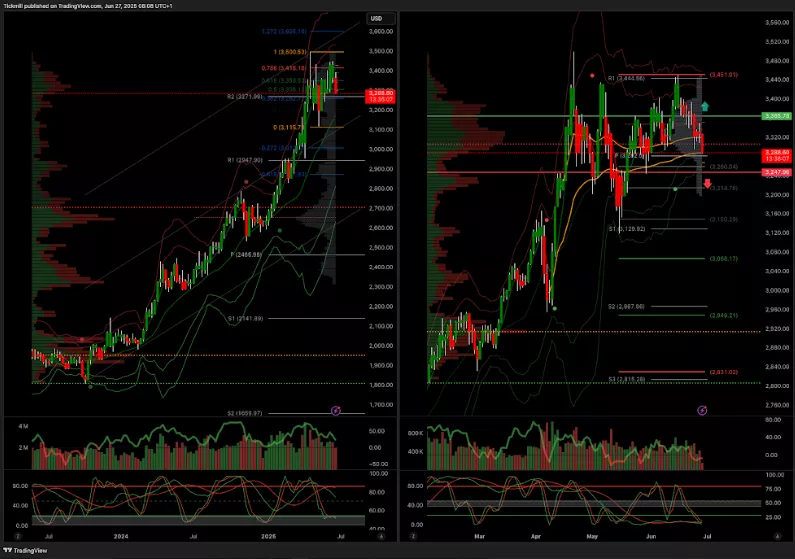

XAUUSD Pivot 3365

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 3410 target 3600

- Below 3240 target 3000

(Click on image to enlarge)

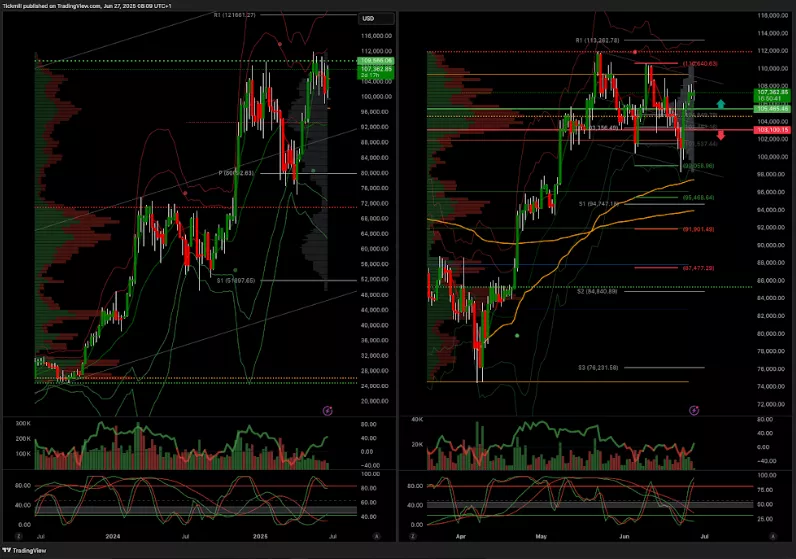

BTCUSD Pivot 105k

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 105k target 118k

- Below 98.3K target 95.5k

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Thursday, June 26

The FTSE Finish Line - Wednesday, June 25

Daily Market Outlook - Wednesday, June 25