Daily Market Outlook - Monday, June 2

Image Source: Pexels

Several key developments emerged over the weekend. In brief: President Trump announced plans to increase steel and aluminium tariffs to 50%. He accused China of violating their recent agreement, prompting a strong response from China, which suggested it would take "forceful measures." Bessent believes the issue will be resolved shortly and assured that the US "is never going to default," as concerns about the debt ceiling rise, highlighted by a Financial Times article discussing the disconnect between the USD and Treasury yields. China's composite PMI for May remained stable, slightly increasing to 50.4 from 50.2 in April. Fed's Waller sees potential for "positive rate cuts later this year" if lower tariffs occur, but markets await Powell's comments today at 6 pm BST. In The Sunday Times, BoE Deputy Governor Breeden expressed a dovish stance, noting that "waves of disinflation are continuing." In the UK, the CBI's monthly composite growth indicator fell further to a net balance of -30 from -26. OPEC+ announced an increase in production by 411,000 barrels per day for July. Overall, the week begins with a risk-off sentiment as gold prices rise, while Asian equities and US futures decline due to the trade tensions mentioned above.

The start of June signals a packed week of high-profile economic events after a quieter period on the data and events calendar. Following today’s country-specific data releases, next week kicks off with euro area flash May CPI, final manufacturing PMIs, and the US ISM Manufacturing Index, alongside remarks from Fed Chair Powell (all on Monday). Midweek, Services PMIs and ISM data follow on Wednesday.

The week is particularly significant for US labour market updates, including job openings data (Tuesday), the ADP employment report (Wednesday), and the monthly employment report (Friday). These releases will provide further insights into the state of the US labor market.

Central bank meetings take centre stage with the Bank of Canada (BoC) on Wednesday and the European Central Bank (ECB) on Thursday. Analysts anticipate the BoC may cut rates by 25bps to 2.5%, though market pricing suggests this outcome is less likely. Meanwhile, a 25bps rate cut by the ECB, lowering the deposit rate to 2%, is fully priced in by markets.

In the UK, labour market news remains in focus. The Bank of England’s Decision Maker Panel data on wages (Thursday) stands out, as wage trends have become a central point of contention between MPC hawks and doves following the May vote. Earlier in the week, a cross-section of the Monetary Policy Committee will appear before the Treasury Select Committee on Tuesday to discuss the May Monetary Policy Report (MPR). While scheduled events dominate the week, unscheduled headlines, particularly from the US, could still overshadow the calendar. Despite the heavy focus on labour market news, expectations remain that the Federal Reserve is unlikely to adjust its current stance.

Overnight Headlines

- OPEC+ Holds Course With Major Output Hike For July

- Fed’s Waller Sees Rate Cuts Ahead Despite Tariff-Led Inflation Rise

- EU Plans Countermeasures As Trump Doubles Steel Tariffs To 50%

- BoJ Braces For Higher Yields With Provisions Boost

- China Accuses US Of ‘Severe Violations’ Of Trade Truce

- Graham Pushes For Harsher Russia Sanctions Ahead Of G7

- US Sec Warns Of ‘Consequences’ If China Moves On Taiwan

- Israel-Hamas Hostage Deal Hits Impasse As US Envoy Slams Response

- South Korea Exports Drop Sharply Under Tariff Pressure

- US Futures Slip As Crude Surges On Tariffs, OPEC+ Supply Hike

- Big Tech Regains Leadership In S&P 500 As Profit Engines Revive

- Samsung Nears Broad AI Deal With Perplexity

- Morgan Stanley Predicts 9% Drop In Dollar On Growth Bets

- Gold Rises As Geopolitical, Tariff Fears Drive Safe-Haven Demand

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1200 (215M), 1.1250 (2.0BLN), 1.1300-05 (2.9BLN)

- 1.1325-30. (453M), 1.1345-50 (2.7BLN), 1.1365 (678M)

- 1.1400 (494M), 1.1425 (245M), 1.1500-05 (664M), 1.1535 (640M)

- USD/JPY: 142.00 (430M), 142.30 (380M), 142.95-00 (345M)

- 144.00 (720M), 144.65 (480M), 145.00 (402M). EUR/JPY: 159.50 (500M)

- USD/CHF 0.8070 (200M), 0.8250 (426M), 0.8350 (321M), 0.8450 (387M)

- GBP/USD: 1.3350 (283M), 1.3550 (280M), 1.3620 (279M)

- AUD/USD: 0.6400 (1.1BLN), 0.6425 (455M), 0.6445 (404M), 0.6500 (379M)

- 0.6550 (426M), 0.6575 (870M). NZD/USD: 0.5940 (289M)

- USD/CAD: 1.3800 (200M), 1.3900 (456M)

CFTC Data As Of 30/5/25

- The net long position in Japanese yen stands at 164,012 contracts, while the euro net long position is at 79,474 contracts. The British pound holds a net long position of 35,379 contracts. Conversely, the Swiss franc indicates a net short position of -25,483 contracts, and Bitcoin shows a net short position of -2,274 contracts.

- Equity Fund Managers have reduced their net long position in the S&P 500 CME by 17,892 contracts, bringing it down to 854,528 contracts. Moreover, Equity Fund Speculators have decreased their net short position in the S&P 500 CME by 39,763 contracts, resulting in a total of 257,465 contracts.

- Speculators have also cut their net short position in CBOT US Treasury bonds futures by 18,143 contracts, which now stands at 53,890 contracts. Similarly, CBOT US Ultrabond Treasury futures' net short position has been lowered by 12,663 contracts to 233,472 contracts. The net short position for CBOT US 2-Year Treasury futures has been trimmed by 147,428 contracts to reach 1,119,903 contracts. Additionally, the net short position for CBOT US 10-Year Treasury futures has been reduced by 81,827 contracts to 769,604 contracts. On the other hand, speculators have increased their net short position in CBOT US 5-Year Treasury futures by 57,296 contracts, leading to a total of 2,333,237 contracts.

Technical & Trade Views

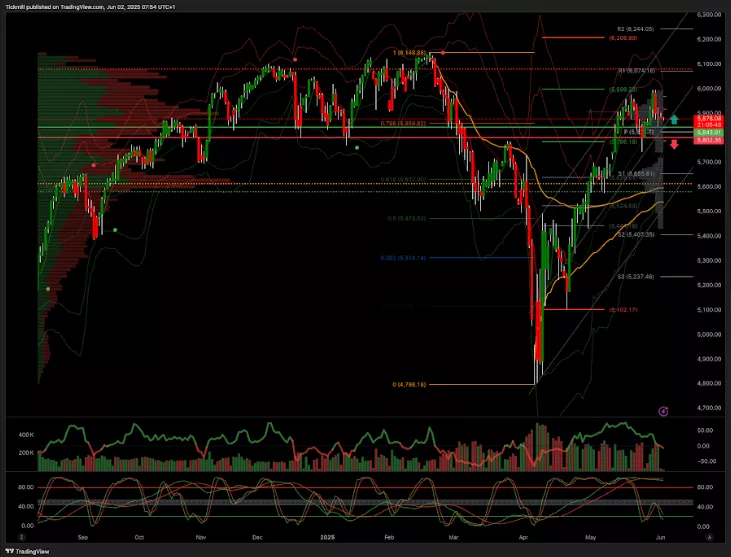

SP500 Pivot 5900

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 5900 target 6100

- Below 5800 target 5610

(Click on image to enlarge)

EURUSD Pivot 1.11

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.11 target 1.19

- Below 1.1060 target 1.09

(Click on image to enlarge)

GBPUSD Pivot 1.3290

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 1.3290 target 1.38

- Below 1.32 target 1.31

(Click on image to enlarge)

USDJPY Pivot 147

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 147.10 target 148.26

- Below 146.53 target 139

(Click on image to enlarge)

XAUUSD Pivot 3365

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 3400 target 3600

- Below 3365 target 2981

(Click on image to enlarge)

BTCUSD Pivot 105k

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 105k target 118k

- Below 103k target 100k

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Thursday, May 29

The FTSE Finish Line - Wednesday, May 28

Daily Market Outlook - Wednesday, May 28