Daily Market Outlook - Monday, Feb. 2

Image Source: Unsplash

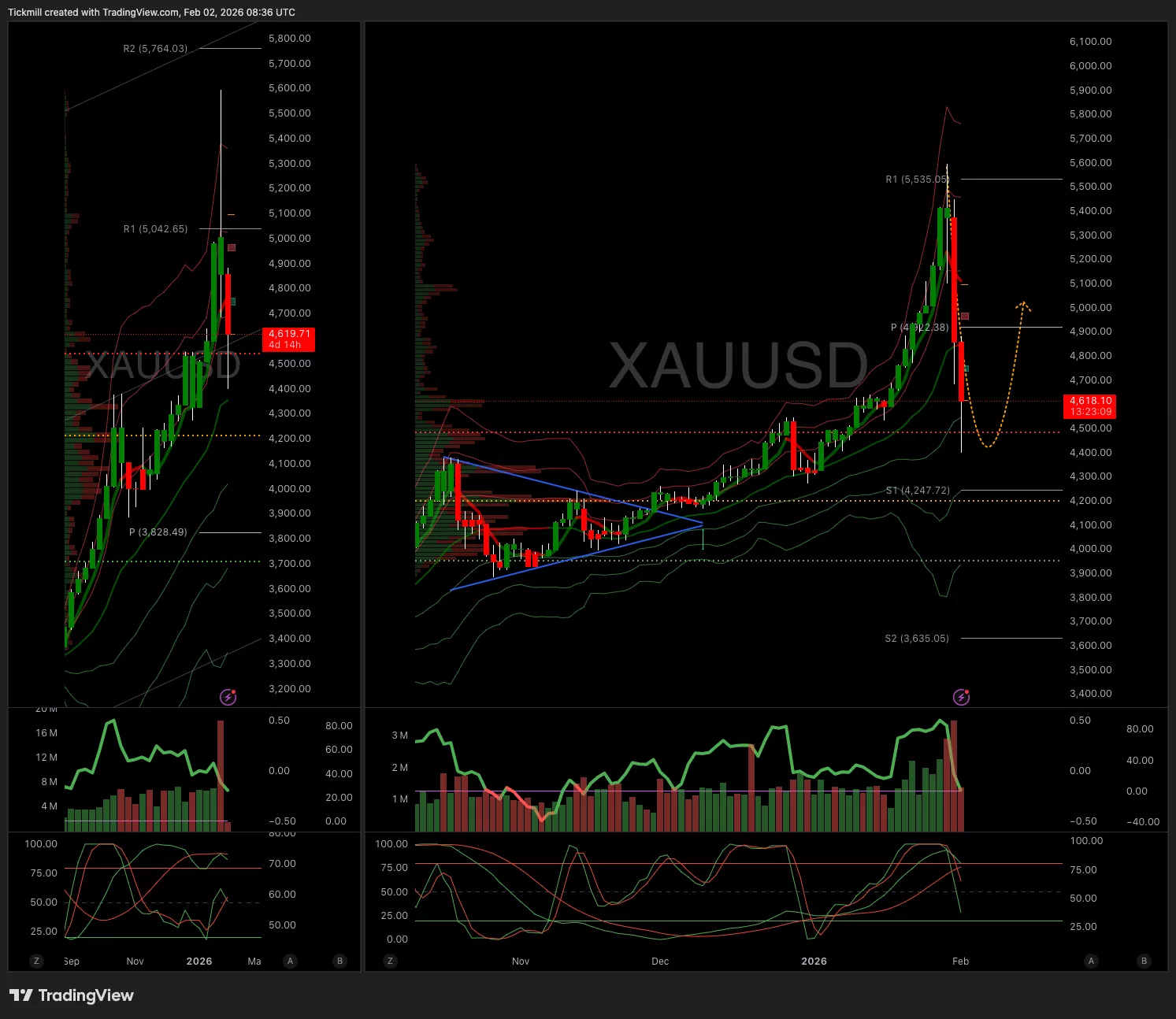

Friday's dramatic market turnaround sent shockwaves through assets that had been thriving in January, triggering a sharp sell-off. Gold and silver, which had already been under pressure, extended their losses alongside equity markets. After soaring to nearly $5,600 an ounce earlier in January, gold experienced a steep drop of 6.3%, briefly dipping below $4,600 on Monday. Silver fared even worse, plummeting 12% following Friday's historic 26% nosedive. The two-day slump in Asian markets marked the steepest decline since early April, while futures pointed to further losses for Wall Street and European indices. These market jitters highlight growing volatility after a period of strong gains in precious metals and record-breaking highs in stocks, largely driven by massive investments in artificial intelligence. Meanwhile, investors are reassessing asset valuations and bracing for potential shifts in monetary policy, particularly with the likelihood of Kevin Warsh leading the Federal Reserve. This comes despite President Trump's repeated pledges to push for lower interest rates. The MSCI All Country World Index, a key global equity gauge, edged down 0.4%, while Asia's benchmark tumbled 2%. South Korea's Kospi, a major index for AI-related stocks, plunged 4%, and Nasdaq 100 futures fell over 1% amid concerns about inflated valuations. On the political front, the U.S. government entered a partial shutdown on Saturday as lawmakers awaited House approval of a funding deal negotiated between Trump and Democrats. The agreement was hastily crafted following widespread outrage over the killing of a U.S. citizen by Border Patrol agents in Minneapolis. Crude oil prices also took a hit, sliding 6.3%, but the spotlight remained firmly on the dramatic moves in gold and silver.

President Trump has confirmed Kevin Warsh as his pick for the next Fed Chair. Warsh is perceived as hawkish compared to other candidates, aligning with Trump’s preference for lower interest rates. Warsh’s support for a smaller Fed balance sheet and less intervention could align with Trump’s goals, as lower policy rates may offset reductions in Fed assets. Additionally, arguments around strong productivity growth and lower structural inflation could justify rate cuts.

However, logistical hurdles remain. Republican Senator Thom Tillis is blocking Fed appointments due to a DoJ investigation, delaying Warsh’s confirmation and extending Miran’s tenure. It’s unclear if Powell will stay on the board after his term as Chair ends in May, potentially influencing Fed independence and adding friction. These uncertainties, combined with political disruptions, are unlikely to trigger a sustained dollar rally. Even assuming Warsh’s eventual confirmation, current rate cut expectations seem underpriced, posing continued pressure on the USD.

The spotlight this week is on the US economic data, with the January jobs report taking centre stage on Friday. Analysts anticipate a modest payroll increase of 50,000, mirroring December's growth, while the unemployment rate is expected to hold steady at 4.4%, alongside unchanged hourly earnings growth of 0.3% month-on-month. Additional insights into the labour market will come from the JOLTS report on Tuesday and the ADP employment report on Wednesday. In other US economic updates, the ISM manufacturing index is due Monday, followed by the services index on Wednesday. On Friday, the February University of Michigan consumer sentiment survey is set for release, with Deutsche Bank forecasting a slight decline to 54.3 from January’s 56.4. Bond markets will also be paying close attention to the Treasury’s quarterly refunding announcement on Wednesday.

On the global stage, central banks will dominate the agenda. The ECB, BoE, and RBA are all set to make monetary policy decisions this week. Economists predict the ECB will maintain its policy rates for the fifth consecutive meeting, while the BoE is expected to keep its Bank Rate unchanged at 3.75% with a likely 7-2 voting split. Similarly, the RBA is anticipated to hold rates steady. Key financial updates include the Fed’s senior loan officer survey on Monday in the US and the ECB’s bank lending survey for the Eurozone on Tuesday. Meanwhile, the Bank of Japan will release its Summary of Opinions from the January meeting on Monday (Tokyo time).

Corporate earnings will also be in the spotlight, with major tech players and household names reporting. Among the "Magnificent 7," Alphabet reports on Wednesday, followed by Amazon on Thursday. Other tech giants like Palantir, AMD, and Qualcomm will also release their results. In the healthcare sector, Eli Lilly and AbbVie headline in the US, while Novartis and Novo Nordisk take the stage in Europe. Additional big names to watch include PepsiCo, Walt Disney, and Uber in the US, as well as Toyota, Sony, and Tokyo Electron in Japan. European banks and corporates will also be closely monitored as the earnings season unfolds.

Overnight Headlines

- OPEC+ Agrees To Keep Oil Output Unchanged Amid Iran Tensions

- BoJ Summary Points To Urgency Around Timely Rate Hikes

- BoE Expected To Hold Rates Amid Conflicting Signals On UK Economy

- Trump Jokes About Suing Warsh If He Doesn’t Lower Rates

- Trump Says India Will Buy Oil From Venezuela

- US Tells Iran It Is Ready To Negotiate A Deal

- BlackRock, Pimco See Inflation Risks The Wider Market Dismisses

- Oracle To Raise Up To $50B This Year For Cloud Investment

- Xi Jinping Calls For Renminbi To Become Global Reserve Currency

- BYD Leads China EV Selloff After Weak January Sales Figures

- Nomura Shares Drop After Profit Falls More Than Estimated

- Gold, Silver Extend Declines After Reversal Of Rally

- Europe’s Oil Majors Prepare To Cut Billions In Shareholder Payouts

- Bitcoin Break Below $80,000 Signals New Crisis Of Confidence

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries and is more magnetic when trading within the daily ATR.)

- EUR/USD: 1.1800 (1.2BLN), 1.1825-30 (506M), 1.1850-55 (1BLN), 1.1900 (793M)

- 1.1925 (1.4BLN), 1.2000 (4.7BLN)

- EUR/CHF: 0.9200-10 (300M)

- GBP/USD: 1.3500 (392M), 1.3650 (400M), 1.3700 (194M)

- AUD/USD: 0.6900 (474M), 0.6925-30 (764M)

- USD/CAD: 1.3500 (1.3BLN), 1.3690 (280M)

- USD/JPY: 153.40 (640M), 154.75-80 (370M), 155.00 (611M), 155.70 (590M)

- 155.90-156.00 (440M)

CFTC Positions as of January 30th:

- .Equity fund speculators have increased their net short position in the S&P 500 CME by 20,307 contracts, bringing the total to 420,688. Meanwhile, equity fund managers have raised their net long position in the S&P 500 CME by 27,365 contracts, resulting in a total of 909,993 contracts.

- Speculators have reduced their net short position in CBOT US 5-year Treasury futures by 45,473 contracts, now totaling 2,091,046. Conversely, they have increased their net short position in CBOT US 10-year Treasury futures by 70,511 contracts, reaching 726,151 contracts. There has also been a reduction in the net short position for CBOT US 2-year Treasury futures by 6,123 contracts, now at 1,218,999. Furthermore, speculators have boosted the net short position in CBOT US UltraBond Treasury futures by 14,649 contracts, bringing it to 273,471. They have trimmed their net short position in CBOT US Treasury bonds futures by 14,903 contracts, which now stands at 8,167.

- Bitcoin's net long position is recorded at 690 contracts. The Swiss franc has a net short position of -42,893 contracts, while the British pound shows a net short position of -16,162 contracts. The euro has a net long position of 132,134 contracts, and the Japanese yen has a net short position of -33,933 contracts.

Technical & Trade Views

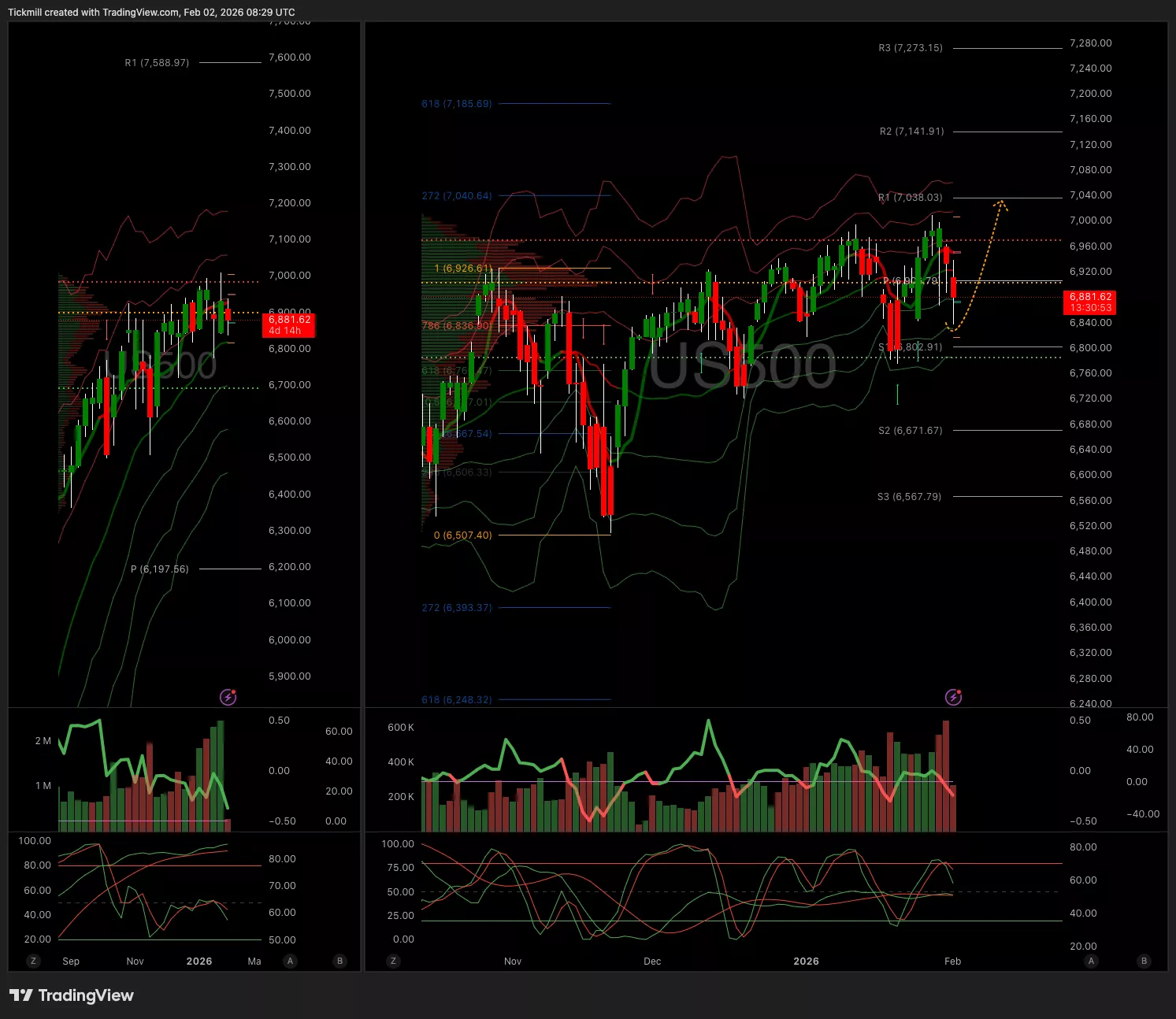

SP500

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 6950 Target 7050

- Below 6835 Target 6785

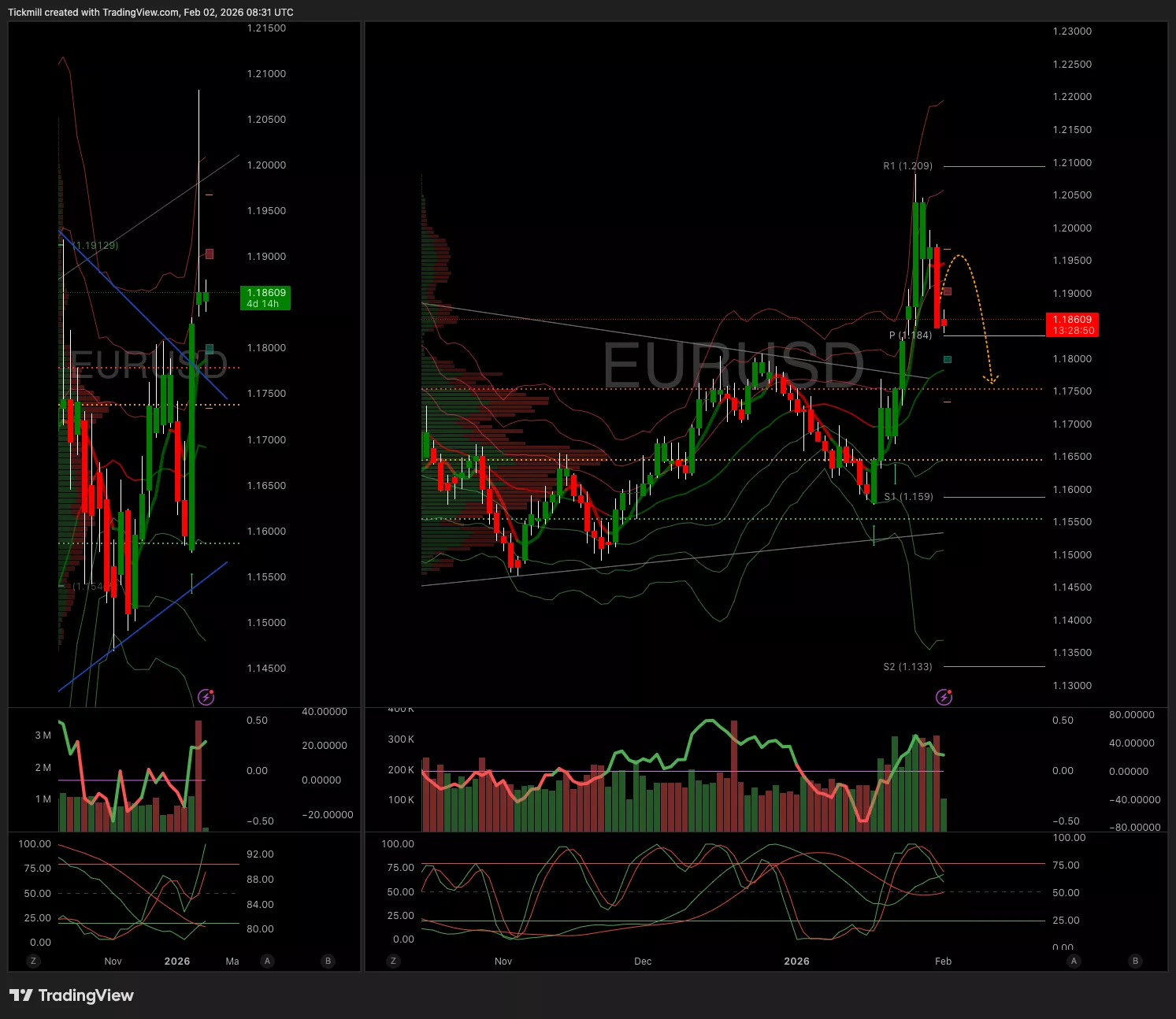

EURUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 1.1950 Target 1.2150

- Below 1.1840 Target 1.1750

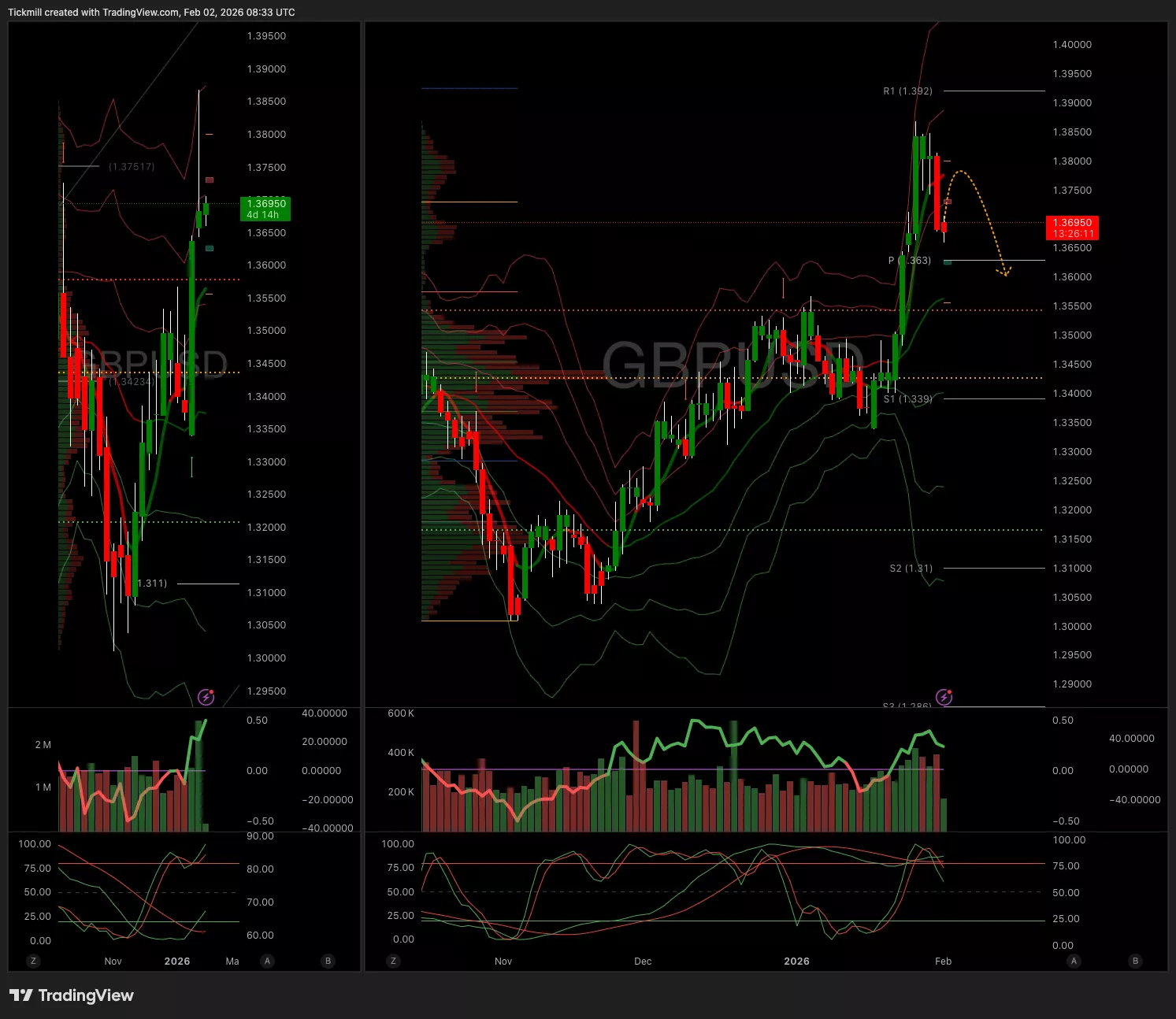

GBPUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 1.38 Target 13950

- Below 1.3770 Target 1.3570

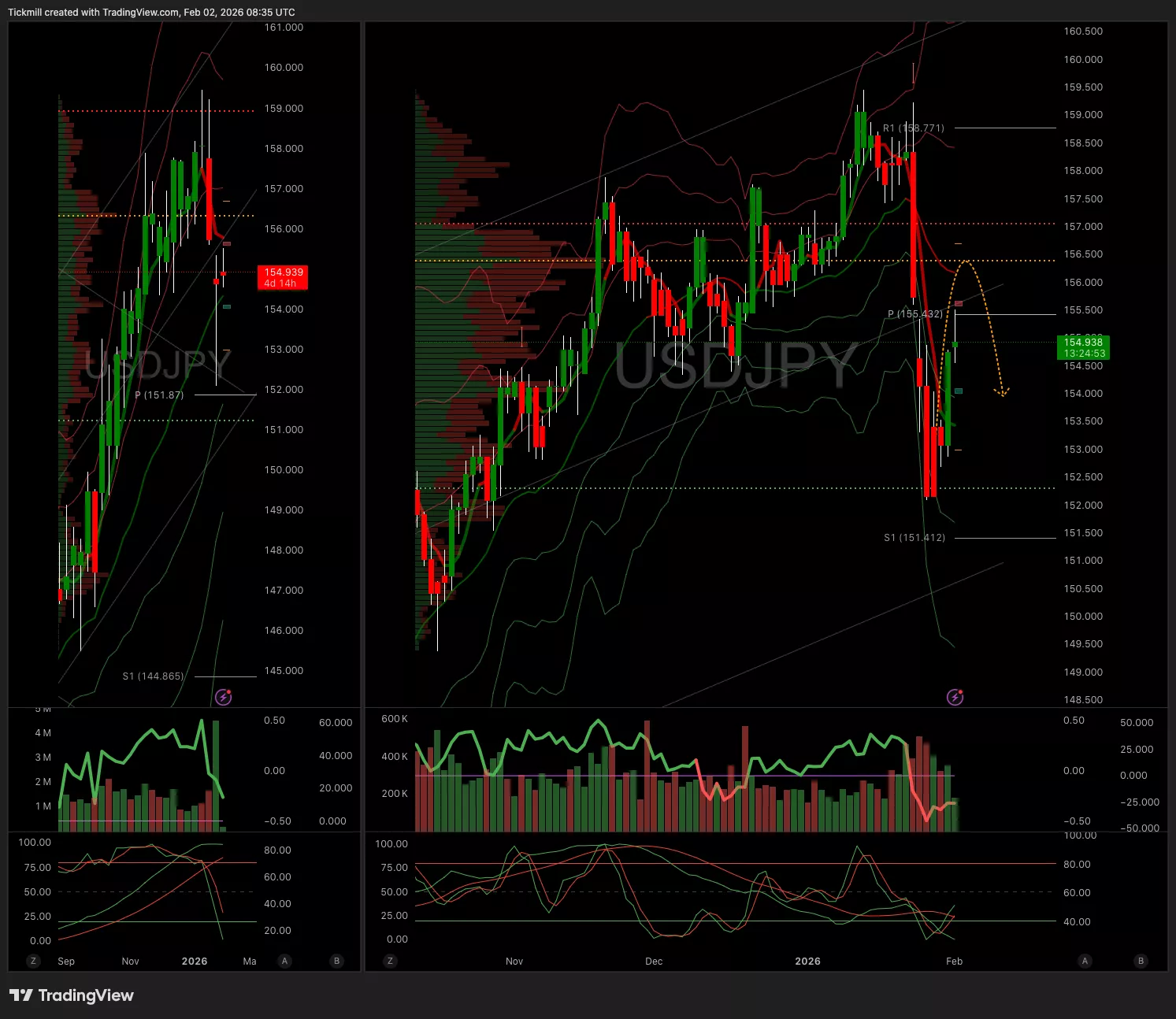

USDJPY

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 154.35 Target 156

- Below 153.50 Target 151

XAUUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 4850 Target 5100

- Below 4400 Target 4200

BTCUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 81k Target 84k

- Below 80.5k Target 70k

More By This Author:

The FTSE 100 Finish Line - Friday, Jan. 30

Daily Market Outlook - Friday, Jan. 30

The FTSE 100 Finish Line - Thursday, Jan. 29