Daily Market Outlook - Friday, Jan. 30

Image Source: Unsplash

Markets took a hit as both stocks and US Treasuries declined amid growing speculation that President Trump is leaning toward nominating Kevin Warsh as the next Federal Reserve chair. Warsh, seen as a more hawkish option compared to other candidates, has sparked mixed reactions from investors. Sources close to the matter revealed that Warsh, one of four finalists on Trump’s shortlist for the role, paid a visit to the White House on Thursday. Gold tumbled 2.8%, while the Dollar strengthened, reflecting market jitters. However, insiders cautioned that no final decision has been made yet, as the president is expected to announce his pick Friday morning. The MSCI Asia-Pacific index fell 0.7%, while S&P 500 futures slipped 0.4%. Meanwhile, US 10-year Treasury yields climbed by four basis points, and cryptocurrencies, led by Bitcoin, experienced a notable selloff. Precious metals experienced a faltering recovery that lost steam following a very volatile trading session on Thursday. Gold declined below 5150 overnight, while silver skidded sub 105. The pullback, driven by the unwinding of overly extended positions, was not entirely unexpected in the precious metals market. Traders appear to be factoring in the possibility of Warsh taking the helm at the Fed, adjusting their expectations for future monetary policy. A more hawkish stance could signal tighter financial conditions, potentially slowing economic growth, pressuring equities, and driving bond yields higher. On the flip side, the Dollar could gain further strength in a higher interest rate environment. In other news, President Trump and Senate Democrats have reportedly reached a tentative deal to avert a government shutdown. The agreement comes as negotiations continue over stricter immigration enforcement measures that have sparked widespread controversy across the nation.

Ahead of next week’s ECB Governing Council meeting, today offers the initial glimpse of Q4 GDP for the euro area, with the flash January CPI data following on Wednesday. While there’s still a fair amount of critical data to analyze before the first rate decision of 2026, it seems unlikely that the prevailing narrative—that policy is ‘in a good place’—will shift significantly. This holds true even if growth deviates from the 0.2% quarter-on-quarter increase projected by the latest ECB staff estimates. Lagarde may expand on her Davos commentary regarding the economic risks posed by elevated uncertainty. On the global trade front, concerns over potential tariffs involving Greenland appear to have subsided. However, trade diversion—boosting China’s exports to the euro area at the expense of U.S. trade—remains a factor that requires attention. Additionally, external considerations such as the exchange rate are gaining prominence. With the Dollar weakening (see chart), a stronger euro is importing some disinflationary pressure. However, the current EUR/USD level of approximately 1.20 is not significant enough to justify another ECB rate cut on this basis alone. Rising breakeven inflation rates and higher commodity prices are counterbalancing factors, complicating the overall outlook. It wouldn’t be surprising if much of the focus during the post-meeting press conference revolves around foreign exchange movements and whether these suggest a dovish policy shift. The extent to which Lagarde addresses this issue could become a key dynamic. At this stage, however, any commentary on the matter is likely to be restrained, making the event potentially uneventful for markets.

With the Federal Reserve out of the spotlight, market attention shifts to upcoming central bank meetings next week, including the RBA (Tuesday), ECB, and BoE (both Thursday). Following the recent strong inflation data, markets view a rate hike by the RBA to 3.85% as more likely than not, though it's not guaranteed. This positions the RBA meeting as a more significant event compared to the ECB and BoE meetings, where no policy changes are anticipated. Discussions in the ECB and BoE post-meeting press conferences may touch on recent exchange rate movements, but domestic currency appreciation likely needs to advance further before Bailey or Lagarde highlights its role in imported disinflation as a dovish signal. The ECB will also have the preliminary January inflation data (Wednesday) ahead of its meeting. In the U.S., the key focus will be on Friday’s employment report, where recent survey data suggests last month’s drop in the unemployment rate could reverse. Earlier in the week, markets will watch for updates on job openings (Tuesday), ISM manufacturing (Monday), ISM services (Wednesday), and details on quarterly refunding plans (Monday/Wednesday). Timing remains uncertain for other critical U.S. announcements, such as the Supreme Court tariff ruling and a decision on the next Fed Chair—both of which could become market-moving events if announced.

Overnight Headlines

- EZ GDP Growth Likely Slowed In Q4; Global Shifts Fuel Concerns

- ECB Locked On Hold As Calls For Hikes Fade, Poll Shows

- Fed Chair Contender Warsh Meets Trump, Appointment Bets Rise

- Deal Reached Advancing US Spending Bills To Avert Govt Shutdown

- Trump Warns UK Against China Deals After Starmer-Xi Meeting

- Trump: US To Decertify, Levy 50% Tariff On Planes From Canada

- Trump Tariff Threat Pushes South Korea Into New US Trade Talks

- US Treasury Presses China On ‘Substantially Undervalued’ Yuan

- Japan’s Modified FX Tactics Deliver Short-Term Success On Yen

- Apple Sales Trounce Estimates As iPhone Powers Record Quarter

- Amazon In Talks To Invest Up To $50B In OpenAI

- OpenAI Targets Q4 IPO In Race With Anthropic

- Elon Musk’s SpaceX Considers Merger With Tesla Or xAI

- Anthropic Faces Pentagon Clash Over AI Limits On $200M Contract

- Bitcoin Slumps To 2-Month Low As US Funds Dump Billions

- Gold’s Record Inflows From Asian ETFs Seen By Some As Warning

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries and is more magnetic when trading within the daily ATR.)

-

Thursday, January 29, 2026, there are no significant FX option expirations noted, which means that trading sentiment will likely be influenced more by bond markets and overall market risk appetite.

CFTC Positions as of January 23rd:

- Equity fund speculators have reduced their S&P 500 CME net short position by 48,733 contracts, bringing it down to 400,381. Meanwhile, equity fund managers have decreased their S&P 500 CME net long position by 49,679 contracts, resulting in a total of 882,629 contracts.

- Speculators have cut their net short position in CBOT US 5-year Treasury futures by 132,601 contracts to 2,136,519 and have also trimmed the CBOT US 10-year Treasury futures net short position by 214,865 contracts to 655,640. The CBOT US 2-year Treasury futures net short position has been reduced by 79,758 contracts to 1,225,122. In contrast, speculators have raised their CBOT US UltraBond Treasury futures net short position by 23,725 contracts, now totaling 258,822. Additionally, speculators have shifted CBOT US Treasury bonds futures to a net short position of 23,070 contracts, compared to 13,835 net longs the previous week.

- The current Bitcoin net long position stands at 298 contracts, while the Swiss franc has a net short position of -43,207 contracts. The British pound is showing a net short position of -21,980 contracts, and the Euro has a net long position of 111,695 contracts. Finally, the Japanese yen reflects a net short position of -44,829 contracts.

Technical & Trade Views

SP500

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 6960 Target 7050

- Below 6960 Target 6860

EURUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 1.1950 Target 1.2150

- Below 1.1890 Target 1.18

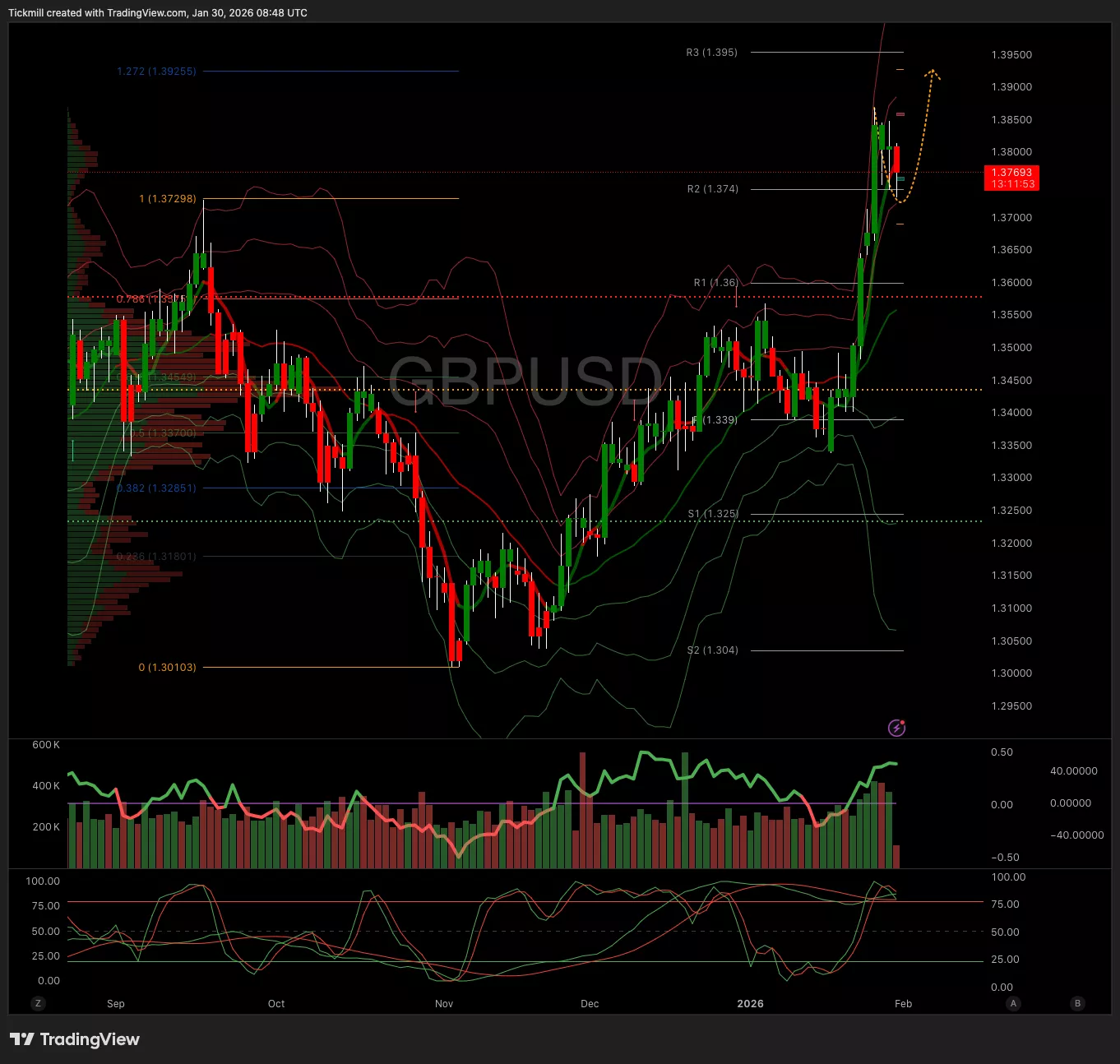

GBPUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 1.3770 Target 13950

- Below 1.3720 Target 1.3640

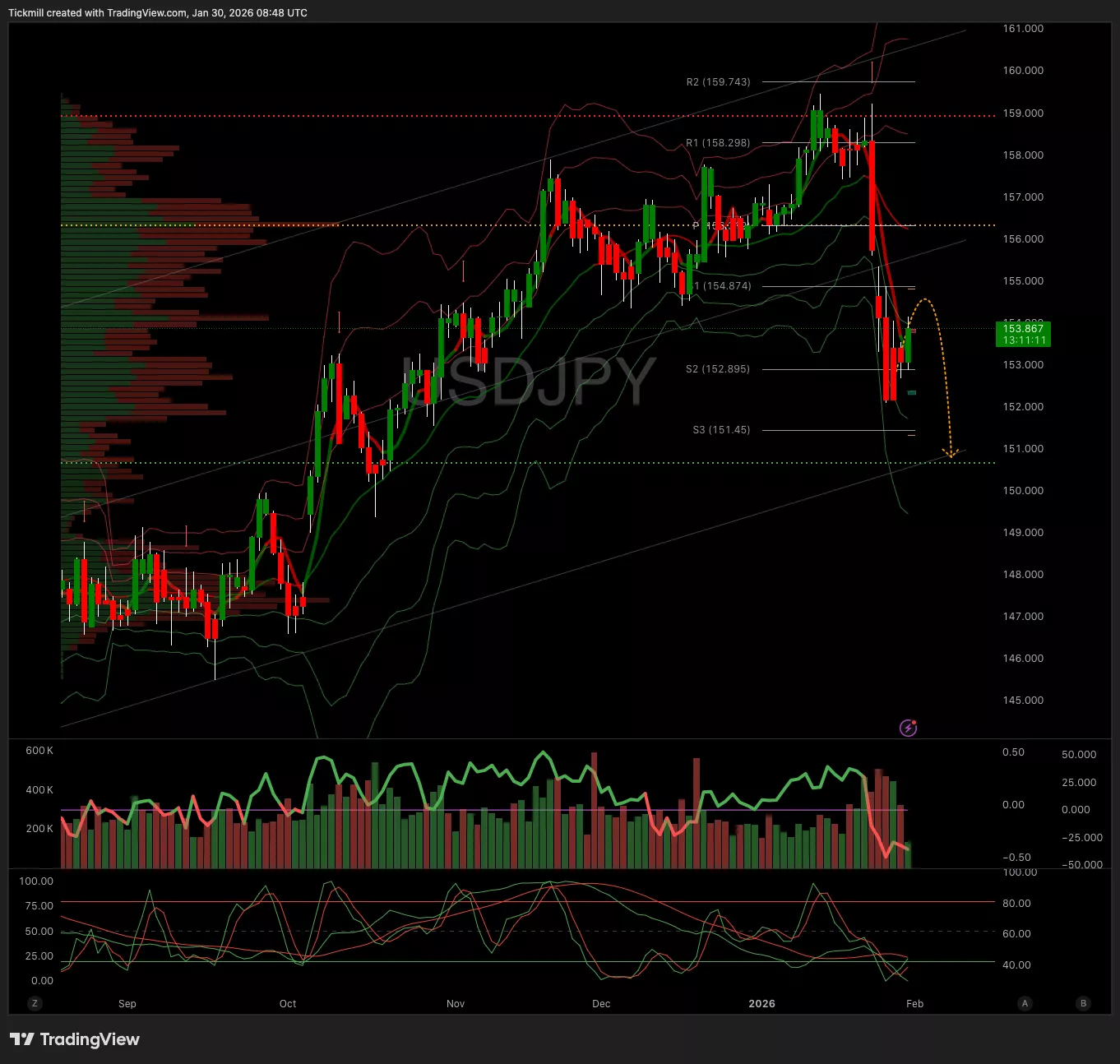

USDJPY

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 154.35 Target 156

- Below 153.50 Target 151

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 5250 Target 5675

- Below 5050 Target 4950

BTCUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 86k Target 90k

- Below 86k Target 76k

More By This Author:

The FTSE 100 Finish Line - Thursday, Jan. 29

Daily Market Outlook - Thursday, Jan. 29

The FTSE 100 Finish Line - Wednesday, Jan. 28