The FTSE 100 Finish Line - Friday, Jan. 30

Image Source: Pexels

Heavyweight banking stocks initially boosted London's FTSE 100 on Friday, setting the index on course for a seventh consecutive month of gains, as investors evaluated the appointment of Kevin Warsh as the new U.S. Federal Reserve chair. However, the blue-chip index pared gains and hovered near the flatline as trading for the week neared its close. The FTSE remains poised for its longest monthly winning streak in over 12 years and is also set to achieve weekly gains following losses in the prior week. Meanwhile, the domestically focused FTSE 250 remained flat on Friday but is on track to end both the week and month in positive territory. Geopolitical tensions resurfaced as Donald Trump warned the UK against deepening business ties with Beijing, labeling it "dangerous." In contrast, Prime Minister Keir Starmer highlighted the potential economic benefits of strengthening the UK-China relationship during his visit to China on Friday. On the economic front, British business confidence dipped in January, coinciding with global economic optimism hitting a one-year low. Despite this, a Lloyds survey indicated that businesses remained optimistic about their own performance and hiring plans, even amid broader uncertainty.

Precious metals miners dropped 4.4% as gold prices plunged over 4%, driven by speculation of a more hawkish Federal Reserve chair. Despite this daily decline, the sub-index has gained approximately 20% this month. Industrial metal miners also fell, closing 2.5% lower. Conversely, the banking sub-index climbed 3.5% for the week and about 5.3% for the month, with a 1.2% gain on Friday. Notable performers included Lloyds and Investec, which rose 2% and 1.4%, respectively. Shares of Experian surged 2% to 2,749p, making it the top gainer on the FTSE 100 index, following the announcement of a $1 billion share repurchase program. The company reaffirmed that its medium-term financial framework, capital allocation, and dividend policy remain unchanged. However, Experian’s stock had experienced a ~2% decline in 2025..

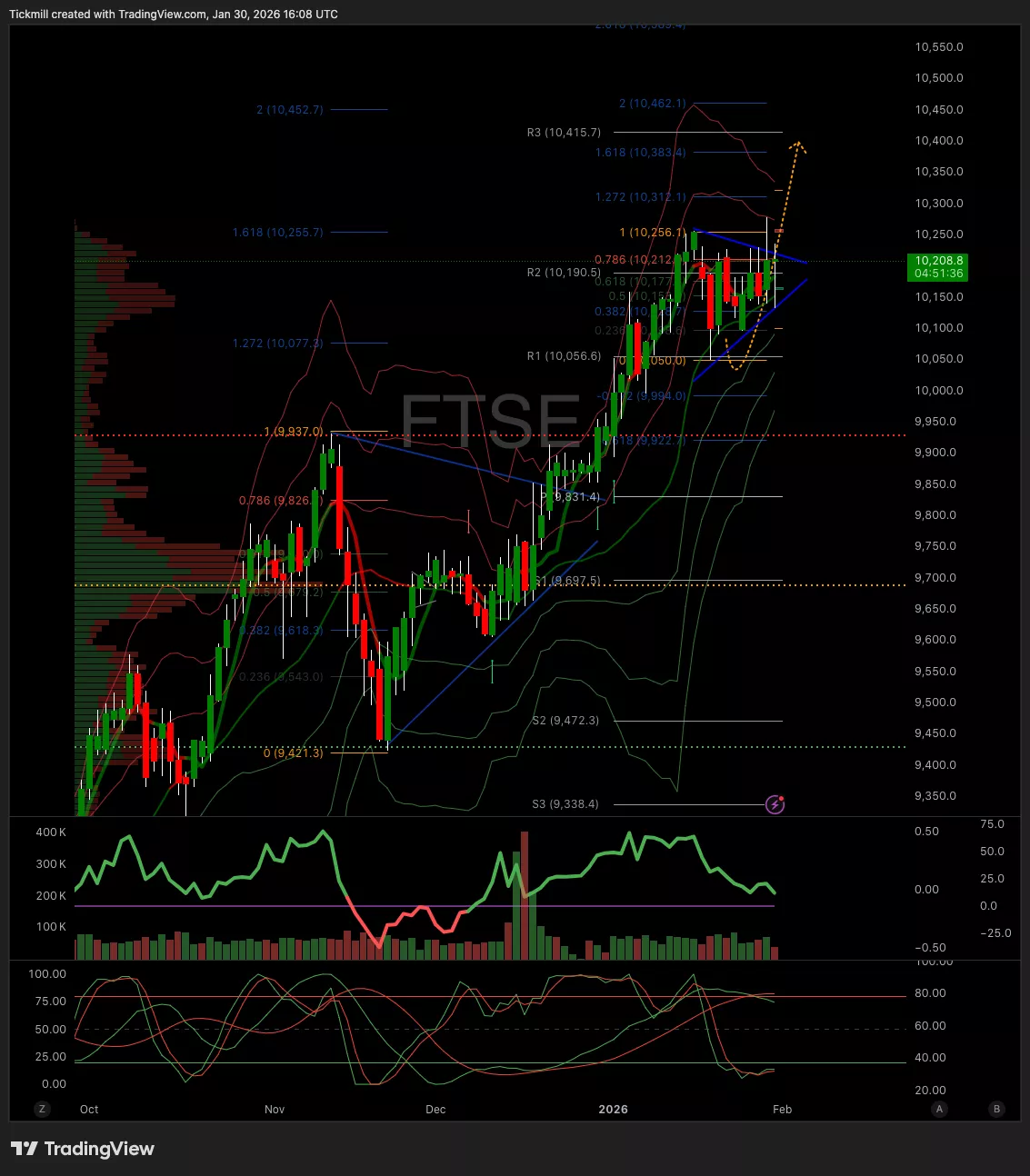

TECHNICAL & TRADE VIEW - FTSE100

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 10150 Target 10300

- Below 10070 Target 9950

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Friday, Jan. 30The FTSE 100 Finish Line - Thursday, Jan. 29

Daily Market Outlook - Thursday, Jan. 29