Daily Market Outlook - Monday, Dec. 15

Photo by Anastassia Anufrieva on Unsplash

US equity-index futures rose as the final full trading week of 2025 commenced, despite worries over tech company earnings and significant AI expenditures leading to a selloff on Wall Street.

Futures for the S&P 500 and Nasdaq 100 gained 0.2% after experiencing a drop of over 1% on Friday, alongside declines in tech stocks. Asian markets fell on Monday, with South Korea, previously seen as a leader in AI enthusiasm, declining by 1.2%. Additionally, futures indicated an upward trend for European stocks at market open. Global appetite for risk has diminished due to concerns about whether tech companies, which have driven global indices to record highs, can sustain their inflated valuations amidst rapid AI spending. Much of the investment is viewed as a long-term bet on technology that could take years to yield substantial returns, intensifying short-term uncertainties. There is increasing scepticism, highlighted by a recent decline in Nvidia shares, a drop in Oracle's stock following its announcement of rising AI expenditures, and a negative sentiment surrounding a network of companies linked to OpenAI. Looking forward to 2026, investors are contemplating whether to scale back their AI investments in anticipation of a possible bubble burst or to double down in order to benefit from transformative technology. In other market developments, gold is set for its fifth consecutive day of gains after mixed statements from Federal Reserve officials led traders to temper expectations regarding further monetary easing in the US next year.

China's November credit data showed a rebound in government borrowing, with total social financing at RMB2.49trn (RMB33.39trn ytd), including RMB1.20trn from government bond issuance. Corporate bond sales surged to RMB417bn, the highest since January, surpassing new yuan lending at RMB405bn. Corporate loan growth slightly increased to 9.0% y/y from 8.7% in October, driven by state bank lending. Household loan growth slowed to +1.1% y/y, the weakest since 2011, reflecting imbalances in the economy. The deflating housing bubble continues to strain household confidence, while government-driven corporate investment and fiscal measures fill the gap. This reliance on leverage and exports highlights structural challenges, with GFCF at 40% of GDP.

The upcoming week’s macro calendar doesn’t carry much of an end-of-year slowdown feel. While the ECB is expected to keep rates unchanged on Thursday, it will release its Q4 staff forecasts. Similarly, Norges Bank and Riksbank meetings on Thursday are likely to hold rates steady. In contrast, markets anticipate a rate hike from the BoJ on Friday and a rate cut from the BoE on Thursday. Ahead of the BoE decision, key UK labour market data on Tuesday and inflation figures on Wednesday could heighten market tensions, especially with the probability of a rate cut currently priced at over 90%. December’s flash PMIs, due Tuesday, might show some recovery from pre-Budget lows, with similar survey data also set to be released for other countries. In the UK, November’s retail sales and public finance updates on Friday will be noteworthy. Meanwhile, delayed US data due to the government shutdown will finally arrive, including the November (and partial October) employment report and October retail sales, both on Tuesday. High-profile US data continues with November CPI figures on Thursday. Inflation remains a key theme, with the euro area’s final November print and Japanese inflation data also scheduled for Thursday. Additionally, a series of regional Fed surveys will be released in the US, alongside Germany’s ZEW (Tuesday) and IFO (Wednesday) indicators, as well as several second-tier euro area reports. On the political front, a potential announcement from Trump regarding the next Fed Chair could dominate headlines. All in all, a quiet wind-down to Christmas is unlikely.

Overnight Headlines

- China’s Retail Sales Weaken To Worst Since Covid As Growth Slows

- China Investment Falls For Third Straight Month In Blow To Economy

- Japan’s Manufacturing Mood Improves, Firming Up BoJ Hike Case

- BoE To Cut Rates To 3.75% As Economic Data Eases Inflation Concerns

- Bond-Market Debate Over Fed’s Path In 2026 Is About To Heat Up

- Hassett Says Trump Can Offer Fed Advice But Won’t Set Its Action

- Trump Assault Opens EU Rift As Leaders Split On US Strategy

- Trump Vows ‘Big Damage’ After Attack On US Troops In Syria

- Israel Kills A Top Hamas Commander In Gaza, Military Says

- Nvidia Considers Expanding H200 Production On Potential China Demand

- Oracle Strikes $150B Of Data Center Leases In November Quarter

- Coca-Cola Holds Talks To Salvage Costa Coffee Sale, FT Reports

- TSMC, Broadcom AI Outlook Signals Growth For Samsung, SK Hynix In 2026

- Bitcoin Hoarding Company Strategy Remains In Nasdaq 100

- Gold Holds Gains As Divergent Fed Remarks Temper Easing Outlook

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1600-05 (6.22BLN), 1.1635-45 (1.1BLN), 1.1650-60 (2.0BLN)

- 1.1665-75 (2.0BLN), 1.1680-90 (1.64BLN), 1.1695-00 (2.64BLN)

- 1.1725-30 (643M), 1.1745-50 (905M), 1.1775-85 (1.0BLN), 1.1790-00 (721M)

- 1.1820-25 (761M)

- USD/JPY: 154.00 (271M), 154.97-00 (984M), 155.25-35 (528M)

- 156.00 (1.1BLN), 156.25-35 (572M), 156.50 (1.5BLN), 156.75-80 (274M)

- EUR/JPY: 182.15 (334M)

- USD/CHF: 0.7950 (411M), 0.8000 (355M), 0.8035-45 (457M)

- 0.8075-80 (438M). EUR/CHF: 0.9230 (300M), 0.9275 (501M)

- 0.9350 (1.0BLN), 0.9425 (500M)

- GBP/USD: 1.3300-05 (372M), 1.3390-00 (813M), 1.3500 (1.14BLN)

- AUD/USD: 0.6600-10 (366M), 0.6625-30 (901M), 0.6650 (1.1BLN)

- 0.6670-75 (590M). NZD/USD: 0.5800-10 (517M)

- AUD/NZD: 1.1400 (684M), 1.1450 (754M), 1.1475 (274M)

- 1.1515 (422M), 1.1550 (678M)

- USD/ZAR: 16.75 (250M)

CFTC Positions as of the Week Ending 7/10/25

- CFTC FX positioning data backlog clears January 20. Upcoming data on December 12, 16, 19, 23, 30, followed by January 6, 9, 13, 16, 20. Normal service resumes January 23.

- CFTC Positions as of October 21st:

- - S&P 500 CME net short: +23,090 contracts to 436,879;

- - S&P 500 CME net long: -13,254 contracts to 899,788;

- - CBOT US 5-year Treasury net short: +12,206 contracts to 2,273,950;

- - CBOT US 10-year Treasury net short: +15,726 contracts to 846,523;

- - CBOT US 2-year Treasury net short: +92,575 contracts to 1,278,422;

- - CBOT US UltraBond net short: +2,299 contracts to 299,110;

- - CBOT US Treasury bonds net short: -30,583 contracts to 27,781;

- - Bitcoin net short: -329 contracts;

- - Swiss franc net short: -27,844 contracts;

- - British pound net short: -16,775 contracts;

- - Euro net long: 111,752 contracts;

- - Japanese yen net long: 70,414 contracts.

Technical & Trade Views

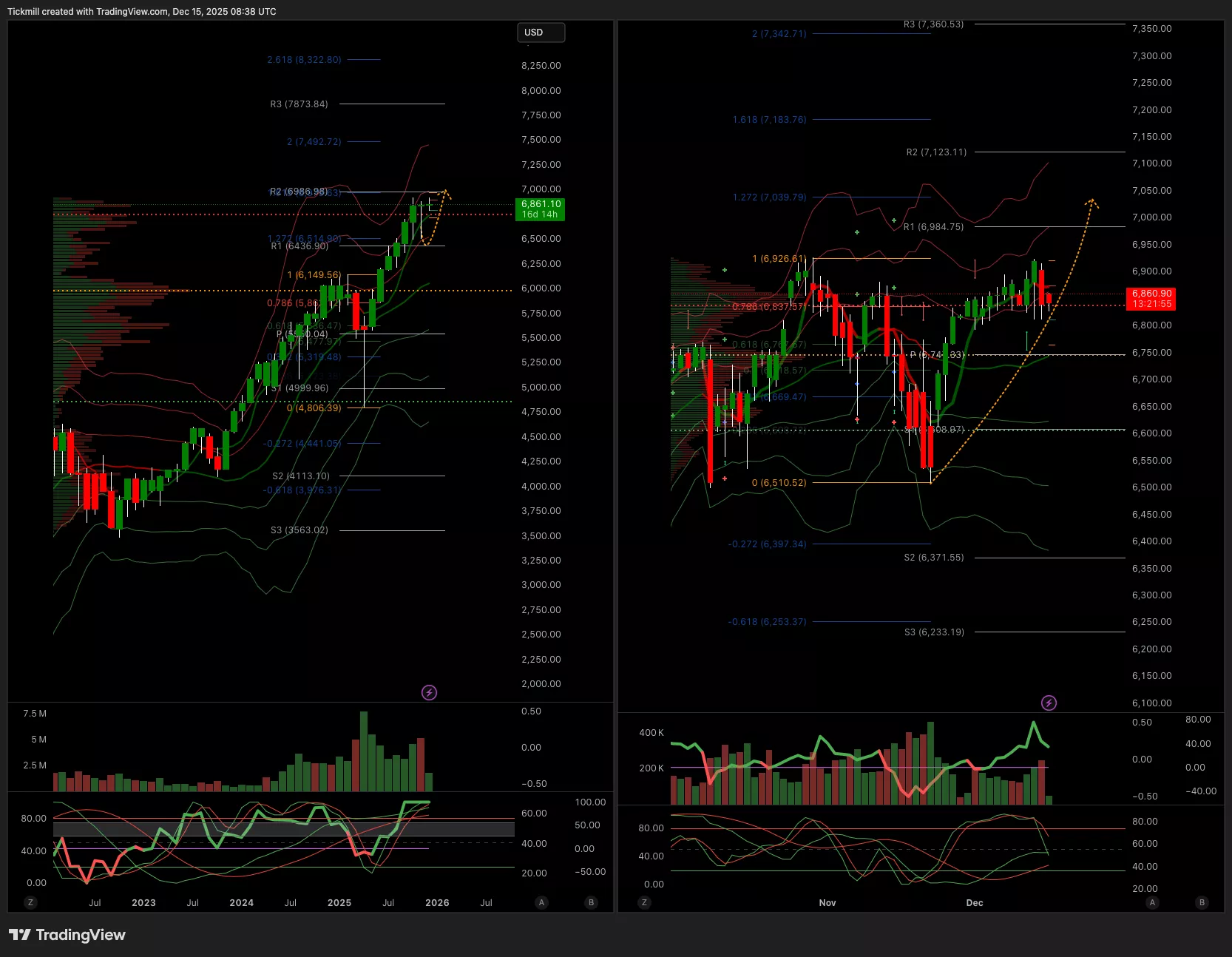

SP500

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 6875 Target 7030

- Below 6850 Target 6770

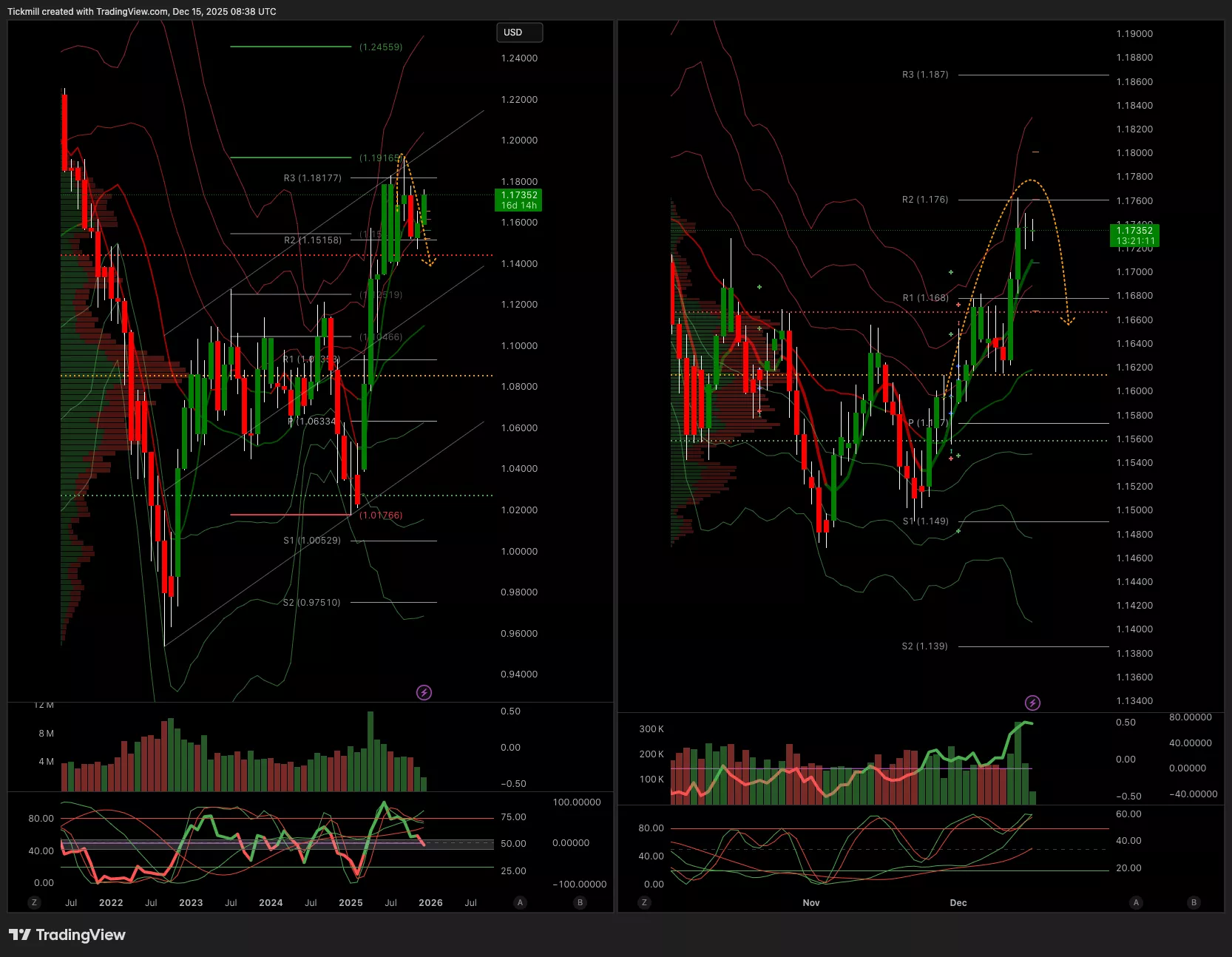

EURUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 1.17 Target 1.1780

- Below 1.1650 Target 1.16

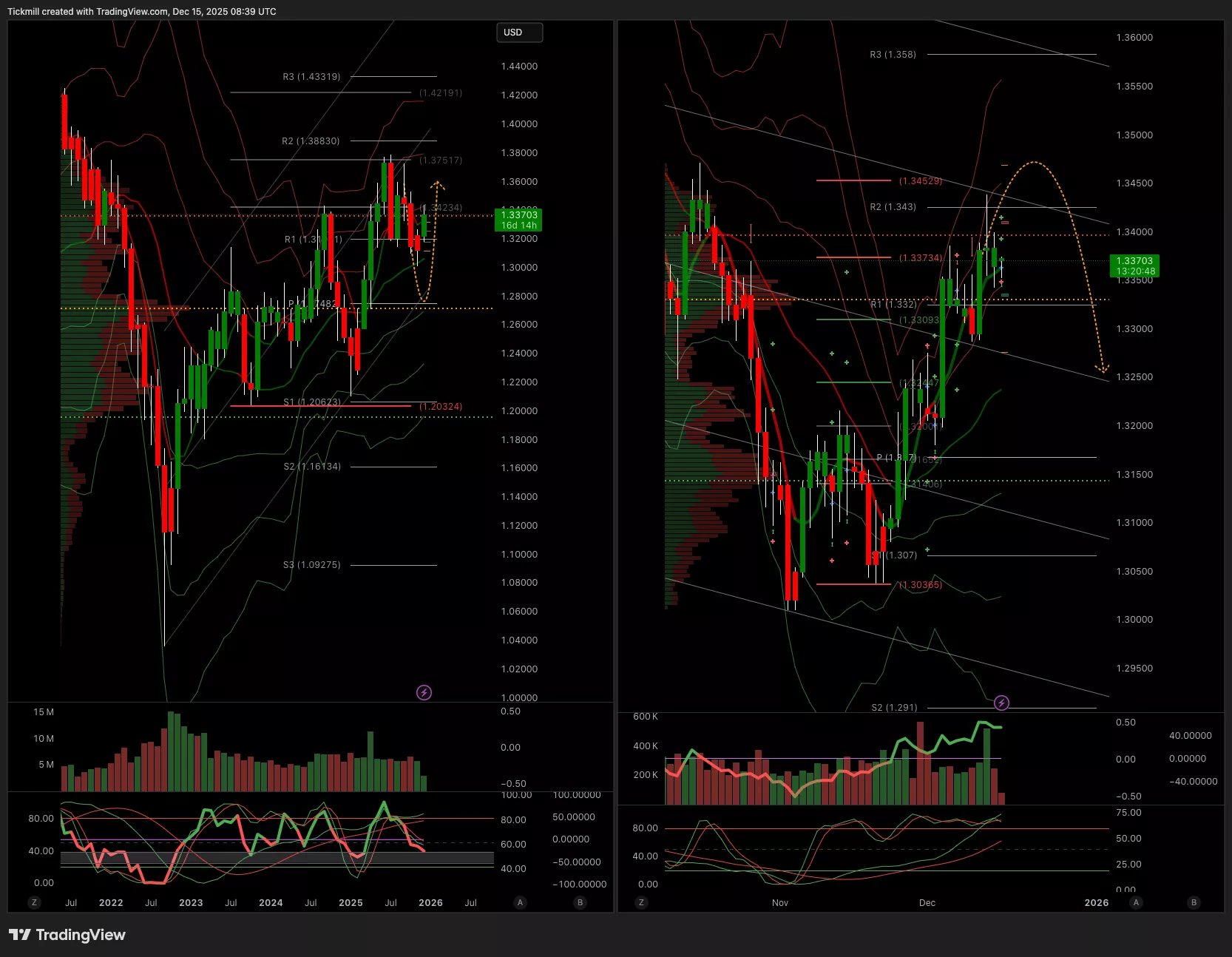

GBPUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 1.3330 Target 1.3435

- Below 1.3280 Target 1.3228

USDJPY

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 155.69 Target 157.79

- Below 155.36 Target 154.59

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 4274 Target 4380

- Below 4260 Target 4151

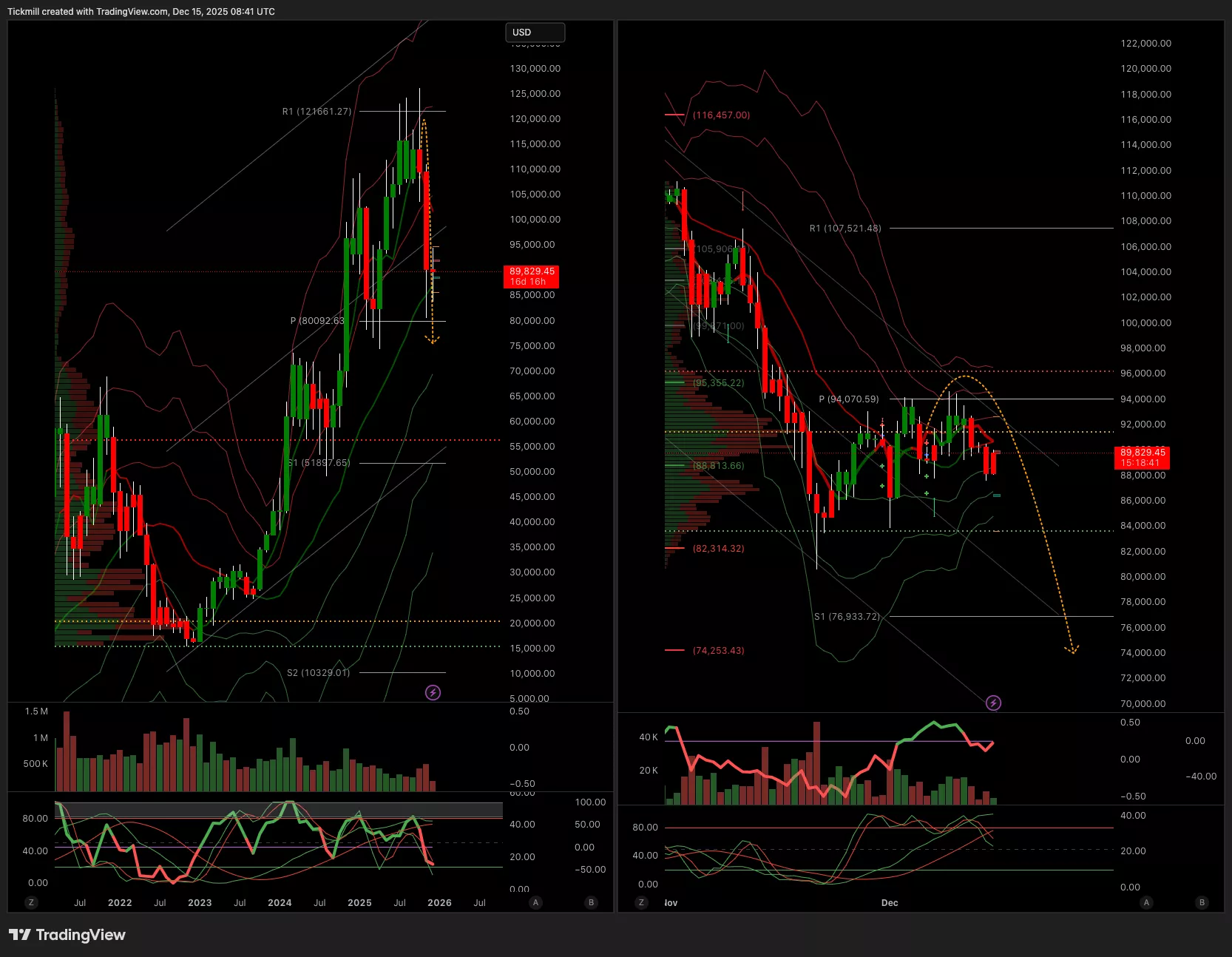

BTCUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 90.8k Target 95.7k

- Below 89.4k Target 86.2k

More By This Author:

Daily Market Outlook - Friday, Dec. 12

Daily Market Outlook - Thursday, Dec. 11

Daily Market Outlook - Wednesday, Dec. 10