Daily Market Outlook - Thursday, Dec. 11

Image Source: Pixabay

Bonds surged, and stocks advanced as the Federal Reserve implemented its third consecutive interest rate cut, with Chair Jerome Powell expressing confidence in economic recovery, provided the inflationary effects of tariffs prove temporary. The S&P 500 rose 0.7%, nearing its record high, while the Nasdaq 100 ended in positive territory. The Russell 2000, an index of small-cap stocks, climbed 1.3%, reaching a new peak. However, the global market rally driven by the Fed’s rate cut lost momentum after disappointing earnings from Oracle weighed on tech stocks, shifting focus to the central bank's outlook for further easing in the coming year. Nasdaq 100 futures dropped over 1.5%, while a selloff in Asian technology stocks erased earlier gains, causing the regional equities benchmark to decline. S&P 500 futures slid 0.8%. Oracle shares, heavily tied to the AI boom, plunged more than 10% in extended trading after its second-quarter cloud revenue missed analyst estimates. Bitcoin also fell over 2%, reflecting reduced risk appetite. Oracle disclosed increased spending on AI data centres and other infrastructure, with these investments taking longer than expected to translate into cloud revenue. Meanwhile, MSCI’s global stock index has gained over 20% this year, primarily driven by an AI-fuelled rally, and is on track for its best annual performance since 2019. Despite this, an index of Asian tech stocks fell over 1%, outpacing a 0.5% decline in the broader regional benchmark. In Tokyo, SoftBank Group shares tumbled more than 8%.

The FOMC’s decision to lower the Fed Funds rate by 25bps to 3.50-3.75% came as no surprise. However, the SEP projections and press conference provided much to analyse. The Fed’s outlook on rates showed little change for the coming years, with one additional cut anticipated and limited adjustments beyond that. The macroeconomic projections, however, painted a more dynamic picture: growth forecasts for 2026 were revised upward to 2.3% from 1.8%, inflation expectations declined (boosted by Powell’s optimism about rising productivity), while unemployment projections remained largely unchanged. During the press conference, Powell discussed the challenges the FOMC is navigating. Two dissenting members, who favoured a pause, remained concerned about inflation risks—attributed at least partially to tariffs. For the majority of the committee, however, the labour market was the primary focus, as recent data had been slightly weaker than anticipated, compounded by data gaps. Powell also expressed scepticism about payroll figures, suggesting the reported +40k average job growth might actually be closer to -20k after revisions. The unemployment rate’s stability, he noted, was due more to a shrinking labour supply than robust hiring. The rate cut was intended to help stabilise these conditions. Powell further stated that monetary policy was now back in the neutral range, albeit at the upper end, though some fine-tuning might still be necessary. Overall, his tone appeared balanced and less hawkish than markets had anticipated.

The Bank of Canada kept rates steady at 2.25% in its final meeting of the year, adopting a slightly more dovish tone. The Governing Council downplayed near-term inflation upticks, attributing them to last year’s GST/HST holiday, and shifted from previous expectations of easing inflationary pressures. Despite recent job market improvements, the BoC remained cautious, citing weak hiring intentions and sector vulnerabilities. While market pricing now suggests a potential rate hike, Governor Macklem indicated current rates were appropriate to maintain 2% inflation and support the economy amid structural adjustments from U.S. tariffs. The BoC emphasised modest growth and persistent uncertainty.

Overnight Headlines

- SNB Set To Hold Rates This Week, Maybe Much Longer – Analysts

- Germany’s 10Y Yield Hits Fresh 9-Month High, Central Banks In Focus

- UK Pledges Extra £1.5B On NHS Medicines As Part Of Trump Tariff Deal

- Trump: Fed Could Have ‘At Least Doubled’ Latest Interest Rate Cut

- Treasury Yields, Dollar Fall After Fed Cut, Powell Remarks

- BoJ Likely To Conduct Multiple Hikes Ahead, Ex-Executive Says

- Brazil Holds Rate At 15% On Stubbornly High Inflation Forecasts

- Australia Sheds Jobs Unexpectedly, Supports RBA Caution

- US Seizes Venezuelan Oil Tanker Bound For Cuba In Latest Escalation

- Trump Talks Ukraine Peace Deal With Macron, Merz And Starmer

- US Blueprint For Economies Of Russia, Ukraine Sets Off Clash With Europe

- Adobe Forecasts Annual Revenue Above Estimates

- Synopsys Sees Strong 2026 As Ansys Acquisition Boosts Q4 Revenue

- Oracle Posts Weak Cloud Sales, Raising Fear Of Delayed Payoff

- Coca-Cola CEO Quincey To Step Down, Replaced By COO Braun

- Google DeepMind To Open AI Lab In UK To Discover New Materials

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1550-60 (487M), 1.1575-85 (608M), 1.1590-00 (4.8BLN)

- 1.1605-15 (5.5BLN), 1.1620-30 (1.03BLN), 1.1635-40 (700M)

- 1.1650-60 (1.51BLN), 1.1675-85 (1.1BLN), 1.1700-10 (1.6BLN)

- 1.1725-30 (601M), 1.1735-40 (968M), 1.1750-55 (915M)

- 1.1760-65 (1.2BLN), 1.1800 (2.21BLN

- USD/JPY: 154.95-05 (932M), 155.25 (398M), 156.00 (1.24BLN) 156.15 (250M), 158.00 (919M)

- USD/CHF: 0.7950-70 (1.2BLN), 0.8000-10 (430M)

- GBP/USD: 1.3250 (326M). EUR/GBP: 0.8720-25 (392M),

- 0.8775 (200M)

- AUD/USD: 0.6550 (1.9BLN), 0.6600-10 (283M), 0.6615-25 (624M) 0.6630-40 (545M), 0.6700-05 (492M), 0.6750 (50M)

- USD/CAD: 1.3775 (211M), 1.3920-25 (352M), 1.3950

- (1.2BLN)

- USD/ZAR: 16.9150 (190M), 16.9500 (250M), 17.00 (300M) 17.29-30 (526M)

CFTC Positions as of the Week Ending 7/10/25

- CFTC FX positioning data backlog clears January 20. Upcoming data on December 2, 5, 9, 12, 16, 19, 23, 30, followed by January 6, 9, 13, 16, 20. Normal service resumes January 23.

- CFTC Positions (Week of October 28th):

- - S&P 500 CME net short: +21,626 contracts (458,504 total)

- - S&P 500 CME net long: +7,029 contracts (906,817 total)

- - CBOT US 5-year Treasury net short: +130,976 contracts (2,404,926 total)

- - CBOT US 10-year Treasury net short: +64,407 contracts (910,930 total)

- - CBOT US 2-year Treasury net short: +34,053 contracts (1,312,475 total)

- - CBOT US UltraBond Treasury net short: -2,057 contracts (297,053 total)

- - CBOT US Treasury bonds net short: -12,678 contracts (15,103 total)

- - Bitcoin net short: -543 contracts

- - Swiss franc net short: -27,858 contracts

- - British pound net short: -20,262 contracts

- - Euro net long: 107,333 contracts

- - Japanese yen net long: 68,115 contracts.

Technical & Trade Views

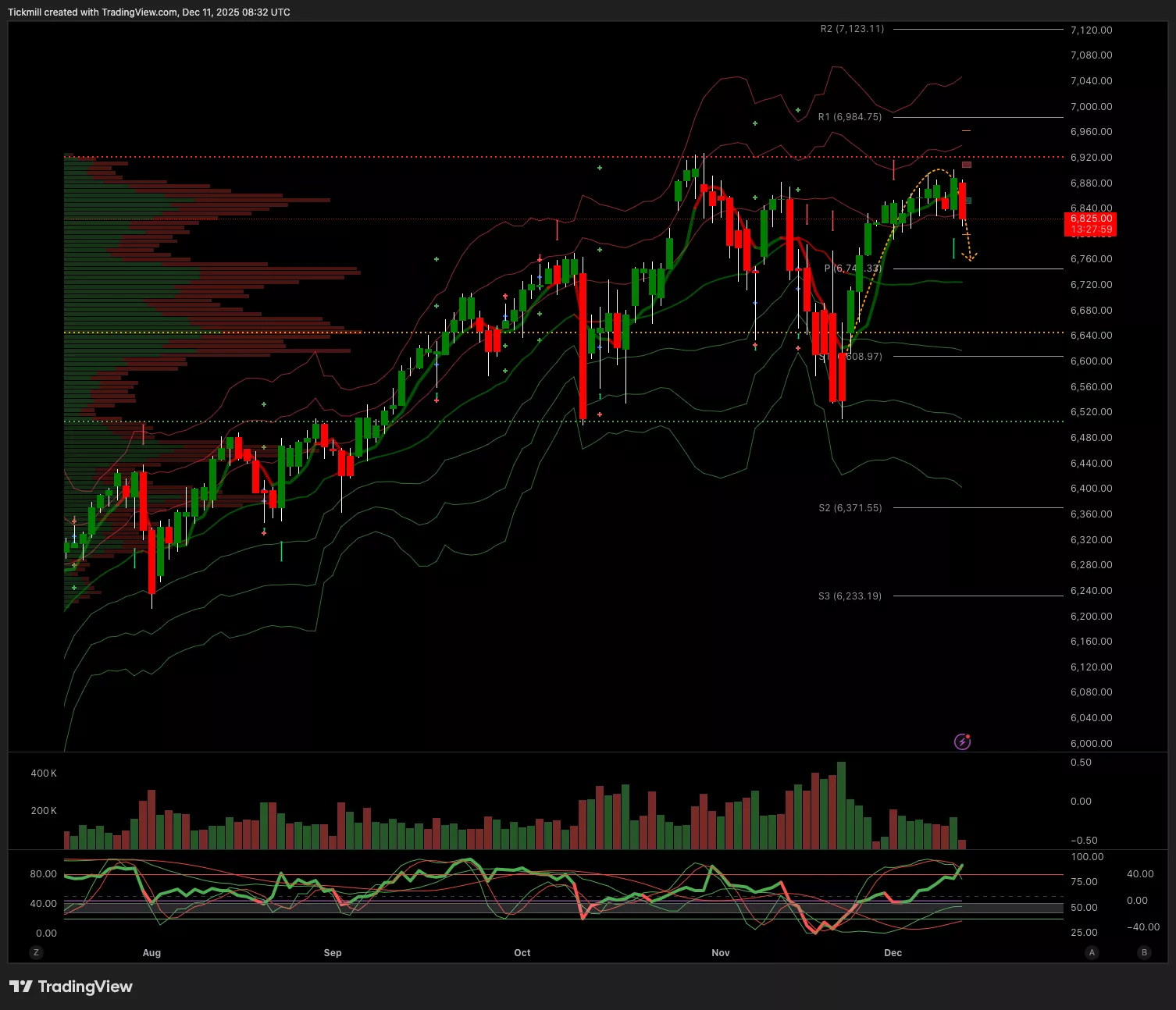

SP500

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 6860 Target 6920

- Below 6834 Target 6770

EURUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 1.17 Target 1.1730

- Below 1.1650 Target 1.16

GBPUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 1.3330 Target 1.3435

- Below 1.3280 Target 1.3228

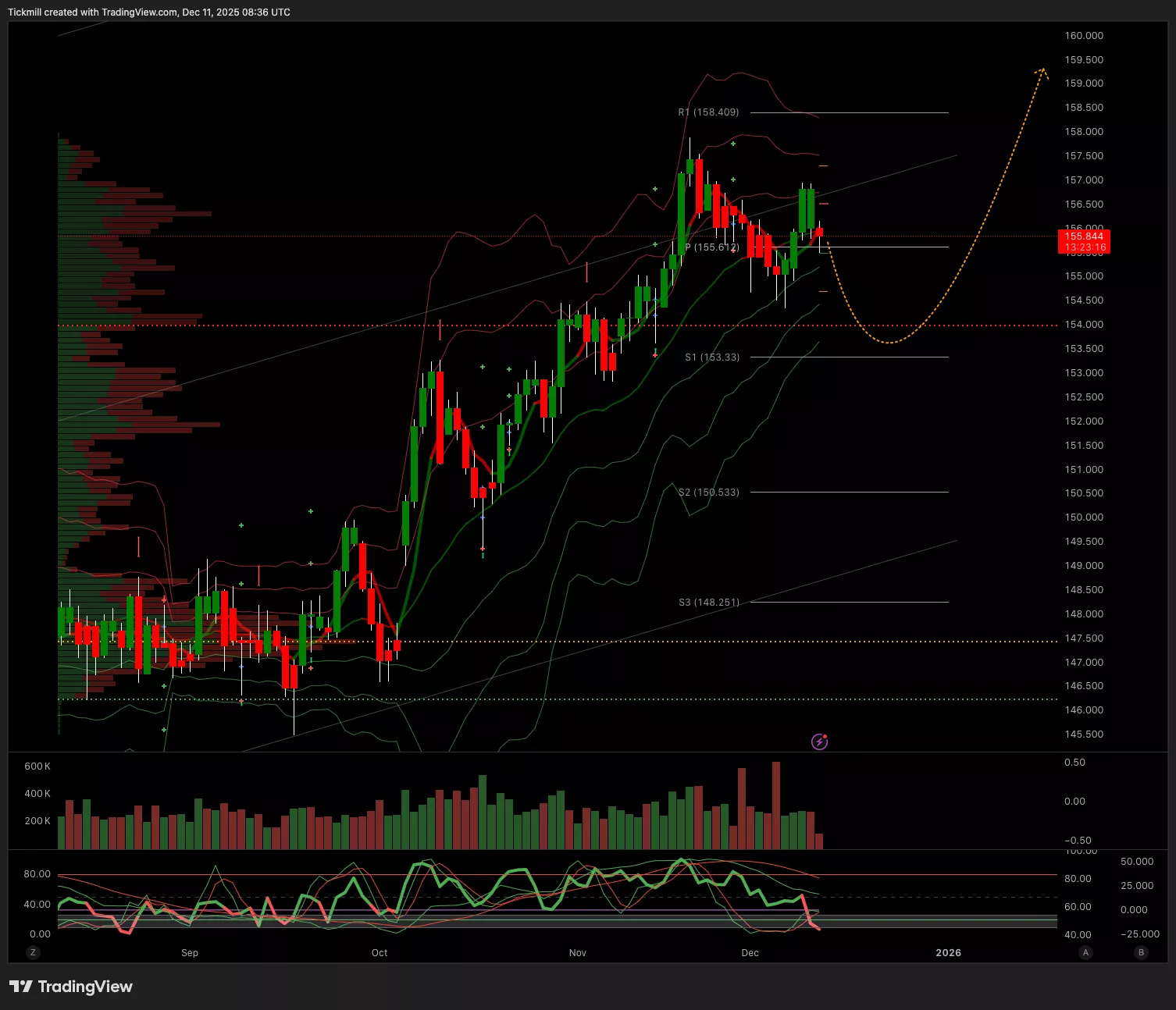

USDJPY

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 155.69 Target 157.79

- Below 155.36 Target 154.59

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 4274 Target 4319

- Below 4215 Target 4151

BTCUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 90.8k Target 95.7k

- Below 89.4k Target 86.2k

More By This Author:

Daily Market Outlook - Wednesday, Dec. 10

The FTSE Finish Line - Tuesday, Dec. 9

Daily Market Outlook - Tuesday, Dec. 9