Daily Market Outlook - Friday, Nov. 28

Photo by Ishant Mishra on Unsplash

Stocks declined on the final trading day of the month, even as expectations for a Fed interest rate cut increased, keeping a global equity index poised for its strongest week since June. The CME faced an issue that disrupted trading. Trading in futures and options on the CME was suspended due to technical difficulties. This problem impacted, among other things, trading in US Treasuries futures and S&P 500 Index contracts. Traders indicated that forex trading on the EBS platform was affected because of the CME stoppage. In the meantime, the MSCI All Country World Index remained mostly unchanged as stocks struggled to find a direction following the US Thanksgiving holiday. Nevertheless, the index finished the week with a 3.1% increase. Asian equities held steady, heading for their first monthly drop since March. Gold is set for a fourth consecutive monthly advance, fuelled by heightened expectations of another rate cut in the US. Rate cuts typically boost the price of gold, a non-yielding asset. The metal has appreciated nearly every month this year and is on track for its best annual performance since 1979. Brent crude oil held steady above $63 per barrel, on course for its fourth monthly decline in November, marking the longest losing streak since May 2023. The OPEC+ nations are set to convene on Sunday and are expected to uphold their commitment to pause output increases until early 2026.

Domestically, the UK November Lloyds Business Barometer fell 8 points to 42%, reflecting declines in business expectations and economic optimism. Pre-Budget uncertainty likely impacted sentiment. Pricing intentions remained high, with 60% of firms planning price increases, only slightly down by 3 points. This contrasts with the flash PMIs, which showed margin compression and weaker pricing power, especially in services. Mixed signals on inflation and potential post-Budget activity rebound offer limited evidence for a near-term rate cut. The BoE's Decision Maker Panel survey next week may also reflect pre-Budget distortions, but the market still implies a 90% probability of a December rate cut.

The Federal Reserve’s quiet period means no commentary ahead of the December 10 rate decision. With limited data releases following the recent shutdown, the monthly ADP employment report (Wednesday) stands out as the key highlight. Additionally, the ISM manufacturing (Monday) and services (Wednesday) reports, along with the University of Michigan sentiment index (Friday), will hold significance. In the euro area, attention centers on the flash November CPI (Tuesday), though a consensus estimate of 2.2% year-on-year suggests little change to the ECB’s outlook. ECB President Lagarde will make her quarterly appearance at the European Parliament (Wednesday), and the region will also see a final reading of Q3 GDP (Friday). In the UK, the Treasury Select Committee hearing on the Bank of England’s November Monetary Policy Report appears delayed, with scrutiny shifting to the Budget and testimony from OBR Chief Richard Hughes (Tuesday). The key UK data release will be the latest BoE Decision Maker Panel survey (Thursday), which some MPC members have emphasized. Meanwhile, MPC hawks are scheduled to speak twice (Wednesday and Thursday), and BoE money and credit data for October will kick off the week (Monday). Globally, final November manufacturing PMIs (Monday) and services PMIs (Wednesday) will be released, but overall, it’s shaping up to be a relatively quiet week for major data releases.

Overnight Headlines

- Gold Poised For Fourth Monthly Gain On Fed Rate-Cut Optimism

- Russia’s C Bank: Gold Driven By G7 Attempt To Get Our Frozen Assets

- Putin Says US Plan For Ending Ukraine War A Starting Point, Needs Work

- Tokyo Inflation Beats Forecast, Keeping BoJ On Rate Hike Path

- BoE Official Plays Down Impact Of Energy Bill Cut On Inflation

- UK Budget Trims Inflation But Offers Limited Relief For BoE

- Reeves Budget Calms Markets And Party But Leaves Britons Unhappy

- UK Delays Imposing Sanctions On Lukoil International Until February

- Carney Inks Energy Deal With Alberta, Conditions For New Oil Pipeline

- Canadian Dollar Touches 8-Day High As Current Account Deficit Improves

- German Drone Maker Quantum Systems Secures €3B Valuation

- China Turns To France For Support During Its Feud With Japan

- BIS Warns Of Hedge Fund Bond Market Bets Risking Yield Spikes

- OpenAI Partners Amass $100B Debt Pile To Fund Its Ambitions

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1400 (EU822m), 1.1600 (EU799.3m), 1.1570 (EU779m)

- USD/JPY: 154.00 ($1.28b), 145.00 ($590.6m), 156.50 ($516.2m)

- USD/BRL: 5.3000 ($1.33b), 5.4000 ($1.31b), 5.3500 ($1.1b)

- AUD/USD: 0.6600 (AUD420.9m), 0.6240 (AUD352.3m), 0.6400 (AUD325.1m)

- EUR/GBP: 0.8900 (EU588.8m), 0.8825 (EU437.5m)

- GBP/USD: 1.3200 (GBP758.3m), 1.3000 (GBP368.7m), 1.3150 (GBP352.7m)

- USD/CAD: 1.3750 ($474m)

- NZD/USD: 0.5650 (NZD300.4m), 0.5550 (NZD300m)

CFTC Positions as of the Week Ending 7/10/25

- CFTC FX positioning data backlog clears January 20. Data for the week ending September 30 published Wednesday. October 14 data next Tuesday (Nov 25). Upcoming data on December 2, 5, 9, 12, 16, 19, 23, 30, followed by January 6, 9, 13, 16, 20. Normal service resumes January 23.

- CFTC Positions for the Week Ended October 7th:

- - S&P 500 CME net short: +20,343 contracts (458,398 total)

- - S&P 500 CME net long: +9,589 contracts (944,434 total)

- - CBOT US 5-year Treasury net short: +3,838 contracts (2,267,738 total)

- - CBOT US 10-year Treasury net short: +48,050 contracts (787,958 total)

- - CBOT US 2-year Treasury net short: +12,837 contracts (1,219,958 total)

- - CBOT US UltraBond net short: +7,409 contracts (266,858 total)

- - CBOT US Treasury bonds net short: -16,378 contracts (62,352 total)

- - Bitcoin net short: -1,108 contracts

- - Swiss franc net short: -27,470 contracts

- - British pound net short: -4,476 contracts

- - Euro net long: 118,365 contracts

- - Japanese yen net long: 46,307 contracts

Technical & Trade Views

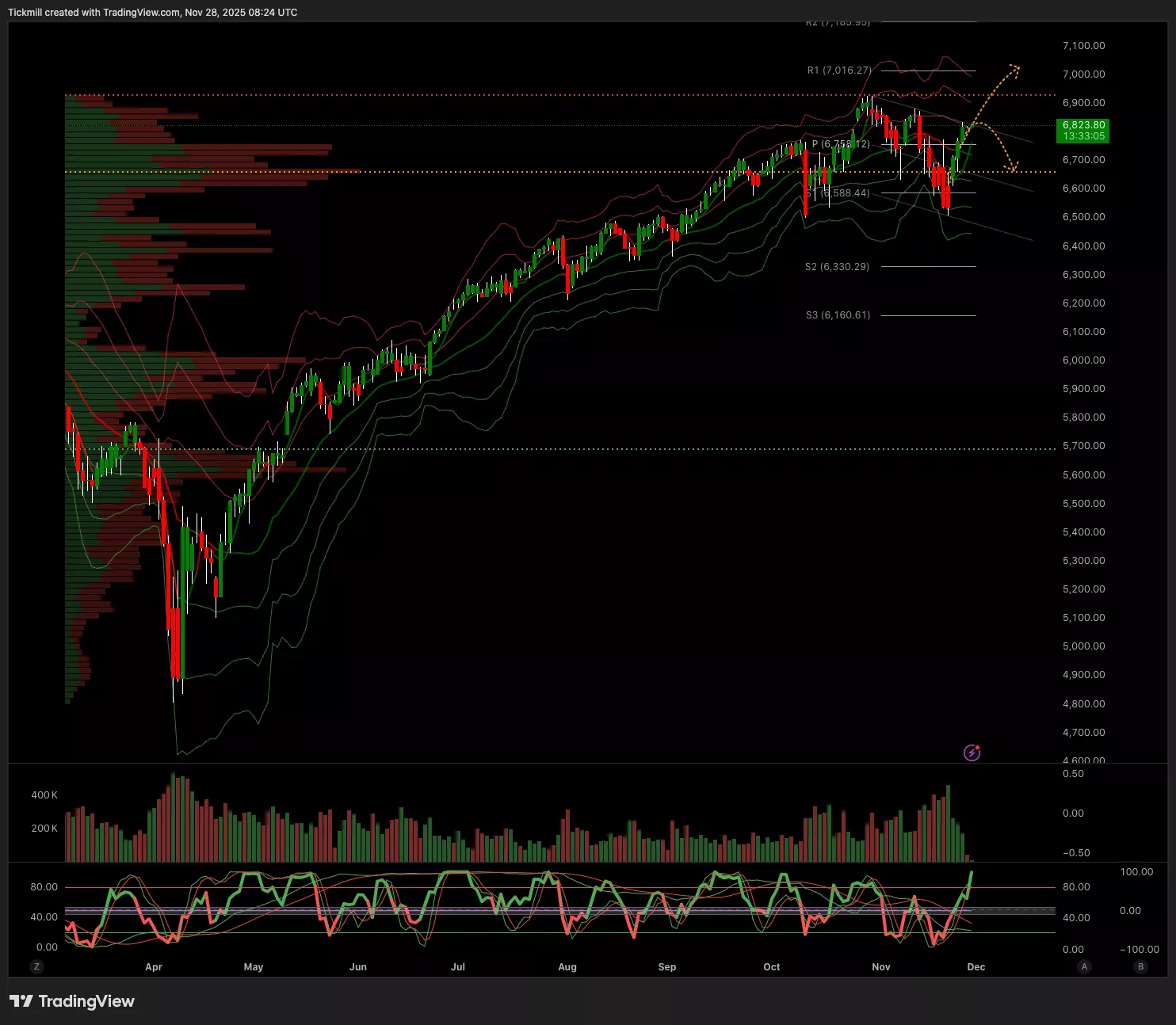

SP500

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 6762 Target 6903

- Below 6720 Target 6628

EURUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 1.1571 Target 1.1637

- Below 1.1556 Target 1.1435

GBPUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 1.3188 Target 1.3298

- Below 1.3157 Target 1.3078

USDJPY

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 156.84 Target 158.06

- Below 155.49 Target 154.12

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 4145 Target 4213

- Below 4080 Target 4008

BTCUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 92k Target 98k

- Below 89.2k Target 86k

More By This Author:

The FTSE Finish Line - Thursday, Nov. 27

Daily Market Outlook - Thursday, Nov. 27

The FTSE Finish Line - Wednesday, Nov. 26