Daily Market Outlook - Friday, Feb. 28

Image Source: Pixabay

Asian markets faced heightened pressure amid a global stock sell-off, with the Dollar strengthening and Treasury yields edging lower as investors shifted away from high-risk assets following Trump’s escalation of tariffs. The S&P 500 tumbled 1.6% on Thursday, wiping out its gains for the year, while the MSCI recorded its steepest drop in over a month. Nvidia’s shares plunged 8.5% after its latest earnings report, contributing to a 2.8% decline in the Nasdaq 100. Meanwhile, European equity futures pointed to continued losses ahead. Markets were rattled by mounting concerns that Trump’s latest tariffs targeting China, Canada, and Mexico could dampen global economic growth. Investors steered clear of riskier assets, resulting in a sharp sell-off in Hong Kong’s tech sector. Trump announced a 10% tariff on additional Chinese imports and confirmed that 25% tariffs on goods from Canada and Mexico would take effect on March 4th. Economists cautioned that these measures could curb U.S. GDP growth, drive up inflation, and potentially spark recessions in Canada and Mexico. The plan includes imposing tariffs on over $1 trillion worth of imports unless last-minute negotiations yield a resolution.

Cryptocurrency prices have significantly declined recently, with major digital currencies losing nearly all gains since Trump's election win. Analysts predict a subdued market until bullish signals arise, such as possible interest rate cuts or clear pro-crypto regulations. Bitcoin has dropped 21% since January, returning to pre-election levels, while other cryptocurrencies like ether have fallen over 40%. Trump's meme coin has seen an 80% decrease from its January peak. Although Trump promised pro-crypto initiatives, including a national bitcoin stockpile and favorable regulation, these moves have not positively impacted crypto prices. An executive order established a cryptocurrency working group, but investor expectations remain unfulfilled regarding the U.S. purchasing bitcoin.

Ukrainian President Volodymyr Zelenskiy will meet with U.S. President Donald Trump to sign a minerals deal aimed at regaining U.S. support amid the Russian invasion. Unlike Biden's administration, Trump has expressed a desire to end the war quickly and improve relations with Moscow. The minerals deal opens Ukraine's resources to the U.S. but lacks security guarantees, disappointing Ukraine. Trump aims to recover weapon costs through a reconstruction fund linked to mineral sales. Despite criticizing Zelenskiy, Trump praised the Ukrainian military, while UK PM Starmer, in a meeting with Trump yesterday, emphasized a tough yet fair peace plan involving U.S. military involvement, which Trump dodged. The agreement mandates Ukraine to share 50% of future resource revenues for reconstruction. The dollar-yen currency pair often mirrors U.S. Treasury yields, which have fallen to new two-week lows as traders consider the possible repercussions of a global trade war on the U.S. economy, which has recently begun to show signs of weakness. A significant report is expected later today regarding the PCE deflator, the inflation measure favored by the Fed. Traders have consistently increased their expectations for a dovish Federal Reserve, with two quarter-point rate cuts that have recently been factored into the market now anticipated for June and September.

Next week the ECB decision and US employment report are key highlights. The ECB is expected to cut the Depo Rate by 25bps to 2.5% (Thu), with attention on new macroeconomic forecasts and whether policy remains "restrictive." Lagarde may avoid strong signals on April's decision. Flash February CPI (Mon) and individual country estimates will precede this.In the US, survey data reflects Trump policy uncertainty, though employment metrics remain solid. Federal layoffs' impact may appear later, so robust ADP (Wed) and BLS employment reports (Fri) are anticipated. Final February PMIs (Mon/Wed) and Services ISM (Wed) will also be monitored. In the UK, the BoE Decision Maker Panel (Thu) could reveal trends in price expectations, while Bailey’s Treasury Select Committee appearance (Wed) on the February MPR is a key event. Trump policy updates, including postponed Canada/Mexico tariffs (Mon), may also dominate headlines.

Banks project USD demand for February's month-end rebalancing. Deutsche Bank's model anticipates moderate USD buying, driven by U.S. equity underperformance and European equity outperformance, signaling EUR/USD selling. Seasonal trends also highlight potential NZD/USD and AUD/USD declines around month-end. Conversely, Credit Agricole notes a global equity downturn in February and a significant USD drop, suggesting weak USD rebalancing flows, particularly against SEK. While EUR selling is possible, no clear trading signals or recommendations are provided for February.

Overnight Newswire Updates of Note

- Trump Says Canada, Mexico Tariffs to Take Effect, Adds New China Duty

- Pres. Trump: Tariffs With UK May Not Be Required With Deal

- Pres. Trump: Working Very Hard To Get War In Ukraine To End

- BoJ'S Uchida: Will Raise Rates If Outlook Is Realised

- White House Temporarily Blocked From Firing Federal Workers

- Japan To Crack Down On Booming Market For JGB-Backed Loans

- UK's Starmer Discussed 'Tough And Fair' Ukraine Peace Deal With Trump

- UK Firms Turn More Hopeful On Economy, Plan To Hire More, Lloyds Says

- Bitcoin Down 25% From All-Time High As Crypto Rout Worsens

- Stocks Slide As Fears Grow Over Tariffs And US Economy

- Gold Set For Largest Weekly Fall Since November

- Dell’s AI Server Sales Outlook Fails to Ease Profit Worries

- North Korea’s Kim Orders Nuclear Readiness After Missile Test

- China Opposes New Trump Tariff Threat As Deadline Looms

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0300 (871M), 1.0385-95 (2.7BLN), 1.04.00-05 (3.9BLN)

- 1.0425-30 (1BLN), 1.0440 (550M), 1.0460 (655M), 1.0475-80 (1.2BLN)

- USD/CHF: 0.8875 (1BLN), 0.8920 (1.2BLN), 0.8950 (363M), 0.9000 (490M)

- GBP/USD: 1.2400 (305M), 1.2590-1.2600 (571M), 1.2650 (412M)

- EUR/GBP: 0.8245 (540M). NZD/USD: 0.5615 (647M)

- USD/CAD: 1.4375 (840M), 1.4400 (1.9BLN), 1.4450 (397M), 1.4500 (1.3BLN)

- USD/JPY: 149.50 (900M), 150.00 (1.6BLN), 151.30 (1.4BLN)

- EUR/JPY: 154.85-155.00 (622M), 157.00 (380M). AUD/JPY: 93.75 (405M)

CFTC Data As Of 21/2/25

- Positions Report from the CFTC for the Week Ending February 18th

- The net short position in euros stands at -51,420 contracts.

- The net long position for the Japanese Yen stands at 60,569 contracts.

- The Swiss franc has recorded a net short position of -38,359 contracts.

- The net short position for the British pound stands at -579 contracts.

- The net short position for Bitcoin stands at -367 contracts.

- Equity fund managers have increased their S&P 500 CME net long position by 18,069 contracts, bringing the total to 948,011. Meanwhile, equity fund speculators have reduced their S&P 500 CME net short position by 332 contracts, resulting in a total of 365,901.

- Speculators have raised their positions on CBOT. The net long position in US Treasury Bonds futures has risen by 3,780 contracts, reaching a total of 47,781. Speculators are increasing their activity on the CBOT. US Ultrabond Treasury futures net short position decreased by 6,301 contracts, totalling 246,242. Speculators have reduced their positions. Chicago Board of Trade US 2-Year Treasury futures have seen a net short position decrease of 9,093 contracts, bringing the total to 1,289,519. Speculators are reducing their positions on the CBOT. The net short position in US 10-Yr Treasury futures has decreased by 41,507 contracts, bringing the total to 709,527. Meanwhile, speculators have reduced their net short position in CBOT US 5-Yr Treasury futures by 124,202 contracts, resulting in a total of 1,737,533.

Technical & Trade Views

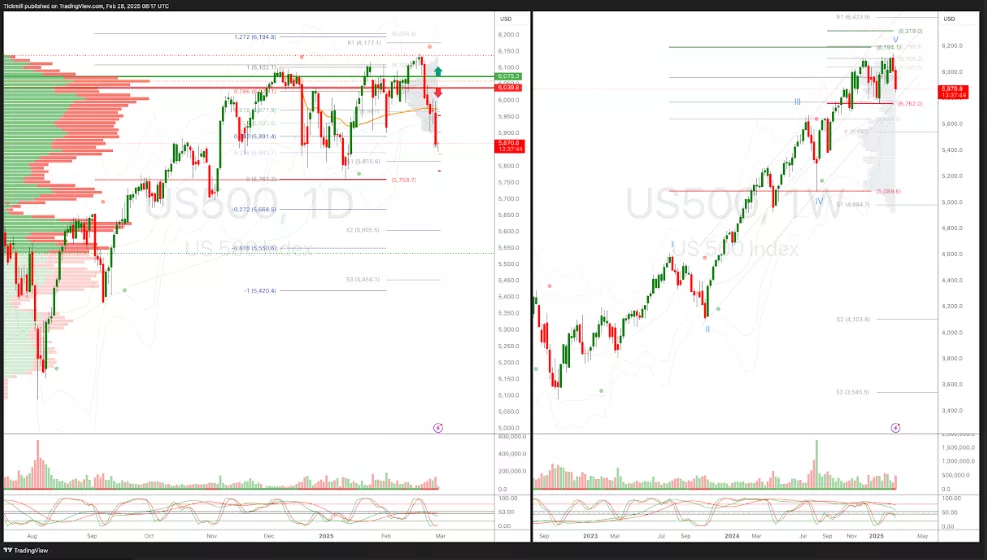

SP500 Pivot 6040

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bearishness Into March 7th

- Long above 6075 target 6195

- Short Below 6045 target 5743

(Click on image to enlarge)

EURUSD Pivot 1.0435

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 30th

- Above 1.0505 target 1.0634

- Below 1.0435 target 0.9758

(Click on image to enlarge)

GBPUSD Pivot 1.2614

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 10th

- Above 1.2685 target 1.2812

- Below 1.2615 target 1.1878

(Click on image to enlarge)

USDJPY Pivot 153.77

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 1.5377 target 165.50

- Below 152.41 target 150

(Click on image to enlarge)

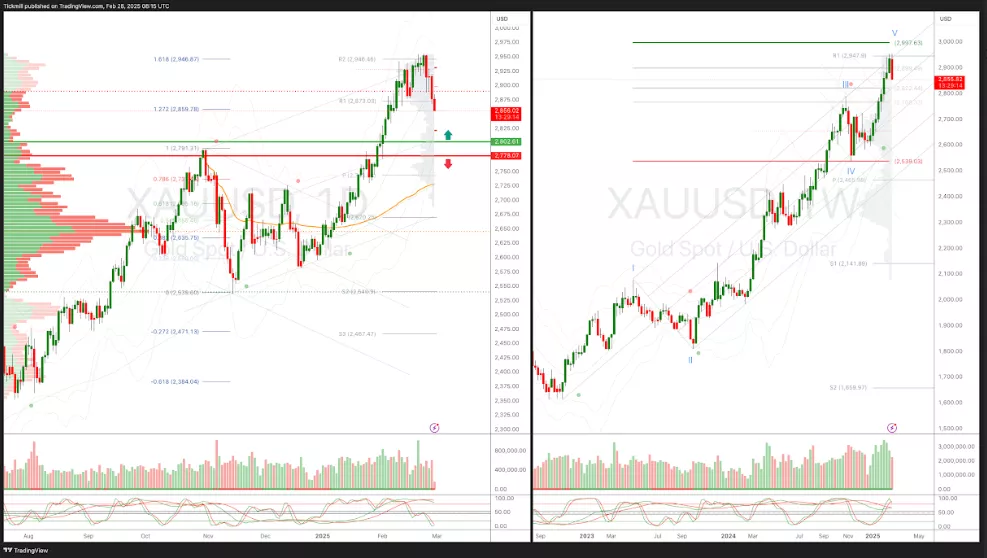

XAUUSD Pivot 2692

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests volatile bullishness into Feb 22nd

- Above 2725 target 2997

- Below 2692 target 2475

(Click on image to enlarge)

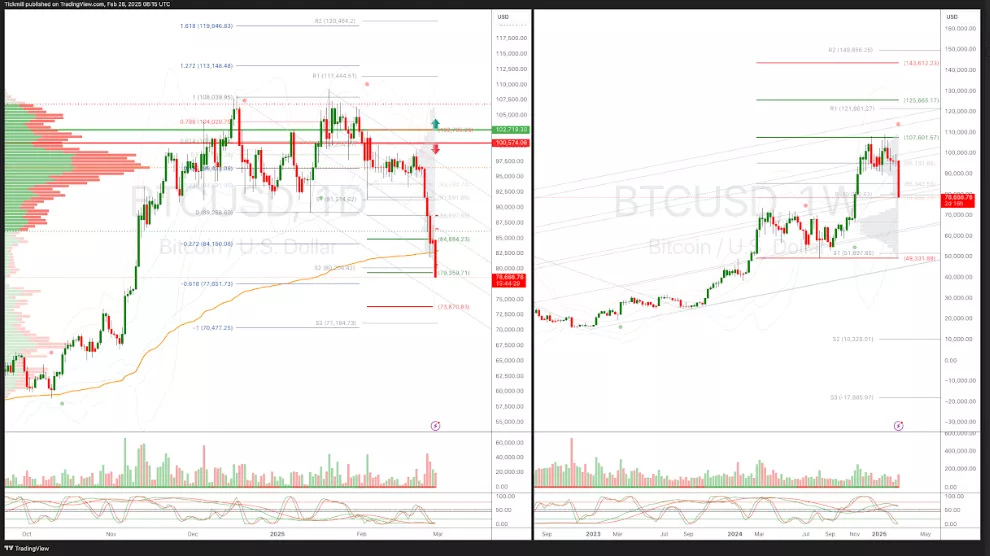

BTCUSD Pivot 101,960

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 104,020 target 110,000

- Below 101,942 target 879,359

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Thursday, Feb. 27

Daily Market Outlook - Thursday, Feb. 27

The FTSE Finish Line - Wednesday, Feb. 26