The FTSE Finish Line - Thursday, Feb. 27

Image Source: Unsplash

UK's FTSE 100 rose 0.6% on Thursday, outperforming other European markets amid U.S. tariff threats. Rolls-Royce surged nearly 19% to a record high, driving an 11% sector boost, after raising mid-term targets and surpassing profit estimates. The London Stock Exchange Group gained 2.2% on growth projections, while Aviva rose 1.9% after exceeding profit expectations. Meanwhile, WPP plummeted 15.6% on a larger-than-expected drop in organic revenue. In Europe, the STOXX 600 fell as tariff-sensitive stocks declined following U.S. President Trump's 25% tariff announcement on EU cars and products. UK Prime Minister Keir Starmer is set to discuss tariffs with Trump in Washington..

Single Stock Stories & Broker Updates:

- Shares of advertising group WPP drop 19%, the lowest level since November 2020. The stock could face its worst day since August 1992; it is the biggest loser on the FTSE 100, which is down 0.17%. WPP reports a 1% organic revenue decline for 2024; it expects flat or up to a 2% revenue decline in the first half, with improvement in the second half. JPM analysts believe the shares will remain under pressure until growth accelerates in the second half and there is clarity on the Mars review, which will influence potential growth through 2026. The shares have fallen 60% in 2024.

- Ocado's shares have dropped approximately 15%, potentially leading to the worst day since September 2023; it is currently the top loser on the FTSE mid-caps with a -0.9% loss. Co. delays robotic warehouse roll-out with Kroger to 2026. Reports pre-tax loss of 374.3 million pounds for year ending Dec 1, 2024, slightly better than the 387 million pounds loss in 2022-23. JP Morgan analysts expect no significant changes to consensus estimates. Stock down ~6.5% YTD after current losses.

- Shares of Taylor Wimpey dropped 3.3%, making it a top percentage loser on the FTSE 100. The UK homebuilder reported an over 32% decline in 2024 pre-tax profit to 320.3 million pounds, missing estimates of 400.8 million pounds. FY24 operating profit fell by about 12% to 416.2 million pounds. However, TW anticipates meeting 2025 operating profit estimates of 444 million pounds. Investors expressed frustration over a lack of top-line growth despite a 16% larger order book compared to last year. The stock is down approximately 16% over the past year.

- Shares of Hiscox Ltd rose 6.2%, the highest since September 2024. The stock is a top gainer on the FTSE 100 and announced a $175 million buyback starting with an $87.5 million tranche to be completed by Q3 2025. Insurance contract written premium grew 3.7% to $4.77 billion year over year. Jefferies expects a positive response to FY 2024 results and buyback, considering wildfire exposure reasonable. The stock is up 7.2% over the last 12 months.

- Shares of British wealth manager St James's fell 4.4%, making it one of the top losers on the FTSE 100, which is up 0.1%. SJP reported 2024 net inflows of 4.3 billion pounds ($5.43 billion), down from 5.1 billion pounds ($6.44 billion) in 2023. Nine of 15 analysts rate the stock "buy" or higher, with a median price target of 1,150 pence. The stock has risen 26.97% in 2024.

Technical & Trade View

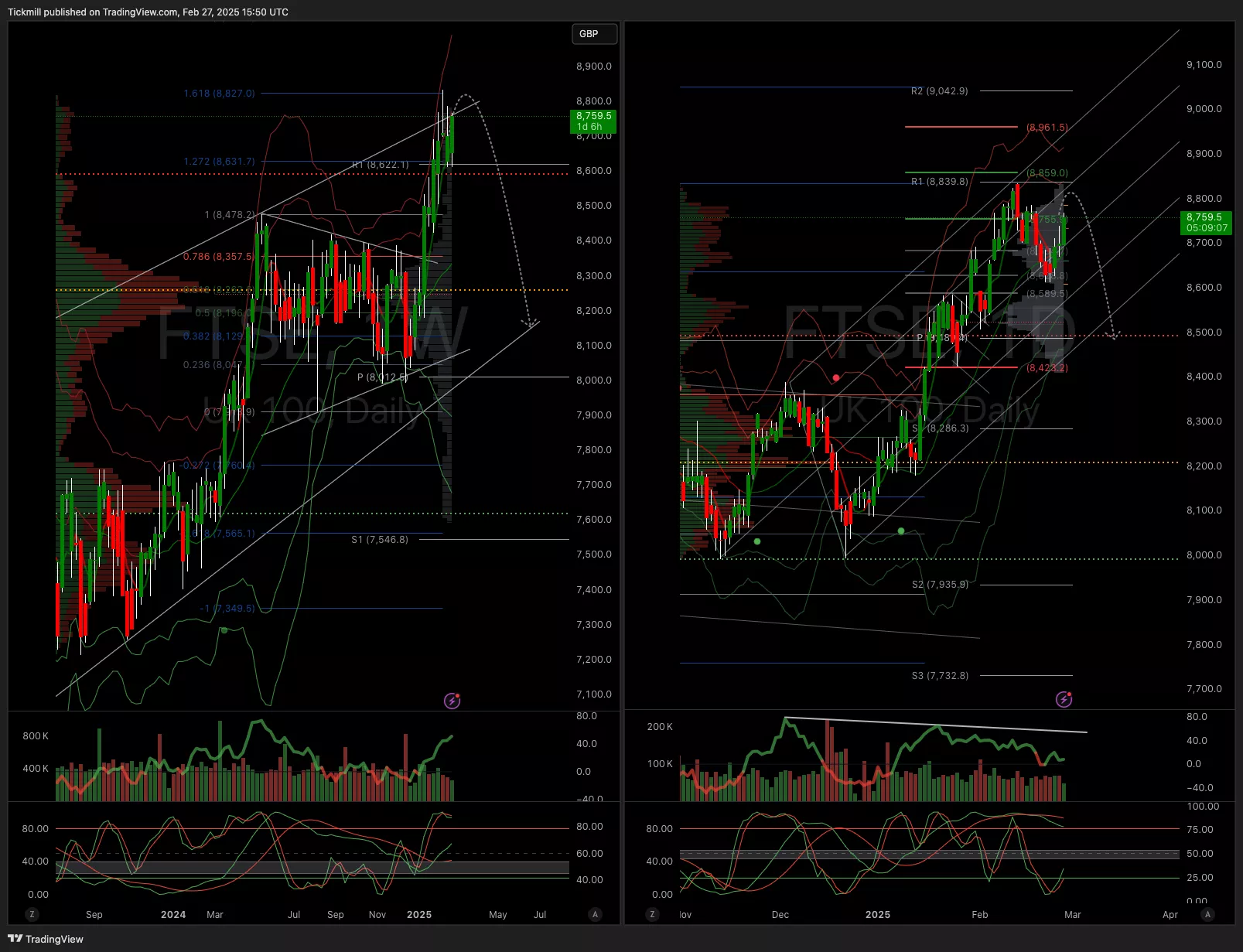

FTSE Bias: Bullish Above Bearish below 8850

- Primary support 8400

- Below 8400 opens 8225

- Primary objective 8500

- Daily VWAP Bullish

- Weekly VWAP Bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Thursday, Feb. 27The FTSE Finish Line - Wednesday, Feb. 26

Daily Market Outlook - Wednesday, Feb. 26