A Fresh Milestone For The U.S. Dollar Vs. The Japanese Yen

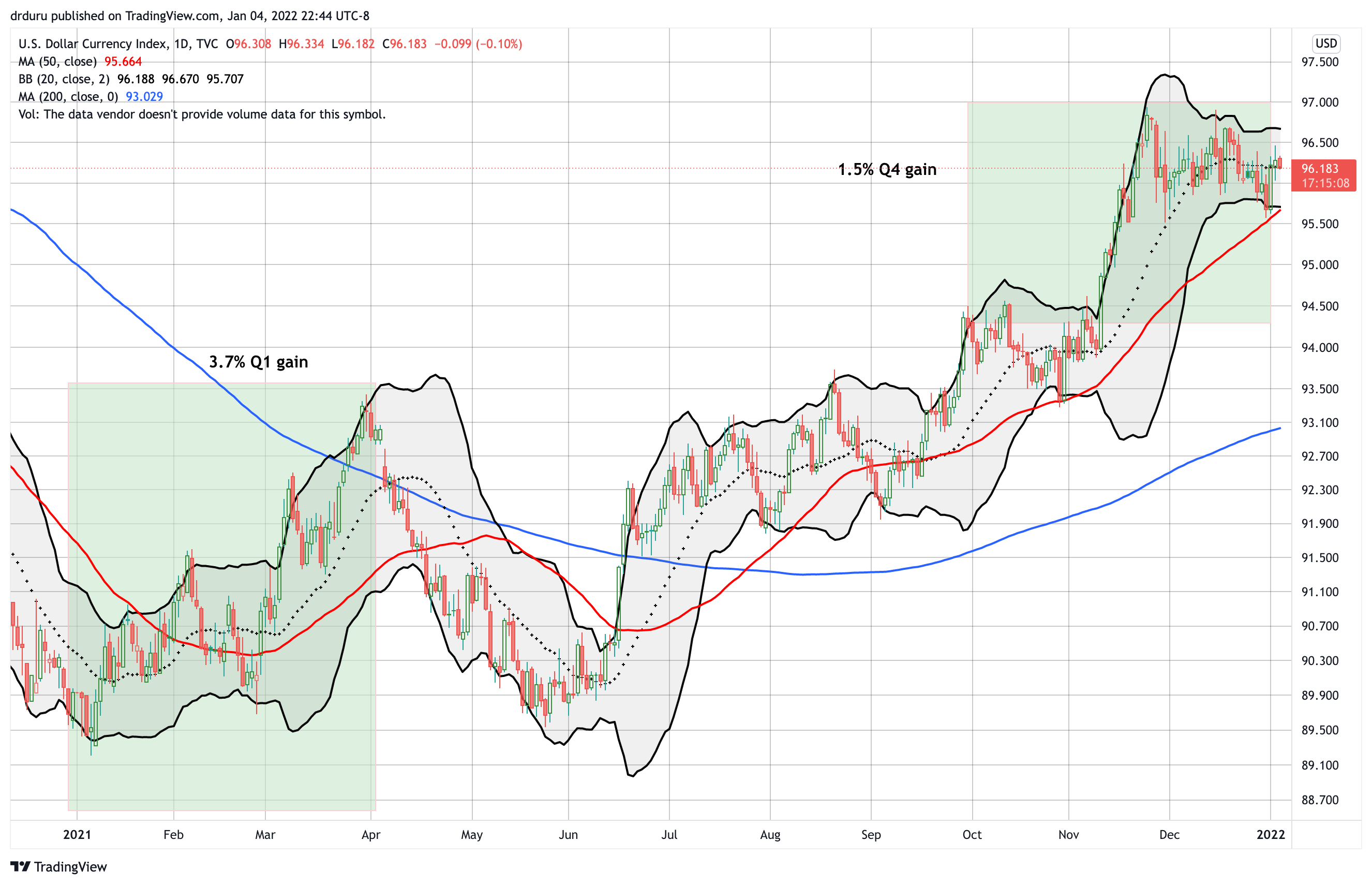

The U.S. dollar index (DXY) had a relatively strong year in 2021.

Image Source: Pixabay

The greenback gained 6.4%, but the gains were concentrated mostly in just two quarters. DXY gained 3.7% in Q1 and 1.5% in Q4 (most of Q4's gain really came in a 2 week span in November).

(Click on image to enlarge)

In between, I finally recognized the Fed-driven shift in tides favoring the U.S. dollar. With the new year 2022 starting off with a surge in interest rates, the U.S. dollar received a fresh boost. While the index did not make a new high, one of the key components of the index did: the dollar vs. the Japanese yen (FXY) (USD/JPY).

(Click on image to enlarge)

This breakout is bullish price action that builds upon the ongoing weakness in the Japanese yen. I am a buyer here with a first upside target of 118. The above chart of the U.S. dollar index is a reminder of the importance of using breakouts to confirm upside pressure. If the Federal Reserve continues to follow through on monetary tightening, all else being equal, I expect the USD/JPY to continue to favor the upside.

However, note that a major caveat looms. If financial markets conclude that monetary tightening will lead to a weakening economy in the future, rates could suddenly reverse downward and take out the sails from the U.S. dollar. The yen would doubly benefit as a safety trade. This cautionary note is thinking one or two steps ahead, but the scenario is worth keeping in mind when sizing positions and mapping out trading timing frames. On to the next Fed meeting on January 25-26!

Be careful out there!

Great read, thanks.