The U.S. Dollar Braces For Fed Tapering And Tightening

"Almost 60 percent of respondents anticipated the first reduction in the pace of net asset purchases to come in January, though, on average, respondents placed somewhat more weight than in the June surveys on the possibility of tapering beginning somewhat earlier."

Federal Reserve Meeting Minutes, August 18, 2021

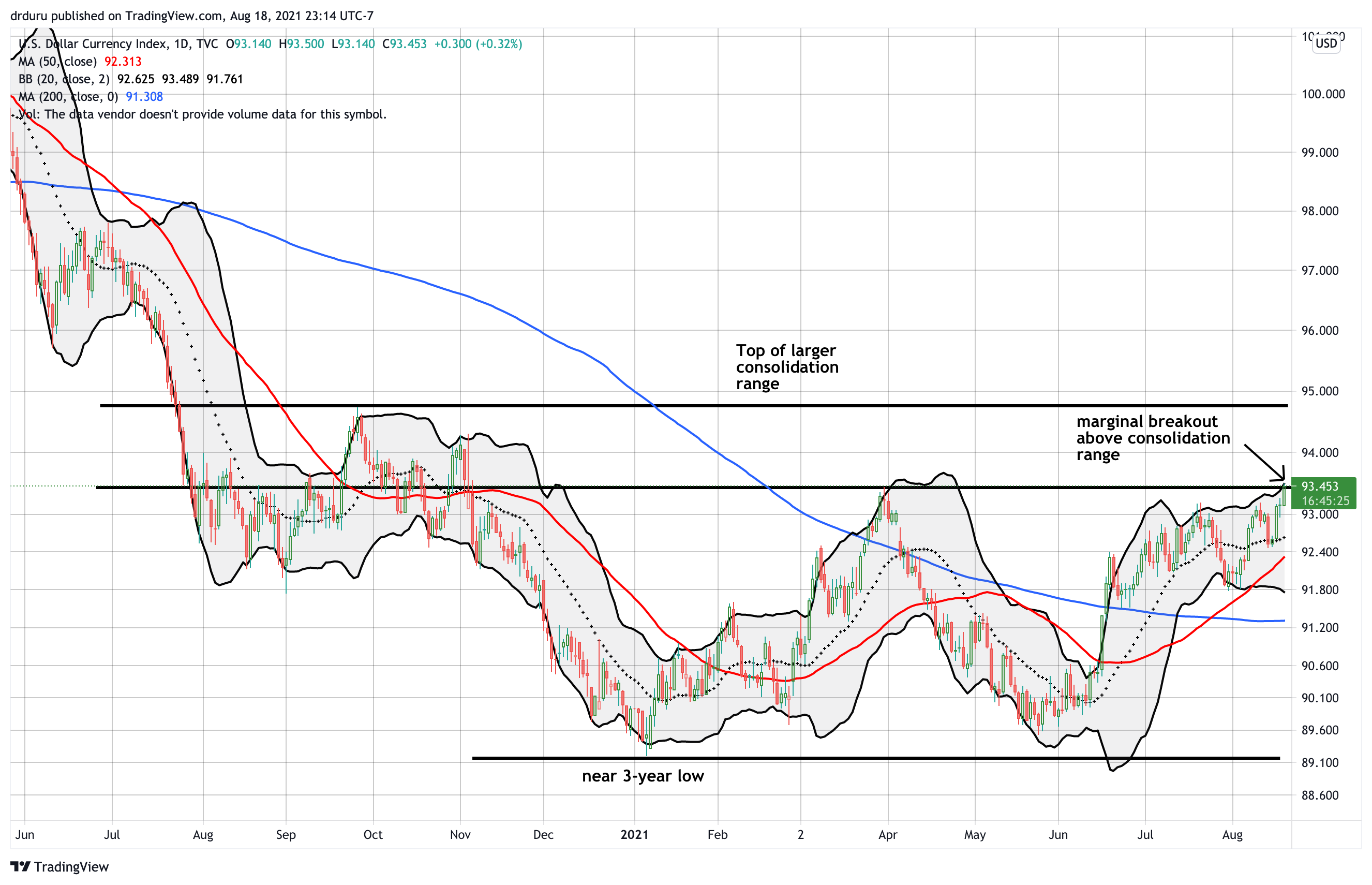

The talk of tapering the Fed's asset purchases has moved quickly from a taboo topic at the Fed to a rising buzz. Accordingly, financial markets are slowly shifting around to the idea that tapering is very real and imminent. In particular, the U.S. dollar index (DXY) is firming once again. In the wake of the minutes, the U.S. dollar edged just above its high from March/April. The highs from last September through November present the next hurdles. A move above those peaks will create a breakout that should form the basis of a sustained move higher. In the meantime, the U.S. dollar index is building a base for a sustained rally.

The U.S. Dollar Index (DXY) is consolidating and building an extended base. Source: TradingView

Despite the majority of Fed participants appearing ready to go with tightening in the near future, an imminent tapering of asset purchases is not a foregone conclusion. The minutes from the Fed meeting are full of important caveats like the following quote:

"Most participants judged that the Committee's standard of "substantial further progress" toward the maximum-employment goal had not yet been met."

Accordingly, the smoke signals from the Fed in the form of various speeches will be as important as ever. The minutes are well-timed ahead of the Jackson Hole, Wyoming confab. I believe a lot of anticipation has built that an official tapering message will come from that meeting. Given the minutes, I expect any such "official" message to include caveats. For example:

"In discussing the uncertainty and risks associated with the economic outlook, many participants remarked that uncertainty was quite high, with slowing in progress on vaccinations and developments surrounding the Delta variant posing downside risks to the economic outlook."

Hot Markets

I took great interest in the Fed's observations of financial markets. Mortgage-backed Securities (MBS) came up for discussion. After more than 12 months of red-hot housing activity, some Fed participants are finally actively asking why the Fed continues to provide emergency level support to the housing market. (James Bullard got the ball rolling back in June).

"Several participants commented on the benefits that they saw in reducing agency MBS purchases more quickly than Treasury securities purchases, noting that the housing sector was exceptionally strong and did not need either actual or perceived support from the Federal Reserve in the form of agency MBS purchases or that such purchases could be interpreted as a type of credit allocation."

In parallel to a heated housing market, the Fed continues to note stretched valuations in both the stock and bond markets. As usual, the Fed implicitly reassured markets that it is not interested in intervening in the bullish price action.

"The staff judged that asset valuation pressures were elevated. In particular, the forward price-to-earnings ratio for the S&P 500 index stood at the upper end of its historical distribution; high-yield corporate bond spreads tightened further and were near the low end of their historical range; and house prices continued to increase rapidly, leaving valuation measures stretched. That said, the staff did not see signs of loose mortgage underwriting standards or excessive credit growth that could potentially amplify a shock arising from falling house prices."

The Trade

I used the current breakout for the U.S. dollar index as a signal for closing out all but one of my remaining short U.S. dollar positions, including my favored short USD/CAD position. I also rolled into a new long EUR/USD position. From here, I am waiting for confirmation of the breakout before completing my transition from back to net long the U. S. dollar.

Be careful out there!

I have always seen mortgage backed securiies as a rather deadly poison with a very sweet small. That is to say no good can come of their existaance. he one past financial crisis was caused by these and it is not clear that exactly the same thing will not happen again. And when interest rates do increase, as certainly they need to, where will the profitability of those securities head? It is indeed a real fool that refuses to learn from mistakes.

And the Fed probably feels trapped into continuing to buy MBSs. I will be watching closing when they finally to decide to ramp that down.

Agreed.