Could Bitcoin Break $200K This Cycle? What Investors Need To Know After Its $124K Peak

Image Source: Unsplash

With Bitcoin climbing to a new all-time high above $124K this year, the question on every investor’s mind is whether this cycle could carry it even higher – possibly toward $200K.

As the original cryptocurrency and so-called “digital gold”, Bitcoin draws strength from its fixed supply of 21 million coins, institutional demand through spot ETFs, and growing liquidity powered by stablecoins. Add in record network security and the post-halving supply squeeze, and the long term scarcity case looks more compelling than ever.

But Bitcoin’s path is never straightforward. Supporters see unmatched security, global brand power, and deeper integration into traditional finance. Skeptics point to its notorious volatility, speculative flows, and exposure to shifting regulations that can spark painful short-term drops.

Today, BTC trades just below its record, reflecting optimism about adoption but also caution around policy and broader market risks. That tension, between Bitcoin as a maturing store of value and Bitcoin as a volatile trading instrument, is what makes the next move so critical.

Could this be the setup for a run toward $200K, or are investors at risk of another harsh reality check?

Let’s map it using the IDDA (Capital, Intentional, Fundamental, Sentimental, Technical):

IDDA Point 1 & 2: Capital & Intentional

Before investing in Bitcoin, ask yourself:

Do you want exposure to a scarce, decentralized digital asset with global adoption momentum?

Are you comfortable with high volatility and the possibility of large drawdowns in exchange for long-term upside?

Do you believe in Bitcoin’s role as “digital gold” and its potential to thrive alongside expanding stablecoins and ETFs?

Bitcoin is trading just below its $124K peak, driven by strong fundamentals like reduced supply after the halving, record network security, rising ETF demand, and growing liquidity from stablecoins and supportive U.S. policy. Market sentiment is cautiously optimistic, with investors buying dips but staying wary of sharp swings caused by leverage or political news.

Technically, it’s consolidating between key support around $105K–110K and resistance at $124K, leaving room for either a breakout or pullback.

Still, crypto is extremely volatile and best suited for those with a high or aggressive risk tolerance—every investor should carefully assess their own risk profile and have a clear strategy before committing to Bitcoin or any digital asset.

Bottom line: For long term investors, Bitcoin continues to offer unmatched scarcity, institutional adoption, and network strength – an asset to consider as part of a diversified growth or “digital gold” allocation. For short term investors, however, its volatility, leverage-driven swings, and sensitivity to macro conditions mean caution and strict risk management remain essential.

IDDA Point 3: Fundamental

Post-Halving Supply Squeeze

Every four years, Bitcoin goes through a “halving,” where the number of new coins miners receive is cut in half. The latest one happened in April 2024, reducing rewards to just 3.125 BTC per block. This matters because it tightens the amount of new Bitcoin entering circulation, creating a natural scarcity. With demand still strong, the supply shock has been one of the main drivers pushing prices toward all-time highs.

Institutional Demand via Spot ETFs

Another key force is the rise of U.S. spot Bitcoin ETFs. These funds make it easy for everyday investors, retirement accounts, and institutions to buy exposure to BTC without directly managing wallets or private keys. Since launch, they have attracted steady inflows, especially during bullish waves. This “mainstream adoption” channel continues to soak up supply, supporting higher price levels and adding credibility to Bitcoin as an investable asset.

Stablecoins Fueling Liquidity

The growth of dollar-backed stablecoins – like USDT and USDC – has created a massive pool of on-chain liquidity. In 2025, their combined market cap has climbed to record highs, now exceeding $260 billion. Stablecoins act like digital dollars that traders use to buy Bitcoin instantly. With U.S. regulators recently outlining supportive rules (such as the GENIUS Act), this market looks set to expand further, giving Bitcoin even deeper liquidity and more efficient trading rails.

Strong Network Fundamentals

Under the hood, Bitcoin’s network has never been stronger. Its computing power (hashrate) surged past 1 zettahash per second this month, an all time high. A rising hashrate signals that miners are still committing massive resources to secure the network, despite lower rewards after the halving. This robustness boosts investor confidence that Bitcoin remains the most secure blockchain in the world – an important foundation for long-term value.

Macro and Policy Context

Beyond crypto specific factors, Bitcoin continues to trade like “digital gold.” It has benefited from global uncertainty, inflation concerns, and rising demand for alternative assets outside traditional banking. In the U.S., policy signals are turning more constructive – particularly around stablecoins and crypto-friendly rhetoric during election season. Together with supportive global macro flows, these trends reinforce Bitcoin’s role as both a growth asset and a hedge in uncertain times.

Fundamentals: Medium – High

IDDA Point 4: Sentimental

Strengths

Post-Halving Scarcity – New Bitcoin supply was cut in half in 2024, creating a long-term supply squeeze that historically drives multi-year rallies.

ETF & Institutional Adoption – Spot Bitcoin ETFs continue to attract inflows, giving BTC mainstream legitimacy and a steady pipeline of demand.

Stablecoin and Policy Tailwinds – Record-high stablecoin supply plus supportive U.S. regulation (GENIUS Act) are boosting liquidity and investor confidence.

Risks

Volatility & Leverage Risks – Sharp pullbacks, like September’s washouts, show how quickly leverage can unwind and trigger painful corrections.

Regulatory & Political Uncertainty – While U.S. stablecoin policy looks positive, broader crypto regulation remains a wild card globally and could tighten.

Macro Sensitivity – Bitcoin still trades like a risk asset; hawkish Fed moves, liquidity crunches, or equity sell-offs could spill over and cap upside momentum.

Investor sentiment around Bitcoin is sitting in a zone of cautious optimism after its recent all time high near $124K. The August rally sparked excitement, but the sharp pullback that followed reminded traders that leverage and short term flows can still trigger volatility.

Fear & Greed indicators hover around the “greed” side, showing confidence but not yet euphoric mania. Options activity and ETF inflows suggest institutions are still engaged, while retail chatter frames dips as buying opportunities rather than panic triggers.

Overall, the tone is constructive, investors believe the long term trend is intact, but they’re watching closely for signs of overheated leverage or sudden policy shifts that could test momentum.

Sentimental Risk: High

IDDA Point 5: Technical

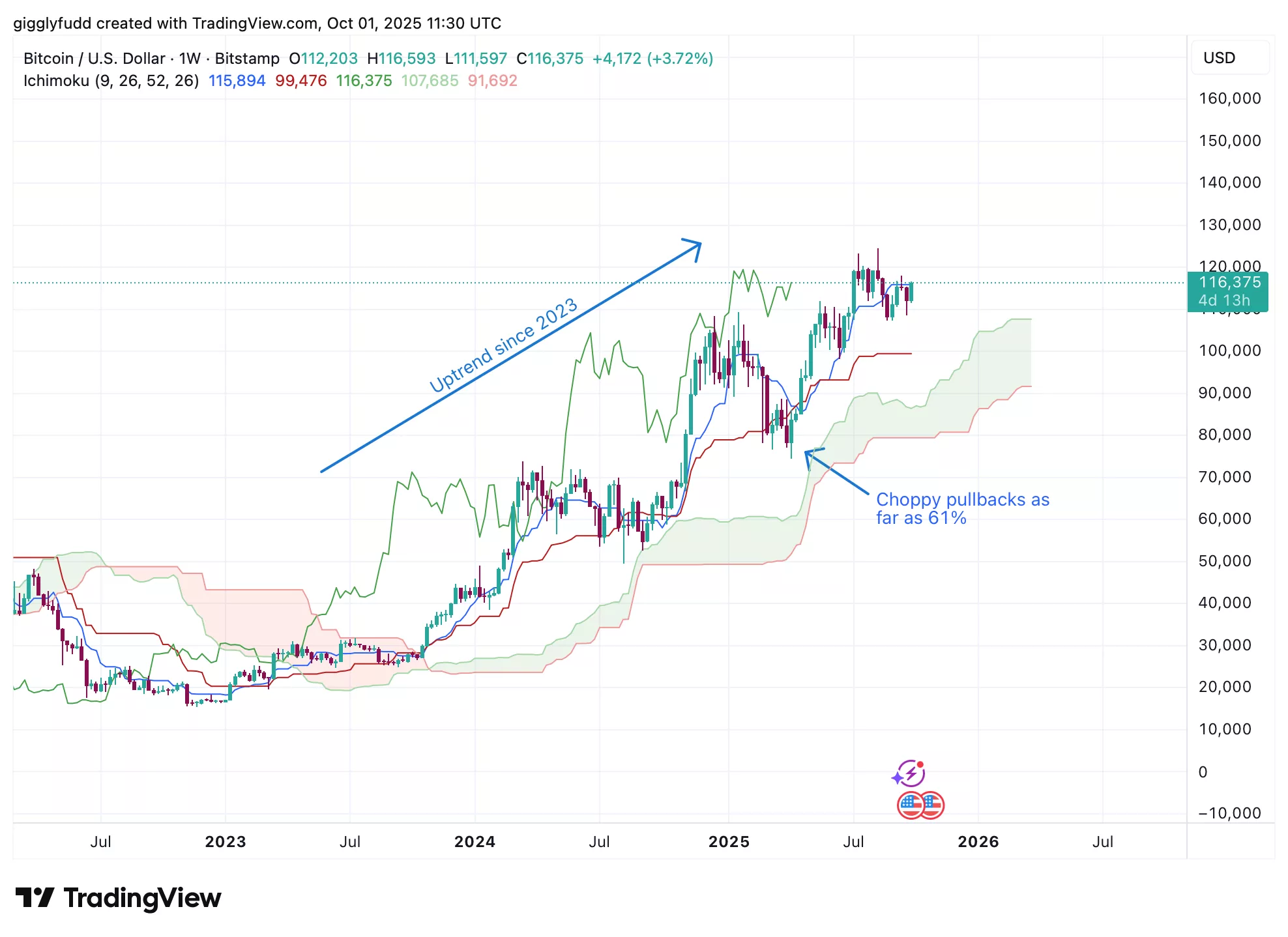

On the weekly chart

Bitcoin has been on a bull run (uptrend) since 2023

Ichimoku cloud is bullish and wide – indicating continued upward momentum

Candlesticks along with the Kijun, Tenkan, and Chikou span are all above the cloud, which is acting as a support zone

We can see that Bitcoin has been in a bull run since 2023 with choppy pullbacks, supported by the wide bullish Ichimoku cloud and candlesticks holding above it as support. Bitcoin recently hit a new high of 124K in August 2025 and now appears to be in the early stages of a pullback or correction.

(Click on image to enlarge)

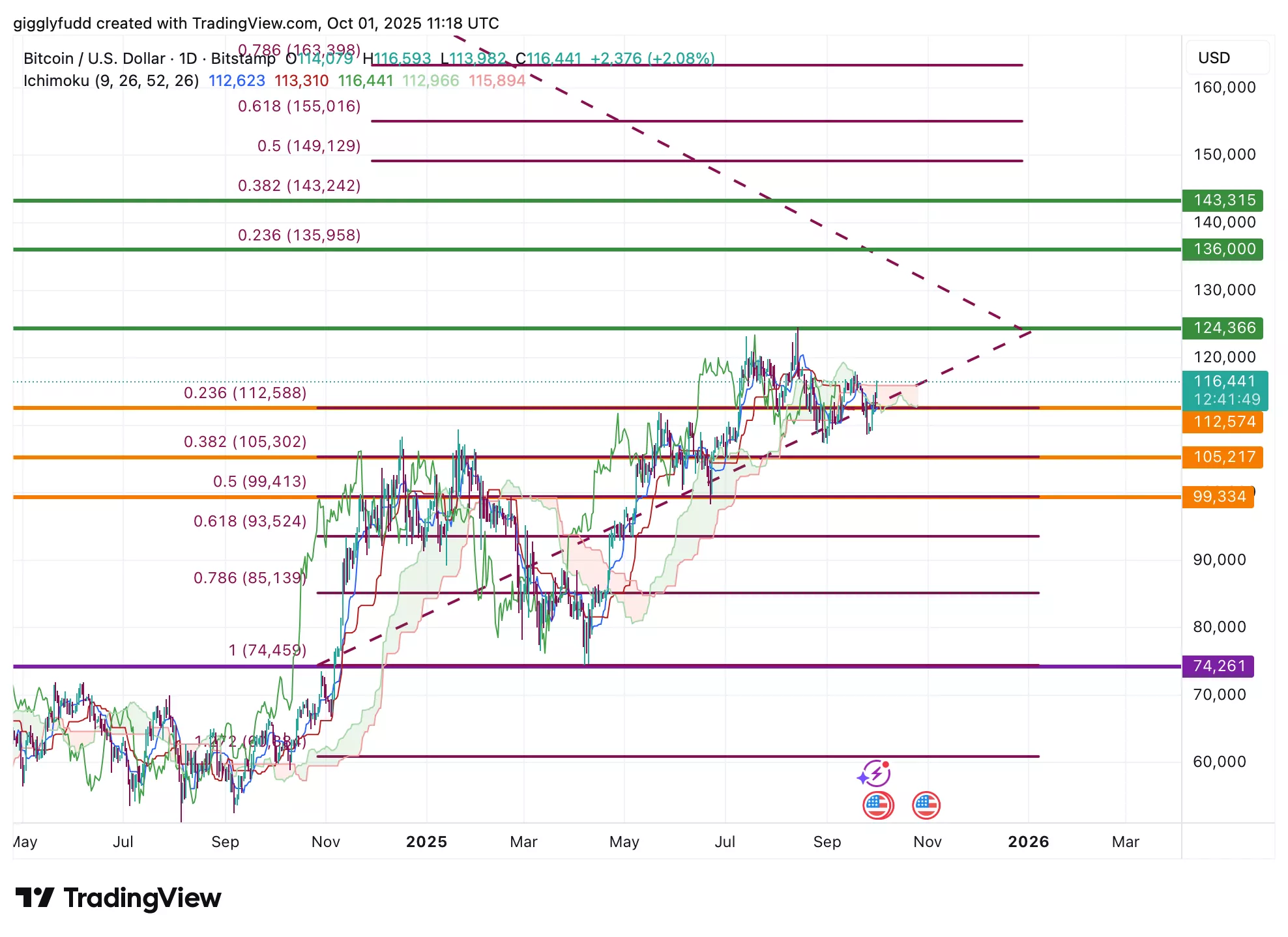

On the daily chart

The latest pattern shows consolidation (sideways trend), indicating market indecision

The current cloud is bearish but flattening, suggesting weakening downward momentum

The latest candlestick is testing the cloud’s ability to hold as a resistance zone

On the daily chart, Bitcoin moved in a choppy uptrend from April until August, reaching a new high of 124K. Since then, it has pulled back slightly and entered what looks like the early consolidation phase. This is supported by the bearish cloud now flattening, showing that downward momentum is slowing into consolidation. The latest candlestick is testing the cloud’s resistance.

If the cloud holds, further downside momentum may follow. If price breaks above the cloud, the key level is 124K – and a break above that could fuel another leg up. Otherwise, more consolidation can be expected.

(Click on image to enlarge)

Investors looking to get in BTC can consider these Buy Limit Entries:

116433 (High Risk – FOMO entry)

112574 (High Risk)

105217 (Medium Risk)

99334 (Low Risk)

Investors looking to take profit can consider these Sell Limit Levels:

124366 (Short term)

136000 (Medium term)

143315 (Long term)

Technical Risk: High

Final Thoughts on Bitcoin (BTC)

Bitcoin has once again captured attention as it pushes to new highs, with bulls pointing to its fixed supply, growing institutional adoption, stablecoin-fueled liquidity, and unmatched network security as drivers of long-term value. Bears, meanwhile, warn that volatility, regulation, and speculative flows could spark sharp corrections. Technically, Bitcoin’s weekly chart shows a strong uptrend with support intact, but the daily chart suggests consolidation as price tests resistance – making the next move critical in determining whether Bitcoin can break higher or extend its pullback.

Key Takeaways:

The debate now centers on whether Bitcoin is evolving into a true global store of value poised for its next leg higher, potentially toward $200K, or whether volatility and policy risks will keep it locked in speculative cycles. Bulls see scarcity, adoption, and network strength as unmatched advantages, while bears highlight its dependence on sentiment and regulatory clarity. For long-term investors, Bitcoin offers diversification and asymmetric upside. But for short term investors its extreme volatility means discipline, risk management, and a clear strategy are essential.

Overall Crypto Risk: High

More By This Author:

ishares Silver Trust ETF: Is This The Beginning Of A Mega Trend Or A Temporary Spike?

Viking Therapeutics Stock: A Stumble Or The Setup Of The Decade?

Amazon Stock Update 2025: Can AI And AWS Growth Outweigh Prime’s $2.5b FTC Settlement?