Ishares Silver Trust ETF: Is This The Beginning Of A Mega Trend Or A Temporary Spike?

Image Source: Pixabay

Silver has been stealing the spotlight in 2025. While gold and even big tech names like NVIDIA are taking a breather, silver prices have soared nearly 60% this year. The iShares Silver Trust (ticker SLV) is the most popular ETF that lets investors ride silver’s moves without holding the physical metal. It is designed to track the price of silver and holds physical bullion in vaults.

But here’s the big question: is this rally the start of a long-term mega trend or just a short-lived spike? With silver demand tied to solar, electric cars, and even the AI data center boom, the story is a lot juicier than it looks on the surface. Investors are asking if they should jump in now or wait for a pullback.

The IDDA Analysis framework is used to analyze companies and determine which are right for you. There are five steps to the process:

- Capital Analysis – Your personal risk tolerance.

- Intentional Analysis – Your unique financial goals and timelines based on your age, health, and lifestyle.

- Fundamental Analysis – The viability of the asset based on company performance, financial health, and market position.

- Sentimental Analysis – The current emotions of Wall Street and other market participants.

- Technical Analysis – Historical price action to identify key psychological levels and market patterns.

Let’s dive into the IDDA analysis to assess iShares Silver Trust (ticker SLV)’s fundamental, sentimental, and technical outlook.

IDDA Point 1&2: Capital & Intentional

The capital and intentional analysis need to be conducted by you.

Select your assets in alignment with your financial goals. Listen to your intuition about each asset, but remember to invest based on your own values, not just because of recommendations from others.

IDDA Point 3: Fundamental

Strong price performance

Silver is up around 57% year to date. SLV, which mirrors silver prices, has grown inflows and now holds over 15,000 tonnes of bullion. This confirms strong demand from investors.

Supply and demand imbalance

The Silver Institute reports 2025 will be the fifth year in a row with a supply deficit. Mines in Mexico and Peru are facing grade challenges and periodic unrest. At the same time, industrial demand from solar panels, EVs, and defense keeps climbing.

Solar and tech boost

AI data centers are hungry for power. Big Tech companies like Amazon, Microsoft, and Apple are signing record solar power deals. Solar panels need silver, so this creates a ripple effect that fuels demand.

Macro tailwinds

Falling interest rates and a weaker dollar push investors toward precious metals. Silver is seen as both an industrial metal and a safe haven, so it benefits twice.

Silver use in solar panels may shrink

Solar panel makers are finding ways to use less silver in each panel. They are testing copper and other materials to bring costs down. If this change spreads fast, the total silver needed for solar could grow more slowly than expected.

Policy headwinds

The U.S. has doubled tariffs on Chinese solar panels. This may slow some U.S. solar projects or shift supply chains, creating bumps in demand timing.

Fundamental risk: Medium.

Silver demand is strong, but supply adjustments and tech shifts make the outlook less predictable.

IDDA Point 4: Sentimental

Overall sentiment is bullish for iShares Silver Trust (SLV). Investors see silver as both a safe haven and a growth story tied to solar and tech. The strong YTD rally has fueled optimism, though some caution flags remain.

Strengths

Silver has outperformed gold this year, which builds momentum and confidence among investors.

Big Tech’s push for more renewable energy and solar capacity is viewed as a lasting demand driver.

Rate cut expectations and a softer dollar are helping safe-haven demand.

ETF inflows are strong, with SLV holdings climbing. This shows retail and institutional appetite.

Analysts highlight the fifth year of a global supply deficit as a bullish signal.

Risks

Silver prices move faster than gold, and that volatility makes investors nervous about sudden pullbacks.

If solar panel makers cut silver use per panel faster than expected, demand growth could slow.

U.S. tariffs on Chinese solar panels may disrupt or delay some projects, affecting demand timing.

Mining supply can recover if new projects or grades improve, easing the tightness in the market.

Some analysts warn that silver’s rally may be “overextended” after a near 60% YTD run.

Sentimental risk: Medium.

Optimism is high, but the market knows silver can flip directions quickly.

IDDA Point 5: Technical

Monthly Chart

Candles are well above the Ichimoku cloud, and the cloud is green, confirming a bullish trend.

Conversion line is above the baseline, another bullish signal.

RSI is at 85, which is in overbought territory.

Price is far above the cloud, which shows strong momentum but also risk of a pullback.

(Click on image to enlarge)

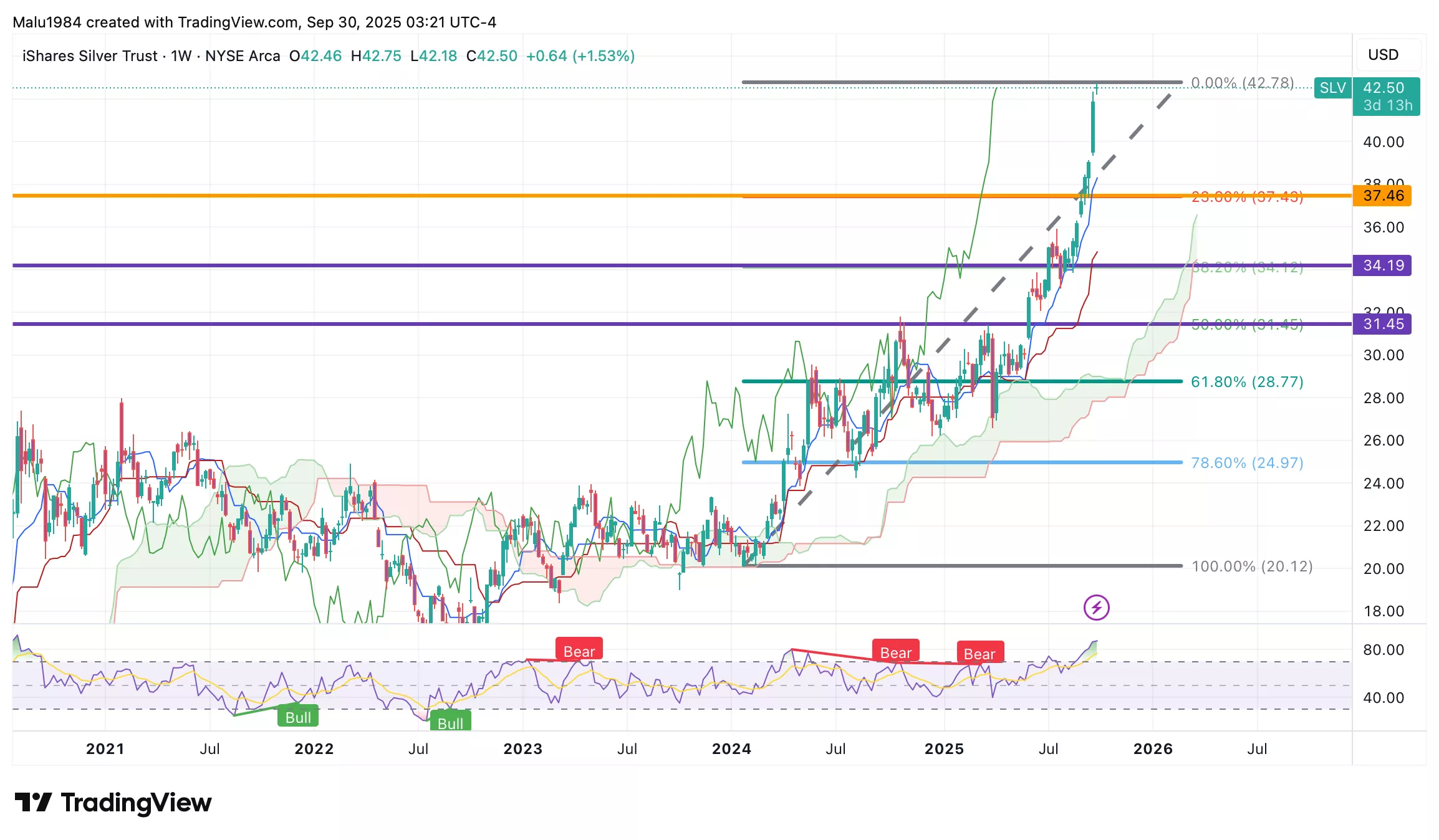

Weekly Chart

Candles are above the Ichimoku cloud, and the cloud is green, confirming ongoing bullish momentum.

Conversion line is above the baseline, supporting the bullish case.

RSI is at 87, signaling extreme overbought conditions.

Price is stretched far from the cloud, suggesting a possible cooling period even if the trend stays intact.

(Click on image to enlarge)

Overall outlook: The technical picture for SLV is very bullish, with strong momentum across both charts. However, RSI shows the price is overbought, and distance from the cloud makes a short-term correction possible before the larger trend continues.

Buy Limit (BL) levels:

$37.46 – High Risk

$34.19 – Moderate Risk

$31.45 – Low Risk

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical risk: High.

The trend is strong and bullish, but with RSI at extreme levels and price stretched far above the cloud, the chance of a sharp pullback is high even if the long-term direction stays positive.

Summary: Final Thoughts

Silver has outshined most assets in 2025 with nearly 60% gains. Fundamentals show strong demand from solar, electronics, and investors, while supply remains tight. The biggest risks are technology shifts that reduce silver use in panels and policy hurdles like tariffs.

Sentiment is bullish with strong ETF inflows and safe-haven buying, but investors know silver’s swings can be sharp. Optimism is high, yet volatility always shadows this metal.

Technicals confirm the bullish momentum. Candles sit far above the cloud, and signals are strong. Still, RSI is flashing extreme overbought, and a pullback could come before the trend continues.

Overall, iShares Silver Trust (SLV) looks bullish but risky. The long-term drivers are real, but short-term swings can test investors’ patience.

Overall risk: High.

More By This Author:

Viking Therapeutics Stock: A Stumble Or The Setup Of The Decade?

Amazon Stock Update 2025: Can AI And AWS Growth Outweigh Prime’s $2.5b FTC Settlement?

Keurig Dr Pepper’s $18b Coffee Bet: Game Changing Split Or Brewing Trouble For Investors?