Tesla Explodes Higher As Company Reports Blowout EPS, Even As CapEx Disappoints Again

Three months ago, the main question for Tesla’s (TSLA) second quarter results was whether the electric-car maker was on a stable path to finally turn profitable. The answer, at the time, was not as Tesla not only missed on the top and bottom line, but the company slashed its capex outlook, suggesting that its vision for the growth future has become far more cloudy. It also sent the company's stock tumbling.

Fast forward to today, when looking at Tesla's Q3 earnings the question for investors will again be more or less the same: will Tesla finally be able to turn a profit in a quarter in which Tesla delivered a record number of vehicles (yet coming light of expectations) with focus increasingly shifting to whether the company can sell cars profitably?

Tesla's margins have come under pressure in recent quarters, as the carmaker has been selling more lower priced, lower margin Model 3 sedans compared with the older Model S and Model X. A further squeeze could also come from rising battery prices, according to Roth Capital Partners analyst Craig Irwin. As a result, the average analyst estimate for Q3 gross margin had fallen sharply after the second quarter, and is down 27% over the past year.

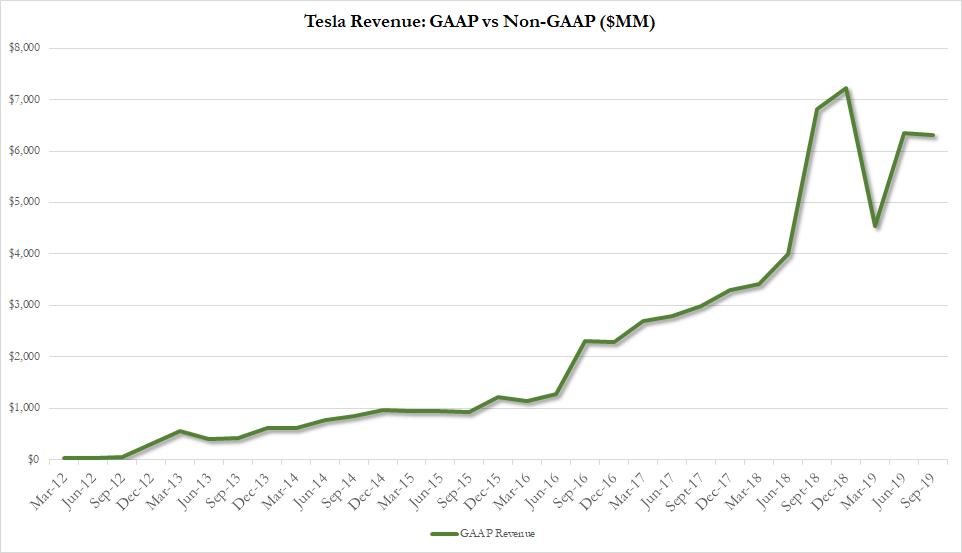

Separately, revenue estimates suggest the company's top line will fall compared with last year, the first such drop for Tesla since 2012 when the Model S started production.

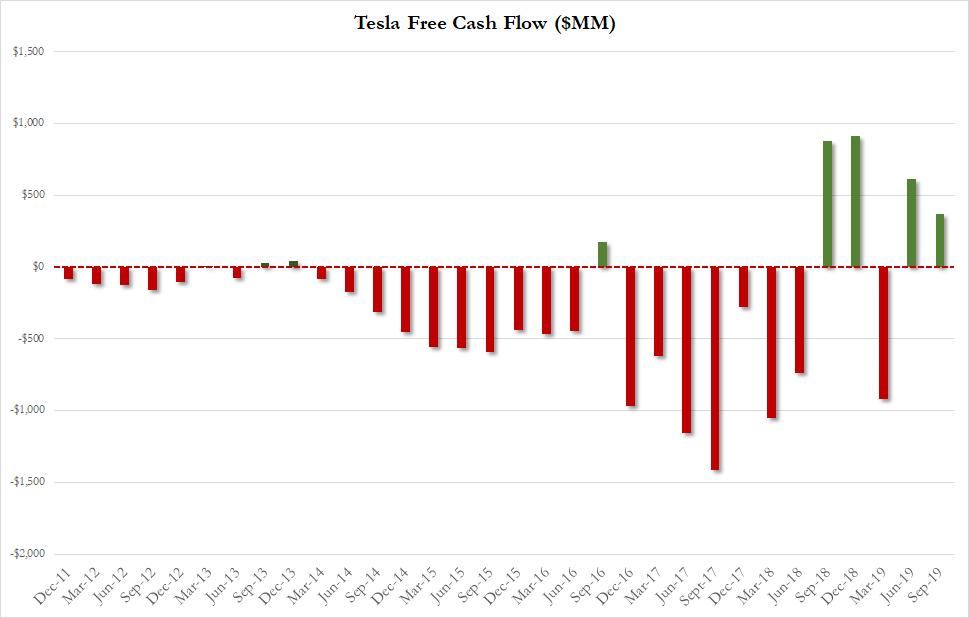

Another key metric will be cash flow with analysts expecting free cash flow to drop to $35.9 million for the period, which according to Bloomberg Intelligence is "The single most important number to track... Paying the bills, supporting global expansion and servicing the debt are the bottom line necessities. Almost all of the other metrics are just noise."

Also under the microscope will be Tesla's guidance - Musk has said he expects to deliver 360,000 to 400,000 vehicles in 2019, although many analysts believe it will be tough for the company to reach these numbers.

* * *

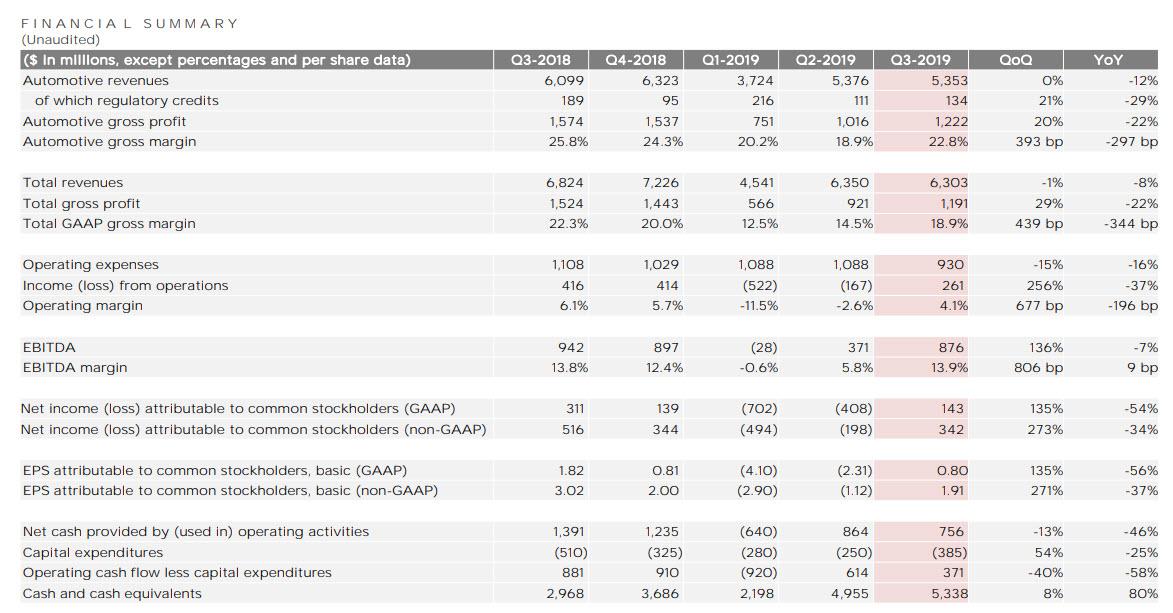

So with all that in mind, here are the main numbers that Tesla reported for the third quarter, bizarrely in a totally different format to Elon Musk's previous investor letter, one which this time was not signed by Musk as is customary:

- Revenue as expected, was a disappointment, at $6.30BN, far below the estimate of $6.45 billion

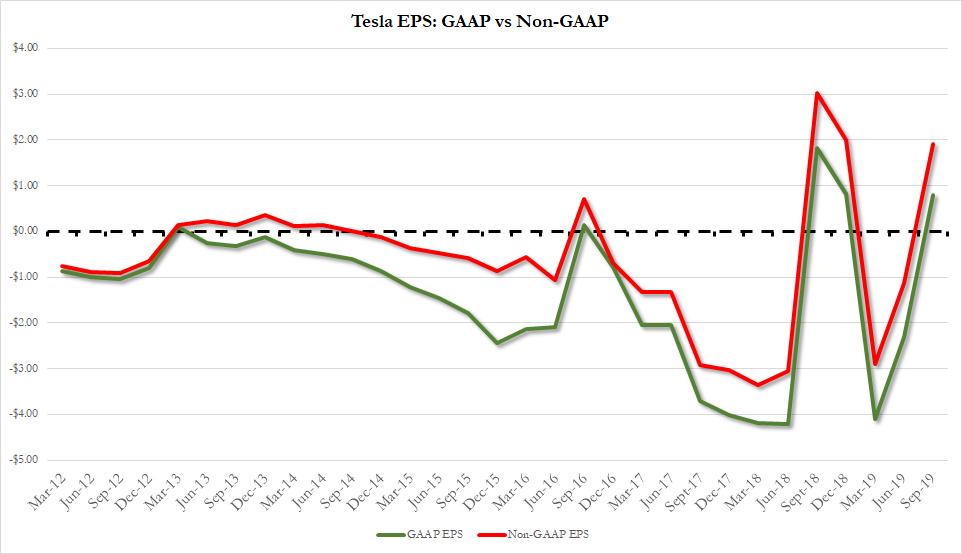

- But it was EPS that blew investors away, as Tesla reported a mindblowing EPS of $1.91, orders of magnitude above the 24c estimate.

- Free cash flow was $342MM, also far above the estimate of $35.9 million

- On the other hand, automotive gross margin was 22.8%, below the estimate of 25.0%

- Capital expenditures also missed, and at just $385 million, it was far below the estimate of $562 million

For those who are shocked, you are not alone: the bottom line is that whereas consensus expected Tesla to report a net loss of $52MM, the company actually reported $342MM in non-GAAP income. Tesla explained that it was able to pull off this miraculous profit by making operating expenses the lowest since Model 3 production started. It also talked how cheap it was to build the Gigafactory 3 in China, roughly 65% cheaper than the Model 3 production system in the U.S., based on capex per unit of capacity.

As a result, the stock is soaring after hours, up 16% after hours and is set to post its biggest earnings-linked gain since last year's second quarter; the company impressed analysts with stronger-than-expected margins, positive cash flow and reaffirmed its expectation to turn a profit in the remaining quarters of that year. Then again, it has done all that before.

And while the results leave many questions unanswered, at least the company's new reporting format makes following the numbers somewhat easier:

And visually, revenues - as noted above, this was the first Y/Y revenue decline since 2012:

And EPS, which as the chart below shows, is absolutely bizarre and reeks of some truly impressive accounting gimmicks:

Speaking of the company's liquidity situation, TSLA's cash flow declined, and after Q2's dramatic rebound from the $920 million it burned in Q1, spiking to $614 million, it since shrank to $371MM, even as CapEx was only $371MM, nearly $200MM below the consensus estimate.

Regarding the company's cash flow, Tesla said quarter end cash and cash equivalents increased to $5.3B, driven by positive free cash flow of $371M.

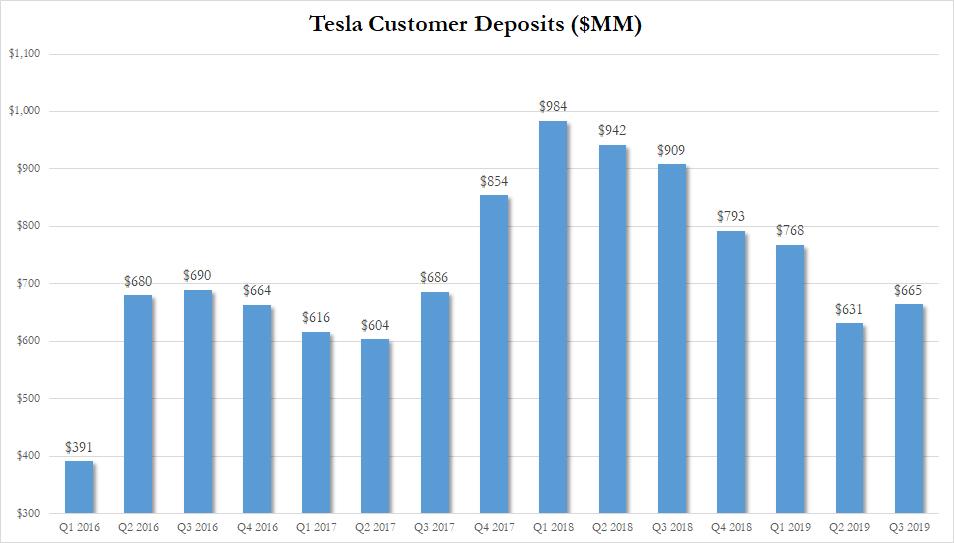

And speaking of sources of funding, Tesla reported that its customer deposits actually increased for the first quarter since Q4 2017, from $631MM to $665MM.

Discussing the revenue decline, Tesla's letter said that compared to Q3 of 2018, "the percentage of leased vehicles has tripled and alone has impacted revenue by the majority of the YoY decrease." As Bloomberg clarifies for the non-auto geeks/New Yorkers who don't own cars, "that means more cars are coming back to the company, and it has to hold them on its books." As a further reminder, EVs have notoriously low residual values, because the tech is changing so fast. Tesla also cut prices to move out inventory, which also hurts the prices of the leased cars in the used market.

That said, Tesla is hoping to accelerate growth "through Gigafactory Shanghai, Model Y and also through increasing build rates on our existing production lines. These capacity increases will allow for higher total vehicle deliveries and associated revenue. We also expect to gradually release nearly $500M of accumulated deferred revenue tied to Autopilot and Full Self Driving features."

Commenting on its profit margin, TSLA said that GAAP Automotive gross margin improved by 393bp QoQ to 22.8% (up 3.66% QoQ excluding regulatory credits), which is bizarre since the average ASP actually decline notably in Q3, and here's how it justified the move:

Margin was impacted in part due to fundamental improvements in our operating efficiency, including higher fixed cost absorption, reductions in manufacturing and material costs and continued improvements in vehicle quality and in part due to Smart Summon-related deferred revenue recognition, FX and other non-recurring items. Improved gross profit combined with a decline in operating expenses resulted in material improvement of GAAP net income.

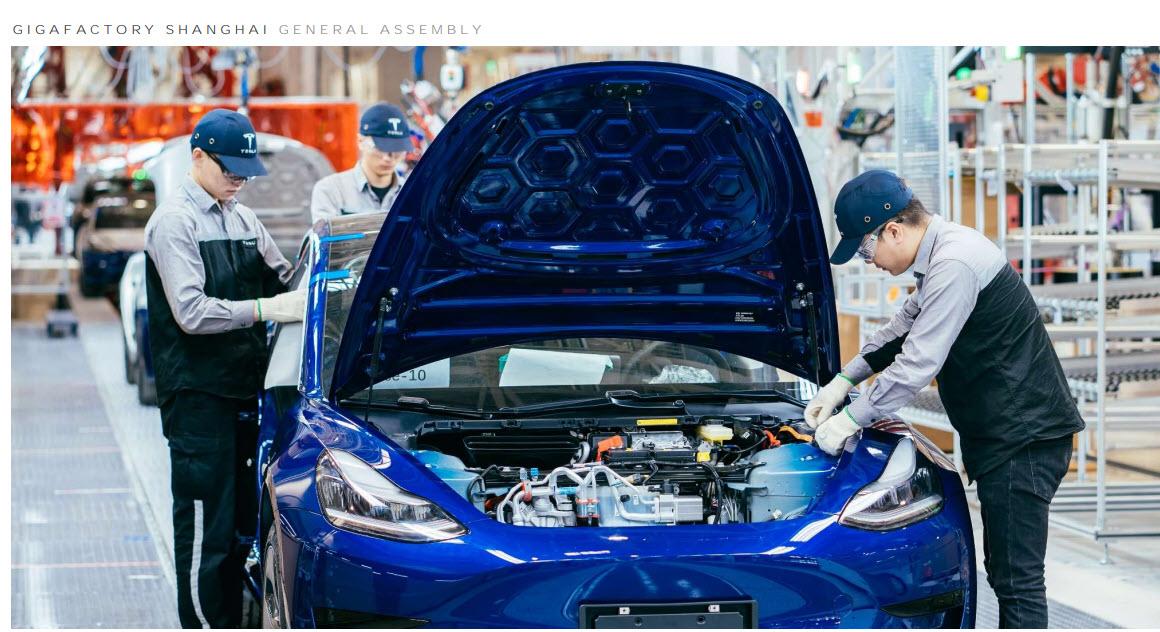

Bizarrely, Tesla dedicated no less than 8 slides in its reformatted "investor letter" to photos of Shanghai factory, such as this one:

The company also reported that "Trial production of Model 3 in Shanghai has begun, ahead of schedule. We are also ahead of schedule to produce Model Y and now expect to launch by summer 2020. We are planning to produce limited volumes of Tesla Semi in 2020 and are hoping to announce soon the location of our European Gigafactory for production in 2021."

And speaking of Shanghai, Tesla said it was already producing full vehicles on a trial basis, from body, to paint and to general assembly, at the Chinese Gigafactory:

"With Model 3 priced on par with gasoline powered mid-sized sedans (even before gas savings and other benefits), we believe China could become the biggest market for Model 3."

Looking ahead, Tesla repeated that "deliveries should increase sequentially... We are highly confident in exceeding 360,000 deliveries this year." It appears that Tesla has now removed the upper end, 400,000 of the range it had provided before.

Most importantly for investors, however, Tesla now forecasts "positive quarterly free cash flow going forward, with possible temporary exceptions, particularly around the launch and ramp of new products. We continue to believe our business has grown to the point of being self-funding."

The only problem with this statement: Tesla has made it before.

So while analysts are scratching their heads to figure out just how Musk padded results this quarter, the stock is exploding higher in a furious short squeeze, trading up 17% to just shy of $300, the highest since April.

Bizarrely, while Elon Musk didn't sign the actual quarterly letter - a first - he did Tweet his own summary of the company's results.

Tesla Q3 results:

— Elon Musk (@elonmusk) October 23, 2019

- Shanghai Giga ahead of schedule

- Model Y ahead of schedule

- Solar installs +48% from Q2

- GAAP profitable

- Positive free cash flow

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

This is a typically bearish article on Tesla which we see on sites such as this and Seeking Alpha.There are many writers out there who either have a short position on Tesla which is killing them, or who are financed by fossil fuel entities because Tesla is a feared disrupter.

Tesla continues to disappoint the FUD's by put-performing from analyst's estimates.It would be a reckless investor who shorts Tesla now.

#Tesla has many obstacles and challenges to overcome. Anyone who denies that isn't willing to face reality. That being said, too many short sellers underestimate the company's loyal fan base. I wonder how many of them have ever driven a Tesla. There's simply no other car out there like it. Just like #Apple's fans got them through the hard times, so will Tesla's. %TSLA $AAPL